The funding and delivery of end-of-life care raise important economic and moral issues (e.g. Gawande 2014). The cost of medical care at the end of life has attracted particular scrutiny, with claims that such spending is uniquely inefficient (e.g. Reid 2017).

In a recent paper (French et al. 2019) we show that even though end-of-life expenses are potentially quite large, in most developed countries, including the US, they only constitute around 10% of aggregate medical spending. We also document that in most developed countries end-of-life expenditures on formal medical services (hospital care, outpatient care, drugs) are reasonably well-insured. By contrast, the extent of insurance for long-term care (LTC) varies substantially. While Scandinavia and the Netherlands provide universal public LTC insurance, in countries such as the US and the UK, public assistance for LTC is largely means-tested. In the absence of public insurance, LTC costs can pose a significant financial risk for many households.

The past century has seen mortality become increasingly concentrated at very old ages, and increasingly attributable to chronic conditions. In 1900, the top three causes of death in the US were infectious diseases that often killed quickly (influenza/pneumonia, tuberculosis, and diarrhoea/enteritis/ulcerative colitis). By 2000, the top three causes of death were all chronic diseases (heart disease, cancer, and stroke).

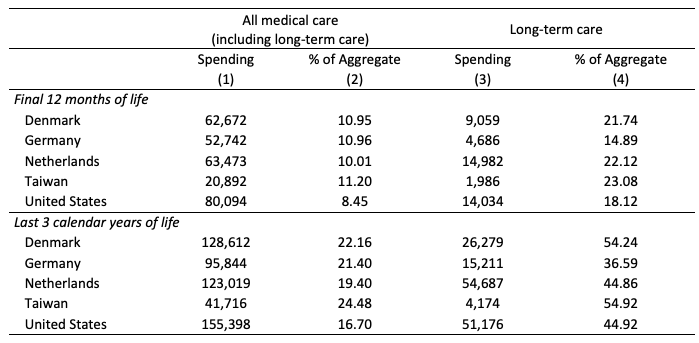

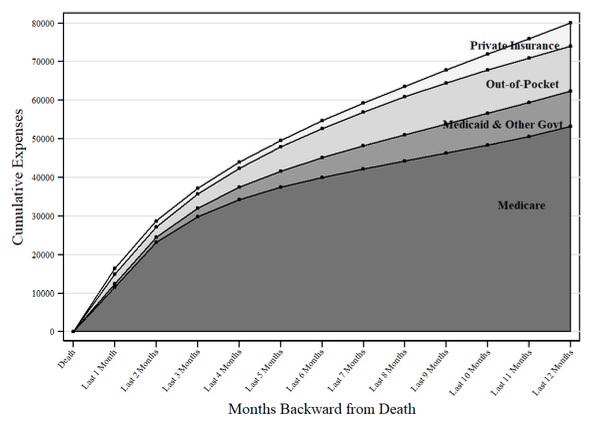

With many individuals dying from chronic conditions, and the high cost of treating these conditions, it is no surprise that end-of-life care is expensive: in the US, average medical spending from all payers during the last 12 months of life was $80,000 (in 2011, measured in 2014 dollars) and spending during the last three calendar years of life was $155,000. Nonetheless, end-of-life spending comprises only a modest share of aggregate expenditures, because the fraction of the population that dies in any given year is small. The US is in no way an outlier in this regard. Cross-country data, displayed in Table 1, show that the fraction of medical spending incurred during the last 12 months of life ranges from 8.5% in the US to 11.2% in Taiwan, while spending in the last three calendar years of life ranges from 16.7% to 24.5%. The high level of medical spending immediately before death is thus part of a pattern of elevated medical spending for several years prior to death, consistent with many end-of-life treatments being for chronic conditions. This finding is reinforced by the left panel of Figure 1, which shows cumulative spending in the US over the last 12 months of life, working backward from the date of death. Although a significant amount of spending occurs in the last two months of life, an even larger amount is incurred in the 10 months preceding that.

Table 1 Average spending on end-of-life care across countries

Notes: “Spending” is per decedent in 2014 U.S. dollars. ‘% of Aggregate’ displays the spending as a percentage of all spending in that medical spending category (both on decedents and survivors). ‘Final 12 months of life’ displays the average medical spending in 2011 that went to those who were in their last 12 months of life. ‘Last 3 calendar years of life’ displays the average medical spending in 2011 that went to those who were in their last three years of life.

Source: Copyrighted and published by Project HOPE/Health Affairs as Eric B. French, Jeremy McCauley, Maria Aragon, et al. “End-Of-Life Medical Spending In Last Twelve Months Of Life Is Lower Than Previously Reported.” Health Affairs (Millwood). 2017, Vol. 36, No.: 1211–1217, Exhibit 3. The published article is archived and available online at www.healthaffairs.org/. Reused with permission from Project HOPE/Health Affairs.

The left panel of Figure 1 also tracks spending by expenditure type. The largest expenditure item is hospital care, followed by LTC. In the US, hospital care is well-insured for those 65 and older. Medicare, public health insurance available to everyone 65 or older, covers most of their hospital costs, and many have private Medigap policies that pay for the remainder. Medicare coverage for LTC expenses, however, is quite limited. Most LTC expenses are paid either out-of-pocket or through Medicaid, a means-tested public health programme.

Figure 1 Average medical spending in the last 12 months of life in the US, by expenditure type (top panel) and by payor (bottom panel)

Source: De Nardi et al. (2016), updated to 2011 MCBS data, adjusted to match national aggregate spending.

The top panel of Figure 1 decomposes these expenditures by payor. Of the $80,000 incurred over the final year of life, 66% is covered by Medicare, 9% by Medicaid, 2% by other government programmes, and 8% by private insurers; $9,530, or 12% of the total, is paid out of pocket. Out-of-pocket expenditures can be so high that households are unable to cover them – uncollected liabilities are 3% of the total. Nonetheless, this share is well below the share paid out of pocket by US households not in their last year of life.

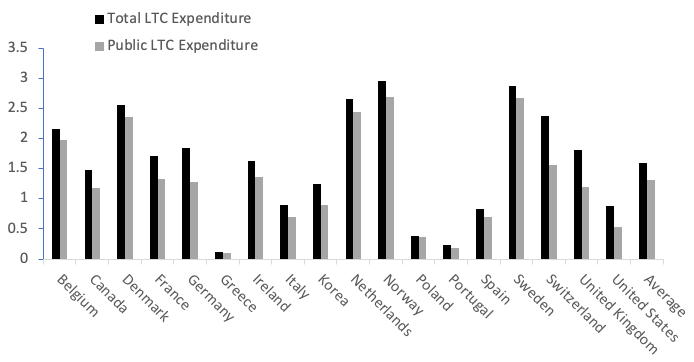

Among the various health-related costs facing older households, LTC expenditures arguably impose the most significant financial burden. While most OECD countries other than the US provide universal insurance for acute care at all ages – as the US does for the elderly – many fail to provide similar insurance for LTC (Brown and Finkelstein 2011). Figure 2 shows that total spending on LTC equals almost 3% of GDP in some countries, such as the Netherlands and Sweden. Other countries, such as Greece, Portugal, and Poland, devote less than 0.4% of their GDP to LTC. The LTC share for the US is toward the bottom of the range, at 0.9% in 2016, even though the US has the highest expenditure share for health care in total.

Public financing of LTC likely influences the use of end-of-life care (Orlovic et al. 2017). For example, Scandinavian countries and the Netherlands, which provide universal publicly funded LTC, spend a high share of their GDP on LTC. In contrast, the UK, Canada, and the US, who have means-tested public programmes for LTC, spend a more modest share of their GDP on LTC. Some of the differences in spending likely reflect substitution across providers, such as the replacement of institutional care with informal care in countries with low public LTC funding (Barczyk and Kredler 2018).

Figure 2 Long-term care expenditures in the OECD as a percentage of GDP, 2016

Source: OECD (2018). Notes: Figure shows total expenditures and public LTC expenditures as percentages of GDP for various OECD countries. Public LTC expenditure data for the U.S. are not available for 2016; this spending is inferred by assuming that the public share of total LTC expenditures in 2016 was the same as in 2013.

Given the significant financial risk posed by LTC, one might expect extensive use of LTC insurance products. In practice, only about 10% of older US households hold private LTC insurance (Lockwood 2018). The private LTC insurance market is also very small in Europe, even in countries with more limited public insurance (Barczyk and Kredler 2018).

The low rate of LTC insurance purchases may imply that households do not view LTC spending risk as a major concern (Lockwood 2018). However, even if households are concerned about LTC risk, there are several potential reasons why the take-up of private LTC insurance is low. First, many households may rely on means-tested public insurance programmes such as Medicaid. These programmes typically serve as the ‘payor of last resort’, covering only the expenses not covered by other insurers. Brown and Finkelstein (2008) calculate that for most US households, purchasing private LTC would just displace Medicaid payments, rather than provide additional insurance. Among these households, Medicaid crowds out private insurance.

Second, even if consumers would like to insure against LTC risk, they may view LTC insurance as expensive and low quality. Premia for LTC insurance policies are often marked up substantially above the expected claims, with loads on typical policies from 13 to 66 cents on the dollar (Brown and Finkelstein 2011). These loads are much higher than those estimated for other private insurance markets. Moreover, most LTC insurance policies provide only limited insurance against catastrophic nursing home expenses. The typical LTC insurance contract caps both the maximum number of days covered over the life of the policy and the maximum daily payment for a nursing home stay (Fang 2016). People holding LTC insurance also face the risk of unilateral price increases or insurer default (Ameriks et al. 2018).

Finally, suppliers of LTC insurance face several significant hurdles. One is that of moral hazard, as the presence of private LTC insurance may encourage families to switch from informal to formal LTC, even in cases when formal care is of little value to the family. Such overuse drives up the cost to the insurer (Pauly 1990). Mommaerts (2016) and Ko (2018) find empirical support for this hypothesis. A second hurdle is adverse selection, as suppliers face difficulty in assessing applicants’ risks. Hendren (2013) estimates that 17% of 65-year-olds are precluded from purchasing LTC insurance because their risks are too difficult to assess. Braun et al. (2018), who use a detailed model to evaluate several potential explanations, concluded that the most important reason for the low take-up of LTC insurance is adverse selection.

While end-of-life care is for the most part well-insured, policymakers and researchers should aim to better understand the financial risks that still exist and how to mitigate them. In many countries LTC at the end-of-life remains a large financial burden for older households. Recent work suggests that subsidizing informal care may be an effective way to reduce this burden and compensate informal caregivers (Barczyk and Kredler 2017). A particularly pressing question is why the utilisation of private LTC insurance is so low. Ameriks et al. (2018) argue that LTC policies with benefits based on the insured’s health (e.g. failures in ‘activities of daily living), rather than formal LTC services, would be more attractive to households. Given the high cost of LTC, continued work on this issue is of utmost importance.

References

Ameriks, J, J Briggs, A Caplin, M D Shapiro and C Tonetti (2018), “The long-term-care insurance puzzle: Modeling and measurement”, NBER Working Paper No. 22726.

Barczyk, D and M Kredler (2017), “Evaluating long-term-care policy options, taking the family seriously”, The Review of Economic Studies 85(2): 766-809.

Barczyk, D and M Kredler (2018), “Long-Term Care across Europe and the U.S.: The Role of Informal and Formal Care”.

Braun, R A, K A Kopecky and T Koreshkova (2018), “Old, Frail, and Uninsured: Accounting for Features of the U.S. Long-term Care Insurance Market”, Federal Reserve Bank of Atlanta Working Paper 2017-3c.

Brown, J R and A Finkelstein (2008), “Medicaid and the long-term care insurance market”, American Economic Review 98(3): 1083–1102.

Brown, J R and A Finkelstein (2011), “Insuring long-term care in the United States”, Journal of Economic Perspectives 25(4): 119–142.

De Nardi, M, E French, J B Jones and J McCauley (2016), “Medical spending on the U.S. elderly”, Fiscal Studies 37(3-4): 327-344.

Fang, H (2016), “Insurance markets for the elderly”, in J Piggott and A Woodland (Eds), Handbook of the Economics of Population Aging, North Holland Publishing, pp. 237-309.

French, E, J McCauley, M Aragon, P Bakx, M Chalkley, S H Chen … and E Kelly (2017), “Data from the U.S. and eight other developed countries show that end-of-life medical spending is lower than previously reported”, Health Affairs 36(7): 1211-1217.

French, E, J Jones, J McCauley and E Kelly (2019), “End-of-Life Medical Expenses”, CEPR Discussion Paper No. DP13913.

Gawande, A (2014), Being mortal: Medicine and what matters in the end, Metropolitan Books.

Hendren, N (2013), “Private information and insurance rejections”, Econometrica 81: 1713-1762.

Ko, A (2018), “An equilibrium analysis of the long-term care insurance market”.

Lockwood, L M (2018), “Incidental bequests and the choice to self-insure late-life risks”, American Economic Review 108(9): 2513-2550.

Mommaerts, C (2016), “Long-term care insurance and the family”.

Orlovic, M, J Marti and E Mossialos (2017), “Analysis of end-of-life care, out-of-pocket spending, and place of death in 16 European countries and Israel”, Health Affairs 36(7): 1201-1210.

Pauly, M V (1990), “The rational nonpurchase of long-term-care insurance”, Journal of Political Economy 98(1): 153-168.

Reid, T R (2017), “How we spend $3,400,000,000,000”, The Atlantic, 15 June.