The creation of the European Community in 1957 was the beginning of a long endeavour towards completing the European Single Market (ESM). The aim was to create an area without obstacles to the free movement of goods, services, people and capital. Trade in the EU has been essentially free of quotas and tariffs since 1968. In this long journey, the member states have also agreed to share numerous standards and regulations to remove implicit barriers between countries. In this respect, the Single European Act signed in 1987 has provided a major impetus. All in all, these are major achievements. Such a large free trade area makes it possible to reap economies of scale and provides access to cheaper goods.

However, several studies highlight the limits of the ESM. Head and Mayer (2000) show that national borders still matter a lot. And recent reports highlight that considerable room for improvement remains as the ESM is still fragmented (see for instance Monti 2010).

The Single Market has delivered a lot

Is the regulatory glass half full or half empty? Against the background of an erosion of political support for the European project, it is worth assessing whether the ESM has been effective in boosting economic integration. A simple way to look at this question is to check whether the countries that are in, or have joined, the ESM have deeper trade and foreign investment links than the countries outside the ESM. This is first explored here with a look at trade and foreign investment trends. As many drivers of integration can play a role at the same time, this is also investigated with gravity models of trade and foreign investment.

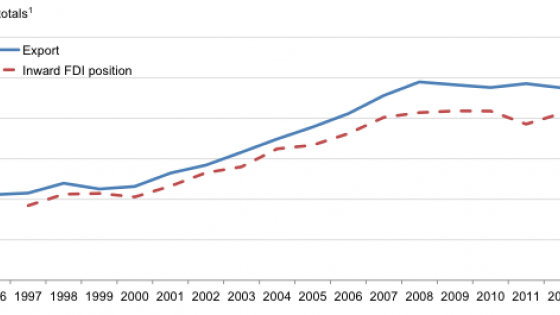

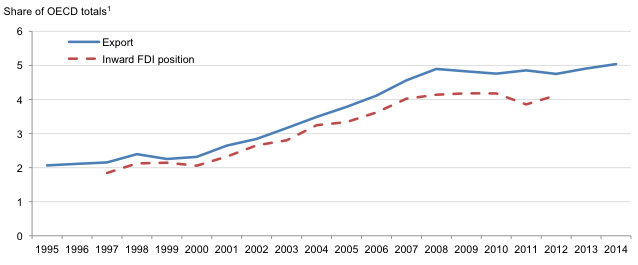

Both inspecting trends and econometric estimates suggest that the ESM is a game changer. In the six OECD countries that joined the EU in 2004 (Czech Republic, Estonia, Hungary, Poland, Slovak Republic, and Slovenia), total exports and inward foreign direct investment have increased much faster than in the rest of the OECD. The share of OECD exports from these six countries and the share of foreign direct investment towards them have doubled between 2000 and 2008 (Figure 1, Panel A). This rise started before the accession year, as countries began to align policies with EU standards and as firms anticipated the completion of the process. This sharp boost to integration is stronger than the rise observed in other OECD countries that are also catching up to the productivity frontier, such as Chile and Mexico, for instance (Figure 1, Panel B). The specific pattern observed for the countries joining the EU strongly suggests that the integration in the ESM has had a major effect on trade and foreign investment.

Figure 1. The sharp rise of exports and inward foreign direct investment in new EU countries

Panel A. Czech Republic, Estonia, Hungary, Poland, Slovak Republic, and Slovenia

Panel B. Chile and Mexico

Notes: The OECD total for FDI excludes Greece, Ireland, Korea, Luxembourg and Turkey due to missing data.

Source: OECD International Direct Investment Statistics database (third edition) and OECD Economic Outlook No. 98 database.

Beyond this evidence, econometric analyses also show a strong effect. Estimates with gravity models of bilateral trade and foreign direct investment measure the effect of the ESM, controlling for many other factors that affect integration. This provides a large and significant effect on trade (Fournier et al. 2015) and on foreign direct investment (Fournier 2015). Estimates suggest that in a country where half of foreign direct investment and trade are from or towards countries belonging to the EU, joining the ESM can increase trade by about 30% and the foreign direct investment stock by about 60% in the long run compared with the countries that are outside the ESM.

Regulatory convergence can boost trade and foreign investment

Beyond the explicit barriers to international trade and investment, firms also face national regulatory hurdles. Firms have to deal with numerous specific rules in other countries that can be complex. This complexity has a cost. Harmonisation of regulations reduces such costs and thereby boosts trade and foreign direct investment.

The empirical analysis provides evidence on the positive effect of regulatory convergence on trade and foreign investment. Regulatory convergence plays a role on top of ESM membership, suggesting that a lot more can be done to remove implicit barriers. The analysis thus also helps explain why Head and Mayer (2000) found large negative trade effects of national borders.

The OECD collects detailed data on product market regulations that hamper competition, including, for instance, the involvement of the state in business operations, licencing systems, or sector-specific regulations (e.g. regulations of telecommunication firms). Regulations that do not discourage competition (e.g. safety requirements applied to all firms) are excluded. These data allow one to look at differences of regulatory settings between country pairs. This reveals that there is a sizeable heterogeneity in regulatory settings across countries.

In a recent paper, I show that firms prefer to invest in a country with a similar regulatory environment (Fournier 2015). A broad reform package that would cut regulatory differences by one fifth could increase foreign direct investment by about 15%. Such a pace of convergence has been observed between 2008 and 2013, for pairs of countries such as Austria and the Slovak Republic. Regulatory differences in some fields reduce foreign direct investment more than others. This is especially the case for antitrust exemptions, regulatory barriers in service sectors, command and control regulations, and barriers in network sectors. This research also shows that deeply rooted heterogeneity of rules, such as differences in legal systems, also reduce foreign direct investment. This helps explain the remaining border effect that still prevails within the ESM.

Reducing regulatory differences and regulatory stringency also boosts trade, as my co-authors and I show in Fournier et al. (2015). For instance, a broad reform package that would align product market regulation to the average of the 50% best performers and cut regulatory heterogeneity by one fifth can increase trade intensity within the EU by more than 10%.

In sum, the ESM has already delivered large economic integration gains, but it is also right that more can and should be done to deepen it further. The long list of policy actions that are warranted is well-known (e.g. Monti 2010, Fournier 2014, OECD 2016). Better communicating the successes so far achieved can help to build the necessary momentum to complete the ESM.

References

Fournier, J-M (2014) “Reinvigorating the EU Single Market”, OECD Economics Department Working Papers, No 1159, OECD Publishing.

Fournier, J-M (2015) “The negative effect of regulatory divergence on foreign direct investment”, OECD Economics Department Working Papers, No 1268, OECD Publishing.

Fournier, J–M et al (2015) “Implicit regulatory barriers in the EU Single Market: New empirical evidence from gravity models”, OECD Economics Department Working Papers, No 1181, OECD Publishing.

Head, K and T Mayer (2000) “Non-Europe: The magnitude and causes of market fragmentation in the EU”, Review of World Economics, 136(2): 284-314.

Monti, M (2010) “A new strategy for the Single Market”, Report to the President of the European Commission.

OECD (2016) OECD Economic Survey: European Union 2016, OECD Publishing, forthcoming.