The debate on the Stability and Growth Pact (henceforth “the Pact”) continues (Wieser 2018, Bénassy-Quéré et al. 2018). There is a widespread perception that fiscal rules in the EU are inadequate despite the improved fiscal and economic situation in recent years.

Criticism of the Pact comes from many, and often opposite, angles. However, a common rallying cry of the critics is excessive complexity. This feature is undeniable. Simply finger-pointing to the number of pages of legal and interpretative documents, which run to the several hundreds, has become the shortcut proof for this situation.

A substantive analysis of the underlying causes of complexity is missing though. In this column, we identify the several, and mutually reinforcing, dimensions of the complexity of the EU fiscal rules and argue that recognising the root causes of complexity and coming to a shared view is crucial before embarking on reforming the Pact. Before proceeding with a 'deconstruction' of complexity, we present a brief assessment of the performance of the Pact.

Track record under the Pact: Imperfect, but effective?

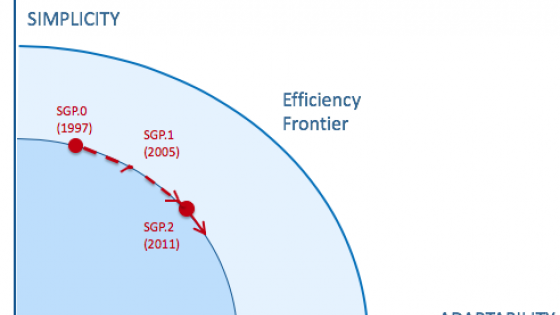

Set against its main objective of fiscal discipline, the record of the Pact can be assessed as positive to mixed, depending on the fiscal metrics and the geographical aggregation (see Figure 1).

- There has been a noticeable convergence of headline deficits, with all but one member state having exited the Excessive Deficit Procedure. This contrasts with the looser fiscal positions observed elsewhere in advanced economies.1

- A very significant reduction in public expenditure growth, which in the past was the prime driver of fiscal developments that turned out to be unsustainable, can be observed in recent years compared with pre-crisis years. This reduction was achieved, however, against the background of a sustained reduction in economic growth.

- At the same time, the underlying fiscal positions (i.e. structural balances) continue to differ markedly across the euro area. While the large majority of member states have achieved or are close to the Pact’s medium-term objective of a close-to-balance or in surplus structural position, a few member states, accounting for about half of the GDP of the euro area, remain far away from this, with little sign of progress.

- Finally, the member states where progress towards the medium-term objective has been stalling are those where it would be most needed to bring down the public debt from very high, arguably dangerous, levels. More generally, the overall improved economic situation did not yet lead to a substantive reduction in government debt in the euro area, which remains higher than a decade ago.

In the absence of a counterfactual, it is hard to assess how the Pact has affected this mixed fiscal performance. Anecdotal evidence, consistent with a widespread view among national policymakers, nonetheless suggests that without the Pact, fiscal imbalances would have been larger in countries with a relatively weak fiscal prudence culture. This conclusion has been recently backed by more rigorous empirical analysis finding that EU fiscal rules have been effective in constraining excessive deficits, and in particular have resulted in a clustering effect on the Treaty reference value of 3% of GDP for government deficits (Eyraud et al. 2018). Furthermore, the existence of rules may have contributed to containing market stress and spillover effects which, if larger, could have had a more negative impact on the sustainability of fiscal positions in some member states.

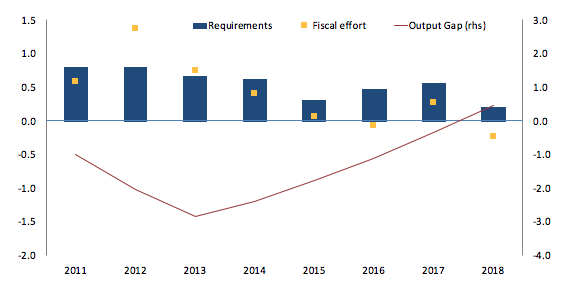

At the same time, there is a clear tendency for pro-cyclical behaviour. Pro-cyclicality predates the Stability and Growth Pact, but the Pact has not succeeded in materially altering it – buffers are not sufficiently built up in in good economic times and fiscal consolidation tends to happen in bad times. The flexibility introduced in 2015 has contributed to bringing the fiscal requirements more in line with cyclical conditions, although the delivery of the required fiscal efforts remains an issue in practice (European Commission 2018).

Overall, this picture goes in the direction of the conclusion reached by the European Fiscal Board that, albeit 'imperfectly applied', the application of the Pact has struck an acceptable balance between controlling fiscal behaviours and preserving growth (European Fiscal Board 2017).

Figure 1

Source: AMECO database, authors' calculations.

Complexity from multiplicity: The role of sedimentation

A key source of complexity relates to the design of rules and in particular the multiplicity of rules (Figure 2). In the present Pact, there are multiple substantive rules (headline balance, structural balance, public expenditure, debt), mirrored by different indicators for measuring compliance with them and including several clauses allowing for derogations. The implementing procedures (preventive arm and corrective arms of the Pact, ex ante and ex post assessments) are equally complex.

Figure 2 A sedimented framework

An evident reason for this complexity is sedimentation over time. The present Pact is a legacy of successive reforms which have added new features incrementally. For instance, the 'six-pack'2 complemented the framework with a debt reduction benchmark, aimed at operationalising the debt criterion, and an expenditure benchmark (for public expenditure net of discretionary revenue measures) aimed in particular at better controlling spending in good times. In addition, interpretational changes in recent years allowed for short-term flexibility in terms of deviation from targets or the required adjustment path with a view to bolstering public investment and growth-enhancing reforms.

A good case can be made for each new element on its own, including filling gaps in surveillance, providing stronger economic underpinnings, strengthening enforcement, or adapting the rules to new circumstances. These contribute to making the rule more ‘adequate’ (read, more adaptable to economic circumstances and therefore more economically founded). But the accumulation tends to blur the key requirements, or worse, opens up opportunities for 'cherry-picking'. Put differently, also in matters of fiscal rules, less can be more.

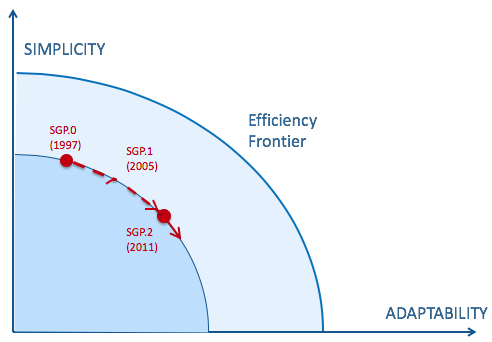

The evolution of EU fiscal rules can be depicted along the lines of a trade-off between simplicity and adaptability (see Figure 3). To a point, increased complexity has been the price to pay for having smarter fiscal rules. While this trade-off has been the consequence of the prevailing circumstances and the successive policy choices regarding the design of the Pact in recent years, the terms of this trade-off should not be exaggerated either. It is hard to deny that the current state of the rules remains well below the efficiency frontier between simplicity and adaptability.3 In other words, it should be possible to improve the adaptability of the framework without increasing its complexity.

Figure 3 Trade-off between simplicity and adaptability

Coexistence of EU and national fiscal rules

The coexistence of EU rules and national rules is another dimension of complexity. Discrepancies have emerged between the Pact and those national rules adopted in line with the Fiscal Compact in 2012. In particular, the evolving interpretation of the Pact has not been mirrored by developments in national rules, giving rise to potential inconsistencies. This has complicated the tasks of all players involved and allowed certain member states to ease the more stringent commitments that stemmed from national rules, thereby undermining their credibility.

Two lessons transpire:

- First, in the policy debate the requirements under EU rules tend to prevail over those set by national rules, especially in countries with a relatively weak fiscal prudence culture. Indeed, in the majority of member states, achieving compliance with the Pact has typically been seen as a convenient waiver from the possibly tighter requirements implied by a strict reading of national rules.

- Second, while there is a need for stability of the fiscal framework, the design and/or interpretation of rules are bound to evolve given changing economic realities, raising the question of how to preserve the alignment between EU and national rules over time.

National independent fiscal institutions (i.e. national fiscal councils), for their part, raise awareness of fiscal issues, enhancing transparency and to some extent the unbiasedness of forecasts (Beetsma and Debrun 2018). But likewise, independent fiscal institutions occupy a challenging position in the triangle that they constitute with national budgetary authorities and EU institutions. Moreover, the present landscape of independent fiscal institutions is quite diverse across member states, with some having a more visible standing than others.

Implementation: The enforceability quandary

A third source of complexity resides in the intrinsic political difficulties of enforcing the Pact. The EU rules are meant to be enforced, not just set indicative benchmarks. They are therefore backed by the possibility of (pecuniary) sanctions. Rules are often to be enforced when they are ‘inconvenient’ for member states, thus being perceived as limiting national ownership. Stronger and more automatic enforcement mechanisms have been put in place in the aftermath of the crisis.

The costs of enforcing the rules argue for taking into account economic circumstances so as to avoid undesirable economic outcomes, a source of 'design complexity'.

But the causality also goes the other way round: arguably, a lack of ownership of the framework is a key reason for complexity (Pench 2015). This point is often missed but it is probably an essential 'deep cause' of complexity, especially in a multilateral setting where a fully authoritative central body is not in place and budgetary sovereignty remains fundamentally at the national level.4

In order to capture all kinds of possible situations while maintaining a sufficient degree of predictability, the tendency has been to put in place incremental, detailed ex ante specifications in an elusive quest for a ‘complete contract’. The need to take into account evolving economic realities and policy preferences entailed the repeated introduction of new sub-rules and/or exceptions to the rules. This was a recognition that the rules must be at the same time predictable and adaptable to circumstances. Even then, this approach disregarded the fact that no system could eliminate or template the necessary role of economic and political judgement in unusual circumstances or in borderline cases. Moreover, the lack of simplicity generated by this over-specification turns against its proclaimed objective of predictability.

Fundamentally, the dilemma faced by EU fiscal rules and mentioned above is actually a trilemma between adaptability, enforceability and simplicity (see Figure 4).5 The absence of a single authority for adjudicating on compliance, consistent with the multi-level governance characterising the EU, exacerbates the tensions between the three elements (Buti 2016). It is also a reason for doubting that a state-of-the-art design of the rules would be sufficient to ensure a smooth working of the system.

Figure 4 A trilemma for EU fiscal rules

The more flexible approach to compliance adopted by the Commission in recent years, thereby exercising its constrained discretion, can be seen as an illustration of this inherently complicated dynamic, as well as of a desire to reconcile different national preferences on deficit and debt reductions across member states.

Conclusions

The fiscal performance under the Stability and Growth Pact is arguably better than is sometimes credited, taking into account unusually difficult economic circumstances in the 2010s. The complexity of the framework is undisputable; the number of rules and sub-provisions has inflated through incremental additions, each with justifications, but without concomitant streamlining of existing provisions. We have also argued that there are deeper causes of complexity which reflect the specificities of the EU governance setting. In particular, the willingness to combine adaptability to circumstances and predictability in implementation exerts constant pressure for developing detailed specifications to establish the existence of deviations from the Pact 'beyond reasonable doubts', at the expense of simplicity. This is not to say that there is not an element of unnecessary complexity in the current framework that should be improved upon.

Authors' note: The views expressed in this column are the authors' own and may not, under any circumstances, be interpreted as stating an official position of the European Commission.

References

Beetsma R and X Debrun (2018), Independent fiscal councils, watchdogs or lapdogs?, A VoxEU eBook.

Beetsma, R and M Larch (2018), “Risk reduction and risk sharing in EU fiscal policymaking: The role of better fiscal rules”, VoxEU.org, 10 May.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani- Ferry, H Rey, I Schnabel, N Véron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No. 91.

Buti M (2016), “What future for rules-based fiscal policy”, inO Blanchard, R Rajan, K Rogoff and L Summers (eds), Progress and Confusion: The State of Macroeconomic Policy, University Press Scholarship Online.

Carnot, N (2014), “Evaluating fiscal policy: A rule of thumb”, European Economy Economic Papers No. 526.

Debrun X and L Jonung (2017),” Rules-Based Fiscal Policy: How Sustainable Is It?”, paper presented at the Fiscal Frameworks in Europe: Background and Perspectives conference, Copenhagen, 1–2 June.

European Commission (2018), “Review of the flexibility under the Stability and Growth Pact”, Commission staff working document (SWD(2018) 270 final),accompanying the Communication of 23May 2018,

European Fiscal Board (2017), Annual Report, 15 November.

Eyraud L, X Debrun A Hodge V Lledo and C Patillo (2018), “Second generation fiscal rules: balancing simplicity, flexibility and enforceability”, IMF Staff discussion notes, 18/04.

Leino P and T Saarenheimo (2017), “On the limits of EU policy coordination”, European Law Review 2.

Pench L R (2015), “Shortcomings of EU Fiscal Rules and Institutions and Possible Ways Forward”, Contribution to the 17thBank of Italy Workshop on Public Finance, “Beyond the Austerity Dispute: New Priorities for Public Finances”, Perugia, 9-11 April.

Wieser, T (2018), “Fiscal rules and the role of the Commission”, VoxEU.org, 21 May.

Endnotes

[1] It has been argued though that these countries can afford higher fiscal deficits and debt because they have a central fiscal instrument and one single sovereign bond market (Beetsma and Larch 2018).

[2] The five regulations and one directive that amended the Pact in 2011.

[3] For a parsimonious approach to rules design, see for instance Carnot (2014).

[4] On the limits of EU policy coordination more generally, see Leino and Saarenheimo (2017).

[5] For reflections on the problematic role of enforcement, see Debrun and Jonung (2017).