This week is the 10th anniversary of the Lehman Brothers bankruptcy. While the US economy was recovering from the Great Recession, the sovereign debt crisis in the euro area delayed recovery there. The initial announcement in October 2009 by Greece’s Finance Minister at the time, George Papaconstantinou, had limited immediate impact on the interest rates of other countries in the euro area, but it revealed a deep distrust between its member states.

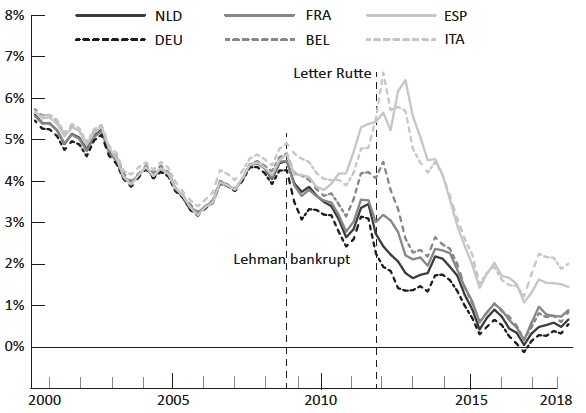

Figure 1 documents that interest rates started to diverge more strongly from the autumn of 2010 onwards (Greece, Ireland, and Portugal are left out to maintain a reasonable scale). The figure marks the date at which the Dutch Prime Minister, Mark Rutte, published an article in the Financial Timesarguing that member states that did not live by the fiscal rules should be expelled from the monetary union. This symbolised the lack of confidence among member states. The response to the letter was not a hike in interest rates but a divergence – rates went down in Germany and the Netherlands, and went up in Italy, Spain, Belgian, and France. The fear of break-up of the euro area and a redenomination of sovereign debt in new currencies pushed up the rates in countries that were expected to devaluate under that scenario. This mechanism destabilised the monetary union. Countries in distress had to pay an insurance premium for a risk – redenomination in a weaker currency – that would not materialise unless the euro area fell apart. At same time, countries with the lowest stress benefitted from lower interest rates by investors’ flight to save havens.

Figure 1 Interest rates in the euro area, 2000-2017

This process had to be stopped for the euro to survive. In the spring of 2012, the leaders of the member states met at the European Council in Brussels to negotiate a solution to the problem. Germany and the Netherlands blamed excessively high deficits and the default risk. Italy, Spain, Belgium, and France blamed the redenomination risk and the lack of a fiscal backstop. For Italy and Spain the default risk may have been real, but for Belgium and France that risk was negligible. A compromise would therefore only be acceptable if it included both a more substantial fiscal backstop and stricter fiscal rules.

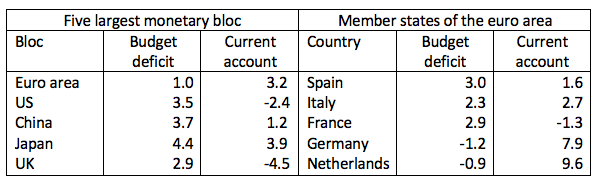

With the benefit of the hindsight, this outcome was remarkable. First, the divergence of the interest rates between member states has been dwarfed by the subsequent overall decline (see Figure 1). Second, budgets deficits are far lower in the euro area than in any other monetary bloc (see Table 1). Even Spain’s deficit, among the highest in the euro area, is low compared to those in other monetary blocs. From that perspective, the tightening of the fiscal rules in the euro area was an anomaly. That the euro area ended up in a sovereign debt crisis despite its rather low deficits suggests that there is at least some truth in the argument that the lack an adequate fiscal backstop was to blame.

Table 1 Budget deficits and current accounts for various countries, 2017 (% of GDP)

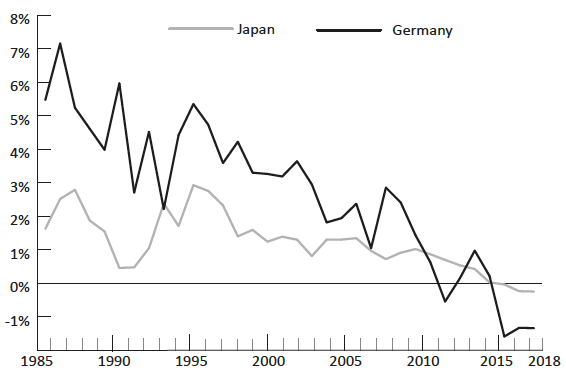

Falling nominal and real interest rates is a global phenomenon dating back to 1985. Figure 2 plots real interest rates in Japan and Germany – though the fall in Japan precedes that in Germany, the general trend is the same. This phenomenon has been dubbed ‘secular stagnation’. Blanchard et al. (2014) provide an overview of the causes of this trend: the supply of savings has gone up due to global trends in demography and the rapid growth of China, the demand for capital has gone down due to a fall in the price of capital goods, and there has been a flight to safety, while the supply of safe assets (mainly sovereign debt) has gone done (Caballero and Fahri 2017). The excess supply of savings – the ‘savings glut’ – might have been one of the main causes of the 2008 financial crisis (see Caballero et al. 2008 a,b).

Figure 2 Real interest rates in Japan and Germany, 1985-2017

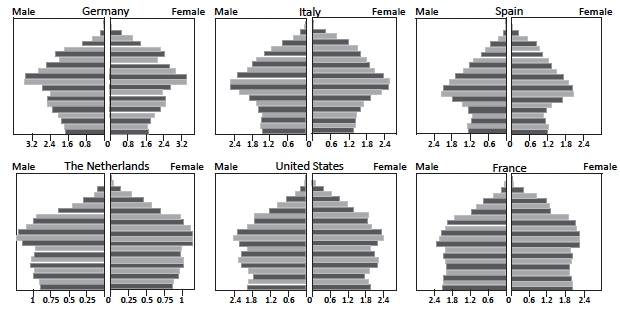

Jason Lu and I have argued that demography plays a major role (Lu and Teulings 2016). The introduction of the contraceptive pill led to a substantial fall in fertility rates in Germany around 1970, and in Italy and Spain five years later. In all three countries, the last cohort born before the fall in fertility rates is about twice the size of the cohorts born recently (see Figure 2). The age distributions in the Netherlands, the UK, and in particular France are more balanced. The life cycle hypothesis states that the stock of savings of an individual is at its maximum around the age of retirement, say, between 55 and 70. Since the last large cohorts born before the fall in fertility are currently in that age category, the stock of savings are high and will remain high for the next 15 years, driving interest rates down.

Figure 3 The age distribution in a number of European countries, 2014

Japan’s age structure of precedes that of Germany, Italy, and Spain by 20 years. What happened to Japan during the past two decades is therefore a useful laboratory for what is awaiting the euro area, (Krugman 1998): low interest rates, deflationary pressures, and an increasing public debt to absorb the excess savings (Japan’s public exceeds 200% of GDP). The blocs with an unbalanced age structure (the euro area, Japan, and China) can use their savings surplus in three ways (or a combination thereof):

- a current account surplus (exporting the savings),

- higher budget deficits, or

- a high capital intensity and high real estate prices induced by low interest rates.

I discuss these three solutions in turn.

Regarding current account surpluses, Table 1 offers some interesting insights. China’s demographic structure is similar to that of Germany, while the US has a balanced structure like the UK and France. This fits exactly the current account balances of the main monetary blocs – the euro area, Japan, and China have a surplus, while the US and the UK have a deficit. Also, within the euro area, Germany, Italy, and Spain have a surplus, while France has a deficit. The only exception is the Netherlands, which has a balanced age distribution but a large current account surplus.

Whether this solution is sustainable is doubtful. President Trump has started a trade war aiming to eliminate bilateral current account deficits. Irrespective of one’s evaluation of this policy, the euro area might better be prepared for a world in which it cannot run its current surpluses, but is forced to spend them within its own borders. Hence, two options remain: high deficits or low interest rates.

Regarding the latter, the fiscal rules in the old Stability and Growth Pact were too strict and their update laid down in the new European Fiscal Compact made matters worse. The euro area’s demography makes a 60% sovereign debt more of a lower bound than an upper bound. Public debt has to grow at the same rate as GDP to keep the debt ratio constant. Nominal growth of GDP is slightly higher than 3% on average (1% real growth + 2% inflation). Public debt therefore has to grow by 60% x 3% = 2% of GDP every year to keep the debt ratio constant; hence, the deficit must be 2% of GDP on average. During a severe recession, the deficit tends to increase by 3 percentage points or more (so from 2% to 5%); during the Great Recession of 2009-2010, some countries had deficits well above 6% of GDP without this leading to any distress on financial markets. Hence, the fiscal rules should allow for an upper bound during a bad recession of 5-6% of GDP. The upper bound allowed by the Stability and Growth pact is far lower, at 3%. The 2012 European Fiscal Compact added a new constraint: the structural deficit – i.e. ignoring cyclical fluctuations – must not exceed 1 % of GDP. This corresponds to a level of sovereign debt of 1%/3% = 33% of GDP. So, if the member states will live by the rules during the next decades, the euro area is heading for an unprecedented decline of public debt. The more likely outcome is the rules being simply ignored. But then it is better revise them now so that member states can be held accountable when violating them.

If the euro area is unwilling to change its fiscal rules, which is indeed unlikely, only the third solution remains: higher capital intensity and high real estate prices brought about by lower real interest rates. This option runs into another constraint: the zero lower bound for nominal interest rates (Eggertson and Krugman 2012). It will be a challenge for the ECB’s monetary policy to implement a real interest rate that is consistent with the euro area’s demographic outlook and its stated aspiration for reducing public debt, in particular when the economy slides into a recession, as will happen sooner or later.

Whether one prefers higher public debt or lower real interest rates, the position of the presidents of the Bundesbank and the Nederlandsche Bank is hard to justify – they are opposing both alternatives. Also, for German and the Dutch public this is unappealing position as it puts the Eurozone at risk. One might therefore feel some sympathy for Tilford (2018) when he argues that Jens Weidmann is the most dangerous man in Europe.

Author’s note: This column is based on the ebook, "Beyond the dykes", on the decade since the fall of Lehman in September 2008, available here.

References

Blanchard, O, D Furceri and A Pescatory (2014), “A prolonged period of low interest rates?”, in C Teulings and R Baldwin, Secular Stagnation: Facts, Causes and Cures, A VoxEU.org eBook, CEPR Press.

Caballero, R and E Farhi (2017), “The safety trap”, The Review of Economic Studies 85(1): 223-274.

Caballero, R, E Farhi and P-O Gourinchas (2008a), “An equilibrium model of ‘global imbalances’ and low interest rates”, American Economic Review 98(1): 358-93.

Caballero, R, E Farhi and P-O Gourinchas (2008b), “Financial crash, commodity prices and global imbalances”, NBER Working Paper 14521.

Eggertsson, G and P Krugman (2012), “Debt, deleveraging, and the liquidity trap: A Fisher-Minsky-Koo approach”, The Quarterly Journal of Economics 127(3): 1469-1513.

European Commission (2017), “Designing Europe’s future: Trust in institutions, Globalisation Support for the euro, opinions about free trade and solidarity”, Special Eurobarometer 461.

Foster, C and J Frieden (2017), “Crisis of trust: Socio-economic determinants of Europeans’ confidence in government”, European Union Politics 18(4): 511-535.

Lu, J and C Teulings (2016), “Secular stagnation, bubbles, fiscal policy and the introduction of the pill”, CEPR Policy Insight

Krugman, P (1998), “It's baaack: Japan's slump and the return of the liquidity trap”, Brookings Papers on Economic Activity 1998(2): 137-205.

Teulings, C N (2018), Beyond the dykes …

Tilford, S (2018), "The most dangerous man in Europe is Jens Weidmann", Foreign Policy, 8 March.