Remember some of the objectives of the creation of the euro? A single currency area within Europe would carry with it:

- Enhanced factor mobility

- Greater productivity growth

- Acceleration of financial development; and

- Improved macroeconomic policies.

Or, at least, that was the hope (Wyplosz 1997).

Newspaper headlines these days make it all too clear that the Eurozone has so far defaulted on these promises. In a recent paper, however, we highlight one area in which it appears to be working precisely as intended – integrating consumer markets and bringing about price convergence (Cavallo et al. 2013).

Benefits of price convergence

Why might price convergence be desirable? Price dispersion for identical goods is only possible in the presence of barriers to arbitrage, broadly defined. To the extent that the euro reduced transaction costs, uncertainty, and search and informational costs associated with purchasing the same good in different geographies, it improved economic efficiency. Price convergence would be a natural manifestation of these reduced frictions. Moreover, regardless of the reasons for price convergence, in many environments, price equalisation for goods with the same production and distribution costs is a requirement for efficient allocations.1

Further, the behaviour of international relative prices is critical in standard open-economy models, and is closely related to the degrees of shock transmission and risk sharing. Price equality implies a real exchange rate of unity, at least among those traded goods. Our results therefore also inform discussions of the costs and benefits of various currency regimes, as they suggest differences in real exchange-rate behaviour across these regimes.

Exchange-rate regimes and price dispersion

We study the pricing behaviour of four industry leaders: Apple, IKEA, H&M, and Zara. These companies’ online prices are generally identical to their offline prices. We analyse how the prices of these stores differ across countries for identical goods, and evaluate how cross-country price dispersion depends on the currency of denomination. We find that prices from the exact same store for the exact same product differ significantly across countries outside the Eurozone, but are often identical within the Eurozone.

A voluminous literature has documented significant price differences for the same goods or category of goods sold in different countries.2 Explanations typically focus on aspects such as transport costs, tariffs, differences in language, culture, or competition, differences in income, etc. By contrast, we find that by far the most salient determinant of price differences is when prices are quoted in the same currency.

When we compare the exact same products across two countries that have flexible exchange rates, price dispersion is higher than when the two countries have fixed exchange rates. This is not terribly surprising. The price deviation is about 15–40% less for fixed exchange rates than for flexible rates, some of which might plausibly be attributable to typical levels of nominal exchange-rate volatility.

Price convergence in currency unions

Even more surprising is that when moving from fixed currencies to currency unions, where there is no difference in nominal exchange-rate volatility (both have none), price dispersion drops by a further 30–50%! In fact, whereas identical prices almost never exist outside of currency unions, they are commonplace inside them. Put differently, when we compare Denmark to Germany – a country pair with a very credible fixed exchange-rate regime – the prices exhibit dramatically more dispersion than when we compare Germany and France.

Further, this is not a purely euro-specific phenomenon. We compare prices in the US to dollarised countries (such as Ecuador and El Salvador) and to countries with strong pegs to the dollar (such as Jordan and Lebanon). The qualitative pattern is the same – prices of identical goods sold in countries that share a currency are more similar than prices in countries with different currencies, even in the absence of exchange-rate fluctuations.

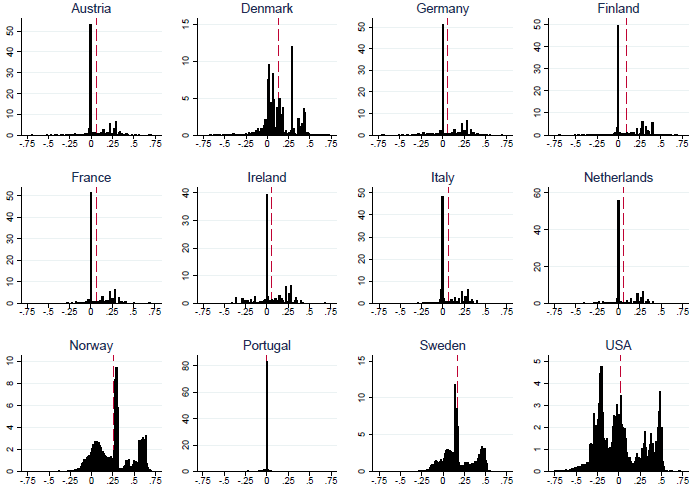

To visualise these results, we pool our data across goods and time, and plot below in Figure 1 the logarithm of the price of each good in the listed country relative to the price in Spain, after translating the prices into a common currency. (An x-axis value of 0 in the bottom-right histogram labeled ‘USA’, for example, would mean that a good is sold at an identical price in the US and Spain after taking into account the dollar–euro exchange rate; an x-axis value of 0.1 would mean a good costs roughly 10% more in the USA than in Spain.) The y-axes in the histograms capture the density of products corresponding to each of these relative prices. The figure confirms the statistics described above. Countries sharing a common currency have a large mass at identical prices corresponding to the spikes at zero. Non-Eurozone countries, including Denmark which pegs to the euro, have far more mass elsewhere.

Figure 1. Good-level real exchange rates with Spain (in logs)

Clearly, these international pricing patterns might not be representative of all traded goods. For example, our results are likely less informative about the behaviour of fresh food or auto prices. But we note that consumption spending in the three industries we study – clothing, electronics, and furniture – equals roughly 20% of all US consumption expenditures on goods.

Concluding remarks

Why is price dispersion so dramatically reduced among the Eurozone countries? We hope in future work to answer this question. We can, however, rule out several possible explanations.

- First, it is not merely due to all European customers being routed to the identical web page (though if firms did choose this structure, that would itself be puzzling).

If a consumer in Madrid tries to access the firm’s Italian web page, they are either re-routed to the Spanish page or are not allowed to input a shipping address outside of Italy.

- Second, price equalisation in the Eurozone is not required by regulations or competition policies, since all such policies exist at the EU level as opposed to the Eurozone level.3

Finally, we use an identical matching algorithm in our analysis of all bilateral country pairs, regardless of their currency regime. The fact that this same procedure identifies such small price differences in one set of countries implies that the large price differences found among others is not due to matching errors, which result in price comparisons of different goods.

These results perhaps suggest a greater role for consumer psychology or firm organisational structure in macro models of price determination. Furthermore, regardless of their motivation, the pricing structure which emerges carries implications for the theory of optimal currency areas and for the path of external adjustment. We hope to continue exploring some of these possibilities in future research.

References

Bailey, D and R Whish (2012), Competition Law, Oxford University Press: New York.

Berka M, M Devereux and C Engel (2012), “Real Exchange Rate Adjustment in and out of the Eurozone”, American Economic Review: Papers and Proceedings, 102(3): 179–185.

Cavallo A, B Neiman and R Rigobon (2013), “Currency Unions, Product Introductions, and the Real Exchange Rate”, Quarterly Journal of Economics, forthcoming.

Crucini M, C Telmer and M Zachariadis (2005), “Understanding European real exchange rates”, The American Economic Review, 95(3): 724–738.

C Engel (1999), “Accounting for US Real Exchange Rate Changes”, Journal of Political Economy, 107(3): 507–538.

Gopinath, Gita, Chang-tai Hsieh, Pierre-Olivier Gourinchas and Nicholas Li (2011), “International Prices, Costs, and Markup Differences”, The American Economic Review, 101(6): 2450–2486.

Wyplosz, Charles (1997), “EMU: Why and How It Might Happen”, Journal of Economic Perspectives, 11(4): 3–21.

1 Berka et al. (2012) write, for example, “Deviations from price equality that are not driven by differences in costs of delivering the goods to different locations lead to inefficient resource allocation.”

2 See, for example, Crucini et al. (2005), or Gopinath et al. (2011). Relatedly, Engel (1999) demonstrates that movement in relative prices of tradable goods across countries is the principle driver of variation in bilateral real exchange rates.

3 Further, according to Bailey and Whish (2012), “The Court of Justice in United Brands v Commission ruled that ‘it was permissible for a supplier to charge whatever local conditions of supply and demand dictate, that is to say that there is no obligation to charge a uniform price throughout the EU.’”