The euro is almost 20. It has existed through two very distinct decades. A successful first ten years, in which macroeconomic conditions remained benign, and a second decade where a deep crisis raised concerns about its viability. As interest rates reached the zero lower bound and monetary policy run out of ammunition, all eyes turned to fiscal policy. After a countercyclical stance during the first two years of the crisis, policy switched to a procyclical stance, driven by austerity, from 2010 to 2014.

The question of how procyclical fiscal policy affected economic performance in the euro area has been controversial, with seemingly never-ending debates on the size of fiscal policy multipliers. The work of Blanchard and Leigh (2013) was an inflection point in this debate. They provided convincing evidence of large short-term multipliers in response to the fiscal consolidation during 2010 and 2011. Their work also suggested that policymakers had underestimated the size of the multipliers, making fiscal policy even more procyclical.

Building on this work, in a recent paper Larry Summers and I showed evidence that these damaging effects have persisted (Fatás and Summers 2018). Looking at forecasts to 2022, GDP is still affected by the consolidation of those early years. This is consistent with a view that hysteresis has turned procyclical policy into permanent scars on GDP.

Recently I analysed fiscal policy decisions in real time between 2010 and 2014 (Fatás 2018). I argue that the damage done by fiscal policy in this period is likely to be even larger than previous studies have suggested. This is due to a negative loop between estimates of potential output used to design policies and feedback from the effects of these policies. I have called these dynamics a 'fiscal policy doom loop'.

In short, unfounded pessimism feeds into policy. The consequences make policymakers even more pessimistic and cause permanent damage. This validates the (originally unfounded) forecast. This may lead to successive rounds of fiscal policy mistakes that magnify the effects over time, and reduce long-term GDP. An analysis of real-time policy decisions and potential output estimates reveals that this loop is a good characterisation of fiscal policy in the euro area between 2010 and 2014.

Potential output estimates are highly procyclical

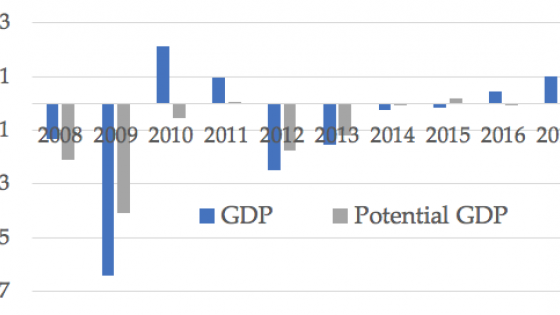

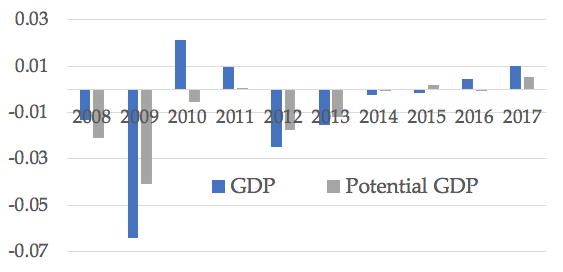

Long-term forecasts of GDP (potential output) react immediately to surprises in GDP growth. This was clearly true from 2010 to 2014. Figure 1 shows forecast errors for real GDP, as well as for estimates of potential, in a two-year window. There is an almost perfect correlation. Surprises in GDP growth immediately translate into changes in potential output estimates.

In my paper I provide additional evidence about this pattern by regressing changes in estimates of potential on GDP surprises using one-year, two-year, and six-year windows. In all cases, potential output reacts to short-term changes in GDP. What is remarkable is that even when we look at the shortest (one-year) window, the regression suggests that a 1% surprise to GDP translates into an immediate 0.65-0.85% change in estimates of potential output. These patterns are true for a variety of potential output estimates, including those produced by the IMF as well as the European Commission (AMECO).

Figure1 Forecast errors over two-year horizon (euro area aggregate)

Source: IMF World Economic Outlook.

Pessimism creates a vicious cycle with fiscal policy

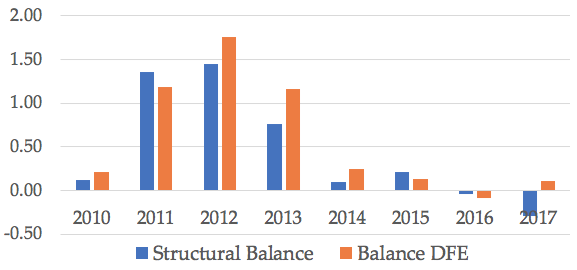

Pessimism about potential GDP between 2008 and 2009 combined with other factors (such as increasing debt) led to a first wave of fiscal consolidation from 2010 to 2011 (see Figure 2). From Blanchard and Leigh (2013) we know that this had a negative effect on GDP growth. Consistent with our earlier argument, these changes in GDP immediately led to downgrades in estimates of potential output by 2011. The magnitude is, as before, between 0.6% and 0.8% for every 1% change in GDP. These effects are even larger if we look at estimates of nominalpotential output, which would be the relevant measure if we were making decisions on the sustainability of debt and so is likely to be the measure driving future fiscal policy.

These growing concerns about debt sustainability led to a second wave of fiscal consolidation from 2012 to 2013, as shown in Figure 2. In the data, it is clear that countries whose economic conditions deteriorated more form 2010 to 2011 engaged in larger consolidation in 2012 and 2013. Replicating Blanchard and Leigh's calculations for the second period again shows large fiscal policy multipliers, and similar revisions to potential output estimates by 2013.

Figure2 Planned and actual structural balance change and discretionary fiscal effort (DFE) for the euro area

Source: Structural balances: IMF World Economic Outlook discretionary fiscal effort: European Commission.

The dynamics of the fiscal policy doom loop

We are describing a situation in which policymakers start with unfounded pessimistic views about potential GDP. They take fiscal policy actions based on these views. Policymakers ignore both the actual size of the short-run fiscal policy multiplier, and the possibility that both the initial cyclical shock and the effects of their policies create hysteresis.

Because they underestimate multipliers, the short-term effects of their policies are a surprise. They downgrade, once again, estimates of potential GDP and engage in a second wave of fiscal consolidation. The tragedy is that as policymakers act on their pessimism about potential, the cyclical effects of their policies become permanent through hysteresis. As a result, their forecasts become true partly because of the effects of the policies they designed in response. This is self-fulfilling pessimism.

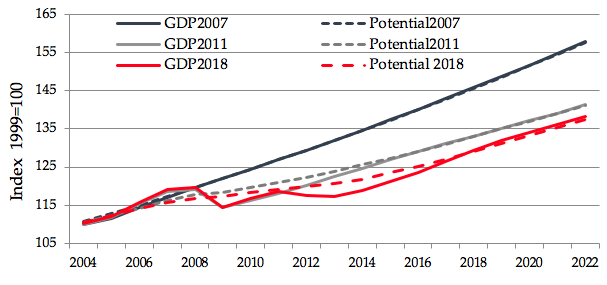

The final outcome is an economy whose potential output is significantly lower because of successive downward revisions (Figure 3). The effects of the earlier decisions are amplified through successive rounds of procyclical policy. This reduces GDP forecasts until 2022.

Figure 3 Revisions to euro area actual and potential GDP

Source: Fatás (2018).

We can do better next time

The main lesson from this experiment is that if we ignore the possibility of hysteresis, it's a very dangerous cocktail if we underestimate fiscal policy multipliers and make highly procyclical estimates of potential output. To avoid a similar event in the future we need the following:

- Long-term forecasts of GDP that are not as cyclical (Claeys et al. 2016). This would solve the problem of procyclical policies, both in good and bad times. The damage done by procyclical policies would likely be larger in bad times than in good times, because fiscal policy multipliers are likely to be larger during a crisis.

- Fiscal targets that are less dependent on potential output estimates. Expenditure targets are likely to be less subject to procyclicality than structural balance targets (Darvas et al. 2018).

- Models that properly estimate the size of fiscal policy multipliers and are open to the possibility of hysteresis. Without these models, fiscal policies are not only procyclical (or not countercyclical enough), but their cost is large because they permanently damage GDP. This damage may ex postvalidate the assumptions that triggered those policies, even though the assumptions would have been excessively pessimistic.

The dynamics during these years might be specific to this unique episode – a large crisis during which monetary policy was hampered by zero interest rates. Should we then use this episode to guide a new fiscal policy framework in the euro area? Yes, because even if these episodes are rare, they seriously affect GDP, debt levels, and political support for the euro project. It is these moments that test the foundation and viability of a currency area, not the expansion years. Therefore it would be wise to explicitly recognise the challenges of a large crisis, and the need for aggressive fiscal and monetary policies in euro area policy frameworks.

Author’s note: The paper on which this column is based was presented at “The Euro at 20”, a conference organised by the IMF and the Central Bank of Ireland, 25-26 June 2018.

References

Blanchard, O J and D Leigh (2013), “Growth forecast errors and fiscal multipliers”, NBER working paper 18779.

Claeys, G, Z M Darvas, and A Leandro (2016), “A proposal to revive the European fiscal framework”, Bruegel Policy Contribution.

Darvas, Z M, P Martin, and X Ragot (2018), “The economic case for an expenditure rule in Europe”, VoxEU.org, 11 September.

Fatás, A, and L H Summers (2018), “The permanent effects of fiscal consolidations”, Journal of International Economics 112: 238–250.

Fatás, A (2018), “Fiscal Policy, potential output and the shifting goalposts”, CEPR Discussion Paper 13149.