The Eurozone is trapped in a debt crisis which is generating a massive lack of confidence in global financial markets, and which threatens to become systemic and plunge developed economies into a new recession (see on this site Muellbauer 2011). International investors have been running from European assets in a stampede that the two EU summits in July and August have failed to stop, and are now in a “wait-and-see” mode, making extremely difficult the renewal of huge amounts of public and private debt. Although the Eurozone as a whole will end 2011 with lower levels of public debt and deficit than the US or the UK, the poor management of the heterogeneity among members and the absence of efficient political institutions able to handle this heterogeneity are pushing financial stress in the Eurozone to limits even higher than those observed during the Lehman crisis.

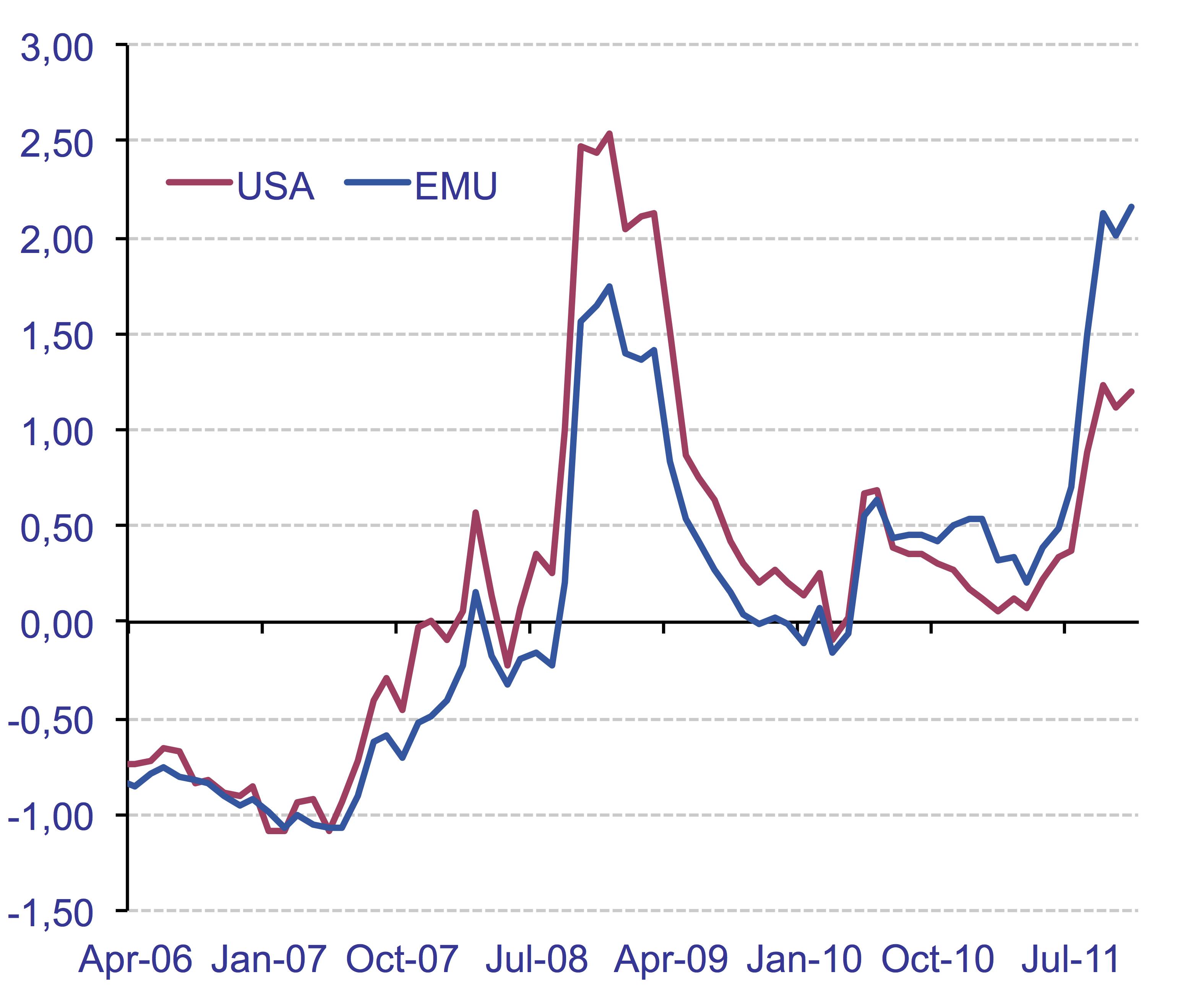

Figure 1. Financial Tensions Index: Eurozone and the US (April 2006 to November 2011)

Source: BBVA Research

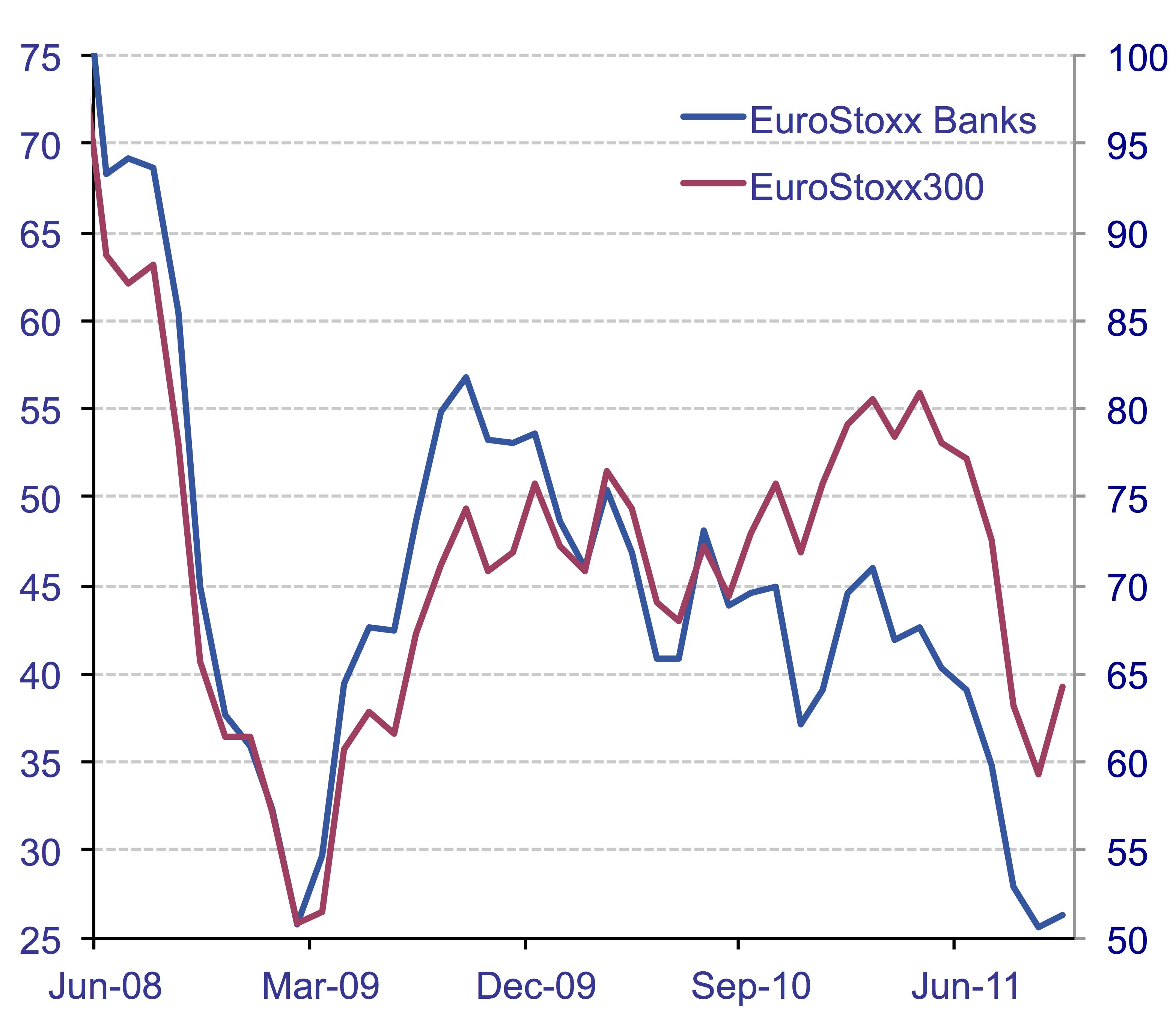

Figure 2. Eurostoxx 300 and Eurostoxx banks (April 2006=100)

Source: Bloomberg

Figure 1 corroborates this assertion, showing the recent behaviour of BBVA’s Index of Financial Tensions for the EZ and the US.1 In the same vein, Figure 2 represents the Eurostoxx index for banks, which shows a clear W pattern, where the current levels are similar to those observed at the beginning of 2009, when Eurozone countries’ growth was plummeting. The interaction between the sovereign debt crisis and banking risk is creating a greater financial stress, which is not only reflected in higher sovereign and corporate risk premia but also in completely distorted wholesale funding and interbank markets, and liquidity tensions. These conditions indicate that a credit crunch may have already started in the Eurozone and that this time it could be even more intense than the one observed after the Lehman Brothers bankruptcy.

To evaluate the effects on growth of persistent and intensified financial tensions we have used two alternative approaches, obtaining similar results. In both exercises we compare the baseline scenario, in which financial tensions remained at the levels observed in the first half of 2011 (when we were expecting a growth rate for the Eurozone of 1.3% for 2012), and a risk scenario, in which European countries do not solve the sovereign debt crisis and financial tensions in 2012 remain at the same levels as the ones observed in the past few weeks.

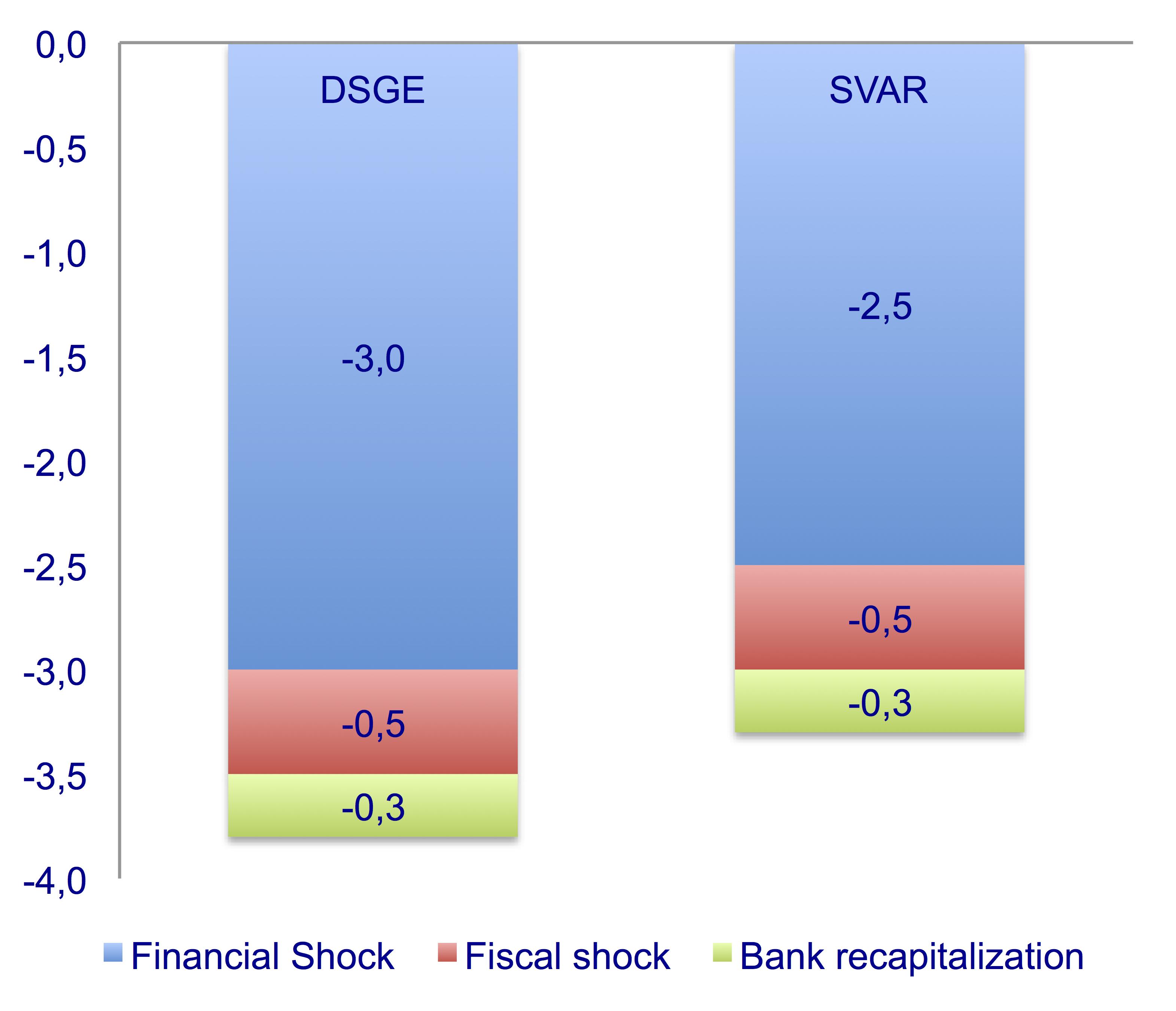

In the first exercise we use a DSGE model estimated for the Eurozone (see Doménech et al 2011), which is an extended version of the DSGE model with banks estimated by Gerali et al (2010), including public consumption and investment and a wide range of distortionary taxes. According to the results of this model, should financial tensions remain at current levels then three percentage points of GDP growth will be detracted from the base line scenario. Additionally, if we take into account the effects of an additional fiscal adjustment to ensure the deficit targets of Eurozone members in 2012, growth will fall by a further 0.5 percentage points. Finally, since in a new recession it is difficult to expect that the potential benefits from the bank recapitalisation could materialise (eg, reopening of funding markets), our DSGE model indicates that growth may fall an additional 0.3 percentage points as a result of the recapitalisation decided at the last European summit (see BBVA 2011a). Altogether, GDP growth will fall from 1.3% in the baseline scenario to -2.5% in the risk scenario.

In the second exercise we use the SVAR proposed by Falbo (2011), obtaining similar results. The estimated model includes as endogenous variables the GDP of the Eurozone, the financial tensions index and the GDP of the OECD, in order to estimate only pure financial stress effects with no contamination of the world economic cycle. The results are also similar to those found by Hakkio and Keeton (2009) for the US. In particular, GDP will fall 2.5 percentage points with respect to the baseline scenario if financial tensions in 2012 remain at their current levels.

Figure 3. Growth effects of persistent financial tensions in 2012 (Deviations from baseline)

Source: BBVA Research

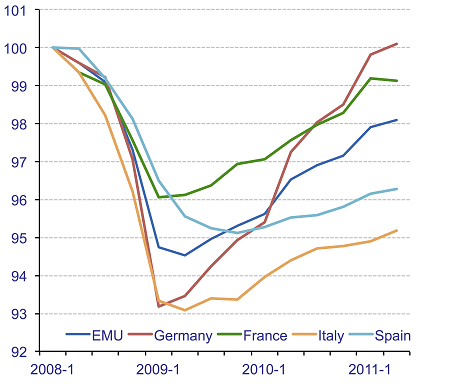

Figure 4. GDP of the Eurozone (2008Q1=100)

Source: Eurostat

Figure 3 summarises the results obtained with these two alternative methodologies, which can be interpreted as a lower estimate of the negative effects of financial tensions on economic growth, for at least two reasons.

- First, as experienced after the Lehman crisis, if the European sovereign debt crisis is not solved quickly it will also negatively affect the activity of other economies, because of its systemic nature. There would therefore be a negative feedback through the expected fall in global demand for Eurozone exports.

- Second, although financial shocks were larger, according to the GDP growth decomposition of our DSGE model, we have found that during the 2009 recession there was a positive correlation between financial and other macroeconomic shocks that also contributed to the Great Recession, something that cannot be ruled out if there is a new financial recession.2

Therefore, taking together all these effects, we cannot rule out that the sovereign debt crisis may cause a recession of a magnitude similar to the one observed in 2008 and 2009.

The results presented so far refer to the Eurozone as a whole. Although it is clear that a new recession may have asymmetric effects among its members, the empirical evidence of the recession in 2008–09 is also very informative. Figure 4 shows that the fall of GDP was very substantial among the largest members (Germany, France, Italy and Spain account for almost 80% of the GDP of the EZ), confirming its systemic nature. Therefore, it is reasonable to expect that if the Eurozone slips into a new recession, due to a systemic sovereign debt crisis, all Eurozone members will be adversely affected. In fact, the latest indicators are consistent with this hypothesis. For example, the Purchasing Managers Index in manufacturing in most Eurozone countries is already showing a clear and worrying deterioration of activity in the fourth quarter of 2011.

Based on the evidence of Figure 4, solutions to avoid a new financial crisis spreading across all Eurozone countries should be not only national but also supranational. Regardless of the changes that European institutions should design for the long term, in the short run the Eurozone needs very convincing and effective actions to help the financial markets stabilise immediately. As proposed by BBVA (2011b) or The Economist (2011), among many others, a well-designed short-term solution requires bold action in three areas simultaneously, which should be implemented with great urgency and determination:

- Structural reforms to stimulate growth and competitiveness, and a rigorous fiscal consolidation

- Until the preceding fiscal consolidation and structural reforms produce results that stabilise financial markets, European institutions should implement all available options to avoid a credit crunch, including full financial support and unlimited liquidity to the EFSF by the ECB.

- Greater political capital and leadership at national and European levels

Conclusions

European countries are running out of time to reduce the current financial tensions that may ultimately trigger very disruptive risk scenarios. If the sovereign debt crisis continues with the current intensity during 2012, the Eurozone’s GDP may fall 2.5% or even more next year. A double-dip recession would be particularly dangerous and problematic, given the existing fragilities and weaknesses in most countries, and the smaller margin of manoeuvre of fiscal and monetary policies. In the present circumstances, in order to significantly reduce current uncertainties and the probability of a deep recession it is necessary to implement efficient and substantive short-term solutions, overreacting to get a step ahead of the markets and not behind, as has happened so far. Eurozone countries must respond to the challenges they face with urgency, determination, and responsibility, having a sense of history. The longer it takes to resolve the current situation, the greater the economic, political, and social costs.

References

BBVA (2011a), Europe Economic Outlook, Forth Quarter, pp. 9-11..

BBVA (2011b), “Solving the European debt crisis in the very short run”, Europe Economic Watch.

Blanchard, O and D Quah (1989), “The Dynamic Effects of Aggregate Demand and Supply Disturbances”, American Economic Review, 74(4):655-673.

Doménech, R, A García, R Ménedez and J Rubio-Ramírez (2011), “Bank Lending and Business Cycle in EMU: a Slow and Fragile Recovery”, Europe Economic Watch,

Economist (2011), “The Euro Zone, Is This Really The End?”, 26 November.

Falbo, R (2011), “Tensiones financieras y actividad económica en EEUU y la zona euro”, Economic Scenarios Economic Watch.

Gerali, A, S Neri, L Sessa, and F Signoretti (2010), “Credit and Banking in a DSGE Model of the Eurozone”, Journal of Money, Credit and Banking, 42.

Hakkio, CS and WR Keeton (2009), “Financial Stress: What Is It, How Can It Be Measured, and Why Does It Matter?”, Economic Review, Federal Reserve Bank of Kansas City, Second Quarter 2009.

Muellbauer, John (2011), “Germany and the Eurozone: Clutching disaster from the jaws of victory?”, VoxEU.org, 25 November.

1 This index is computed as the sum of the standardised principal components (across variables, countries or firms) of the following financial indicators: sovereign risk (5-years CDS), equity volatility, credit risk (5-years CDS of main banks and firms, and emissions), interest rate volatility, FX volatility and spreads between interbank markets and 3-month bills.

2 Although the estimation is based on the assumption that the disturbances are uncorrelated at all lags and leads, the evidence of other empirical studies shows that in specific periods this may be not the case. For example, Blanchard and Quah (1989) found that the 1974-5 recession was explained initially by adverse supply shocks, followed by negative demand disturbances.