In response to the financial crisis and its fallout on economic activity, inflation, and inflation expectations, central banks around the globe flooded markets with liquidity and slashed interest rates to unprecedented low levels. The ECB led the way in actively providing financial markets with massive amounts of liquidity. After the real impact of the crisis had become apparent, the ECB cut its policy rate, reducing it to an all time low of 1% by early 2009.

The ECB’s unconventional measures, or “enhanced credit support”, comprised several key ingredients. When interbank money market stress erupted in the second half of 2007, the ECB reacted promptly with significant adjustments in its liquidity management operations (soon followed by other central banks). It provided liquidity in copious amounts, especially at longer maturities (Figure 1). When interbank trading came to a virtual halt in mid-September 2008, the ECB made further significant adjustments to its regular operations by extending the (already long) list of collateral assets, substantially increasing the share of private sector assets in the process. Meanwhile, the (already large) number of counterparties participating in ECB’s refinancing operations increased to 2200 from 1700 before the crisis, as refinancing through money markets became more difficult. In May 2009, the ECB extended the maturity of its long-term refinancing operations to 12 months and announced a program to purchase covered bonds up to €60 billion. Reflecting the importance of the banking sector in credit provision in the Eurozone, the ECB’s measures focused on providing banks with sufficient liquidity in a flexible manner.

Figure 1. ECB’s open market operations, 2005–2009

How effective have the ECB’s unconventional measures been in dealing with the market tensions during the global financial crisis? There is some indication that the measures helped to improve functioning of the money market. Liquidity premia in term euro money markets declined sharply, primarily as a result of the ECB’s proactive liquidity management. Following the unlimited provision of longer-term funds at fixed rates, commencing in late October 2008, term money market spreads dropped sharply and now match closely measures of counterparty risk, while liquidity premia seem to have virtually been eliminated. Spreads remain at somewhat elevated levels as perceptions of elevated counterparty risk in the banking sector persist.

Taking a closer look

In a recent study (Čihák, Harjes and Stavrev 2009), we examined the ECB’s response to the financial crisis more rigorously, using a combination of econometric approaches, ranging from vector autoregression (VAR) models to more sophisticated methods, such as a theory-based general equilibrium model, to analyse empirically the transmission from policy rates to market interest rates. In addition, we applied a macro-financial model, adapted from Bernanke, Reinhart, and Sack (2004), to analyse the effect of the unconventional measures on the term spreads of Eurozone government benchmark bonds.

Interest rate pass-through

We have used the VAR model to study the pass-through of policy rate changes to various market interest rates before and during the crisis. The results (Figure 2) show that even during the crisis, policy rate changes have continued to be transmitted to market rates, but the pass-through to all market rates has slowed down during the crisis. In particular, impulse responses from the bivariate VARs in first difference imply that the time for the full adjustment of market rates has increased from 3–6 months before the crisis to over 12 months. In addition, the pass-through from the policy rates to market rates has become less reliable during the crisis. Specifically, the variance of the residuals of the equations for the market rates has increased since the beginning of 2008, in most cases significantly.

Figure 2. Eurozone: The impact of crisis on policy rate pass-through

Note: VARs in first difference, response to Cholesky one S.D. innovations, 85% confidence interval. Source: Authors’ estimates.

Overall transmission and expectations

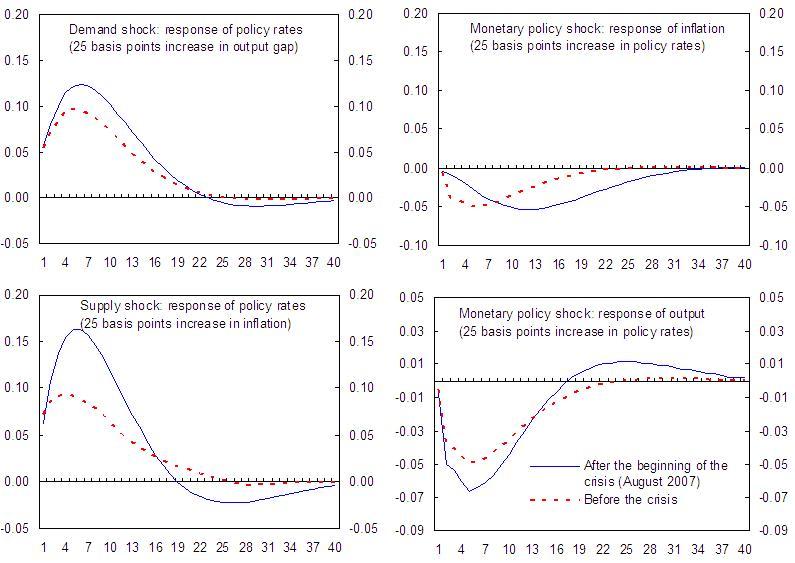

To examine all channels of monetary policy transmission, including the role of expectations, we have calibrated a theory-based general equilibrium model. A comparison of impulse responses from the theory-based model estimated before and after the beginning of the crisis (Figure 3) indicates that the overall transmission has slowed since the beginning of the crisis. For both supply and demand shocks, the policy reaction needed to stabilise the economy is somewhat stronger, with the time needed for the policy feedback to pass-through increasing, from about 1.5 year before the crisis to about 2.5 years. Similarly, the time for a full transmission of monetary policy shocks to inflation has increased from about 2 years before the crisis to about 3 years during the crisis. Compared with the findings from the VAR, these results suggest that not only the first stage of the transmission (i.e., the pass-through to market rates) but also the overall working of the transmission mechanism seems to have slowed down during the crisis.

The model residuals confirm that shocks increased since mid-2008. Indeed, the variability of the residuals from the models jumped up after mid-2008. The increased volatility of the residuals (shocks) suggests that during the financial crisis, the transmission of monetary policy has not only become subject to longer lags (i.e., slower), it has also become less predictable (i.e. subject to more noise). At the same time, the changes in the main structural parameters of the economy are not dramatic. The coefficients of the underlying model have remained basically unchanged during the crisis.

Figure 3. Eurozone: Effectiveness of monetary policy (pre- and post- crisis in basis points)

Source: Authors’ estimates.

Impact on government bond rates

The “enhanced credit support” measures have been primarily implemented to support the flow of credit in the economy, but they may have also affected term spreads and the yield curve of Eurozone government benchmark bonds. To investigate if such effects occurred, we have used a macro-financial model as applied by Bernanke, Reinhart, and Sack (2004). This is a VAR-based model that additionally imposes a no-arbitrage condition, commonly applied in affine term structure finance models.

The model as applied in our paper comprises four macroeconomic variables as state variables, which are the factors for pricing bonds:

(i) a measure of the output gap obtained by detrending with a Hodrick-Prescott filter an index of economic activity that is the weighted average of seasonally adjusted industrial production (30%) and retail sales (70%);

(ii) year-on-year inflation as measured by the ECB’s Harmonised Index of Consumer Prices;

(iii) the monthly average of overnight interest rate (EONIA); and

(iv) the one-year Euribor interest rate as a proxy for market expectations of short-term rates and inflation that may not be fully captured by the other variables, given that separate data for interest rate futures and inflation expectations in the Eurozone are only available very recently.

Data are monthly observations from January 1999 to January 2009. Following Rudebusch, Swanson, and Wu (2006), we estimate the model in two stages. First, the VAR model is estimated. Second, the coefficients from the VAR model are taken as given, and the stochastic pricing kernel factor loadings are estimated using nonlinear least squares to fit the bond yield data.

We find that the predicted yields from the model track actual bond yields very closely (see Figure 7 in our paper). Short-term (two-year) model residuals do not have an obvious trend, but model residuals for long-term government bonds have been more or less consistently negative since 2004–05. This reflects the fact that, as in the US (where former Federal Reserve Chairman Alan Greenspan famously called it a “conundrum”), long-term rates did not rise much when the ECB raised its policy rates. The residuals have fluctuated since the onset of the crisis but sharply turned negative in October 2008, when the ECB introduced a host of new non-standard measures. In the subsequent period, the actual yield curve has become lower and flatter than the predicted yield curve.

These results provide an indication that the ECB’s policy actions during the crisis had some effect on yields, although the results should be treated only as preliminary and illustrative. The lower level of the yield curve could, for example, reflect the increase in the monetary base and the relative supply of money relative to bonds, as suggested by the portfolio rebalancing channel. Moreover, the flattening of the yield curve could imply that markets interpreted the ECB’s policy actions as implicit commitments to keep policy rates low longer than anticipated and the current state of the economy (as captured by the simple VAR) would suggest. This finding should be interpreted cautiously, given that the time period under investigation is short, and given that we analyse the impact of the ECB’s measures only indirectly. Despite these caveats, the fact that the level of the yield curve has been lower and the slope flatter than predicted by the macroeconomic variables suggests that the unconventional monetary policy may have also lowered the risk of deflation.

Conclusion

Our results suggest that the unconventional monetary policy in the Eurozone was broadly effective. Even during the crisis, the core part of ECB’s monetary policy transmission – from policy rates to market rates – continued to operate. But the transmission was somewhat slower (the lags between policy rates and market rates were longer), requiring cuts in the policy rate to unprecedented low levels to stabilise the economy and inflation expectations. The ECB’s “enhanced credit support” contributed to a reduction in money market term spreads, facilitating the pass-through from policy to market rates. Finally, the yield curve for Eurozone government bonds has been lower and flatter than predicted by standard macro variables since September 2008, indicating that the policy measures may have had some beneficial effects.

The ECB’s experience can also provide some useful pointers in designing central bank operational frameworks with market-stabilising features. Elements found particularly useful in this respect include flexibility with regard to collateral requirements, counterparty eligibility, and maturity of operations (Chailloux, Gray, McCaughrin 2008; Chailloux et al. 2008).

References

Bernanke, Ben, Vincent Reinhart, and Brian Sack (2004), "Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment," Board of Governors of the Federal Reserve, Finance and Economics Discussion Series 2004-48, September.

Chailloux, Alexandre, Simon Gray, and Rebecca McCaughrin (2008), "Central Bank Collateral Frameworks: Principles and Policies", IMF Working Paper 08/222, September.

Chailloux, Alexandre, Simon Gray, Ulrich Kluh, Seiichi Shimizu, and Peter Stella (2008), "Central Bank Response to the 2007–08 Financial Market Turbulence: Experiences and Lessons Drawn", IMF Working Paper 08/210, September.

Čihák, Martin, Thomas Harjes, and Emil Stavrev (2009), “Eurozone Monetary Policy in Uncharted Waters,” IMF Working Paper No. 09/185.

Rudebusch, Glenn, Eric Swanson, and Tao Wu (2006), “The Bond Yield ‘Conundrum’ from a Macro-Finance Perspective,” Federal Reserve Bank of Dallas Working Paper No. 2006–16.