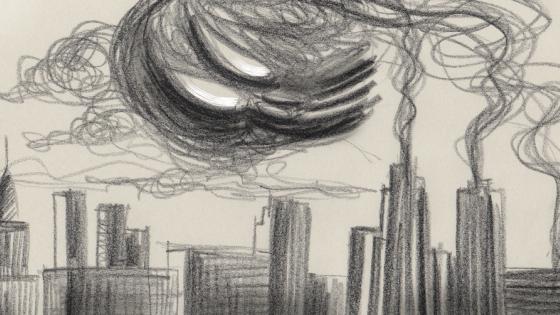

Climate change is threatening the future of the globe. Extreme weather conditions have attracted policymakers’ interest who urge the need to take action. The UN Climate Change Paris conference in December 2015 put forward a limit of a 1.5°C increase in average global temperatures relative to those prevailing before the Industrial Revolution. This limit can only be reached by drastically cutting carbon emissions. The transition to a carbon-neutral economy requires raising the environmental consciousness of firms and banks. We therefore ask how bank financing can contribute to reaching the global climate objectives.

Investors factor environmental risk in their decisions either because of their specific preferences (Riedl and Smeets 2017) or because of the physical or transition costs that the risk entails (Krueger et al. 2020). There is empirical evidence that environmental risks are priced in equity markets (Bolton and Kacperczyk 2021), bond markets (Fatica et al. 2019), and real-estate markets (Bernstein et al. 2019).

At the same time, the evidence on bank lending is more fragmental. For example, firms with environmental risks pay a higher loan spread and obtain loans granted by syndicates with fewer banks (Chava 2014). There is also a significant negative relationship between voluntary disclosure of CO2 emissions and loan spreads for informationally opaque borrowers (Kleimeier and Viehs 2018). Some further evidence indicates that environmental risks related to firms’ direct emissions are priced, but studies do not find differential pricing of these risks by green banks (Ehlers et al. 2021).

In a recent paper (Degryse et al. 2021), we investigate whether and how environmental consciousness (‘greenness’) of firms and banks is reflected in the pricing of bank credit. Using a large international sample of syndicated loans, we find that firms are indeed rewarded for being green in the form of cheaper loans – but only when borrowing from a green consortium of lenders and only after the ratification of the Paris Agreement. Hence, we find that environmental attitudes matter when ‘green meets green’.

We develop a stylised theoretical model to explain why a robust green-meets-green pattern emerges after the Paris Agreement. We argue that heightened perception of the carbon-transition risk – following the world leaders’ resounding commitment to a carbon-neutral future – may have incentivised a subset of banks (i.e. green banks) to engage in third-degree price discrimination with regard to firms’ greenness, resulting in an equilibrium in line with our estimated green-meets-green pricing patterns.

Our empirical analysis requires proxies for banks’ and firms’ greenness. We classify a firm as green if it voluntarily reports to the Carbon Disclosure Project, an investor-oriented non-profit initiative to facilitate and standardise disclosure of a firm’s environmental impact. Firms reporting to the Carbon Disclosure Project are expected to have better in-house capabilities to measure and manage their exposure to the green transition of the economy, which can be viewed as evidence of their environmental consciousness.

Banks are classified as green if they are members of the United Nations Environment Programme Finance Initiative (UNEP FI), which aims to “mobilise private sector finance for sustainable development”. Since its creation in 1991, more than 160 banks have joined the Initiative. There is evidence that the Initiative’s signatory banks can issue green bonds with a premium because they can more clearly signal their environmental attitudes in lending (Fatica et al. 2019).

Using these proxies, we analyse the price information of syndicated loans using a comprehensive international syndicated loans database for 2011–2019. Our results suggest the presence of a statistically and economically significant 'green meets green' effect. We estimate that green firms enjoy an additional discount of 35–38 bps when borrowing from green banks rather than from non-green (‘brown’) ones.

We further examine whether the Paris Agreement, reached on 12 December 2015, affected the relationship between the banks’ and firms’ environmental attitudes and loan credit spreads. While the green-meets-green effect is insignificant before the Paris Agreement, it is statistically and economically significant after.

In particular, the ‘after the Paris Agreement’ subsample shows that green banks offer to green firms a discount of about 60–69 bps relative to brown firms. Overall, the green-meets-green effect is intimately linked to the changes brought about by the Paris Agreement. We further confirm this with a difference-in-difference-in-differences regression model.

Why would the Paris Agreement have such a big indirect impact on lending terms, and why is this restricted to green banks? One can interpret the Paris Agreement as a shift in the perception of climate transition risks, both by firms and by banks. Much of the difficulties in managing risk related to climate change are attributed to the highly uncertain real impacts of climate change and to the endogenous nature of future policy shocks that affect the transition to a low-carbon economy (Campiglio et al. 2018). However, shifts in public opinion could lead to political pressure to strengthen environmental regulation, which could harm firms that do not anticipate such shocks.

For example, in May 2021 Royal Dutch Shell, a major player on the oil and gas market, was ordered by a Dutch court to cut its carbon emission faster, overruling the firm’s own transition plans. This signalled to the market an increased likelihood that the judiciary system would become involved in climate issues in the future.

As the expectation of a regulatory shift – and the probability of a negative shock – increases, so does the firms’ and banks’ equilibrium environmental attitudes. In an uncertain environment prone to sudden equilibrium shifts, there is a strong emphasis on public events that anchor expectations and coordinate the behaviour of economic agents.

The Paris Agreement, as the world’s first comprehensive climate agreement, raised public awareness of climate-related risks and increased the commitment of policymakers to stricter enforcement of climate policy. This shifted investors’ perception of climate transition risk, therefore materially influencing equilibrium prices.

A recent column argues that countries that rely on capital markets more than on banking are more forthcoming in dealing with climate change (De Haas and Popov 2018). Our findings, however, show that (at least parts of) the banking systems may also be conducive to the transition as banks are favourably pricing loans to green firms relative to brown firms. This holds when banks have a similar environmental consciousness – our green-meets-green effect. Putting climate change on the agenda through the Paris Agreement has fostered this attitude.

References

Bernstein, A, M T Gustafson and R Lewis (2019), “Disaster on the horizon: The price effect of sea level rise”, Journal of Financial Economics 134(2): 253–72.

Bolton, P, and M Kacperczyk (2021), “Global pricing of carbon-transition risk”, VoxEU.org, 24 March.

Campiglio, E, Y Dafermos, P Monnin, J Ryan-Collins, G Schotten and M Tanaka (2018), “Climate change challenges for central banks and financial regulators”, Nature Climate Change 8(6): 462–68.

De Haas, R, and A Popov (2018), “Finance and pollution”, VoxEU.org, 5 October.

Degryse, H, Goncharenko, R, Theunisz, C and Vadasz, T (2021), “When green meets green”, CEPR Discussion Paper DP16536.

Ehlers, T, F Packer and K de Greiff (2021), “The pricing of carbon risk in syndicated loans: Which risks are priced and why?”, Journal of Banking and Finance, forthcoming.

Fatica, S, R Panzica and M Rancan (2019), “The pricing of green bonds: Are financial institutions special?”, JRC Working Papers in Economics and Finance.

Kleimeier, S, and M Viehs (2018), “Carbon disclosure, emission levels, and the cost of debt”, SSRN Working Paper.

Krueger, P, Z Sautner and L T Starks (2020), “The importance of climate risks for institutional investors”, Review of Financial Studies 33(3): 1067–111.

Riedl, A, and P Smeets (2017), “Why do investors hold socially responsible mutual funds?”, Journal of Finance 72(6): 2505–50.