The nominal exchange rate plays a dual role in the macroeconomic adjustment process. On the one hand, it is at the centre of the transmission mechanism of monetary policy. On the other hand, changes in the nominal exchange rate help accommodate shocks (both external and domestic) through changes in the real exchange rate. These two roles are particularly important in open economies with ‘inflation targeting’ regimes.

For the exchange rate to play these two roles effectively, the ‘pass-through’ needs to be different for different types of goods: it has to be (significantly) higher for tradables than for nontradables. If the pass-through is similar (or the same) for both categories of goods, changes in the nominal exchange rate will not be translated into adjustments in the real exchange rate, and the country will face a costlier external adjustment process. This situation may arise even if the nominal exchange rate is an effective channel for transmitting monetary policy. Historically, in a number of countries with relatively high inflation the pass-through has been very high (close to one) and has affected nontradable goods as much as tradable goods. This has especially been the case in Latin America.

Most studies of exchange rate pass-through have focused on aggregate data and have tended to ignore these two functions of the exchange rate. In fact, very few studies have concentrated on the implications of the pass-through for real exchange rate accommodation and external adjustment.

Forbes et al. (2018) have pointed out that many central banks – including some in the most advanced countries – do not rely on systematic quantitative studies of ‘pass-through’ when considering the effects of monetary policy actions. Instead, they base their analyses on rough rules of thumb.

A tale of two pass-through coefficients

In a new paper (Edwards and Cabezas 2021), we use detailed disaggregated data for Iceland to analyse a number of often neglected aspects of exchange rate pass-through. In particular, we investigate how changes in the nominal exchange rate are transmitted into different components of the consumer price index.1 Our analysis considers 12 sub-indexes in Iceland’s Consumer Price Index (CPI) that go from highly tradable goods to nontradable goods and services (see Table 1 for the sectors). This decomposition allows us to investigate the relation between the pass-through coefficient and the real exchange rate.

In addition, we investigate whether there have been changes in the size of the pass-through coefficients in Iceland during the last 20 years. We focus, in particular, on two points in time: (1) Iceland’s financial and currency crisis of 2008, and (2) the adoption of a ‘flexible inflation targeting’ regime by the Central Bank of Iceland in 2009-2010.2

The main findings from our research may be summarised as follows:

- The pass-through into headline inflation in Iceland is significantly lower than most previous works have suggested. The point estimate for the short-run exchange rate pass-through is 0.15 and the long term it is 0.23.

- The exchange rate pass through is different for different sectors. It is much higher for tradable than nontradable goods.

- There was a structural break, with a significant decline in the exchange rate pass-through, at the time Iceland announced a strengthening of the ‘flexible inflation targeting’ framework, in 2009.

Table 1 Short-run and long-run exchange rate pass-through coefficients for CPI and components, 2003-2019

Notes: Obtained from the error-correction estimates. Categories with mostly tradable components are: Food and non-alcoholic beverages; Alcoholic beverages and tobacco; Clothing and footwear; Furnishing and household equipment; and Transport. Categories with higher nontradable components are: Housing, water, electricity, gas, and other fuels; Health; Communications; Recreation and culture; Educational services; Hotels, cafés, and restaurants; Miscellaneous goods and services.

Baseline analysis

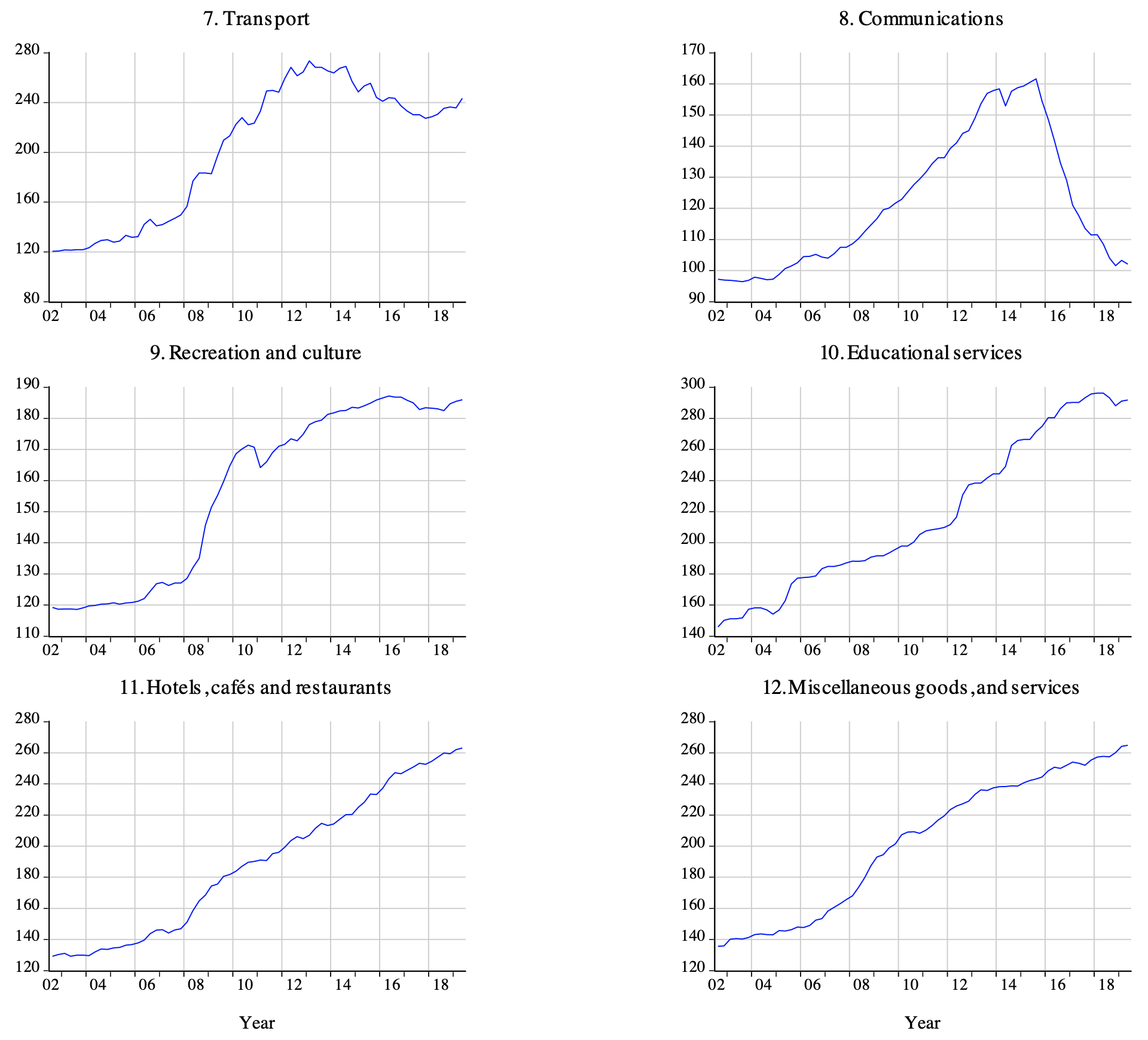

Figure 1 presents, for 2002–2019, the evolution of 12 sub-indexes of the CPI in Iceland. These data are in levels and are not seasonally adjusted. As may be seen, different indexes show different behaviours. In some categories the effect of the 2008 devaluation is quite clear, while in others it is almost imperceptible. Some of these categories have a heavy component (or are fully comprised) of nontradables (i.e. educational services), while other are dominated by tradables (see the note in Table 1 for details).

In our baseline analysis we report results of exchange rate pass-through coefficients using two estimation methods: (1) error-correction equations with instrumental variables (IV), and (2) structural vector auto-regressions (VARs).

Figure 1 Consumer price indexes for 12 goods categories in Iceland, 2002-2019

Table 1 summarises the results from the IV error correction models, and report both short-term and long-term pass-through coefficients. The five categories with the lowest long-term pass-through correspond to nontradable sectors: Educational services; Hotels, cafés, and restaurants; Housing, water, electricity, gas, and other fuels; Health; Miscellaneous goods and services. The two categories with the highest pass-through are comprised of heavily tradable items (Furnishing and household equipment, and Clothing and footwear).

In order to gain further insights, we constructed two aggregate indexes: one for tradable and one for nontradable goods/services. The mean for the short-term exchange rate pass-through for nontradables is 0.078, while the long-term mean is 0.138. For tradable goods the mean short-run exchange rate pass-through is 0.308; the long-run pass-through for tradable goods is 0.416.

Estimates based on VARs confirm the differences between pass-through coefficients for tradable and nontradable goods. However, there are differences in the point estimates. The VARs suggest lower exchange rate pass-through than those from the error-correction model. Take, for example, the estimates for aggregate headline CPI inflation: the error-correction estimate for the short run is 0.154, while it is 0.070 for the VAR. For the long run, the error-correction coefficient is 0.226 and it is only 0.161 for the VAR estimates.

We also report results of the error-correction model at a significantly more disaggregated level. We considered data on 65 very detailed subcategories collected by Iceland’s statistical authorities for the CPI. Although at this level of disaggregation the estimates are less precise, the main messages carry forward. That is, it is still the case that tradable goods have significantly higher exchange rate pass-through than nontradable ones.

Breakpoints and monetary policy credibility

In its 2017 report, the Central Bank of Iceland (CBI) argued that around 2010, there was an important improvement in the ‘quality’ of monetary policy. According to the Bank, at the centre of the successful new monetary policy was an increase in the degree of credibility of the ‘inflation targeting plus’ regime. The reform included changes in governance and communication strategy of the Central Bank of Iceland.3 According to our model of pass through, increased credibility is reflected in a lower exchange rate pass-through coefficient for the aggregate CPI.

We identified a structural break in the exchange rate pass-through coefficient in the first quarter of 2009. The date corresponds to the announcement of the new policy and is somewhat earlier than the actual change in monetary policy procedures, or what the Central Bank of Iceland has called the adoption of ‘inflation targeting plus’. This suggests that the announcement of a change in policy the framework was credible, in the sense described by Sargent (1982) in his classical study on stabilisation.

Our results indicate that after the first quarter of 2009, both the short and long-run exchange rate pass-through coefficients declined significantly. The point estimate for the short-term pass-through before the change of regime is 0.129; it is only 0.050 after the break. The long-term pass-through coefficient is 0.194 in the earlier period and 0.075 in the post-reform period. Our results also indicate that after the reforms the exchange rate pass-through declined significantly in ten out of the 12 components of the CPI.

Nature of shocks

An important question raised by Forbes et al. (2018) and Comunale (2020) is whether pass-through coefficients are affected by the nature of the shocks that hit the economy. In order to investigate this issue, we estimated a series of error-correction equations with interactive terms for real exogenous shocks, defined as changes in the terms of trade, and for foreign financial shocks defined as the first difference in the euro area short-term interest rates.

The results obtained suggest that the exchange rate pass-through is higher in the presence of financial shocks (i.e. higher euro area interest rates), and lower when there are real shocks. The results also indicate that there is no difference in the coefficient for positive and negative shocks.

Concluding remarks

Iceland provides a unique opportunity for analysing the way in which changes in exchange rates are translated into domestic prices. Our model and results suggest that a coherent, focused, transparent, and credible reform in the monetary policy framework can result in a significant reduction of the pass-through coefficients. After the announcement of the ‘flexible inflation targeting’ regime in 2009 the pass-through coefficient declined significantly in Iceland. The results also show that the pass-through is significantly higher for tradables than for nontradables. This means that changes in the nominal exchange rate helped accommodate required changes in the relative price of tradables to nontradables or real exchange rate.

Authors’ note: The column on which this paper is based is part of a research project on exchange rates and monetary policy at the Central Bank of Iceland. We thank Thórarinn G. Pétursson, Ásgeir Daníelsson, Karen Á. Vignisdóttir, and Lilja S. Kro for very helpful comments. We have benefited from comments by Ed Leamer.

References

Aliber, R and G Zoega (2019), “A retrospective on the 2008 Global Financial Crisis”, In R Aliber and G Zoega (eds.), The 2008 Global Financial Crisis in retrospect: Causes of the Crisis and National Regulatory Responses, Palgrave MacMillan.

Comunale, M (2020), “Shock dependence of exchange rate pass-through in the euro area”, VoxEU.org, 20 April.

Central Bank of Iceland (2017), “Monetary policy based on inflation targeting: Iceland’s experience since 2001 and post-crisis changes”, Special Publication No. 11.

Danielsson, J (2013), “Iceland’s post-Crisis economy: A myth or a miracle?”, VoxEU.org, 21 May.

Edwards, S (2006), “The relationship between exchange rates and inflation targeting revisited”, NBER Working Paper 12163.

Edwards, S and L Cabezas (2021), “Exchange Rate Pass-Through, Monetary Policy, and Real Exchange Rates: Iceland and the 2008 Crisis”, NBER Working Paper No. 28520.

Forbes, K, I Hjortsoe and T Nenova (2018), “The shocks matter: improving our estimates of exchange rate pass-through”, Journal of international economics 114: 255-275.

Gylfason, T (2015), “Iceland’s seven meagre years”, VoxEU.org, 26 November.

Pétursson, T (2019), “Post‐crisis monetary policy reform: Learning the hard way”, In R Alibert and G Zoega (eds.), The 2008 Global Financial Crisis in retrospect: Causes of the Crisis and National Regulatory Responses, Palgrave MacMillan.

Pétursson, T (2020), “Long‐term inflation expectations and inflation dynamics”, International Journal of Finance and Economics, 1–17.

Sargent, T (1982), “The ends of four big inflations”, In R Hall (ed.), Inflation: Causes and effects, University of Chicago Press.

Endnotes

1 See Gylfason (2015) for an analysis of Iceland’s 2008 crisis. Edwards (2006) analyses the relation between pass through and the real exchange rate with aggregate data; he uses the CPI as a proxy for nontradables and the Producer Price Index (PPI) as a proxy for tradables.

2 For analyses on Iceland’s crisis and subsequent recovery, see Danielsson 2015, Aliber and Zoega 2019, Pétursson 2019, 2020)

3 Central Bank of Iceland (2017, pp. 34-36).