Flexible exchange rates have been praised in economic theory as a mechanism for helping relative prices adjust between countries in response to shocks to relative supply and demand (Friedman 1953). In this view, fluctuations in the real exchange rate, measuring the relative cost of living across countries, are a welcome thing. However, an alternative explanation for fluctuations in the real exchange rate is the presence of shocks arising in the financial market that move the nominal exchange rate, which then are passed on to the real exchange rate due to sticky prices. Such real exchange-rate fluctuations would not promote economic adjustment to real economic shocks, but could instead be a source of economic disruption. In a classic contribution to the literature, Mussa (1986) offered evidence supporting this second view, documenting that the variance of the real as well as nominal exchange rate rose steeply after the Bretton Woods system of fixed exchange rates ended. Mussa used this evidence that short-run real exchange-rate volatility is affected by the nominal exchange-rate regime to argue in favour of nominal shocks as an important driver of real exchange rates. For if real exchange-rate fluctuations primarily reflect real shocks to economic fundamentals, then one might ask why a change in the nominal exchange-rate regime would raise its volatility.

Our latest paper provides a modern makeover for the empirical evidence of Mussa (Bergin et al. 2012). Recent research on real exchange rates has tended to focus on long-run dynamics, rather than the short–run volatility discussed by Mussa. In particular, a large body of literature has found that it takes a remarkably long time for the real exchange rate to recover from a shock and return to its long run value. Estimates of the half-life of real exchange-rate adjustment typically range from three to five years for the flexible exchange-rate period since 1973. The combination of high real exchange-rate volatility and high persistence is referred to as the 'Purchasing-Power Parity Puzzle'.

The exchange-rate regime matters

Bergin et al. (2012) compare fixed versus flexible exchange-rate regimes in terms of their implications for the long run dynamics of the real exchange rate. Using data for twenty industrialized countries, we estimate the half-life of the real exchange rate in data during the fixed exchange period of Bretton Woods and the post-Bretton Woods period of flexible exchange rates. The paper finds that the puzzle of a long half-life found in previous studies for the flexible exchange-rate period does not apply to the fixed exchange-rate period. The half-life is roughly half as long as under the flexible exchange-rate regime.

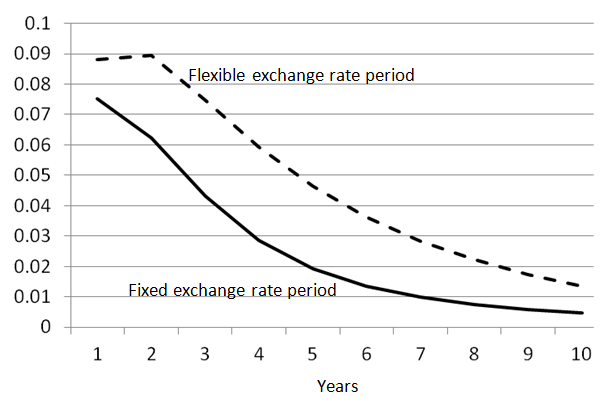

This is illustrated by Figure 1 which shows the estimated impulse responses to a one standard deviation shock to the real exchange rate during the fixed and flexible regime periods. (This graph is computed using annual data and a specification with two lags.) A half-life can be computed as the amount of time it takes for the impulse response to decay to half of the maximum impact. The half-life rises from 2.7 years for fixed exchange rates up to 4.3 years for flexible exchange rates; for an alternative specification with one lag (not shown in the graph) the half-life rises from 2.3 years to 4.3. This finding reiterates the question of Mussa: if real exchange-rate fluctuations reflect real shocks to economic fundamentals, why would a change in the nominal exchange-rate regime raise its persistence?

Figure 1. Adjustment of the real exchange rate to a one std. dev shock

This finding also suggests a reinterpretation of the original finding of Mussa regarding volatility. The variance of the real exchange-rate data can be broken up into two components – the volatility of exogenous shocks and the persistence in the rate at which the effects of shocks die out. The finding indicates that approximately two thirds of the rise in variance as our sample countries moved from a fixed exchange-rate regime to the more flexible rate regimes can be attributed to a rise in the persistence at which shocks die out, rather than a rise in the variance of exogenous shocks, themselves. This finding underscores the importance of studying long-run dynamics and not just short-run volatility in isolation.

The finding also offers a way to reconcile the two parts of the longstanding PPP puzzle. Monetary models with sticky prices are good at explaining real exchange-rate volatility but not its persistence, whereas real models are good at explaining real exchange-rate persistence but not volatility. However the finding above indicates that the two facts are best viewed as complementary: a high level of persistence helps create a high level of variance in observed real exchange-rate data.

An explanation

Further analysis suggests an explanation for the finding that the persistence of real exchange-rate changes rises with a more flexible exchange-rate regime. Decomposing the real exchange rate into its two components – the nominal exchange rate and the ratio of domestic and foreign prices, Cheung et al. (2001) showed that shocks to the nominal exchange rate tend to be longer-lived than those to goods prices. In the present context, this suggests that when Bretton Woods ended and permitted exchange-rate shocks to become more prevalent, this changed the composition of shocks driving the real exchange rate, and raised the average level of persistence. We verify this interpretation of the data by estimating a two-variable panel vector error correction model of nominal exchange rate and relative prices. Price shocks are identified as movements in the price ratio not associated with a contemporaneous movement in the nominal exchange rate. The estimated half-lives become much more similar across regimes when conditioning on the nature of shocks: the half-live of real exchange-rate changes conditional on price shocks is 0.6 of a year for the Bretton Woods period and 0.5 year for the floating period; the half-live conditional on exchange-rate shocks is 2.4 for Bretton Woods and 3.6 for the floating period. Thus the higher average half-life of the real exchange rate observed since 1973 is attributable to the fact that exchange-rate shocks are more persistent than price shocks, and these shocks became more prevalent during the floating rate period.

Overall, one may conclude that the exchange-rate regime chosen by policymakers does matter. But policymakers may wish to worry more about exchange rates as a damaging source of disruption rather than a helpful mechanism of adjustment.

References

Bergin, Paul, Reuen Glick, and Jyh-li Wu (2012), “Mussa Redux and Conditional PPP”, NBER Working Paper 18331.

Bergin, Paul, Reuven Glick, and Jyh-lin Wu (forthcoming), “The Micro-Macro Disconnect of Purchasing Power Parity”, Review of Economics and Statistics.

Cheung, Yin-Wong, Kon Lai, and Michael Bergman (2004), “Dissecting the PPP Puzzle: The Unconventional Roles of Nominal Exchange Rate and Price Adjustments”, Journal of International Economics, 64(1):135-150.

Friedman, Milton (1953), Essays in Positive Economics, University of Chicago Press.

Mussa, Michael (1986), "Nominal Exchange Rate Regimes and the Behavior of Real Exchange Rates: Evidence and Implications", Carnegie-Rochester Conference Series on Public Policy, 25(1):117-214.