Few global economic measures of late have moved so swiftly to the centre of focus as commodity prices. Soaring food and energy prices in particular have raised inflationary fears while heightening concerns about the spread of global poverty. Figure 1 shows the dramatic increase in selected commodity price indices in the recent five years. Such record high price increases were quite unexpected. As a consequence, few economic puzzles are currently of greater moment than this simple one: Where are commodity prices headed next?

Figure 1. Commodity prices

Source: IMF database.

Note: The figure plots the following monthly Commodity Price Indices: (i) the Commodity Price Index (including both Fuel and Non-Fuel Indices), (ii) the Commodity Agricultural Raw Materials Index (including timber, cotton, wool, rubber, and hides), (iii) the Commodity Fuel Index (including crude oil, natural gas and coal), (iv) the Commodity Food Price Index (including cereals, vegetable oils, meat, seafood, sugar, banana, and orange), (v) the Commodity Metals Price Index (including copper, aluminium, iron ore, tin, zinc, lead and uranium). The index sets 2005 equal to 100.

Alas, the forecasting of commodity prices has doggedly resisted an armada of technical approaches. In a recent speech (Bernanke 2008), Federal Reserve Chairman Ben Bernanke highlighted the difficulty in obtaining a meaningful gauge for future commodity price movement. He noted especially the inadequacy of price forecasts based on signals obtained from commodity futures, and emphasized the importance of finding alternative approaches to forecast commodity market movements.

In a recent paper (Chen, Rogoff and Rossi, 2008), we demonstrated that a carefully chosen set of exchange rates, those we call "commodity currencies", may indeed offer such an alternative approach to the forecasting of commodity prices.

Using data obtained over the past one to three decades for Australia, Canada, Chile, New Zealand, and South Africa - all small commodity exporters with market-based floating exchange rates - we find that their currencies embody remarkable forecasting power for future global commodity price movements. Individually, these exchange rates can forecast the prices of their country's major commodity exports, and together, they do an excellent good job at predicting aggregate commodity market movements.

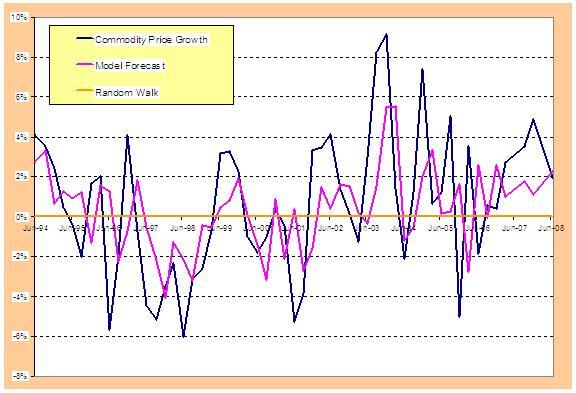

Figure 2 Commodity price growth, actual and predicted

Note: The figure depicts the actual quarterly commodity price rate of growth along with the exchange rate-based model forecast and the random walk forecast.

Figure 2 shows the rate of growth of the IMF global commodity price index (the US dollar price index of over 40 exchange-traded primary commodities, weighted according to world export earnings) since 1994. It has indeed been highly positive in the past 5 years, resulting in the high price levels shown in Figure 1. Our forecast based on the exchange rates, labelled “Model Forecast”, is strikingly close to the actual realisation. Indeed, we find that such forecasts of future commodity prices are significantly better than forecasts that rely on traditional statistical models, such as an auto-regression or a random walk.

The predictive relationship holds both in-sample (using Granger-causality tests robust to parameter instabilities) and out-of-sample (using pseudo out-of-sample rolling forecasts). It holds when non-dollar major currency cross exchange rates are used, as well as with techniques such as forecast combinations. Exchange-rate based forecasts of future commodity prices are also better than forecasts based on forward prices. Moreover, these forecasts are easy to obtain, as exchange rates are available in real time, at high frequency, and, unlike many macroeconomic series, are never revised.

In particular, following several quarters of strong commodity price growth, these exchange rates-based forecasts foretell the downturn in the aggregate commodity markets at the end of June, 2008, by predicting a 6% to 12% decline over the third quarter of 2008. (The broad range in this forecast reflects results based on various aggregate commodity indices, each tracking a different basket of commodity products).

This forecasting success of commodity currencies is no deus ex machina but has a sound and intuitive economic basis. It follows naturally from the fact that exchange rates are asset prices that embody expectations of future movements in macroeconomic fundamentals, specifically ones that will directly affect the exchange rates. For commodity currencies, global commodity prices matter to their exchange rate values.

We note that the five countries we study produce a variety of primary commodity products ranging from crops to minerals to energy-related goods. Taken together, commodities represent from one quarter to well over one half of each of these countries' export earnings. In view of this, global commodity-price fluctuations affect a substantial share of their exports, and represent major terms-of-trade shocks to the value of these countries' currencies. As a result, when market participants foresee a commodity price shock, this expectation will be priced into the current exchange rate through its anticipated impact on future exchange rate values. The forecasting power of commodity currencies thus has a firm economic root. And as these exchange rates each embody market expectations of the future price dynamics of various commodity products, combining them we are able to obtain forecasts for price movements in the overall aggregate commodity market, as shown in Figure 2.

Because these countries are relatively small players in the overall global commodity market, they are in general "price takers" for the vast majority of their commodity exports. The particular attribute of global commodity prices – they are determined in the global markets rather in the specific small countries - allows us to make a contribution to the empirical exchange rate literature in addition. Specifically, our findings provide strong evidence for the present value approach to exchange rate determination. Using forward looking asset prices, such as the exchange rates, to predict fundamentals has been attempted in earlier papers by Campbell and Shiller (1987) and Engel and West (2005). Those earlier efforts, however, were stymied by the fact that the fundamental variables being considered (for example savings, interest rates, outputs, money supplies) are themselves endogenous – jointly determined along with the exchange rates - making it difficult to interpret their findings or draw any structural conclusions.

Last but not least, we also uncover some evidence that commodity prices can help predict exchange rates, but the evidence overall is much weaker; the exchange rate forecasting exercise does not survive out-of-sample testing. We do not find it surprising that exchange rates are better predictors of exogenous commodity prices than vice-versa. The apparent asymmetry can be traced to the fact that the exchange rate is fundamentally forward-looking, embodying information about future commodity price movements that cannot easily be captured by simple time series models. In contrast, commodity prices tend to be quite sensitive to current conditions because both demand and supply are typically quite inelastic. In addition, financial markets for commodities tend to be far less developed than for foreign exchange. As a result, commodity prices would offer a less useful barometer of future conditions than would exchange rates.

Given that commodity prices are extremely volatile and difficult to predict – and that commodity price futures are notoriously bad predictors of future commodity prices – this new approach to predicting commodity prices has important potential practical value. One might eventually extend the approach to look at countries that have few or no commodities, such as most of Asia, to see whether commodity prices nonetheless affect the value of their currencies, and whether their currency fluctuations may offer predictive power for, say, oil prices.

References

Bernanke, B. (2008), "Outstanding Issues in the Analysis of Inflation," Speech at the Federal Reserve Bank of Boston’s 53rd Annual Economic Conference, Chatham, Massachusetts, June 09, 2008.

Campbell, J. Y., and R. Shiller (1987), "Cointegration and Tests of Present Value Models," Journal of Political Economy 95(5), 1062-88.

Chen, Rogoff, and Rossi (2008), “Can Exchange Rates Forecast Commodity Prices?”, NBER Working Paper 2008-02.

Engel, C., and K. D. West (2005), "Exchange Rates and Fundamentals", Journal of Political Economy 113(3), 485-517.