In 2017, the euro area economy recorded its highest annual growth rate in ten years. The long recovery in the euro area moved further into expansion, with an average quarterly growth rate of 0.7% in 2017, the highest since the start of the crisis. The level of economic activity now exceeds its pre-crisis peak and the recent growth rates have increased our optimism that the legacies of the crisis are diminishing. For the first time since 2007, all member states saw their economies expand and growth was broad-based across all countries and sectors. The debt-to-GDP ratio in the euro area declined significantly. At the aggregate level, the right balance between sustainability and stability was broadly achieved; in those member states where debt levels are still high, now is the time to continue building buffers.

It is also ten years since the crisis started and Europe is at the cusp of new and different challenges. Today, the baseline scenario for the European economy over the next two years is one of continued expansion. However, the assessment of risks to the forecast has changed, and the nuances have become more critical.Economic fundamentals are better but the relative weakness of recent data has forced a re-assessment of the outlook. The pace of growth moderated in the first quarter, raising the question as to whether growth may have already peaked.1

A soft patch or a turning point?

Earlier this year, the mood in the markets about the state of the global economy was almost euphoric. Even the euro area economy, long considered by many economists as a lame duck, was viewed as having rediscovered its own dynamic (Krugman 2018). The first shocks came, ironically, with the positive surprise of robust wage increases in the US, which caused investors to reassess the speed and degree to which the exceptionally accommodative monetary policy that have supported asset prices would be withdrawn. Stocks corrected not just in the US but around the world, including in the euro area, even if inflation here was turning out below expectations. With incoming data weak, some economists have even argued that euro area growth is set to slow down substantially or even stagnate (Financial Times 2018).

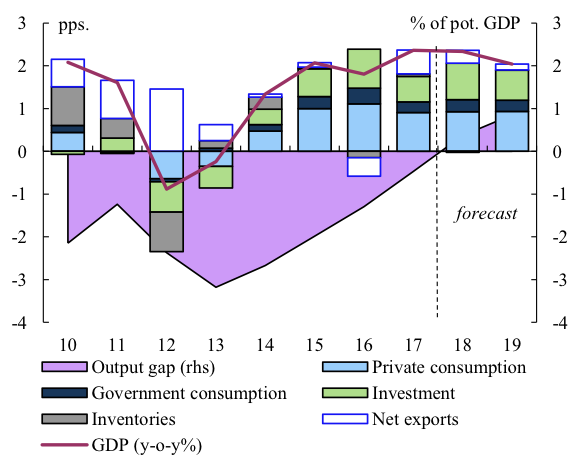

In the European Commission’sspring forecast we argue that the recent weakness represents a soft patch, which is probably due to a number of temporary factors including bad weather, strikes, and the early Easter. Euro area and EU GDP growth are projected to moderate only mildly from 2.4% in 2017 to 2.3% this year before easing to 2.0% in 2019 (Figure 1). These are the same overall growth rates as projected back in the winter interim forecast, which was concluded before the financial stress had started in February.

Figure 1 Real GDP and its components, euro area

The spring forecast maintains this steady baseline forecast for several reasons.

- First, the forecast for 2018 benefits from the large carryover of the robust growth at the end of last year. The recent decrease in sentiment, though negative, is minor and sentiment remains at very high levels.

- Second, in the short term, the European economy is expected to benefit somewhat from the additional external demand generated by pro-cyclical fiscal stimulus in the US.

- Third, despite the financial market stress earlier this year, financing conditions for businesses and households remain favourable.

Looking further ahead, with strong fundamentals and some slack still remaining, the economy has the room to continue growing above potential rates, at least over the forecast horizon, with unemployment falling further and inflation increasing only very gradually. Importantly, growth has been broad-based across member states and sectors, and this augurs very well for self-sustained growth and convergence. To highlight some facts, for 2017, Eurostat just reported that intra-EU trade accounted for 64% of total exported goods and almost all member states had more than 50% of their exports going to the EU. As domestic demand continues to strengthen, it should foster further trade and convergence.

The remaining gaps in the economy therefore leave room for the economic expansion to continue before inflationary pressures build, as illustrated in Figure 2 (Buti and Döhring 2017). The share of investment in GDP remains below its long-term average and underinvestment in infrastructure risks weighing on both the level and quality of the capital stock, which could lead to an erosion of potential growth (EIB 2017). Despite the improvement in headline unemployment rates and tight labour markets in some countries, there is still substantial labour market slack in the euro area. For example, full-time employment is still below its pre-crisis peak. This slack helps to explain why wage growth remains sluggish even as the output gap is turning positive (Hong et al. 2018). The combination of low wages, underemployment and precarious conditions for such a long time may indirectly fuel social unrest and populist threats. Low wage growth in turn stands in the way of a faster pick up of inflation. The large current account surplus, which partly reflects this frailty of domestic demand, has yet to be overcome. The over-reliance of investment on exports instead of domestic demand implies a high degree of vulnerability to trade tensions and investor sentiment.

Figure 2

Notes: I-I* is the absolute difference between the investment share for the total economy and its long-term average 1995-2008; 2%-core inflation is the absolute difference between core HICP and the ECB target rate; CA-CA* refers to the absolute difference between the CA balance and the CA fundamentals benchmark[1]and u-u*to the absolute difference between unemployment and the NAWRU.

Indeed, the growth drivers of the European economy have recently changed somewhat. The favourable global environment has contributed significantly to the strong recovery in investment (Figure 3), which (excluding Ireland, where quarterly data are volatile) grew last year at its highest pace since 2007. On the other hand, consumption moderated more than expected and wage growth remained subdued. As such, the expansion looks increasingly dependent on strong external demand and investment and thus exposed to external risks, precisely where we think the highest risks and flashpoints may come from. Accordingly, the risk profile has shifted meaningfully to the downside.

Figure 3

Notes: The chart is for EU member states, excluding Croatia, Cyprus, Ireland and Malta.

The balance of risks has shifted to the downside

There are two important and interlinked assumptions in the spring forecast with huge caveats. The first is a benign scenario where global trade broadly maintains its current momentum. The second is that financing conditions will remain on the whole favourable and the withdrawal of monetary stimulus will be smooth. But downside risks to this global outlook have increased significantly in both the short and the medium term as a result of recent policy developments and their potential impact on global financial conditions and trade.

The first key risk is related to recent US policies. The US is pushing the accelerator with fiscal stimulus just as its other foot is stepping on the brakes with trade disputes. The recently adopted fiscal stimulus is pro-cyclical for the US. While boosting growth in the short run and pressuring a faster normalisation of US monetary policy, it raises the risk of unsustainability in the medium term, increasing the trade deficit and widening global imbalances. It appears to be strong enough to put investors on alert to a potential re-assessment of the shape of the US yield curve if US government debt increases substantially in the more medium term. This could have repercussions in global financial markets to which Europe would not be immune.

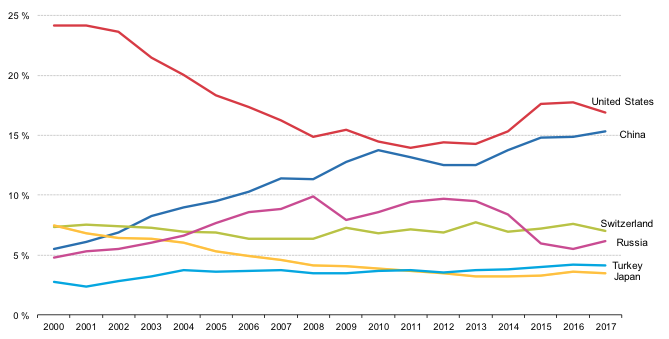

Second, the pro-cyclical fiscal expansion will likely be reflected in a higher trade deficit, which will increase further the trade war rhetoric. In fact, this seems to be increasing especially among the EU's top two trading partners, the US and China (Figure 4). This is particularly concerning given that the vulnerability of EU growth to trade may have increased. An escalation of trade restrictions could end up in a structural readjustment of global value chains, and affect trade, prices and investment plans (Cœuré 2018). This implies non-linear effects that are hard to assess ex ante. They could also lead to further adjustments in asset valuations and increase financial market volatility.

Figure 4 The EU’s top trading partners, 2006-2017

(share in total extra-EU trade in goods, based on trade value)

This leads to the third interrelated key risk: financial market realignments and financial stability concerns. As pressures on US yields continue to increase, the risk is that higher yields could drive a global reassessment of the relative risk-return trade-off, which would likely depress the prices of whole segments of financial assets. With high levels of debt around the world, especially in emerging markets, this would further push up debt burdens and reduce the probability of a smooth exit and a safe landing (IMF 2018). If financial market volatility were to lead to acute investor risk aversion, there could be significant spillovers on the global economy, including Europe.

A strong policy signal needed

Global financial market stress could put pressure on euro area sovereign bond spreads and rewind much of the recent progress on convergence. However, the risk of this has diminished due to the relative safety of euro area sovereign assets and the improved fundamentals of all European economies since the crisis. This increases confidence for the next two years, but one cannot be complacent in the face of looming risks because Europe has already had to learn the lessons of the crisis the hard way.

The likelihood that supply will be gradually more constrained over the coming years, however, is a strong motivation for swiftly implementing policies that encourage higher labour force participation, focus on qualification and education, favour productivity growth, and remove bottlenecks in physical and digital infrastructure. This would also make the economy more resilient to adverse financial market conditions, weaker world trade or simply the next economic downturn whenever it comes. To be more resilient, Europe also needs to make sure it has the capacity to use macroeconomic policy in the future, which means Member States need to continue reducing debt and make an ambitious push to complete the EMU (Buti et al. 2018). The June European Council must not postpone crucial decisions. It is wise to repair the roof while the sun is shining; but when dark clouds already gather on the horizon the task becomes urgent.

References

Krugman, P (2018), “Notes on European Recovery (Wonkish)”, New York Times, 11 February.

Financial Times (2018), “The mystery of the eurozone slowdown”, 15 April.

Buti, M and B Döhring (2017), “Continued growth in a changing policy context: The European Commission’s autumn forecast”, VoxEU.org, 9 November.

European Investment Bank (EIB) (2017), Investment Report 2017/2018: From recovery to sustainable growth, November.

Hong G H, Z Koczan, W Lian and M Nabar M (2018), “More Slack than Meets the Eye? Recent Wage Dynamics in Advanced Economies”, IMF Working Paper 18/50.

B. Cœuré (2018). ‘The consequences of protectionism’. Speech at the 29thedition of the workshop “The Outlook for the Economy and Finance”, Cernobbio. 6 April.

IMF (2018), Global Financial Stability Report April 2018: A Bumpy Road Ahead.

Goldman Sachs (2018), “Measuring Reversal Effects from ECB's QE Unwind: Long-Lasting Stock, Lower Flows”, Goldman Sachs Economic Research, April.

Buti, M, G Giudice and J Leandro (2018), “Deepening EMU requires a coherent and well-sequenced package”, VoxEU.org, 25 April.

Endnotes

[1] An explanation of the different business cycle phases can be found on Eurostat's webpage: http://ec.europa.eu/eurostat/cache/bcc/bcc.html