While the recent financial crisis originated in the US, in 2008-09 we witnessed a steep decline in output, consumption and investment that was of similar magnitude in the rest of the world. Figure 1 illustrates this synchronicity by comparing the evolution in the US with other G20 countries.

Figure 1. Global growth (per cent; annual; real)

Source: Datastream. Growth over past four quarters. Broken line is the US; solid line is the non-US G20 minus Saudi Arabia. Consumption and investment also do not include China.

This evolution is surprising from a historical perspective, since we have never observed such close business cycle co-movements. Both the Great Depression and post WWII recessions witnessed far weaker co-movement of business cycles across countries. How can we explain this synchronicity? And why did it occur in 2008-09 and not in other periods?

Adding to a rapidly growing literature on the synchronicity of the Great Recession (Mody, Sandri and Ohnsorge 2012), our recent research develops a two-country model that allows for self-fulfilling business cycle panics and highlight factors that generated particular vulnerability to a global panic in 2008; namely tight credit, the zero lower bound, unresponsive fiscal policy and increased economic integration (Bacchetta and van Wincoop 2013).

Financial-sector contagion cannot fully explain co-movements

Understanding international co-movements sheds light on the factors that lead to the Great Recession. While the US clearly suffered from a house price bubble and from deficiencies in its financial sector, many other countries had a sound financial system and did not experience any real-estate price decline. So how did the initial US shock evolve into a global recession? One approach is that financial shocks were transmitted internationally, affecting in particular the credit process. While this financial channel has definitely played a role, it cannot explain the strong co-movement for at least two reasons:

- First, empirically, credit did not decline noticeably in non-US countries and only declined gradually in the US.

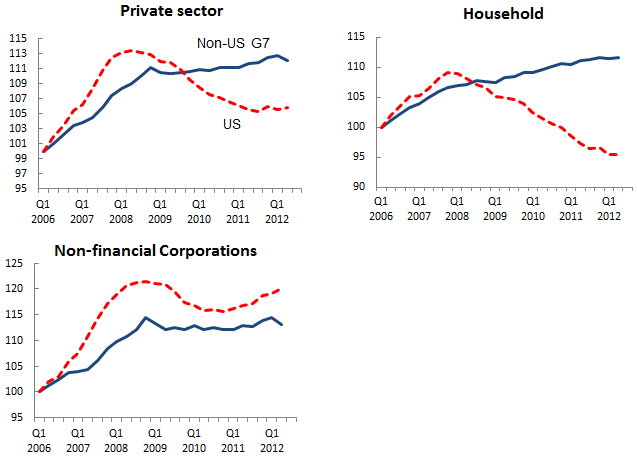

This is illustrated in Figure 2 that compares total credit in the US vs other G7 countries, using a recent BIS database.

Figure 2. Total credit

Source: Bank for International Settlements, Long series on credit to private non-financial sectors. The credit series are divided by the GDP deflator and normalised at 100 in 2006:Q1. The non-US G7 series is computed using relative PPP-adjusted GDP weights.

- The other reason why synchronicity cannot be fully explained by financial shocks is the presence of home bias, both for trade and financial flows.

As countries are only partially integrated, a shock originating in one country can only be transmitted partially to other countries (e.g. see van Wincoop 2013). Empirically, Rose and Spiegel (2010) and Kamin and Pounder (2012) find that there is little relation between financial linkages that countries have with the US and the decline in their GDP growth and asset prices during 2008-09.

A global panic perspective

Assume instead that the Great Recession is caused by a global panic, in the sense that consumers and firms negatively revise their expectations of future income and economic activity. This can reduce demand throughout the world in a simultaneous fashion and produce the observed strong co-movement. This shift in expectations can be seen in survey data. In Figure 3, we can observe a decline in expected GDP growth combined with an increase in its perceived variance of similar magnitudes in the US and a set of 17 countries.

Figure 3. GDP growth forecasts probabilities: Expectation and variance

Note: Data from Consensus Forecasts, based on one-year ahead forecast probabilities. Non-US: Australia, China, Hong Kong, India, Indonesia, Malaysia, New Zealand, Singapore, South Africa, Taiwan, Thailand, Japan, Germany, France, UK, Italy, Canada.

To analyse this issue we develop a simple two-country New Keynesian model and make three main points:

- First, the global panic was based on a rational self-fulfilling mechanism.

As consumers and firms reduce their demand based on lower expectations, the lower demand can feed into lower future economic activity, thereby confirming pessimistic expectations. In our model, the relationship between low current demand and low future economic activity goes through firms’ profits. Low firm profits today reduce the number of firms operating in the future. Moreover, uncertainty about future income may also increase.

- The second point is that full co-movements can be observed even with incomplete economic integration across countries.

However, we show that some economic integration is still necessary for the panic to be global. With sufficient economic integration, a country cannot have a panic alone. Either it is ‘saved’ by the other country through foreign demand or foreign capital flows; or it drags the other country into a panic.

In 2008-09 the world economy was ripe for a panic

There were also several factors that made the global economy more sensitive to a global panic:

- First, credit was tighter due to the financial crisis, making firms more vulnerable when hit with lower demand and lower profits.

- Second, there was limited scope for monetary policy as interest rates were already approaching the zero lower bound.

- Third, there were constraints on countercyclical fiscal policy due to increasing debt levels and new fiscal rules.

- Fourth, economic integration, although incomplete, had substantially increased in previous decades.

The first three factors generate vulnerability to a self-fulfilling panic in general, while the last one generates particular vulnerability to a panic that is global in nature.

References

Bacchetta, Philippe and Eric van Wincoop (2013), "The Great Recession: A Self-Fulfilling Global Panic", working paper.

Kamin, Steven B and Laurie Pounder DeMarco (2012), "How Did a Domestic Slump Turn into a Global Financial Crisis?", Journal of International Money and Finance 31, 10-41.

Mody, Ashoka, Damiano Sandri and Franziska Ohnsorge (2012), ”Precautionary savings in the Great Recession”, VoxEU.org, 22 February.

Rose, Andrew and Mark Spiegel (2010), "The Causes and Consequences of the 2008 Crisis: International Linkages and American Exposure", Pacific Economic Review 15: 340-363.

Van Wincoop, Eric (2013), "International Contagion through Leveraged Financial Institutions", American Economic Journal: Macroeconomics, forthcoming.