Floods are estimated to be the costliest natural disasters worldwide (Miller et al.2008, Kousky et al.2018) and are expected to become more frequent and devastating as a concomitant of climate change (National Academies of Sciences, Engineering, and Medicine 2016, Field et al. 2012, Kocornik-Mina 2015, Abatzoglou and Williams 2016, Desmet 2018, Munich Re 2020). The recent floods that have ravaged entire regions across Central Europe appear indicative of what is to be expected – fatalities, increasing fiscal pressure related both to reconstruction and adaptation needs, and rapidly rising costs for the insurance sector. Policy responses will combine public interventions and private sector mitigation and adaptation strategies to reduce the long-term implications of climate-related events (Bolton et al. 2021, Hiebert 2021). Lin et al. (2021), for instance, discuss possibilities to tax new housing constructions and to subsidise flood insurance in flood-prone areas. In this discussion, a consideration of the nature and malleability of risk preferences could help to devise strategies promoting behavioural changes towards more sustainable choices.

Why are changes in risk preferences worth more policy attention – especially now?

Whether and how risk preferences are affected by natural disasters are questions with first-order policy relevance. The role of risk preferences in predicting investment decisions, labour market outcomes, and health-related behaviour is well-documented. Risk aversion is, among other factors, a strong predictor of asset allocation, with more risk averse individuals holding much less of their wealth in stocks than more risk tolerant ones (Kimball et al. 2008). At a more aggregate level, countries with higher risk aversion are more likely to have lower total factor productivity (Falk et al. 2018), which affects macroeconomic performance. There is, however, only scarce evidence whether and how natural disasters shape individual risk behaviour (Hanaoka et al. 2018).

Large-scale floods disproportionally affect the risk preferences of men

In a new paper (Avdeenko and Eryilmaz 2021a), we first quantify the impact of the extreme flooding in Germany in June 2013 on risk preferences using a representative longitudinal data set.

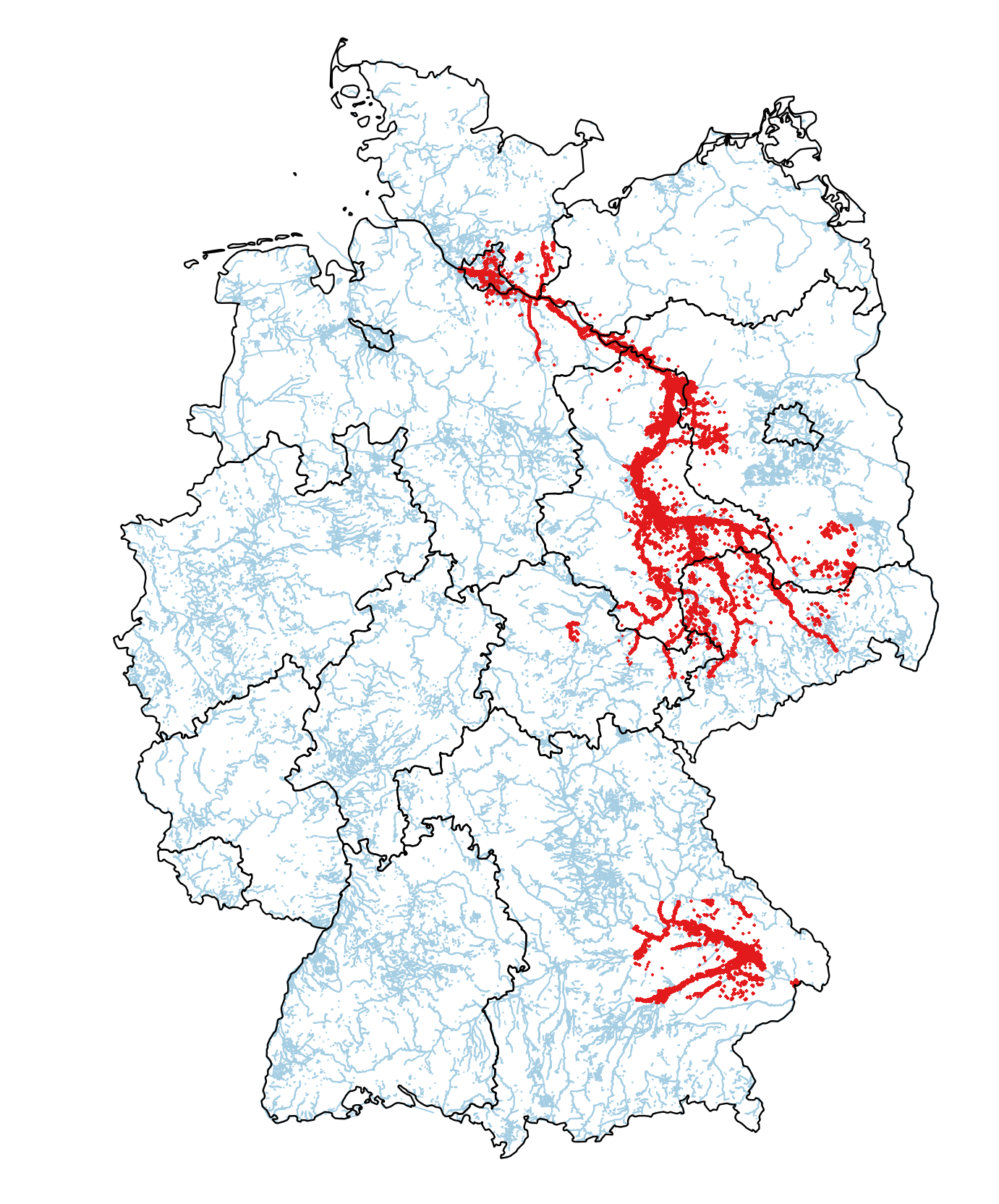

The 2013 flood led to considerable financial damage of up to €8 billion (of which €1.65 billion were borne by the insurance industry), killing 14 people, injuring 128, and affecting almost 600,000 individuals in total (Thieken et al. 2016). Prior to the currently ongoing events, it was the most severe flood Germany had experienced in hydrological terms (Schröter et al. 2015). The following figure displays the areas affected in 2013 using information provided by the Center for Satellite Based Crisis Information (ZKI) of the German Aerospace Center (DLR).

Figure 1 German regions affected by the 2013 flood

Note: Figure is based on data provided by the ZKI and author’s own calculations.

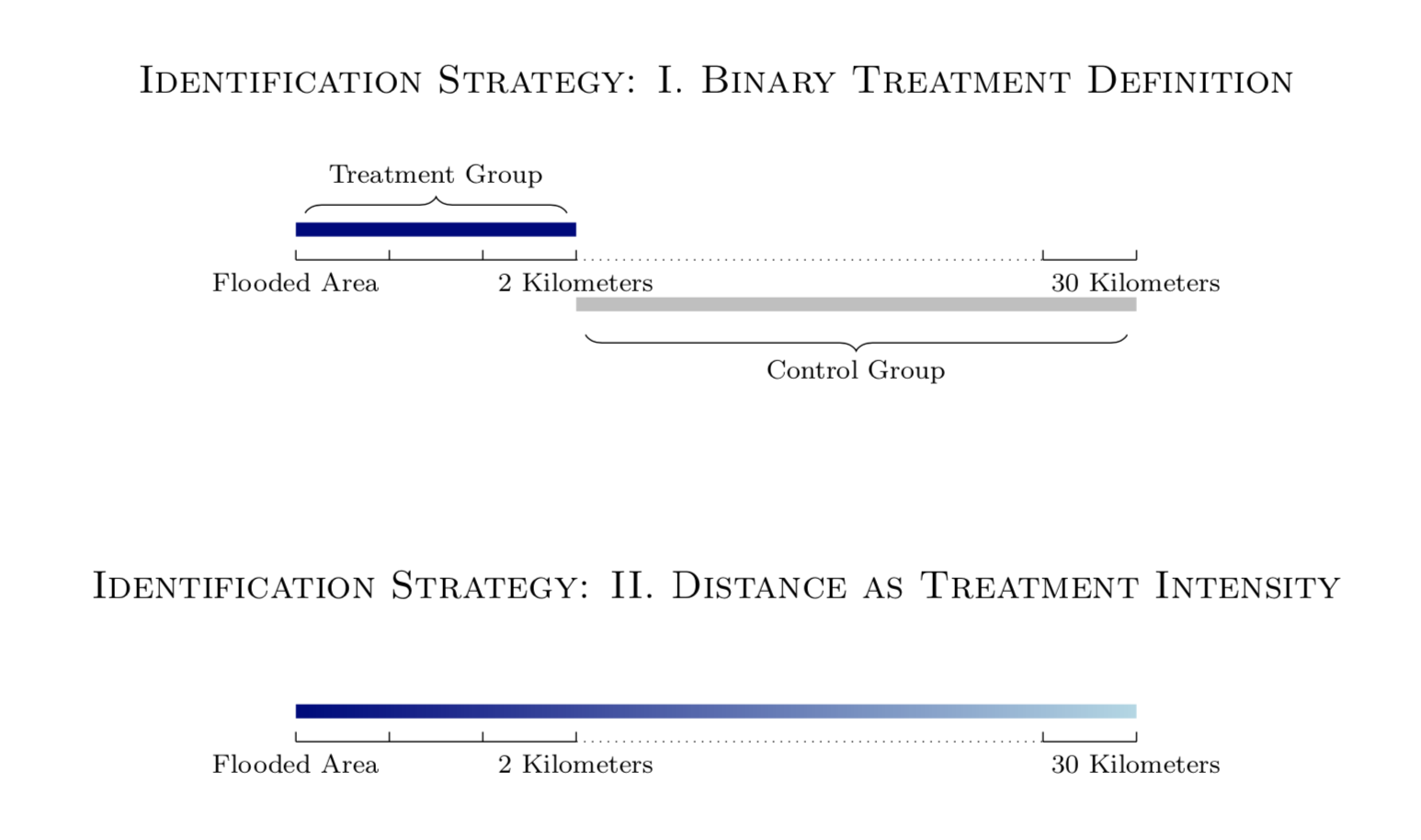

Exploiting the circumstance that this weather phenomenon was not anticipated, we provide robust evidence that flood exposure had a significant depressing impact on an individual’s stated willingness to take risks. We use an experimentally validated survey question from the German Socio-Economic Panel (GSOEP) whereby participants choose their general willingness to take risks on an eleven-point scale. Furthermore, we compare changes (before and after the flood) in risk preferences of individuals living closer to the floods with those living further away (Figure 2).

Figure 2 We estimate the impact of the 2013 flood on individual risk preferences using a difference-in-differences strategy with a treatment variable defined alternatively as binary (I) or as continuous (II)

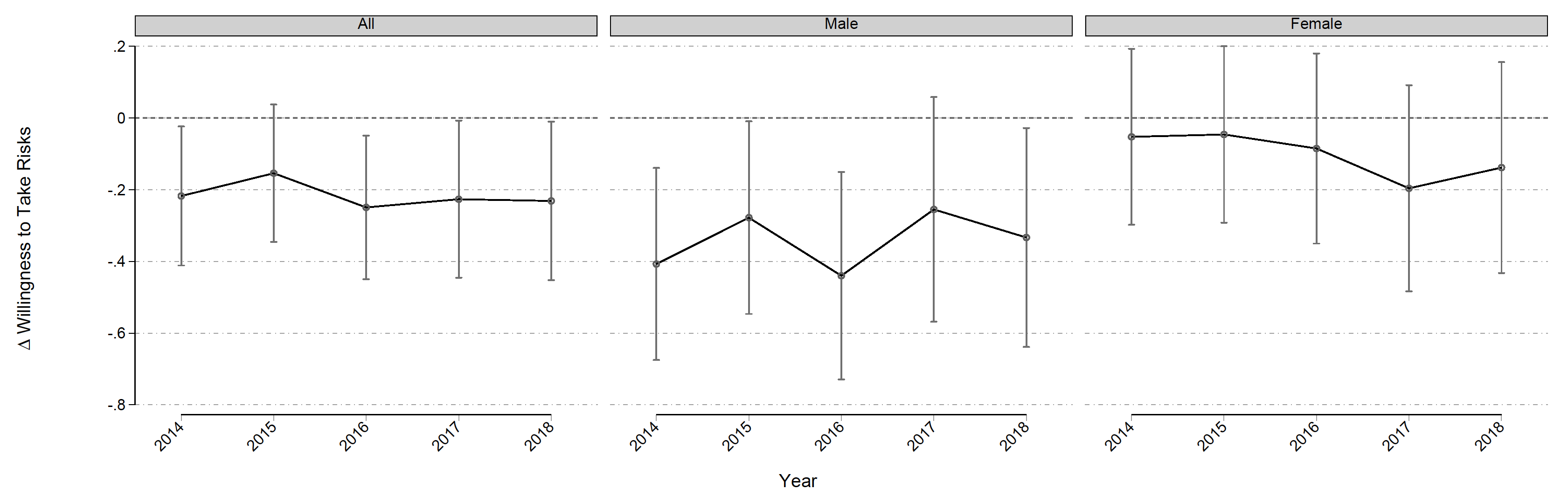

Our results show that, following the flood, men within two kilometres of the affected area are significantly more risk averse than men in the control group – an effect which is also captured if distance to the water line is continuously measured (our second identification strategy to capture the impacts). The impact one year after the flood (in 2014) is equivalent to an 8.33% decrease of the pre-treatment mean (measured in 2013), whereas we find no such effect for women. And given that women are more risk averse, this effect reduces the well-documented gap in risk aversion between genders (Croson and Gneezy 2009, Eckel and Grossman 2008). We further explore the persistence of the changes up to the year 2018. For men living in proximity to the water line, a statistically significant and sizable reduction in the willingness to take risks is detectable in almost all subsequent years. For women, no significant impact is found in the years after the 2013 extreme floods.

Figure 3 Treatment effects in the years following the flood

Why do men become more risk averse?

It is plausible to assume that the increase in risk aversion is due to a wealth effect, i.e. primarily due to the loss of assets. Simply put, an individual with increasing wealth levels may care less about additional risks, and vice versa. We test this channel, yet our results provide little evidence in favour of such an explanation. Instead, the shift in risk preferences is associated with negative impacts on wellbeing: we find strong evidence of a drop in life satisfaction and suggestive evidence of more frequent feelings of sadness – again only for men living in proximity to the water line after the disaster. Emotional reactions have also been linked to gender differences in risk attitudes captured in economic laboratory experiments (Croson and Gneezy 2009, Loewenstein et al. 2001). Altogether, these findings are in line with the Affect Infusion Model, which proposes that negative emotions like fear and stress increase risk aversion (Forgas 1995) and the role of fear in changing investors’ actions (Koudijs and Voth 2014).

Why should we care?

How may these results help policymakers to design better adaptation policies? We present suggestive evidence of changes in households’ financial decision-making associated with the captured changes in risk preferences. The flood is also associated with an 8.5 percentage point increase in the likelihood of life insurance ownership for households led by men. Additional analysis shows that this result is associated with preceding changes in men’s risk preferences. This empirical result underpins the presumption that a portion of the costs associated with natural disasters is likely to be internalized by households at risk. This is particularly relevant if governments want to provide incentives for household-level adaptation measures, such as procuring disaster risk insurance products or implementing better building standards (Baylis and Boomhower 2021). While, given the data at hand, we do not study impacts on the uptake of flood insurance, we can show that targeting at-risk households to take up life insurance could be a policy mechanism to shift some of the disaster costs to at-risk households. Moreover, if the risk of larger floods increases, it is necessary to also address the population who lives further away from the rivers.

What are the next steps?

Our study on the causal impacts of disasters on risk preferences is one of the few that is set in a high-income country. It points to a fruitful research field. Further evidence on how different individuals cope with and adapt to natural disasters is becoming increasingly relevant. In investigating this question, it seems important to consider the endogenous nature of changes in preferences. For European policy makers and insurers modelling future policies and insurance products to mitigate climate change impacts, our study highlights the relevance of heterogeneous responses and potential mechanisms.

References

Abatzoglou, J T and A Park Williams (2016), Impact of anthropogenic climate change on wildfire across western US forests," Proceedings of the National Academy of Sciences of the United States of America, 113 (42): 11770-11775, October.

Avdeenko, A and O Eryilmaz (2021a), "The Impact of Climate Change on Risk Aversion and Mitigation Behavior: Evidence from Germany", CEPR Discussion Paper 16266.

Avdeenko, A and O Eryilmaz (2021b), “Extreme floods change men’s risk preferences, and it could matter for financing climate adaptation measures”, VoxEU.org, 3 August.

Baylis, P and J Boomhower (2021), “Building codes and community resilience to natural disasters," Working Paper, April.

Bolton, P, H Hong, M Kacperczyk, and X Vives (2021), Resilience of the Financial System to Natural Disasters, The Future of Banking 3, CEPR Press.

Croson, R and U Gneezy (2009), “Gender differences in preferences", Journal of Economic Literature, 47 (2): 448-74.

Desmet, K, R Kopp, S Kulp, D Nagy, M Oppenheimer, E Rossi-Hansberg, and B Strauss (2018), “Evaluating the economic cost of coastal flooding”, CEPR discussion paper, 13128.

Eckel, C C and P J Grossman (2008), “Men, women and risk aversion: Experimental evidence", Handbook of Experimental Economics Results, 1: 1061-1073.

Falk, A, A Becker, T Dohmen, B Enke, D Huffman, U Sunde (2018), “Global evidence on economic preferences”, The Quarterly Journal of Economics, 133 (4): 1645–1692, November.

Field, C B, V Barros, T F Stocker, and Q Dahe (2012), Managing the risks of extreme events and disasters to advance climate change adaptation: Special report of the intergovernmental panel on climate change, Cambridge University Press.

Forgas, J P (1995), “Mood and judgment: The affect infusion model (AIM)", Psychological Bulletin, 117 (1): 39.

Hanaoka, C, H Shigeoka, and Y Watanabe (2018), “Do risk preferences change? Evidence from the great east Japan earthquake", American Economic Journal: Applied Economics, 10 (2): 298-330.

Hiebert, P (2021), “Climate change will unevenly impact the European financial system”, VoxEU.org, 13 July.

Kimball, M S, C R Sahm, and M D Shapiro (2008), “Imputing risk tolerance from survey responses", Journal of the American Statistical Association, 103 (483): 1028-1038.

Kousky, C, E O Michel-Kerjan, and P A Raschky (2018), “Does federal disaster assistance crowd out flood insurance?" Journal of Environmental Economics and Management, 87: 150-164.

Kocornik-Mina, A, G Michaels, T McDermott, and F Rauch (2015), "Flooded cities", CEPR working paper.

Koudijs, P and H-J Voth (2014), “Beliefs and leverage: Personal experience and risk taking in margin lending”, CEPR discussion paper 9920.

Lin, Y, T McDermott, and G Michaels (2021), “Cities and the sea level”, CEPR Discussion Paper 16004.

Loewenstein, G F, E U Weber, C K Hsee, and N Welch (2001), “Risk as feelings," Psychological Bulletin, 127 (2): 267.

Miller, S, R Muir-Wood, and A Boissonnade (2008), “An exploration of trends in normalized weather-related catastrophe losses," Climate Extremes and Society, 12: 225-247.

Munich Re, “Flood Risk: Underestimated Natural Hazards (2020)”, Accessed 24 February 2021.

National Academies of Sciences, Engineering, and Medicine; Division on Earth and Life Studies, Board on Atmospheric Sciences and Climate, Committee on Extreme Weather Events and Climate Change Attribution (2016), Attribution of extreme weather events in the context of climate change, Washington, DC: The National Academies Press.

Schröter, K, M Kunz, F Elmer, B Mühr, and B Merz (2015), “What made the June 2013 flood in Germany an exceptional event? A hydro-meteorological evaluation," Hydrology and Earth System Sciences, 19 (1): 309-327.

Thieken, A H, S Kienzler, H Kreibich, C Kuhlicke, M Kunz, B Mühr, M Müller, A Otto, T Petrow, S Pisi, and K Schröter (2016), “Review of the flood risk management system in Germany after the major flood in 2013," Ecology and Society, 21 (2).