Interrelated economic problems

Current high public debt burdens are due to three main forces:

- Bond-financed fiscal stimulus measures applied in response to the Global Crisis (and the earlier crisis in Japan);

- Lower revenues and higher welfare payments due to sluggish growth and higher unemployment, particularly in countries that adopted strong austerity measures;

- Measures adopted to bail out banks.

In some countries, the deflation tendency is most probably due to inadequate final demand and falling wages. If demand was adequate, but supply was deficient, rising inflation would by now be the major problem.

Liquidity traps ̶ situations where lenders cannot find borrowers to lend available surplus money to ̶ should have provided a flashing red light. Policymakers should have given greater attention to resolving, or by-passing, the liquidity traps with new economic policies.

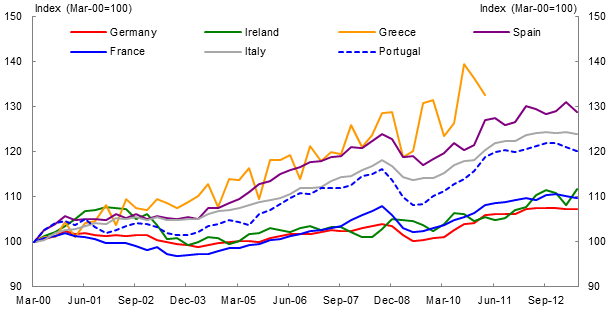

The loss of trade competitiveness is evident and most sustaining in Eurozone periphery countries, reflecting the combination of a common currency and widely different cost and price trajectories across Eurozone countries.

Another pertinent problem is the high unemployment, which is not due to excessive growth in real unit wage costs, as profitability has risen to record levels in many countries, and real wages are generally falling and not rising in afflicted countries. This suggests that the unemployment problem is not of the ‘classical’ variety (excessive real wage costs), but predominantly of the ‘Keynesian demand deficiency’ variety.

We will focus on four likely policy mistakes.

Financing the fiscal stimulus

Ever since the gross excesses in the use of the printing press and new money financing of deficits and debt during the German hyperinflation (under the authority of a private central bank), bond financing has become the preferred method of deficit financing. So, when the Crisis hit, it was natural for policymakers to not even consider whether bond financing would continue to be appropriate. This raises the possibility that a large policy mistake was made, which added directly to the size of the public debt (see Buiter 2014 and Wood 2013).

We will return to the issue of the methods of financing budget deficits later.

Monetary policy

The initial general monetary policy response to the global financial crisis was undoubtedly appropriate.

The subsequent development of monetary policy, particularly from late 2010 onwards, is, however, highly controversial.

Quantitative easing (asset purchases by the central bank) directly increases ‘asset’ prices only. With asset purchases, the ‘money base’ is directly increased but the ‘money supply’ may not be impacted. There may, therefore, be few, if any, significant direct channels of causality by which quantitative easing could raise ‘consumer price’ inflation (see Bernanke 19991).

Despite years of profligate money creation by Japan and the US, there has been no evidence of ‘demand-pull’ or ‘cost-push’ inflation. When one-off events (including the tax hike and higher energy prices in Japan) are taken into account, the deflation tendency remains.

Enterprises, particularly in the US, were highly profitable in late 2010 and commercial banks, too, already had massive financial resources in reserve accounts; they did not need further quantitative easing.

The unemployed, low-income households, and the disadvantaged (all with high marginal propensities to consume) were not recipients of the new money provided under the asset purchase program – that money never reached the ‘real economy’. Those who received the new money were commercial banks, traders, speculators, financial investors, high-wealth individuals, and hedge funds. They all have a low marginal propensity to consume ordinary goods and services.

The attempted flattening of the yield curve caused risk-taking to become distorted. Time-and-interest-rate-dependent purchasing, investment, leverage, production, and savings decisions are all being distorted. Excessive debt and risk-taking is being encouraged.

In the wake of massive injections of new money (quantitative easing) into global financial markets, it is not surprising that price bubbles are now being encouraged in the stock-markets, property (the US, the UK, Germany, Australia, Canada, Switzerland, and New Zealand), commodities (gold), bonds (10-year US Treasury Note), and in selected exchange rates. Collateralised debt obligations are again booming, and levels of private debt are rising strongly. Arguably, asset prices have already moved far beyond what the real economic fundamentals would suggest is reasonable.

Thus, the continued application of quantitative easing beyond 2010 has arguably represented an additional policy mistake.

Directing new money to finance only commercial banks and financial markets is unwise. We will return to this issue and explore an alternative monetary policy approach later in this article.

Fiscal austerity

Blanchard and Leigh (2013) and De Grauwe and Ji (2013) have reasonably demonstrated that fiscal austerity policies have been counter-productive. These policies ̶ cutting government expenditure or raising taxes ̶ contribute to deeper recessions and higher public debt.

Fiscal austerity ̶ by withdrawing demand, and lowering tax revenues without cutting tax rates ̶ creates unemployment and ‘unhealthy’ budget deficits, and works to raise the public debt burden via that mechanism.

The adoption of fiscal austerity policies represents yet another policy mistake.

Internal devaluation

According to the European internal devaluation philosophy, austerity reduces aggregate demand and pushes up unemployment. In turn, the higher unemployment is expected to moderate wage claims and lead to reductions in the growth of nominal wages. The growth in prices is then expected to fall in line with the reduction in wages. The intended result is that national price levels decline in trade deficit countries (relative to those in surplus countries), and competitiveness in the deficit countries is improved.

The reality is that, for many reasons ̶ including weak competition policies, market segmentation, different institutional arrangements across national borders, and rigidities in product and labour markets, etc. ̶ nominal wages (wages’ growth in some countries) have fallen in many periphery countries by more than prices (growth in prices); hence, real wages have declined. This fall in real wages has likely contributed to weakening the demand.

In the meantime, Germany has maintained wage and price competitiveness at a high level relative to many periphery countries. There has been no convergence (see Chart 1 and Wood 2014). Under current Germany policy, the adjustments needed to restore competitiveness in periphery countries would necessitate further reduction in Southern wages, which would push those economies further away from internal balance.

So, austerity, reliance on market forces, and internal devaluation represent another policy mistake. An alternative approach is suggested below.

Figure 1. Export price-based competitiveness indicator

An alternative set of macroeconomic policies

As interest rates are at, or close to, zero bounds, and liquidity traps are widespread and constrain expansion, one might think that all monetary policy options have been exhausted. Fortunately, this is not the case.

The plan involves the creation of new money -- by a central bank or by the Treasury/Ministry of Finance. As the new monetary policy is adopted, the old monetary policy ̶ quantitative easing ̶ can be withdrawn.

The new money should be used to finance a large stimulatory budget deficit and boost household incomes.

The principal purpose of the new money injection is to finance the first round of increased public expenditure or tax cuts. Beyond that, and when multiplier effects take hold, the equivalent of the new money injection could be withdrawn. This new combination of fiscal and monetary policies is termed Overt Money Financing .

Overt Money Financing:

- Represents the most powerful monetary and fiscal policy combination.

- Does not increase either interest rates or public debt (as does bond financing).

- Can be applied if there is or is not an independent central bank, and it could be implemented by the Treasury/Ministry of Finance acting alone.

- Can be applied if Eurozone countries remain inside the Zone or leave (see Bassone and Wood 20133).

- Does not create asset price bubbles.

As internal devaluation has been ineffective in the Eurozone, consideration could also be given, on a case-by-case basis, to the adoption of centralised wage and price policies, or incomes policies, to bring about the appropriate price and wage levels in individual Eurozone countries, including wage and price increases in highly competitive surplus countries. In this way, the large, 18-country convey, can reform the line and steam ahead in closer alignment.

References

Bassone B and R Wood (2013), “Overt Money Financing: Navigating Article 123 of the Lisbon Treaty”, Roubini Global Economics EconoMonitor, 22 July.

Bernanke, B (1999), “Japanese Monetary Policy: A Case of Self-induced Paralysis”, Presentation at ASSA Meeting, December.

Bernanke, B (2002), “Remarks before the National Press Club”

Blanchard and Leigh (2013), “Growth Forecast Errors and Fiscal Multipliers”, IMF Working Paper, WP/13/2013.

Buiter, W (2014), “Why fiscal sustainability matters”, VoxEU.org, 10 January.

De Grauwe and Ji (2013), “Panic-Driven Austerity in the Eurozone and Its Consequences”, VoxEU.org, 21 February.

Friedman M (1948) ‘A Monetary and Fiscal Framework for Economic Stability’, The American Economic Review, Vol. 38, June.

Lerner, A (1943), “Functional Finance and the Federal Debt”, Social Research, Vol. 10, No.1.

Turner, A (2013), “Debt, Money and Mephistopheles: how to get out of this mess”, Cass Business School Lecture, 6 February.

Wood, R (2012), “Delivering Economic Stimulus, Addressing Rising Public Debt and Avoiding Inflation”, Journal of Financial Economic Policy, Vol. 4.

Wood, R (2013), “Overt Money Financing and Public Debt”, Roubini Global Economics Economonitor, 3 September.

Wood R (2014), “Eurozone Macroeconomic Framework: Reducing Internal and External Imbalance”, Roubini Global Economics EconoMonitor, 4 February.

Footnotes

1 Bernanke (1999) implies at page 14 that new money can raise the prices of goods if large quantities of goods are purchased by the monetary authority, or it could raise the price of assets if large quantities of assets were to be purchased. He argues at page 21 that large money transfers to households would raise prices. All and good. On page 24, he refers to possible purchases of long-term government bonds by the central bank. He states that “the object of such purchases would be to raise asset prices, which in turn would stimulate spending (for example by raising collateral values)”. It is the last phrase “which in turn would stimulate spending (by raising collateral values)” that seems questionable, particularly is respect of bond purchases. Spending on new speculation or other assets may increase, but as banks, financial investors, traders, high wealth individuals, and speculators have a relatively low propensity to consume ordinary goods and services, then the link between bond purchases, spending on ordinary goods and services, and consumer prices is of questionable significance. And indeed this may have been an issue in his mind when he states at page 8: “To be clear, it is most emphatically not good practice for monetary policymakers to try to target asset prices directly.”

2 The case for Overt Money Financing of fiscal deficits dates back to Lerner (1943), Friedman (1948) and Bernanke (2002). Overt Money Financing was revisited and proposed in Wood (2012) as a means to address high public debt and deflation by. Subsequently Biagio Bassone, Willem Buiter and E Rahbari, McCulley and Pozar have advocated for it. A deep review of the proposal can also be found in Turner (2013).

3 Article 123 of the Lisbon Treaty does not preclude the use of new money created by the European Central Bank being transferred to individual governments in the Eurozone using non-debt financial instruments. Article 123 of the Lisbon Treaty states that:

“1. Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States (hereafter referred to as nation central banks) in favour of Union institutions; bodies; offices or agencies; central government regional local and other government authorities; other bodies governed by public law; or public undertakings of Member States shall be prohibited, as shall the purchase directly from them by the European Central Bank or national central banks of debt instruments.

2. Paragraph 1 shall not apply to publically owned credit institutions which, in the context of the supply of reserves by central banks, shall be given the same treatment by national central banks and the European Central Bank as private credit institutions.”