The dominant economic model has been called into question as a result of rising inequality and firms’ market power. Low productivity growth in recent decades has not helped, either. Meanwhile, the debate about how to achieve shared prosperity has traditionally focused almost exclusively on the redistribution of income. In this debate, the key trade-off lies in the balance between equity, typically using policy tools such as taxes and transfers, and efficiency to preserve the incentives to work and invest.

To tackle inequality and achieve shared prosperity, it is also important to study predistribution, that is, the determinants of market income distribution before taxes and transfers (Blanchet et al. forthcoming, Filauro and Fischer 2021, Mayhew and Wills 2020). The high and sustained growth of many advanced countries in the past and more recently the successful East Asian countries post-WWII show that there is an economic model that raises efficiency while achieving more equal market outcomes.

We argue that this model is characterised by a high level of economic dynamism (Aghion et al. 2021); that is, it depends on what a country produces and how much it competes domestically and internationally. New policy instruments, beyond taxation and transfers, should aim at achieving a shift toward sophisticated export industries, innovation and creative destruction, and a high level of competition. In other words, dynamism – an economy’s dynamo – should be the aim as it matters for both growth and equity.

Beyond growth: Dynamism and the pursuit of better predistribution

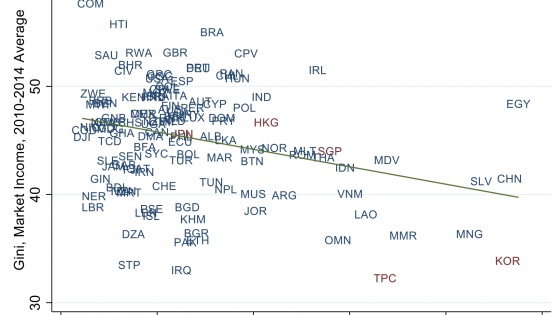

High broad-based growth is indispensable to lift a large number of workers out of poverty and increase wellbeing (Pritchett 2021), and it does not always entail a large increase in inequality. The experience of China illustrates this starkly as about 850 million people were lifted out of poverty in four decades (Yang 2019), contributing to a decline in worldwide inequality over the 2000s (Sala-i-Martin 2006), although there is also evidence that it was accompanied by rising inequality (Ang 2019). In contrast, South Korea and Taiwan Province of China – the ‘Asian miracles’ – have achieved high sustained growth for decades while witnessing a relatively low increase in market income inequality as they got richer (Figure 1).

Figure 1 Average market income inequality (Gini coefficient) by decade

Source: SWIID (Solt 2019).

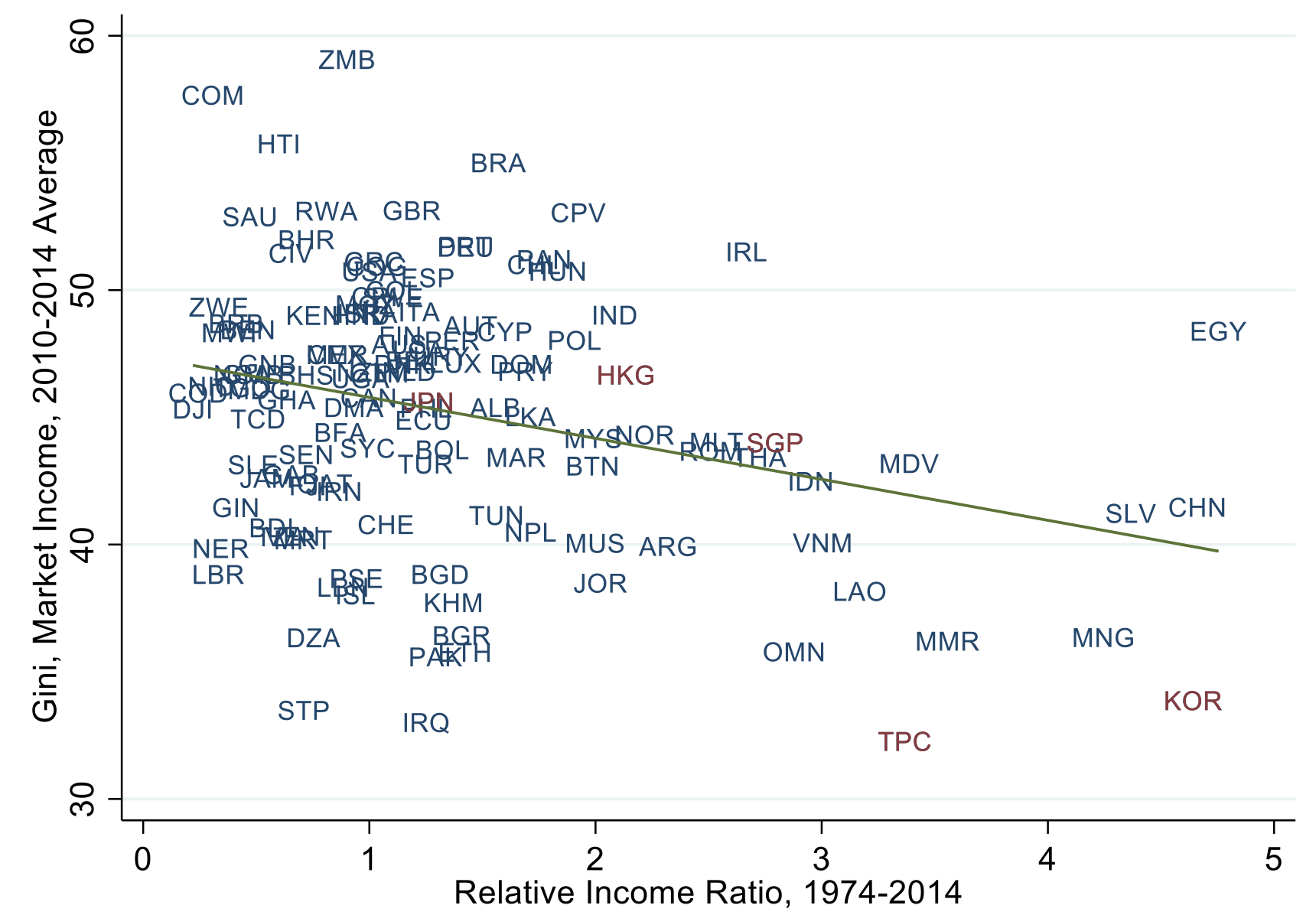

The cross-country relationship between long run growth per capita relative to that of the US over 1970-2014 and the recent levels of market inequality, as measured by the Gini coefficient, is negative (Figure 2). Controlling for other factors such as the level of development (real GDP per capita relative to that of the US), and lagged Gini, fixed effects, and generalised method of moments (GMM) regressions show that a country that has grown faster than others over the previous five years or a decade, witnesses a lower level of market inequality over the following five or ten years (Aghion et al. 2021).

Figure 2 Long-run economic growth versus market inequality, 1974-2014

Source: Penn World Table 9.0 (Feenstra et al. 2015), SWIID (Solt 2019), and authors’ calculations.

Why dynamism matters

Economic dynamism, embodied in a rapid and massive ‘creative destruction’ of activities toward sophistication which changes the industrial structure of the economy, has likely been behind high sustained growth in the Asian miracles (Cherif and Hasanov 2019a, 2019b). This process, driven by innovative firms, expands the set of tasks and industries, letting go of some older ones such as wigs and rice and introducing new and more sophisticated ones such as cars and electronics (Cherif and Hasanov 2019a), in line with Schumpeterian ‘creative destruction’ (Aghion and Howitt 1992). It is conducive to high productivity gains, spillovers, and linkages, and ultimately provides more opportunities for firms and workers, better jobs, and higher wages.

The alternative growth models may provide growth spurts for a few years but may not be sustainable. High growth based on exports of commodities such as oil or copper or agricultural products such as soy or wheat could be possible if a large endowment in natural resources exists and the relative price of these commodities is favourable. However, in many high-income natural resource exporters, productivity growth has been stagnant or negative, resulting in declining relative income over time (Cherif et al. 2016). The model based on low-skilled industries such as tourism would produce similar outcome over the long run. Stagnating productivity would not bode well for a median worker’s real income or country’s poverty levels.

The sophisticated industries are mostly in manufacturing and high-skill services, command a high wage premium, and support social mobility. Although many sophisticated sectors would require higher education, in many manufacturing sectors, specialised skills are acquired on the job and in many cases, do not require higher education. Even after controlling for skills, the compensation (wages and benefits) premium in manufacturing is higher (about 13% in the US in the 2010s) than in other sectors (Mishel 2018). Manufacturing jobs act as transformers of skills, taking many low-skilled entrants and making them into specialised high-skilled workers while paying good salaries. Salvatori and Falco (2017) indicate that about one-third of the reduction in the middle-skilled jobs’ share in OECD countries is due to the decline in manufacturing.

In addition, low-skilled workers benefit substantially more in innovative firms than other firms (Aghion et al. 2019), and more of these types of firms in the economy could help reduce inequality. Aghion et al. (2016) argue that although innovation by incumbents and entrants increases top income inequality, creative destruction, or innovation by entrants, increases social mobility and the entrepreneurial share of income and creates role models to follow.

How to promote dynamism

To promote dynamism for fair and inclusive markets requires three types of policies. A first set of policies should aim at channelling resources toward more sophistication within and across sectors and promoting innovation. The second set is related to enforcing competition, while the last set of policies would encourage technology diffusion.

To reverse the decline in knowledge diffusion and quality upgrading while encouraging firm entry into sophisticated industries would require a type of industrial policy that tackles a myriad of market failures, such as externalities (e.g. learning-by-doing, climate change, and technology development), informational asymmetries, and coordination failures. Fiscal instruments such as investment support and credit policy could be powerful tools for businesses. Skill training for workers is important, while R&D, university research, national labs, and industry clusters could also be promoted. Development banks, venture capital, and export and investment promotion agencies have their role to play in this process, albeit with a focus on promoting innovation and creative destruction with feedback from market signals rather than sustaining incumbents (Cherif et al. 2016, Aghion 2016).

There is also a role for a revamped competition policy to further limit market power and lift barriers to entry. To encourage innovation and creative destruction, competition policy also needs to focus on technology creation and diffusion. The case of Bell Labs in the 1950s illustrates this point vividly and suggests an avenue for dealing with the Big Tech (Watzinger et. al. 2017, Cherif and Hasanov 2021). A policy that would encourage Big Tech firms to set up industrial research labs, allowing all domestic firms to access the technologies produced in exchange for a relatively small license fee, could be very beneficial. The associated technology creation and diffusion could help revive dynamism (Aghion et al. 2021).

Developing purpose-specific skills and infrastructure for sophisticated industries, while laying out an accountability framework based on market signals, would help countries bridge the knowledge gap, advance the technological frontier, and move the economic structure toward sophisticated products. This industrial structure would not only support high sustained growth but also lift incomes of the bottom quintiles, help create good jobs, and keep a lid on market inequality.

Authors’ note: The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management.

References

Aghion, P (2016), “Growth Policy Design for Middle-Income Countries”, In R Cherif, F Hasanov and M Zhu (eds.), Breaking the Oil Spell: The Gulf Falcons’ Path to Diversification, Washington, DC: International Monetary Fund Press.

Aghion, P, U Akcigit, A Bergeaud, R Blundell and D Hemous (2016), “Innovation and Top Income Inequality”, Working paper.

Aghion, P, A Bergeaud, R Blundell and R Griffith (2019), “The Innovation Premium to Soft Skills in Low-skilled Occupations”, working paper, Collège de France.

Aghion, P, R Cherif and F Hasanov (2021), “Fair and Inclusive Markets: Why Dynamism Matters”, IMF Working Paper 21/29.

Aghion, P and P Howitt (1992), “A Model of Growth Through Creative Destruction”, Econometrica 60: 323–51.

Ang, Y Y (2019), “Missing the Big Picture on Poverty Reduction”, Project Syndicate, 13 November.

Blanchet, T, L Chancel and A Gethin (forthcoming), “Why Europe Is More Equal than the United States?”, American Economic Journal: Applied Economics.

Cherif, R and F Hasanov (2021), “In the Footsteps of Bell Labs: Big Tech, Competition, and Innovation”, Bennett Institute for Public Policy Blog, University of Cambridge, 11 November.

Cherif, R and F Hasanov (2019a), “The Return of the Policy that Shall Not Be Named: Principles of Industrial Policy”, IMF Working Paper 19/74.

Cherif, R and F Hasanov (2019b), “Principles of True Industrial Policy”, Journal of Globalization and Development 10(1): 1–22.

Cherif, R, F Hasanov and M Zhu (eds.) (2016), Breaking the Oil Spell: The Gulf Falcons’ Path to Diversification, Washington, DC: International Monetary Fund Press.

Feenstra, R C, R Inklaar and M P Timmer (2015), “The Next Generation of the Penn World Table”, American Economic Review 105(10): 3150-3182.

Filauro, S and G Fischer (2021), “Income Inequality in the EU: General Trends and Policy Implications”, VoxEU.org, 17 April.

Mayhew, K and S Wills (2020), “Inequality: What Has Happened, Why Care, and What Can Be Done About It”, VoxEU.org, 18 June.

Mishel, L (2018), “Yes, Manufacturing Still Provides a Pay Advantage, But Staffing Firm Outsourcing is Eroding It”, Economic Policy Institute, Report.

Pritchett, L (2021), “National Development Delivers: And How! And How?”, CID Faculty Working Paper 398, Harvard University.

Sala-i-Martin, X (2006), “The World Distribution of Income: Falling Poverty and Convergence, Period”, The Quarterly Journal of Economics 121(2): 351-397.

Salvatori, A and P Falco (2017), “Poles Apart? How Technology & Globalisation Have Affected the Global Workforce”, OECD Forum Network, 5 September.

Solt, F (2019), “Measuring Income Inequality Across Countries and Over Time: The Standardized World Income Inequality Database”, SWIID Version 8.2, November.

Watzinger, M, T Fackler, M Nagler and M Schnitzer (2017), “How Antitrust Enforcement Can Spur Innovation: Bell Labs and the 1956 Consent Decree”, VoxEU.org, 19 February.

Yang, Y (2019), “The Open Secret of Development Economics”, Project Syndicate, 22 October.