Is the new-Keynesian approach (Clarida, Galí, and Gertler 2000) right? Here I suggest that US data on inflation, unemployment, and vacancies is best viewed through the lens of old-Keynesian theory.

A dynamic (literally) description of the data

Here I provide a video of data that illustrates how events unfolded in real time. I proceed to connect these data with three strands of research.

- Empirical work with Andreas Beyer (Beyer and Farmer 2007) on the non-existence of a natural rate of unemployment.

- Theoretical models (Farmer 1988a, 1988b) in which I showed that layoffs are more likely when firms hold less cash.

- Recent work (Farmer 2010a, 2010b) that provides theoretical models in which there is a continuum of equilibrium unemployment rates.

The history of unemployment, vacancies, and inflation in the US

There have been ten recessions in the US since WWII. Most of them lasted for less than a year. The average post-war expansion lasted for five years. In some of the post-war expansions, unemployment returned to its previous trough well before the end of five years, but in others it never fully recovered. The evidence suggests that recessions have permanent effects on the unemployment rate. Without exception, every post-war recession was ended by government action as the Fed lowered the interest rate to stimulate demand.

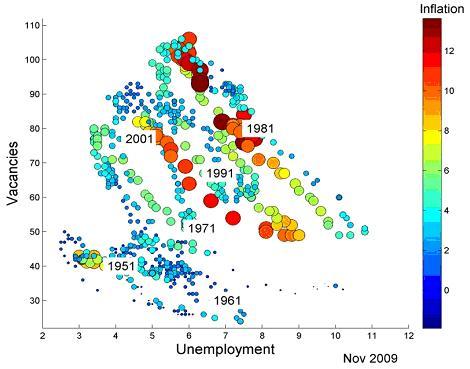

Figure 1. US unemployment and vacancies, 1951 – 2009

Figure 2. Unemployment in real time

Figure 1 shows the relationship between unemployment and vacancies in the US from January 1951 through November of 2009 – the so-called “Beveridge curve”. It also represents inflation in each month by the size and colour of each point. A large red circle represents high inflation; a small blue dot is low inflation. The colour bar on the right of the graph represents inflation rates from -1% to +13% by intensity of colour from dark blue to deep red. Click play to watch the data’s evolution over time in Figure 2.

Notice that between 1951 and 1980, the Beveridge curve shifted out to the right. During this same period, inflation built up, peaking in the early 1980s at 13%. In August of 1979, Paul Volcker took over as chairman of the Fed, and US monetary policy changed dramatically. The Fed moved to a policy of targeting the rate of growth of the money supply, narrowly defined, and the interest rate shot up overnight.

The effect was to induce a severe recession that brought inflation under control. The Beveridge curve drifted back slowly down and to the left and by November of 2009, the trade-off between vacancies and unemployment was close to where it had been in the 1950s.

Is there a natural rate of unemployment?

In a joint paper with Andreas Beyer, we studied the behaviour of unemployment, inflation, and the interest rate in US data before and after 1980 (Beyer and Farmer 2007). In that study we found evidence that, once these data are transformed by mapping them into an unbounded interval, they are each individually non-stationary. The data are connected by two co-integrating relationships that differ before and after 1980.

One co-integrating relationship is stable over the two sub-periods. It is an upward sloping relationship between unemployment and inflation – a Phillips curve. The second breaks in 1980. It is a relationship between unemployment, inflation, and the interest rate that we interpreted in that paper as a policy rule.

Our finding of an upward-sloping Phillips curve at low frequencies is reflected in Figure 1 by the outward drift of the Beveridge curve as inflation increases and the backward shift as it falls. Our finding of different low frequency relationships between inflation, the interest rate, and unemployment before and after 1980 confirms the findings of Clarida et. al. (2000), Lubik (2000), and Schorfheide (2004), who also interpret these relationships as a shifting policy rule.

Why did the Beveridge Curve shift?

The data from Figure 1 suggest that the relationship between unemployment and inflation is more complicated than that suggested by simple new-Keynesian models that incorporate a “natural rate” of unemployment.

The most prominent theory of the natural rate of unemployment is that of search theory. According to this theory, the process by which a worker finds a job can be represented by a technology that uses resources. The search technology uses two inputs. The first is the time spent looking for a job by an unemployed worker. The second is the resources spent by a firm posting a vacancy. Figure 1 suggests that there is a third input.

Variations in the inflation rate change the real trade-off between vacancies and unemployment. When inflation is high, it takes more unemployment and more vacancies to fill a job. The obvious candidate for the missing input is liquidity, represented by holdings of cash balances by firms. In two articles in 1988 (Farmer 1988a, 1988b) I showed that, when firms have cash on hand, they are less likely to need to lay off workers. When inflation increases, it becomes more costly to keep liquid assets, and, as a consequence, firms are more likely to lay off workers when demand falls.

Keynesian economics redux

In two forthcoming books, Expectations Employment and Prices (2010a) and How the Economy Works (2010b), I provide a theory that explains these data. I argue that there is no natural rate of unemployment and that the economy can come to rest in a stationary equilibrium at any point on the Beveridge curve. Which equilibrium persists, is decided by the confidence of households and firms that pins down asset values as reflected in housing wealth and the value of the stock market.

When households feel wealthy, that belief is self-fulfilling. Consumers spend a lot, firms hire workers, and the economy comes to rest at a point on the Beveridge curve with low unemployment and high vacancies. When the values of houses, factories, and machines fall, households spend less, firms lay off workers, and the economy comes to rest at a point on the Beveridge curve with high unemployment and low vacancies. Both situations – and anything in between – are zero-profit equilibria. High inflation makes the trade-off between unemployment and vacancies less favourable, and in the steady state, any inflation rate is consistent with any unemployment rate.

Policy implications

Most policymakers subscribe to the theory of the existence of a natural rate of unemployment. The data suggest that this theory is unconfirmed at best. To make the theory consistent with data, one must posit that the natural rate changes between recessions in unpredictable ways. This version of natural rate theory is difficult or impossible to refute. It is religion, not science.

For more than fifty years policy makers have been trying to hit two targets, unemployment and inflation, with one instrument, the interest rate. Recently, central bankers have discovered a second instrument – quantitative easing. I believe that quantitative easing works by influencing the value of real assets as reflected in housing wealth and the stock market and that it was successfully deployed by central banks in 2009 to maintain aggregate demand. In my two forthcoming books, I argue that quantitative easing should permanently enter the lexicon of central banking as a second instrument of monetary policy and that it will prove to be a more effective and flexible tool than fiscal policy for restoring and maintaining full employment.

References

Beyer, Andreas and Roger E. A. Farmer, (2007). “Natural Rate Doubts,” Journal of Economic Dynamics and Control, 31, pp. 727—825.

Clarida, Richard, Jordi Galí and Mark Gertler (2000). “Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory,” Quarterly Journal of Economics 115, pp 147—180.

Lubik, Thomas A. and Frank Schorfheide, (2004). “Testing for Indeterminacy: An Application to U.S. Monetary Policy,” American Economic Review 94, pp. 190—219.

Farmer, Roger E. A., (1988a). “What is a Liquidity Crisis,” Journal of Economic Theory, vol. 46 # 1, pp. 1–15.

Farmer, Roger E. A., (1988b). “Money and Contracts,” Review of Economic Studies, vol. 55 pp 431–446.

Farmer, Roger E. A., (2010a). Expectations Employment and Prices, Oxford University Press, Oxford.

Farmer, Roger E. A., (2010b). How the Economy Works: Confidence, Crashes and Self-Fulfilling Prophecies, Oxford University Press, Oxford.