High-frequency trading is often blamed for occasionally disrupting markets with `flash crashes’. The concern is that high-frequency trading may have potential adverse effects on liquidity and volatility of financial markets (e.g. Kirilenko and Lo 2013, Lee et al. 2013, Chaboud et al. 2014, Lewis 2014, Hasbrouck 2015, Dobrev and Schaumburg 2016). Somewhat surprisingly, out of a wealth of theoretical and empirical studies into the channels through which high-frequency trading impacts price formation and market thickness (e.g. Brogaard et al. 2014, 2015, Chaboud et al. 2014, Latza et al. 2014, Biais et al. 2015, Foucault et al. 2016), leading contributions, such as Hendershott et al. (2011) and van Kervel and Menkveld (2019) have provided a more reassuring picture.

In a recent study of the foreign exchange market, we provide evidence that high-frequency trading tends to improve many indicators of the quality of trade and market efficiency (Corsetti et al. 2019). This evidence is in line with previous work on stock markets, suggesting that the pattern we uncover is not specific to foreign exchange. The question is therefore: how does high-frequency trading help? We provide an empirical contribution to the answer, uncovering two key – hitherto neglected – facts, which point to a seemingly puzzling mechanism by which high-frequency trading may improve liquidity and market performance.

Here is what we find. Consistent with standard methodology, we assemble a large sample of news and study the order book and trades around the release of each piece of news at high frequency. Differently from other studies, however, we do not focus on traded prices but on quoted prices and calculate their entropy, i.e. a measure of the diversity of their distribution. Based on this, we show that high-frequency trading is associated with higher entropy in quoted prices, both of which have a positive impact on markets.

Here is the puzzle. Intuitively, high entropy (i.e. a rich, diverse distribution) in quoted prices makes information that traders can extract from the order book noisy. How can noise be good? A possible and plausible answer is the following. Suppose markets are populated by momentum traders or trend chasers that, in the absence of contrarian investors, may accumulate large one-sided positions and push prices towards just one direction. Uncontrollable and noisy fast traders may prevent these traders from converging collectively towards one direction of the market. Essentially, noisy information may prevent momentum traders to have firm beliefs and gives them a reason to pause.

“John has a long moustache”

We like to think of this mechanism using a historical parallel from WWII. Just before the Normandy landings on 6 June 1944, the Allies engaged in a successful misinformation operation, sending coded messages via the BBC’s nightly radio broadcasts. Some of the coded messages were important information that British intelligence services wanted to convey to resistance movements in continental Europe.1 Others were complete nonsense and were only meant to create confusion among the Axis powers. Examples of coded messages include “John has a long moustache”, “Molasses tomorrow will bring forth cognac” and – perhaps the most famous of them all – “The long sobs of the violins fill my heart with a monotonous languor” which pre-announced D-Day.

The idea here is that too much information is useless information and prompts the receiver not to react. In this case, the German army’s efforts to decrypt the messages were impaired by the large number of irrelevant pieces of information they received. This levelled the informational playing field. Both relevant and irrelevant states of the world had the same likelihood to occur, hence preventing agents to make decisions on the basis of the information in question.2

Granted, high-frequency trading does not work as the Allied commands of WWII. They do not coordinate their action. The parallel with high-frequency trading is that, because it generates entropy and dispersion in quoted prices, market players have no focal point to converge upon. This basically reduces chances of one-sided trades, and therefore limits market movement and volatility.

Shannon entropy and high-frequency quoting

More specifically, high-frequency traders do not only exploit arbitrage opportunities arising from their ability to place and execute orders over infinitesimal time intervals. They may also try to exploit their ability to process large volumes of information simultaneously, to direct and test the market with orders at disparate prices, which are not necessarily in line with the market norm given available information. Correspondingly, algorithmic trading may rely on programmes which generate either a structured and tidy flow of orders, conditionally predictable once the market starts to move in response to news, or place seemingly erratic orders.

The Shannon entropy – which is well-known in information theory – provides a natural metric to quantify the structure of the order book. Intuitively, the Shannon entropy of a distribution can be understood as the extent of its diversity – maximal for a uniform distribution. Applied to the sequence of orders in reaction to news hitting the market, low entropy will result from distributions of order prices that are quite compact and concentrated. Conversely, entropy will be high when prices in the order book are diverse, spread out, and erratic.

We carry out our study on the foreign exchange market, focusing on the response to news. Our sample covers seven of the most liquid currency pairs,3 sampled at the 100-millisecond frequency, with information on bid-ask spreads, volumes, and direction of trades over the first quarter of 2015. This dataset enables us to identify fast trades as those executed against a limit order within 200 milliseconds, i.e. faster than the reaction time of human beings. Moreover, we build a dataset of about 150 announcements concerning macroeconomic, financial, and policy decisions announcements relevant for the exchange market in 17 countries.

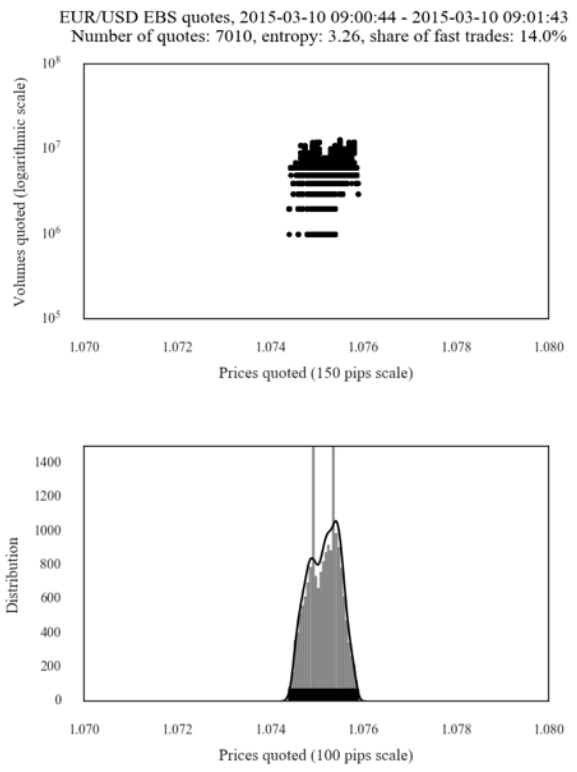

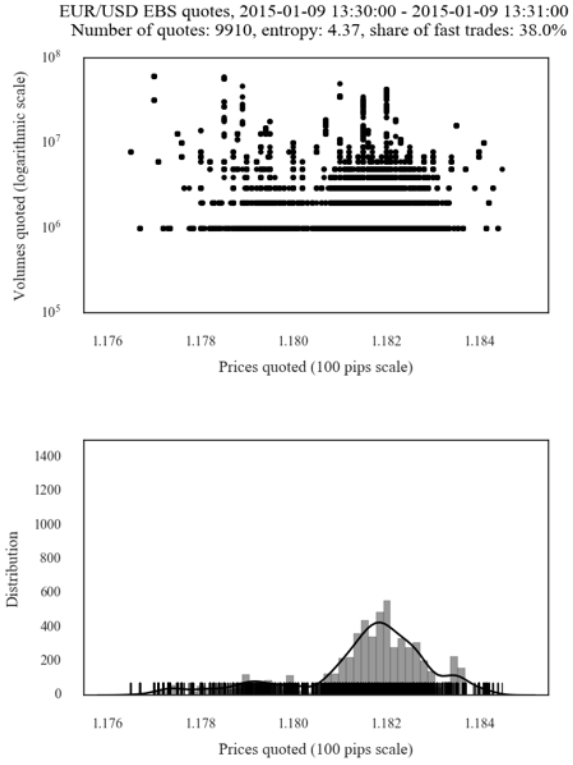

To visualise entropy, in Figure 1 we show the distribution of euro to US dollar quotes sampled at the one-minute frequency immediately after the announcement of two pieces of macroeconomic news. We select two cases with a broadly similar number of quotes (about 7,000-9,000) for the same, most liquid, currency pair, to control for trade volume and liquidity. In the figure, each case study is synthesised by two scatter plots. The upper scatter plot shows quotes and volumes, while the lower one shows the distribution of quote prices. Contrast the two cases. In the case shown on the left-hand side of the figure, the distribution of quote prices is densely concentrated on a narrow range within intervals smaller than two pips. In contrast, in the case study shown on the right-hand side of the figure, the distribution is more spread out. Shannon entropy is low in the first case, high in the second.

Figure 1 Entropy and quoting patterns: EUR-USD case study

Note: The figure shows 1-minute quotes for the EUR-USD on two different days, with low and high values of entropy on the left- and right-hand side of the figure, respectively. The upper quadrant shows scatter plots of prices and volumes quoted, while the lower quadrant shows the respective distributions of exchange rate quotes. The same scale is used for both the vertical and horizontal axes.

We show that entropy of the distribution of quoted prices is a good indicator to synthesise the structure of the order book and its evolution in response to news. In particular, we document that entropy is significantly correlated with the share of fast trading in total trade.

It may be possible, however, that high-frequency trading tends to create, rather than react to, a more diverse distribution of exchange rate quotes as measured by entropy. To ascertain the direction of causality, we use a natural experiment: the reform of the WM/Reuters’ fixing methodology on 15 February 2015, lengthening the time interval over which rates were calculated from one to five minutes. This reform was designed to avoid very short-term manipulations and targeted specifically large orders as well as high-frequency quoting behaviour around the time of the fixing (i.e. 4 pm London time). Before the reform, legal action against large banks with the charge of rigging the market already caused large institutional traders to be wary of placing large orders during the fixing – essentially, they were out. Therefore, the reform should have impacted fast traders first and foremost. The results are suggestive. During the one minute fixing, we found a peak in entropy. After the reform, it disappears. This is consistent with the view that its decline can be largely attributed to fast trading done outside large banks.

A Nietzschean “from chaos comes order”

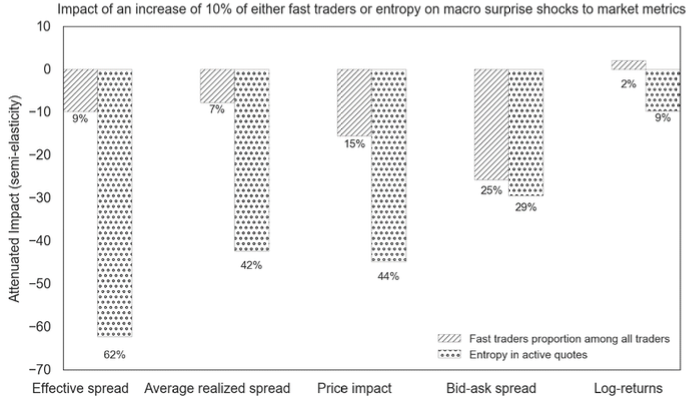

Next, we produce evidence to show that noisier information from higher entropy – which, from an individual trader perspective, might translate into confusion – may have desirable effects from an aggregate perspective. In our findings, fast trading and entropy both cause prices to move more in line with the market-efficiency hypothesis and improve indicators of the quality of trade. Specifically, we find that a 10% increase in entropy reduces the adverse impact of macroeconomic news – adverse in the sense that prices move away from the random walk hypothesis – by over 60% for effective spreads, against 40% for realised spreads and price impacts (see Figure 2).

Figure 2 Economic magnitude of the dampening effect on news: Fast trading vs. entropy

Note: The figure compares the economic magnitude of the dampening effect of fast trading versus entropy on the market reaction to news computed from the estimates reported in Corsetti et al. (2019). The effect is computed using the direct effects of fast trading and entropy, respectively, along with their interacted effect with news.

In our interpretation, entropy is the key channel by which this occurs, with a straightforward behavioural interpretation in the spirit of the mechanism described above, as formalised in classic models such as Hong and Stein (1999). That fast traders post diverse quotes at no specific price levels arguably adds noise to fundamental information, which, in principle, might complicate the problem of other individual traders. In other words, higher values of entropy – a more diverse distribution of exchange rate quotes – also imply slower information diffusion. But from a market-wide perspective, this additional noise may help offset existing distortions that move prices away from efficiency standards. By increasing the amount of information to be processed by traders, higher entropy in the distribution of quotes helps avoid one-sided concentration and mitigates overshooting, in turn bringing the pricing process closer to the prediction of classic theoretical models.

Implications for policy and research

These findings matter for policy and research. From a policy perspective, they suggest that an increasing diversity of exchange rate quotes associated with fast trading is not necessarily damaging for market performance. It is actually beneficial in our estimates. This is a point deserving further attention in the discussion about fast traders’ optimal regulatory regime. From a research perspective, future work should complement the findings reviewed here with an analysis of possible non-linearities and reconsider the role of entropy in situations of market stress. Finally, our paper contributes to the literature on the high-frequency identification of macroeconomic shocks, notably monetary policy shocks. It suggests that microeconomic market conditions, especially high-frequency quoting patterns, are crucial aspects of the mechanism underlying the transmission and interpretation of macroeconomic shocks to exchange rates.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily reflect those of the IMF, the ECB or the Eurosystem.

References

Biais, B, T Foucault and S Moinas (2015), “Equilibrium fast trading”, Journal of Financial Economics 116(2): 292-313.

Chaboud, A, B Chiquoine, E Hjalmarsson and C Vega (2014), “Rise of the machines: Algorithmic trading in the foreign exchange market”, Journal of Finance 69(5): 2045-2084.

Corsetti, G, R Lafarguette and A Mehl (2019), “Fast trading and the virtue of entropy: Evidence from the foreign exchange market”, ECB Working Paper No. 2300.

Dobrev, D and E Schaumburg (2016), “High-frequency cross-market trading and market volatility”, Liberty Street Economics, Federal Reserve Bank of New York, 17 February 2016.

Kirilenko, A and A Lo (2013), “Moore’s law versus Murphy’s law: Algorithmic trading and its discontents”, Journal of Economic Perspectives 27(2): 51-72.

Foucault, T, J Hombert and I Rosu (2016), “News Trading and Speed”, Journal of Finance 72(1): 335-382.

Hasbrouck, J (2015), “High frequency quoting: Short-term volatility in bids and Offers”, New York University, mimeo.

Hendershott, T, C Jones and A Menkveld (2011), “Does algorithmic trading improve liquidity?”, Journal of Finance 66(1): 1-33.Hong, H and J Stein (1999), “A unified theory of underreaction, momentum trading, and overreaction in asset markets”, Journal of Finance 54(6): 2143-2184.

Lee, E J, K S Eom and K S Park (2013), “Microstructure-based manipulation: Strategic behavior and performance of spoofing traders”, Journal of Financial Markets 16(2): 227-252.

Lewis, M (2014), Flash boys – A Wall Street revolt, New York: W. W. Norton & Company.

Van Kervel, V and A Menkveld (2019), “High-frequency trading around large institutional orders”, Journal of Finance 74(3): 1091-1137.

Endnotes

[1] This history is recounted, for example in blog posts on WWII including “”Molasses tomorrow will bring forth cognac.” The BBC’s fascinating coded messages to the French resistance”, https://www.warhistoryonline.com/world-war-ii/the-bbcs-messages.html.

[2] This strategy was part of a more general plan to deceive the Axis powers about D-Day, called Bodyguard operation, which included among its main architects a stockbroker (John Bevan) – which, incidentally, tells much about the trading strategies used by financiers in this earlier era!

[3] EUR-USD, USD-JPY, EUR-JPY, GBP-USD, EUR-GBP, USD-CHF and EUR-CHF