The euro area is growing faster than it has for a decade. But policymakers cannot be complacent – while the single currency has been successful, its macro-financial framework is incomplete. This structural incompleteness gives rise to fragility (Draghi 2016).

In particular, Europe does not enjoy a truly common market for banking services. The idiosyncrasies of local banking systems can amplify national differences in exposures to adverse shocks. Segmented banking systems can also give rise to adverse feedback loops between weak fiscal positions and weak banks.

These inherently destabilising features stand in contrast to the US, where a common banking system helps to dampen idiosyncratic shocks. The monetary policy of the Federal Reserve can therefore be transmitted across the entire US, regardless of local differences in economic conditions.

One source of shock amplification in the euro area is that banks tend to hold large amounts of domestic sovereign debt. This home bias ties the stability of banks to the fortunes of governments – and vice versa. In 2012, governments committed to cutting this Gordian knot, which was responsible for worsening the financial crisis from which Europe is still recovering. Since then, progress towards a full banking union – in which country-level circumstances do not determine bank-level risks – has been substantial. But progress has nevertheless been insufficient. New ideas are needed to move Europe forward by completing banking union.

In this context, a High-Level Task Force of the European Systemic Risk Board (ESRB) has investigated one promising way to cut the knot. The idea under investigation is to bundle sovereign bonds – assembled from countries able to issue debt to private investors – and use it to back the issuance of new securities with different levels of seniority. The most senior component would be protected by mid-tier (‘mezzanine’) and first-loss (‘junior’) securities. The existence of these sovereign bond-backed securities (SBBS) would allow banks to reduce their domestic sovereign risk exposure (by gradually swapping their holdings into senior SBBS) without needing to reduce their overall holdings of sovereign debt-related instruments or engineer sudden and asymmetric adjustments in the composition of those holdings. They therefore offer a gentle path to the completion of banking union that respects the principle of national responsibility for fiscal policy.

These securities were originally proposed by a group of European economists (Brunnermeier et al 2011). The idea has since been elaborated in other papers (Garicano and Reichlin 2014, Brunnermeier et al. 2016, 2017, Bénassy-Quéré et al. 2018). But ‘ivory tower’ ideas do not always work in practice. That is why the ESRB commissioned a High-Level Task Force to investigate the feasibility of these securities in the euro area. This column summarises – in the authors’ own words – the findings of that feasibility study with respect to security design, regulation and market development.

Security design

The payoffs accruing to investors in SBBS arise from central government debt. This makes them unique relative to other securities that currently exist in financial markets. Designing SBBS and assessing their risk properties therefore requires a fresh analytical approach.

There are two basic design choices:

- First, which weights should be used in the portfolio of sovereign bonds that backs the securities?

- Second, which seniority structure should be used, and therefore how much protection should the senior component receive from loss-absorbing securities?

These two design parameters determine the risk properties of the securities. For example, Kraemer (2017) assesses the case of a debt-weighted underlying portfolio and concludes that senior SBBS would require substantial protection from loss-absorbing securities. By contrast, the ESRB High-Level Task Force on Safe Assets (2018) recommends that portfolio weights be guided by the ECB capital key (calculated based on GDP and population). This is very different to debt weights, mostly due to Germany’s higher weight and Italy’s lower weight in a portfolio guided by the ECB capital key.

The second design choice relates to the seniority structure. To achieve low-riskiness, how much protection would senior SBBS require from the loss-absorbing securities? This is an empirical question. To make an assessment, it is necessary to perform stress tests by subjecting different levels of protection to extreme default scenarios.

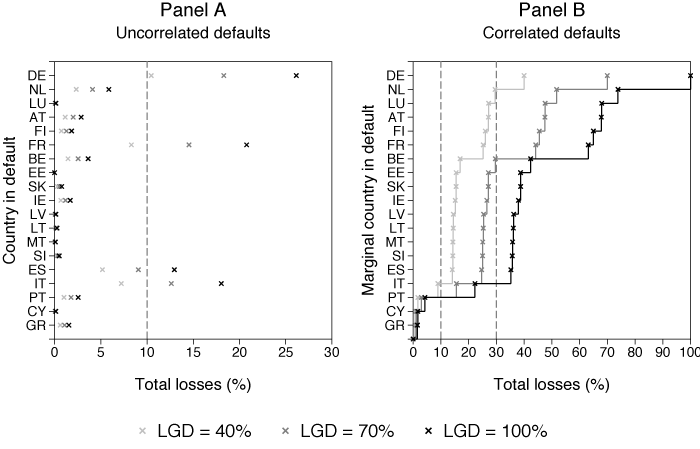

As a first step, Figure 1 plots the losses due to sovereign defaults that would accrue to SBBS backed by a portfolio of sovereign bonds weighted by the ECB capital key. Two insights emerge. First, no single sovereign default can impose losses on senior SBBS when they are protected by 30%-thick mezzanine and junior SBBS. Second, under the strong assumption that multiple countries default in ascending order of their credit rating, the marginal defaulters with respect to 70%-thick senior SBBS are Spain (if loss rates following default are assumed to be 100%), France (if loss rates are 70%) and Germany (if loss rates are 40%). Given that the average loss rate in historical sovereign debt restructurings is 37% (Cruces and Trebesch 2013), these findings suggest that 70%-thick senior SBBS would be more robust to extreme default scenarios than any individual sovereign.

Figure 1 Hypothetical sovereign default scenarios and their effect on SBBS

Source: ESRB High-Level Task Force on Safe Assets (2018).

Note: The figure shows total losses on the SBBS cover pool following a hypothetical default by a single country (Panel A) and defaults by multiple countries (Panel B) for three loss-given-default (LGD) rates (i.e. 40%, 70% and 100%).

Two additional tests confirm that 70%-thick senior SBBS would behave like other low-risk sovereign bonds.

- First, the risk properties of senior SBBS are assessed through the lens of a simulation model in which sovereigns default with a higher frequency and severity than has occurred historically. In these simulations, 70%-thick senior SBBS are shown to have slightly lower risk than German sovereign bonds. For example, in an adverse calibration of the simulation model in which default correlations are high, investors in German sovereign bonds should expect to lose 37% in the worst 1% of outcomes, whereas holders of senior SBBS should expect to lose 26%.

- Second, the historical yields on senior SBBS are estimated using a static copula approach. At the 10-year maturity point, yields on 70%-thick senior SBBS are estimated to have been 0.13% as at October 2016, when yields on equivalent German sovereign bonds were 0.08%. De Sola Perea et al. (2018) use these estimated yields to quantify the performance of senior SBBS when sovereign risk was in its tails historically. From this perspective, senior SBBS are similar to German and other low-risk sovereign bonds. During the sovereign debt crisis, senior SBBS would have had a negative beta (i.e. their value would have increased as the value of higher-risk assets declined). Moreover, senior SBBS would become more insulated from shocks to non-senior SBBS during financial crises (Cronin and Dunne 2018).

The embedded diversification and low-riskiness of senior SBBS makes them promising securities for banks to hold instead of domestic sovereign debt. By swapping into senior SBBS, banks would reduce their domestic sovereign risk exposure, thereby shutting down the contagion channel from national governments to banks. To show this quantitatively, the right-hand side of Figure 2 plots the credit risk of banks’ sovereign bond portfolios depending on the fraction that they re-invest into senior SBBS. If banks reinvest 100% of their portfolios into senior SBBS, their credit risk exposure becomes minimal. By contrast, if they were to reinvest into a diversified portfolio (without any seniority), most banks would see their credit risk exposure increase, as shown on the left-hand side of Figure 2. This highlights the stabilisation benefits arising from the seniority embedded in SBBS.

Figure 2 Credit risk of banks’ sovereign bond portfolios reinvested into a diversified portfolio (left-hand side) and a portfolio comprising senior SBBS (right-hand side)

Source: ESRB High-Level Task Force on Safe Assets (2018).

Note: The figure plots the cross-sectional distributions of the estimated expected loss rates of banks’ sovereign bond portfolios under two reinvestment scenarios. In the left-hand panel, banks are assumed to reinvest a given percentage of their sovereign bond portfolios into a diversified portfolio of euro area central government debt securities weighted by the ECB capital key. In the right-hand panel, banks instead reinvest into senior SBBS. Expected loss rates are estimated according to a benchmark calibration of a default simulation model, which is described in Volume II. In both panels, 0% reinvestment refers to the cross-bank distribution of expected losses based on banks’ sovereign bond portfolios as at mid-2017 according to the EBA transparency exercise (2017). Black lines refer to the median euro area bank and grey lines to percentiles at 10 point increments.

Regulatory policy

At present, SBBS would be treated more harshly than sovereign debt in regulation. This is true across the board – both capital and liquidity requirements and bank and non-bank regulation would treat holdings of senior SBBS more severely than sovereign debt, despite their lower risk. This unfavourable treatment is sufficient to explain the current nonexistence of the securities.

To pave the way for the securities, it is necessary to remove the regulatory obstacles that currently impede their development. Because these obstacles pervade many different financial regulations, the most elegant solution would be to provide for a new treatment in an SBBS-specific enabling regulation. This new regulation would supersede existing regulations and allow for a new approach that recognises the risk properties of the securities, including the diversification and low-riskiness embedded in senior SBBS and the higher risk of the mezzanine and junior securities.

In addition, reforming the regulatory treatment of sovereign exposures would substantially enhance demand for SBBS. This is because banks could use senior SBBS to mitigate the resulting impact on capital requirements. For example, imagine that policymakers decide to impose capital charges on banks’ holdings of sovereign debt as a function of concentration risk. For a particular calibration of such a reform (defined in Table 5.4 of Volume II of the Task Force report), the 105 largest euro area banks would need to raise €37.6 billion in additional capital in order to keep their capital ratios constant. This equates to an increase in their common equity tier 1 of approximately 2.7%. Banks could avoid this incremental capital charge by switching into senior SBBS, which are inherently diversified and would be treated as such in an enabling regulation. Qualitatively similar considerations apply if the regulatory treatment of sovereign exposures were sensitive to credit risk, given the low riskiness of senior SBBS.

In the Task Force, views were mixed as to whether concentration and/or credit risk charges for bank sovereign exposures are necessary to stimulate SBBS market development and to ensure a prudentially adequate treatment. While some Task Force members considered regulatory reform to be critically important, others were sceptical on the grounds that it could prevent banks from stabilising bond markets. Yet, members agreed that the SBBS initiative does not independently justify reforms to the regulatory treatment of bank sovereign exposures, since such reforms should be evaluated on their own merits (Basel Committee on Banking Supervision 2017).

Euro area banks are not the only investors in sovereign debt. In fact, they hold just 17% of euro area sovereign debt securities, as shown in the top chart of Figure 3. Non-euro area investors hold half of outstanding supranational debt securities (see the bottom chart of Figure 3). These insights suggest that a substantial proportion of the demand for SBBS could come from non-banks and investors resident outside of the euro area. This is particularly true for mezzanine and junior SBBS – ECB data indicate that nearly two-thirds of high-yield euro-denominated debt securities are held by investment funds, compared with about 15% held by banks. Investment funds buying SBBS would not help to weaken the nexus between bank risk and sovereign risk, but it would assist in developing a well-functioning market for the securities.

Figure 3 Holdings of euro area general government debt securities (top) and supranational debt securities (bottom) by sector

Source: ESRB High-Level Task Force on Safe Assets (2018).

Note: The figure shows the breakdown by sector of holdings of euro area general government debt securities (top) and supranational debt securities (bottom) as at Q2 2017.

Market development

Developing markets from scratch is no easy task. Demand is to supply as chicken is to egg: each wants to succeed the other. The curious case of missing ‘macro markets’ is evidence that markets do not always emerge spontaneously (Shiller 1998).

Yet Europe has form. In 2012, euro area governments signed the treaty establishing the European Stability Mechanism (ESM). Five years later, the market for securities issued by the ESM had grown to over €80 billion. Market development was assisted by three factors, which could also be applied to the case of SBBS.

- First, regulation treats ESM debt securities on a par with sovereign debt. Hence, regulation does not impede investor demand. A similar approach should inform the treatment of senior SBBS.

- Second, the ESM developed a broad investor base and a well-functioning infrastructure to facilitate successful placements in primary markets. For example, the ESM has attracted more primary dealers than any individual sovereign bond market. In the case of SBBS, internationally active primary dealers may find it advantageous to exploit their scope economies by making markets in the new securities and potentially participating in their arrangement.

- Third, the ESM market developed gradually. Just €10 billion of securities were issued in the first year, allowing investors to acquaint themselves with the new securities. This is small relative to the €800 billion of debt securities issued by euro area governments in 2016. Similarly, the SBBS market could develop gradually by arranger(s) of SBBS purchasing a small fraction of sovereign bonds in primary markets (or by assembling similarly small volumes in secondary markets). The mechanics of issuing SBBS are described in Section 4.1 of Volume II.

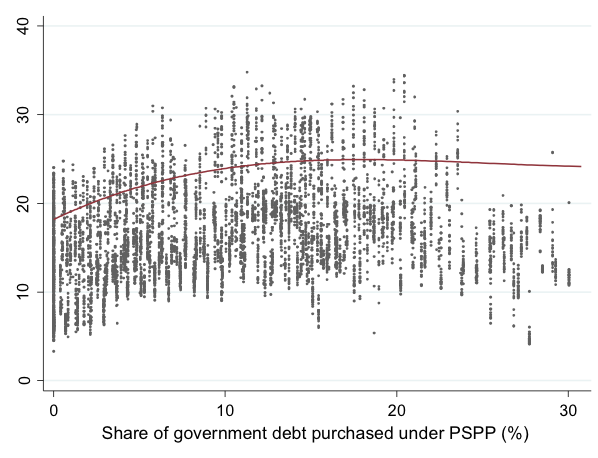

SBBS market development would be demand led. If investor demand for the securities proves substantial, the market could grow over time. To succeed in enhancing financial stability, the SBBS market would need to become large. This is desirable as long as it does not unduly impair liquidity in secondary markets for sovereign debt by reducing turnover. The quantitative importance of this concern can be gauged from the Eurosystem’s public sector purchase programme (PSPP), which has a similar effect on secondary markets. Owing to the careful implementation of this programme, there is no evidence of any meaningful adverse effect on market liquidity, as Figure 4 indicates. As such, a carefully developed SBBS market of approximately €2 trillion could be expected to have similarly benign liquidity effects.

Figure 4 Conditional and fitted values of normalised bid-ask spreads as a function of the share of government debt purchased under the PSPP

Source: ESRB High-Level Task Force on Safe Assets (2018).

Note: The dots in the figure plot the normalised bid-ask spreads for each country after controlling for the country and time fixed effects estimated in Section 4.4.1 of Volume II. The red line shows the fitted values of predicted normalised bid-ask spreads at the euro area level, calculated from the estimated coefficients reported in Table 4.9 of Volume II.

Some commentators have asserted that SBBS would drive up government financing costs. This view is mistaken for several reasons. First, the PSPP analogy suggests that the adverse effect of SBBS on liquidity premia is likely to be minimal. Second, there is an offsetting effect arising from the fact that SBBS would be new securities with liquidity of their own. Senior SBBS could therefore be used to collateralise repo and derivatives transactions, thereby alleviating scarcity of low-risk collateral. The securities could also be combined by dealers to hedge price movements in sovereign bonds, thereby creating a positive liquidity externality for national markets, as shown by Dunne (2018). Third, SBBS could crowd-in demand for euro area sovereign risk from foreign investors, as suggested by their disproportionately large holdings of supranational debt securities. Fourth, with a prudentially adequate regulatory treatment, SBBS could help to stabilise the banking system, and thereby avoid a re-emergence of the endogenous risk that characterised the euro area sovereign debt crisis.

Conclusion

SBBS are a promising tool to weaken the nexus between bank risk and sovereign risk. By providing a truly euro area-wide benchmark asset, a well-functioning market for senior SBBS could also help to complete other aspects of monetary union. The report of the ESRB High-Level Task Force on Safe Assets (2018) sets the foundation for an informed policy discussion on the feasibility of paving the way for SBBS in the euro area.

The Task Force’s main finding is that a gradual development of a demand-led market for SBBS might be feasible under certain conditions. One necessary condition is for an SBBS-specific enabling regulation to provide the conditions for a sufficiently large investor base, including both banks and non-banks. To enhance financial stability, this regulation would need to treat SBBS according to their unique design and risk properties. For banks, regulating senior SBBS no more severely than sovereign bonds could incentivise them to hold these low-risk securities. The regulatory treatment of mezzanine and junior SBBS should reflect their greater riskiness. In this way, SBBS could contribute to enhancing financial stability and the completion of monetary union.

References

Basel Committee on Banking Supervision (2017). “The regulatory treatment of sovereign exposures - discussion paper”.

Bénassy-Quéré, A, M K Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, F Pisani, H Rey, I Schnabel, N Véron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91. Summary available at VoxEU.

Brunnermeier, M, L Garicano, P Lane, M Pagano, R Reis, T Santos, D Thesmar, S Van Nieuwerburgh and D Vayanos (2011), “European Safe Bonds”, The Euronomics Group. Summary available at VoxEU.

Brunnermeier, M, L Garicano, P Lane, M Pagano, R Reis, T Santos, D Thesmar, S Van Nieuwerburgh and D Vayanos (2016), “The sovereign-bank diabolic loop and ESBies”, American Economic Review Papers and Proceedings 106(5): 508-512.

Brunnermeier, M, S Langfield, M Pagano, R Reis, S Van Nieuwerburgh and D Vayanos (2017), “ESBies: Safety in the tranches”, Economic Policy 32(90): 175-219. Summary available at VoxEU.

Cronin, D and P Dunne (2018), “How effective are euro area sovereign bond-backed securities as a spillover prevention device?” ESRB working paper no. 66.

Cruces, J and C Trebesch (2013), “Sovereign defaults: the price of haircuts”, American Economic Journal: Macroeconomics 5(3): 85-117. Summary available at VoxEU.

De Sola Perea, M, P Dunne, M Puhl and T Reininger (2018), “Sovereign bond-backed securities: a VAR-for-VaR and Marginal Expected Shortfall assessment”, ESRB working paper no. 65.

Dunne, P (2018), “Positive liquidity spillovers from sovereign bond-backed securities”, ESRB working paper no. 67.

Draghi, M (2016), “Hearing of the Committee on Economic and Monetary Affairs of the European Parliament”, introductory statement.

ESRB High-Level Task Force on Safe Assets (2018), “Sovereign bond-backed securities: a feasibility study”, Volume I and Volume II.

Garicano, L and L Reichlin (2014), “A safe asset for Eurozone QE: A proposal”, VoxEU.

Kraemer, M (2017), “How S&P Global Ratings would assess European ‘Safe’ Bonds (ESBies)”, S&P RatingsDirect.

Shiller, R (1998), Macro Markets, Clarendon lectures in economics.