After the onset of the COVID-19 pandemic, many central banks relaunched their asset purchase programmes, commonly known as ‘quantitative easing’ (QE). In March 2020, the Federal Reserve announced $700 billion worth of new bond purchases, the ECB announced its €750 billion Pandemic Emergency Purchase Programme, and the Bank of England announced purchases worth £200 billion. These announcements demonstrate that QE is an increasingly important part of monetary policy toolkits in the aftermath of the 2008 financial crisis.

The effectiveness of QE has been a subject of intense debate in both academic and policy circles. A significant part of QE research originates in central banks (Martin and Milas 2012). This research is often quoted in the media, for example:

“The good news is that, by most accounts, QE appears to have succeeded at boosting growth and lifting inflation. Martin Weale, a member of the Bank of England's interest-rate setting Monetary Policy Committee, found asset purchases worth 1% of national income boosted UK gross domestic product by about 0.18% and inflation by 0.3%. A study by John Williams, president of the San Francisco Federal Reserve, concluded that asset purchases had reduced the US unemployment rate by 1.5 percentage points by late 2012 and helped the economy avoid deflation." (Financial Times 2015).

Conflict of interest

When central bankers write about QE – their own policy – they face a conflict of interest. Central banks evaluating their own policies is not unlike pharmaceutical firms evaluating their own drugs. Both have skin in the game. The problem is particularly acute for central banks that view their research output as part of the policy itself. By releasing a study supportive of its policy, a central bank could potentially enhance the policy's effectiveness. Alleviating this conflict is the strong desire of central banks to produce objective research.

Conflicts of interest have been extensively documented in biomedical research, where financial relationships between researchers and the pharmaceutical industry are widespread. Many studies find that industry-sponsored biomedical research tends to draw conclusions favourable to the sponsor (e.g. Bekelman et al. 2003). Mechanisms through which this pro-sponsor bias operates range from drug companies' influence over research design to their suppression of adverse research results, all the way to intimidating researchers and threatening legal action.

A similar bias could in principle affect central bankers. In fact, while academic medical researchers are merely sponsored by industry, central bank economists are directly employed by central banks.

A central bank economist may have various incentives to find the bank’s policy to be effective. For example, she may worry that the nature of her findings could affect her employment status or rank. Such a career concern is relevant even if it is completely unfounded; what matters is the economist’s perception.

Alternatively, a central bank employee may believe a priori that the bank’s policies are effective, and she may select evidence supporting her prior (confirmation bias). Additionally, the economist may care about the bank's reputation, preferring conclusions that validate the bank's actions. She may even care about her own reputation if she is senior enough to have participated in the formation of the bank's policy.

For example, in his presidential address to the American Economic Association, Bernanke (2020) offers a strong endorsement of unconventional monetary policy tools. Given his unique experience as an academic-turned-top policymaker, Ben Bernanke is exceptionally qualified to provide an accurate assessment of the effectiveness of these tools. At the same time, these tools are an important part of his legacy as they were adopted while he was Fed Chair.

What we do

In our paper (Fabo et al. 2020), we compare the findings of central bank researchers and academics regarding the effectiveness of unconventional monetary policy. We construct a dataset comprising 54 studies that analyse the effects of unconventional monetary policy (‘QE’ for short) on output or inflation in the US, the UK, and the euro area.

For each study, we record its baseline estimates of the effects of QE on the level of GDP and the price level, along with their significance. We then compare the findings of studies written by central bankers with those written by academics.

Central bankers find QE to be more effective

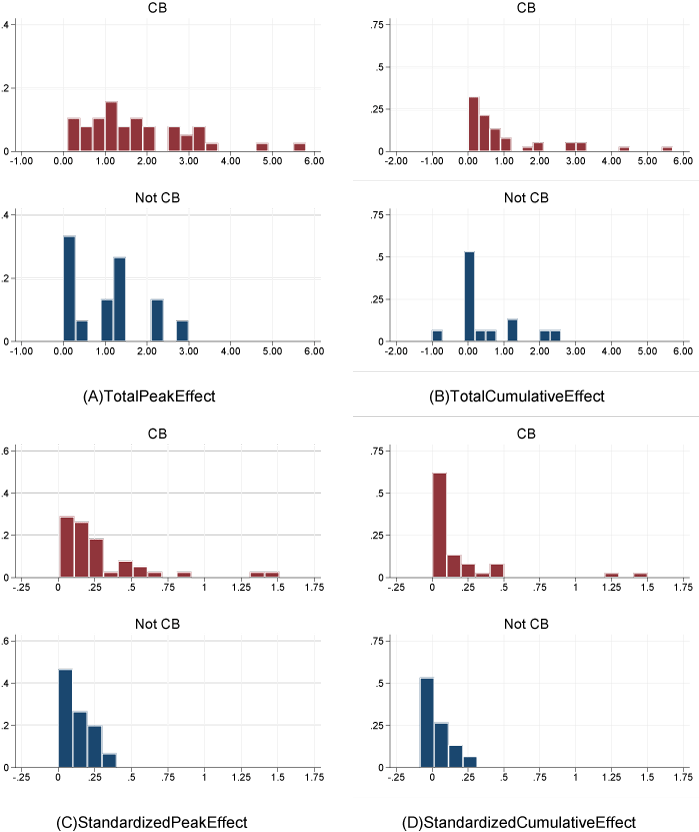

Figure 1 shows the histograms of the estimated effects on output for the subsample of papers with no central bank authors (‘Not CB’) versus papers with at least one central bank author (‘CB’). The figure shows that papers by central bankers report systematically larger effects of QE on output, as indicated by the distribution of central bank papers being shifted to the right. We find a similar pattern for inflation.

Figure 1 The effect of QE on output by central bank affiliation

Central bank papers are also more likely to report QE effects on output that are significant, both statistically and economically. For example, while all of the central bank papers report a statistically significant QE effect on output, only half of the academic papers do.

In addition, central bank papers use more favourable language in their abstracts: they use more positive adjectives and, to a lesser extent, fewer negative adjectives compared with academic papers. Overall, central bank papers find QE to be more effective than academic papers do.

Career concerns?

To see whether this result could be driven by career concerns, we relate the research findings of central bank economists to their subsequent career outcomes. We collect employment histories for all central bank authors and convert their job titles to numerical ranks. We find that authors whose papers report larger effects of QE on output experience more favourable career outcomes.

Career concerns appear to be stronger for senior central bank economists because for them, the relationship between career outcomes and the estimated QE effects is stronger. Motivated by this finding, we look whether our main result – a gap between the findings of central bankers and academics regarding the effectiveness of QE – is larger for papers whose authors are more senior. We find that it is, though the relation is only marginally significant. Our results suggest that senior central bankers report larger effects of QE because they are more incentivized to do so.

Bundesbank

Not all central bankers face the same incentives. Top management of the German Bundesbank has taken a critical view of QE, especially in the context of the ECB. Former Bundesbank officials Axel Weber and Juergen Stark reportedly quit their ECB positions in protest over QE. The current Bundesbank president, Jens Weidmann, has also publicly opposed it. Mindful of their bosses’ views, Bundesbank researchers could potentially face career concerns very different from those of their colleagues at other central banks.

Indeed, we show that studies co-authored by Bundesbank employees find QE to be less effective at raising output compared with academic studies. This evidence is weak statistically, due to a small sample, but it is broadly consistent with managerial influence on research outcomes.

Survey of central banks

To shed more light on this influence, we survey heads of research at the world’s leading central banks. Their responses reveal heterogeneous but substantial involvement of bank management in research production.

In most banks, management participates in the selection of research topics, typically by negotiating with the researcher, and research papers are reviewed by management prior to public distribution. Management also approves papers for public distribution – typically by the head of research, but sometimes also by the bank board. This evidence reveals substantial managerial involvement in research production. Unlike central bankers, academics face little if any managerial interference in their research.

Conclusion

Of course, this evidence does not imply that central bank research is biased. Perhaps academic research is biased toward insignificance. But academics face their own pressure to ‘publish or perish’, and academic journals are well known to favour positive results over negative ones. Given this publication bias, academics have their own incentive to find significant effects.

Importantly, we do not argue that central bank research should be discounted. In many ways, central banks are in an excellent position to provide accurate assessments of their own policies. Like pharmaceutical firms studying their own drugs, central banks have superior information about their own products, exceptionally strong expertise in the subject matter, and an intense desire to preserve their reputation.

In addition, central banks are public institutions whose integrity is generally held in very high esteem. They understand that the effectiveness of their policy is predicated on their own credibility.

We are not questioning that credibility. We simply highlight a previously unexplored conflict of interest that has the potential to influence a small subset of bank research. We hope that our study will help central banks think through the implications of this conflict for their research processes.

References

Bekelman, J E, Y Li, and C P Gross (2003), “Scope and impact of financial conflicts of interest in biomedical research: A systematic review”, Journal of the American Medical Association 289(4): 454-65.

Bernanke, B S (2020), “The new tools of monetary policy”, American Economic Review 110(4): 943-83.

Fabo, B, M Jancokova, E Kempf, and L Pastor (2020), “Fifty shades of QE: Conflicts of interest in economic research”, NBER Working Paper No. 27849.

Financial Times (2015), “Four reasons why QE will be different in the eurozone”, 20 January.

Martin, C and C Milas (2012), “Quantitative easing: A sceptical survey”, Oxford Review of Economic Policy 28(4): 750-64.