Since the Global Crisis, the UK has experienced a period of weak productivity growth and weak business investment, coupled with a decline in credit to the non-financial sectors of the economy. But there is a debate about the direction of causality. Did low growth and other structural factors mean firms and households wanted to borrow less? Or did the financial sector offer too few funds to the real economy in the wake of the Crisis, as banks tried to repair their balance sheets? Alternatively, there may be a deeper issue within the financial system that has been exposed by the crisis – that some of its activity contributes little to output and welfare.

One concern, as set out in the UK Government’s ‘productivity plan’, is that the financial sector is holding back UK productivity. Similar concerns have been asked elsewhere in Europe (Giovannini et al. 2015). In April, the Bank of England published a first assessment of this issue (Bank of England 2016). This column summarises some of our insights. However, an overriding theme of the paper is that our interpretation is blurred by the lack of data and, hence, our discussion paper is also a plea for new research and data to help tackle this question.

Our approach

We split our thinking around two questions. First, is there an obvious deficiency in fixed capital formation in the UK? Here the findings are mixed – the UK has less tangible capital per unit of output than other peer economies, but the returns to capital are comparable. Neither of these series is particularly well measured, however. For instance, intangible capital (which makes up an increasing share of UK firms’ investment activities) is difficult to quantify in the data and the conceptually relevant marginal return on investment cannot be inferred in the national accounts.

Second, we consider if there is enough finance to ensure investment takes place. Simply inspecting the external funds raised by UK non-financial companies is a poor proxy for the supply of finance for investment. The funds raised vary a lot over time, but generally not with investment – instead they vary with acquisitions of financial assets (Figure 1). Second, internal funds play an important role in financing investment, consistent with the pecking order theory of corporate finance (Majluf and Myers 1984). The UK non-financial corporate sector as a whole appears to have enough internal funds to cover its investment. Consistent with this, since 2002 the corporate sector has been a net lender to other sectors, funding their financial deficits.

Figure 1. UK PNFCs’ sources and uses of funds

Sources: ONS and Bank calculations. 2015 data are up to Q3.

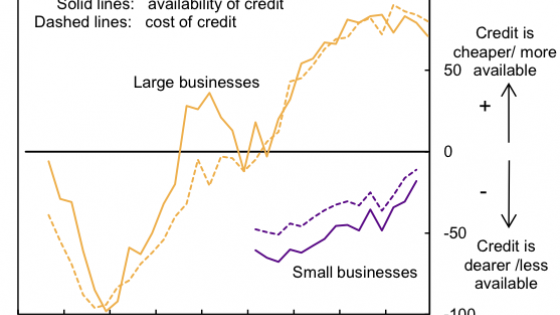

Figure 2. Perceived availability and cost of credit for large and small firms

Notes: Net percentage balances for the cost (availability) of credit are calculated as the percentage of respondents reporting that bank credit is ‘cheap’ (available) in the Deloitte CFO Survey for large corporates or is ‘good’ in the Federation of Small Businesses’ (FSB) Voice of Small Business Index for small businesses less the percentage reporting that it is ‘costly’ (‘hard to get’) in the Deloitte CFO Survey for large corporates or ‘poor’ in the FSB Voice of Small Business Index for small businesses. A positive balance indicates that a net balance of respondents report that credit is cheaper or credit is more available.

Sources: Deloitte CFO Survey, FSB Voice of Small Business Index, Bank calculations.

There is an important caveat. Although internal funds are sufficient for financing investment of the corporate sector as a whole, this is not the case for all firms. Large firms with access to capital markets do not appear to be financially constrained. They have sizeable internal funds and access to equity and debt finance. But we find that small and medium sized firms (SMEs) appear more financially constrained (see, for instance, survey evidence in Figure 2). This is a long-term phenomenon, with evidence going back to the early 20th Century (Macmillan Report 1931).

Known unknowns

In all, our view was that there was no conclusive evidence of investment deficiency in the UK. Similarly, finance also does not appear to be a constraint for the corporate sector as a whole, although this is more of an issue for SMEs.

It is worth stressing, however, that these conclusions are based on rough proxies in the data. To be confident in our findings we do want better data on firm investment hurdle rates, marginal rates of return on investment, and rates of return on other uses of funds. To assess funds for productive investment, it would be helpful to have firm-level data on the use of external and internal funds and various measures of financial constraints.

In addition to the data limitations, there are also conceptual challenges in interpreting the data. Empirical evidence can be consistent with several hypotheses.

For example, we find that smaller, younger and cash-poorer firms have higher rates of return relative to larger, older, and cash-rich firms (Figure 3). But the reasons for this are unclear. The higher rates of return could reflect the increased riskiness of such firms, requiring them to generate higher returns to compensate for that risk. But they could also arise due to other structural impediments, such as skill shortages or monopoly power. Data on the marginal cost of capital for each of these types of firms would allow us to discriminate between different hypotheses.

Figure 3. Rates of return and profit margins across different types of firms

Notes: Young is at most 5 years old. Small is less than 50 employees. Cash rich is when cash (as defined on the balance sheet) less overdrafts, divided by turnover is greater than the sample median. The median of the variable is presented over 1996-2012 for each group.

Source: Bahaj, Foulis and Pinter (2016) using Bureau van Dijk data

There are similar challenges on the financing side. Firm balance sheets tell us about the funds raised by companies, but it is impossible to distinguish their demand for funds from supply available. So it is impossible to assess the funding gap – i.e. how much would companies have raised, if they were not constrained, and at what price. Finally, the evidence on the co-movement between the external funds and acquisitions of financial assets is consistent with several interpretations (Figure 1). On the one hand, it could reflect ‘financialisation’ of the non-financial companies and related crowding out of investment by the companies’ financial activities. This is in line with the findings by Orhangazi (2008), Lazonick (2007), Milberg and Winkler (2010), and Almeida et al. (2016). On the other hand, the crowding out at the firm-level might not translate into crowding out at the level of the domestic or global economy as a whole. More research is needed to establish whether crowding out holds at the macroeconomic level.

Conclusion

We have not found conclusive evidence of investment deficiency in the UK, and the corporate sector as a whole has an adequate supply of finance for investment. However, measuring the links between the supply of finance and firm investment decisions is not an easy task. In an era of big data, we have discovered big data gaps, which may have blurred our overall conclusions. Our ultimate goal is to encourage the research and data community to expand our data collection and methodologies to help us better measure the funding structure of investment. Knowing that will enable us to establish the extent to which finance may be holding back growth.

References

Almeida, H, V Fos, and M Kronlund (2016), “The real effects of share repurchases”, Journal of Financial Economics 119(1), 168-185

Bank of England (2016), “Understanding and measuring finance for productive investment”, A discussion paper.

Corbett, J, and T Jenkinson (1997), “How is Investment Financed? A Study of Germany, Japan, the United Kingdom and the United States”, The Manchester School, No. 65 (Supplement), 69-93

HM Treasury (2015), “Fixing the foundations: creating a more prosperous nation”, 10 July

Kay, J (2015), Other People’s Money: Masters of the Universe or Servants of the People?, Profile Books

Lazonick, W (2007), “The US stock market and the governance of innovative enterprise”, Industrial and Corporate Change 16(6), 983-1035

Macmillan Report (1931), “Committee on Finance and Industry”, Cmd. 3897, London

Majluf, N, and S Myers (1984), “Corporate financing and investment decisions when firms have information that investors do not have”, Journal of Financial Economics 13(2), 187-221

Milberg, W, and D Winkler (2010), “Financialisation and the dynamics of offshoring in the USA”, Cambridge Journal of Economics 34(2), 275-293.

Orhangazi, O (2008), “Financialisation and Capital Accumulation in the Non-Financial Corporate Sector”, Cambridge Journal of Economics 32(6), 863-886