The Global Financial Crisis started with a whimper – it used to be called the Subprime Crisis (Cecchetti 2007a, b). It took off with a bang – Lehman’s fall in September 2008 (Eichengreen et al. 2008). Then came the Eurozone Crisis in 2010 (De Grauwe 2010).

Seeing the crisis with a long-term perspective was helped by an incredibly well timed book in which Carmen Reinhart and Ken Rogoff summarised lessons from 800 years of financial crises (see Reinhart and Rogoff 2009). And research rolls on.

The latest wave of crises has been an impetus to an already rich research programme on the issue. Our recent work provides a synthesis of this research (Claessens and Kose 2013). The review is structured around three main questions:

- What are the main factors explaining financial crises?

- What are the major types of financial crises?

- What are the real and financial sector implications of crises?

What are the main factors explaining financial crises?

Financial crises can stem from problems of private or public sectors’ balance sheets and have domestic or external origins. Irrespective of its origins, a financial crisis is often an amalgam of events, including substantial changes in credit volume and asset prices, severe disruptions in financial intermediation, notably a reduction in the supply of external financing, large-scale balance-sheet problems, and often a need for substantial government and international support.

Although crises can be driven by a variety of factors, they are often preceded by asset and credit booms. Busts, financial crises and poor growth indeed often follow such booms (Figure 1). Given these types of associations, many theoretical and empirical studies have recognised the need to explain sharp movements in asset and credit markets (Brunnermeier, 2001; Evanoff, Kaufman, and Malliaris, 2012). These studies have been able to identify some proximate causes, such as financial liberalisation, productivity gains, and a variety of distortions, such as weak supervision and regulation, under-priced deposit insurance, and poorly designed safety nets.

Figure 1. Coincidence of financial booms and crises

Notes: The numbers, except in the last column, show the percent of cases in which a crisis or poor macroeconomic performance happened after a boom was observed (out of the total number of cases where the boom occurred).

Source: Dell'Ariccia et al (2013).

Many puzzles remain. For example, we still need to have a better understanding of the factors that drive asset-price bubbles and credit booms in the first place (Allen, 2009; and Gorton, 2012).

What are the major types of financial crises?

It is useful to classify crises into four groups:

- Currency crises.

- Sudden stops (in capital flows).

- Debt crises.

- Banking crises.

While there are many common causes, the literature has also identified specific theoretical factors and empirical determinants of each type of crisis (see Goldstein, Assaf Razin 2013).

It has sometimes been difficult to transform the predictions of theories into empirical applications, including into practical ways to identify crises. While it is easy for example to design quantitative methods to identify currency crises and sudden stops, the identification of debt and banking crises remains typically based on qualitative and judgemental methods. The literature therefore employs a wide range of methods to identify and classify crises.

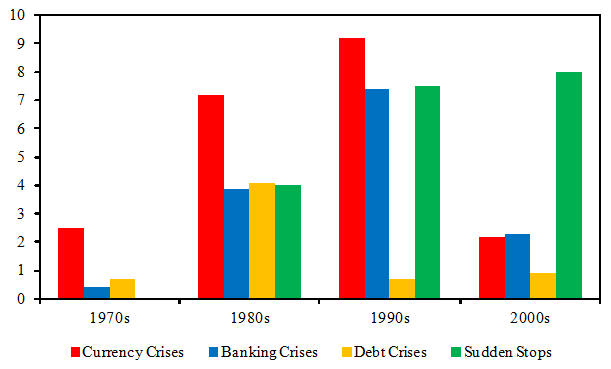

While there are issues with dating, it is clear that financial crises are quite common and tend to cluster over time (Figure 2). They also tend to hit small and large countries as well as poor and rich ones. As Reinhart and Rogoff (2009) fittingly describe: “financial crises are an equal opportunity menace.” History also shows that crises come in different shapes and sizes, evolve over time with certain types being more important in some periods than others, and can rapidly spread across borders (as they did in the 2007-09 global financial crisis).

Figure 2. Average number of financial crises over decades

Notes: This graph shows the average number of financial crises in respective decades.

Sources: The dates of banking, currency, and debt crises are from Laeven and Valencia (2013) and the dates of sudden stops are from Forbes and Warnock (2012).

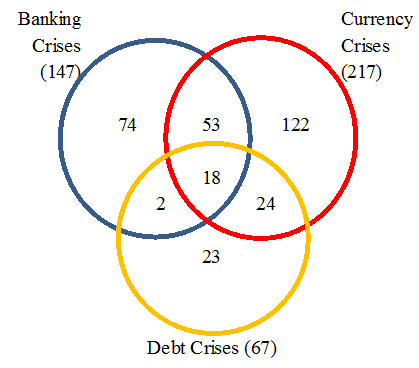

Irrespective of the classification used, different types of crises can often overlap. Many banking crises, for example, are also associated with sudden stop episodes and currency crises (Figure 3). The overlap of multiple types of crises leads to further challenges for the identification of crises and examination of their underlying causes. For example, since banking and sovereign crises often coincide, it is difficult to answer definitively whether a banking crisis leads to a sovereign crisis or vice versa.

Figure 3. Coincidence of financial crises

Notes: A financial crisis starting at time T is considered to coincide with another financial crisis, if the latter starts at any time between (T-3) and (T+3). A financial crisis starting at time T is considered to coincide with two other financial crises if the latter two start at any time between (T-3) and (T+3). The sample consists of 181 countries.

Sources: The dates of banking, currency, and debt crises are from Laeven and Valencia (2013).

What are the real and financial-sector implications of crises?

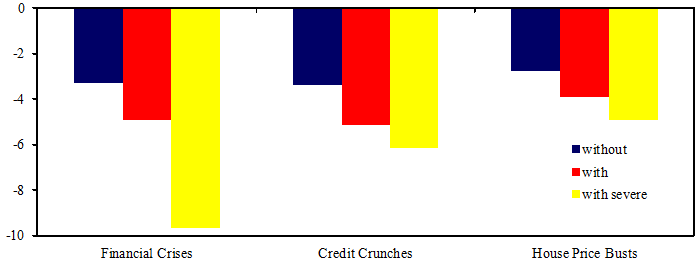

Macroeconomic and financial implications of crises are typically severe, with many commonalities across various types. Recessions with large output losses are common to many crises (Figure 4). Other macroeconomic variables typically register significant declines as well. Financial variables, such as asset prices and credit, usually follow qualitatively similar patterns across crises, albeit with variations in terms of duration and severity. Besides their negative effects over the short run, financial crises often have adverse medium- to long-run effects on activity.

Figure 4. Real implications of financial crises, crunches, and busts: Cumulative loss

Notes: Medians are shown. Cumulative loss combines information about the duration and amplitude to measure overall cost of a recession and is expressed in percent. A recession is associated with a (severe) credit crunch or a house-price bust if the (severe) credit crunch or the house-price bust starts at the same time of the recession or one year before or two years after the peak of the recession. The severe financial crises are the worst 50% of financial crises as measured by output decline during the recession. The sample includes data for 23 advanced countries and covers 1960-2011.

Looking forward

The important lesson from the literature is that future research should aim to eliminate the 'this time is different' syndrome. This is a very broad task that requires addressing two main questions: How to prevent financial crises? And how to mitigate their costs when they take place?

The first question has to start with recognising that booms in asset prices and credit can be risky.

How to prevent financial crises?

It is important to monitor vulnerabilities stemming from such sharp movements in asset and credit markets and capital flows, and determine if they could be followed by large and rapid declines or reversals (crashes, busts, crunches, or capital flight).This may not be enough, though.

The real challenge for policymakers (and researchers as well) is to determine: when to intervene, and how to intervene. To date, research has not been able to provide concrete answers to either question. For example, we still have a limited understanding of the optimal mix of monetary and macroprudential policies to mitigate booms (see Claessens and Valencia 2013).

The second question is equally important.

How to mitigate their costs when they take place?

The global financial crisis and associated recessions have clearly shown the limits of policy measures in dealing with financial meltdowns. Although the literature offers valuable lessons on crisis resolution, countries are still far from adopting ‘best’ practices to respond to financial turmoil (see, for example, Freixas 2012). The latest crisis has also led to an extensive discussion about the ability of other macroeconomic and financial sector policies to mitigate the costs stemming from such episodes.

Answers to these questions will have to be treated with some humility. The era of financial exuberance prior to the 2007-09 crisis appeared to coincide with 'supreme confidence' in the potency of models and policies. The (belated) recognition of weaknesses in economic theory and practice has important lessons.

Concluding remarks

It is useful to be cautious and remember that whenever we say 'this time is different' – implying that we now know better – there remains the risk that we overlook how much more we still need to learn.

In light of the many challenging policy questions we now face, a broader message from the literature is that financial crises will likely to be a fertile area of research in years to come (see Claessens et al. 2013).

Disclaimer: The views expressed here are those of the authors and do not necessarily represent those of the institutions with which they are affiliated.

References

Allen, Roy E., 2010, Financial Crises and Recession in the Global Economy, Edward Elgar Publishing, 3rd Edition.

Brunnermeier, M., 2001, Asset Pricing Under Asymmetric Information: Bubbles, Crashes, Technical Analysis and Herding, Oxford University Press.

Claessens, Stijn and M Ayhan Kose (2013), “Financial Crises: Explanations, Types, and Implications”, in S Claessens, M A Kose, L Laeven, and F Valencia (eds.), Financial Crises, Consequences, and Policy Responses, IMF Publications, forthcoming (also published as IMF WP/13/28).

Claessens, Stijn, M Ayhan Kose, Luc Laeven, and Fabian Valencia (2013), Financial Crises, Consequences, and Policy Responses, IMF Publications, forthcoming.

Claessens, Stijn and Fabian Valencia (2013), “The interaction between monetary and macroprudential policies”, VoxEU.org, 14 March.

Cecchetti, Stephen (2007a), “Federal Reserve policy actions in August 2007: frequently asked questions (updated)”, VoxEU.org, 15 August.

Cecchetti, Stephen (2007b), “Preparing for the next financial crisis”, VoxEU.org, 18 November.

Cecchetti, Stephen (2007c), “Financial crises are not going away”, VoxEU.org, 26 November.

De Grauwe, Paul (2010), “Fighting the wrong enemy”, VoxEU.org, 19 May.

Dell’Ariccia, Giovanni, Deniz Igan, Luc Laeven, and Hui Tong (2013), “Policies for Macrofinancial Stability: Dealing with Credit Booms and Busts,” in S

Claessens, M A Kose, L Laeven, and F Valencia (eds.), Financial Crises, Consequences, and Policy Responses, IMF Publications, forthcoming (also published as IMF SDN 12/06).

Evanoff, Douglas D., George G. Kaufman, A. G. Malliaris, 2012, New Perspectives on Asset Price Bubbles, Oxford University Press.

Forbes, Kristin J, and Frank Warnock (2012), “Capital Flow Waves: Surges, Stops, Flight, and Retrenchment”, Journal of International Economics, 88(2), 235-51.

Freixas, Xavier (2012), “Bank resolution: from Cinderella to centre stage”, Vox Talks, 7 September.

Goldstein, Itay and Assaf Razin (2013), “Theories of financial crises”, VoxEU.org, 11 March.

Gorton Gary, 2012, Misunderstanding Financial Crises: Why We Don’t See Them Coming, Oxford University Press.

Laeven, Luc, and Fabian Valencia (2013), “Resolution of Banking Crises: The Good, the Bad, and the Ugly” in S Claessens, M A Kose, L Laeven, and F Valencia (eds.), Financial Crises, Consequences, and Policy Responses, IMF Publications, forthcoming.

Reinhart, Carmen (2010), “Eight hundred years of financial folly”, VoxEU.org, 5 May.

Reinhart, Carmen M, and Kenneth S Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton Press