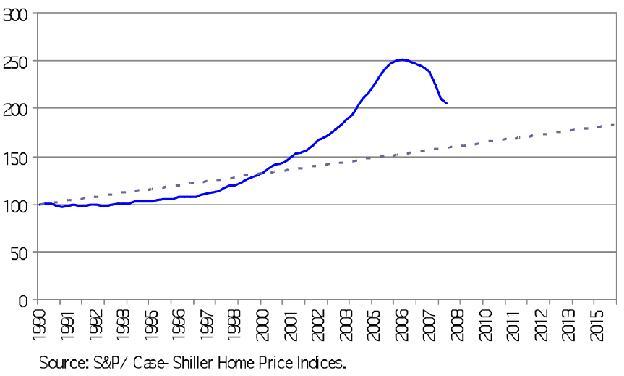

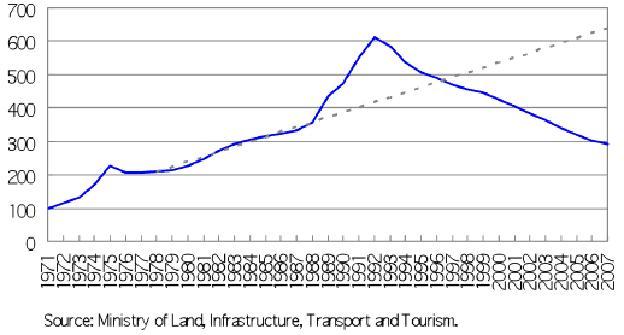

The current crisis in the US and European financial systems seems to be growing similarly to Japan’s banking crisis of the late 1990s and early 2000s. Although the current crisis developed much faster1 than Japan’s crisis, the key mechanism is the same – changes in the prices of real estate that were used as collateral for bank lending. The further development of the crisis will crucially depend on the evolution of these real-estate prices. Figures 1 and 2 show the land price index in Japan and the housing price index in the US. How far will housing prices in the US fall? If we base our projections on the trend line of the 1990s, they should pick up by 2011 at the latest. But this reasoning reminds me of a similar mindset in the early 1990s in Japan. When Japan’s real estate bubble burst in 1991, the trend line indicated that land prices would bottom out around 1995, when in fact they continued to decline steadily for 12 more years.

Figure 1. S&P Case-Shiller US national home price index

Figure 2. Official land price in Japan

Japan experienced more than a decade of continuous land-price declines and low productivity growth. The decade-long stagnation seems to be the result of a protracted external diseconomy that set in due to uncertainty and fear surrounding the payment system. Banks and firms in Japan felt the fear of not being paid in full when they expanded lending because some of their customers hid the fact that they were insolvent. If insolvent agents stick around, healthy agents are forced to face uncertainty and fear. They hesitate to start new transactions with unknown trading partners. Their reluctance results in the shrinkage of the economy-wide division of labour among firms and industries, lowering growth of aggregate productivity. The lower productivity, in turn, drives down asset prices even further and increases the number of insolvent agents, reinforcing the persistence of uncertainty and fear. We may refer to this external diseconomy, or vicious cycle, as "payment uncertainty."2

While the payment uncertainty that has spread through the global interbank market in the last several weeks may be contained by bank-capital injections and government guarantees, the challenge now is to prevent payment uncertainty from spreading to the real sector (i.e., businesses and households). Japan’s policy failures in the 1990s offer several instructive lessons.

Debt restructuring is absolutely necessary to prevent a vicious cycle

Debt relief and rehabilitation of viable but debt-ridden firms and the liquidation of nonviable firms are crucially important to wipe out the payment uncertainty from the economy and restore market confidence. If zombie firms stick around in the market, uncertainty and business shrinkage will linger on.3 Capital injections into banks are just a beginning.

Stringent asset evaluation and sufficient write-offs

Stringent and conservative evaluation of the toxic assets should be the premise behind bank-capital injections and debt restructuring. I suspect that the current capital injections in the US and Europe may not eradicate the payment uncertainty unless they are accompanied by sufficiently stringent asset evaluations. Financial regulators should establish task forces for asset evaluation and push financial institutions to recalculate their asset values conservatively enough so that the market can rely on their numbers. The regulators may have to employ financial engineers (e.g., former employees of the Lehman Brothers) as investigators and let them analyse the risk and losses of the toxic derivative securities by “reverse engineering.’’

Purchase of bad assets by public asset management companies

If bad assets are disposed of by distress selling in the market, stringent asset evaluation will result in a vicious cycle of debt deflation: distress selling causes asset prices to decline further, which in turn accelerates the distress selling of assets. To stop the vicious cycle of debt deflation, the governments struggling with the financial crisis should establish asset management companies, public entities that purchase and hold the bad assets. The purchase and freezing of toxic assets is necessary to stop debt deflation. The public entities should then restructure the bad assets and sell them off gradually after the market stabilises.

Fiscal stimulus packages may not work

One big lesson from Japan’s 1990s is that Keynesian policy per se did not work for the financial crisis due to the collapse of asset prices. While Japan undertook huge fiscal stimulus packages repeatedly in the 1990s, the government did not pursue a serious policy effort to make banks dispose of their nonperforming loans. As a result, a huge amount of hidden nonperforming loans swelled under implicit collusion between the government and banks. Naturally, the payment uncertainty and economic shrinkage persisted for years. The essential problem was the spreading of payment uncertainty, and policies centred on public works and tax cuts were not direct enough to attack the problem, though they were temporarily effective at mitigating the severity of the economic downturn. Direct debt relief for mortgage borrowers and distressed (but viable) firms, along with fiscal assistance for the liquidation of nonviable firms, are straightforward, cost-effective fiscal policies much more capable of wiping out the payment uncertainty than standard public works and tax cuts.

Suspension of mark-to-market accounting has a long-term side effect

The development of huge nonperforming loans in Japan was made possible by the virtual nonexistence of mark-to-market accounting for bank assets. Although suspension of mark-to-market accounting may temporarily calm the panic, it may also enable and seduce bankers to hide their toxic assets from regulators and market participants. If bankers hide bad assets, zombie firms will persist and the payment uncertainty will remain, setting the stage for very low long-term economic growth in the coming years.

The global nature of the current crisis seems to posit interesting points in the arguments for international policy coordination. As the external diseconomy of payment uncertainty affects economies all over the world, the cost to eradicate this diseconomy should be borne worldwide. This normative argument may be justified from the following efficiency point of view: To minimise the prospective tax distortions caused by huge fiscal outlays for global financial rescues, it may be optimal for the world as a whole to let emerging market economies with high prospective growth and solid fiscal positions, such as China and India, bear a considerable amount of the fiscal cost of global financial rescues. (The social surplus generated by the international policy coordination should be shared by both developed and emerging market countries after the crisis is over.) To bear the cost to stabilise the world economy matches with the national interests of China and other emerging economies, since otherwise they should suffer from much greater economic and noneconomic costs for adjusting to shrinkage of the US and European economies.

One idea to cement this global coordination would be the establishment of a new international fund, like the IMF, which could be called the "Financial System Stabilisation Fund" or "World Dollar Stabilisation Fund." The Fund should be established as a temporary organisation to stabilise the current financial crisis, and eventually be dissolved and merged into the IMF in the next three years or so. Emerging market countries would invest public money, which may be their huge stocks of foreign reserves and/or may be raised by issuing new bonds, in the Fund. The Fund could then make loans to the governments of the US and major European countries affected by the financial crisis. The affected governments would use the loan proceeds to make fiscal expenditures needed for injecting capital into their banks and restructuring the debt of their domestic borrowers.

The G8 meeting with emerging market countries, scheduled to be held in New York in November, would be a good occasion to coordinate the global cost distribution for the resolution of the current financial crisis.

References

Caballero, R., T. Hoshi, and A. Kashyap (2008). "Zombie lending and depressed restructuring in Japan." American Economic Review (forthcoming).

Kobayashi, K. (2006). "Payment uncertainty, the division of labor, and productivity declines in great depressions." Review of Economic Dynamics, vol. 9, pp. 715—741.

Kobayashi, K. (2008). "Subprime Loan Crisis – Lessons from Japan’s Decade of Deception."

Kobayashi, K. and S. Kato (2001). Nihon keizai no Wana (Trap of the Japanese Economy). Tokyo: Nihon Keizai Shinbunsha (in Japanese).

Footnotes

1 In February when I warned about the necessity of bank capital injections with taxpayer money, I thought it would not happen until 2009 or 2010. See Kobayashi (2008).

2 See Kobayashi (2006) for a formal model and Kobayashi and Kato (2001) for informal arguments.

3 For zombie firms, see also Caballero, Hoshi and Kashyap (2008).