China’s spectacular economic growth during the past four decades under a largely – and arguably, increasingly – authoritarian political regime has posed fundamental challenges to prevailing economic paradigms, generating renewed debates about the unique role of culture and history. Some have further argued that traditional Chinese institutions aided rather than impede China’s modernisation (Rosenthal and Wong 2011, Brandt et al. 2011). Recently scholars have turned their attention to contrasting the trajectories of monetary and financial institutions between Western Europe and China as a plausible explanation for their early modern divergence (Brandt et al. 2011, Ma and Rubin 2019). My own recent work provides an interpretative survey of China’s financial revolution during the tumultuous era of 1900-37 (Ma 2019). By revealing the remarkable transformations in China’s monetary and financial sectors under a largely free-banking system clustered in the colonial treaty port city of Shanghai, my survey re-examines China’s forgotten history of bottom-up institutional change and the economic liberalism championed by Chinese entrepreneurs and civil communities.

Financial revolution in Republican China

Whether the forced opening of Qing China to Western imperialism and global trade in the mid-19th century marked the beginning of a century of Chinese humiliation or an era of awakening to modernity may be a matter of perspective. But the period from 1900 to 1937 marks an unusual episode of political instability and turmoil in Chinese history, beginning with Qing’s calamitous defeat by Western (and Japanese) allied forces over the Boxer Rebellion in 1901, followed by the Qing dynasty’s collapse in 1911. China’s subsequent Republican era (1911-1949) was marked by the chaotic Warlord period (1911-1927) followed by the Nanjing regime under the new Nationalist government, which ended abruptly with Japan’s full-scale invasion in 1937.

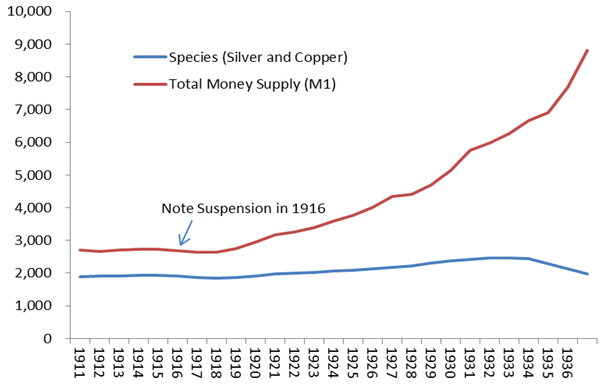

It remains puzzling that amidst this unusual period of political turmoil and recurring fiscal crises, a remarkable transformation occurred in banking and finance, characterised by the rise of a genuine silver standard based on nationally minted silver coins (eclipsing the imported silver coins or ingots), the rise of public debt, private banknotes, and deposits intermediated through modern Chinese banking institutions (Ma 2019, Ma and Zhao 2019). The quantitative magnitude of the financial revolution can be seen in Figure 1, which shows that while total species as measured by silver bullion, silver dollars, and copper cash registered barely any increase from 1911 to 1936, total money supply (M1) increased at an annual rate of 5% between 1911-16 and 1931-36, with bank notes and deposit components of M1 surging at a remarkable annual rate of 9.5%. As a result, the estimated share of notes and deposits in M1 money supply rose from 22.3–34.6% in 1910 to over 40% and 80% respectively in 1925 and 1936 (Ma 2019). Overall, Chinese banks accounted for the lion’s share of growth in this period. Meanwhile, price level remained stable, whereas total money supply nearly tripled between the 1910s and 1930s when annual GDP growth registered no more than 2% during the same period, indicating a heightened degree of monetization and financial deepening (Ma and Zhao 2019).

Figure 1 Species and money supply in China in 1911-1936 (million yuan)

Notes: M1 is equal to species plus bank notes and deposits. See Figure 2 in Ma (2019).

The timing of this financial revolution was even more enigmatic given China’s relative under-development of monetary and banking institutions during the much more stable pre-19th century era (Brandt et al. 2011, Ma 2019). One possible explanation is the absolutist nature of China’s traditional regime, which poses the so-called credible commitment problem: a government strong enough to define property rights is also strong enough to abrogate them for its own benefit.1 But with the collapse that followed the ill-timed landmark constitutional reform of 1903-1911, Republican China saw the reverse of the credible commitment problem: a government too weak to provide a normal social order. My research suggests that the temporal retreat of a centralised imperial power in China allowed for the rise of a quasi-political structure that rested on the institutional nexus of Western treaty ports (with Shanghai being the largest and most notable) and a Maritime Customs service – perhaps China’s first modern and independent civil and tax bureaucracy (Ma 2019). This key nexus offered a substitute form of commitment for the securing of property rights and the repayment of government bonds, which laid the institutional foundation of a financial revolution. More specifically, the relative political autonomy of treaty ports and Maritime Customs began to inadvertently act as an effective system of checks and balances that both constrained and undermined China’s political control at the centre while triggering financial revolution throughout the era of national disintegration.

Institutional foundation

As a designated treaty port, Shanghai opened after the First Opium War of 1842 and fell under separate jurisdictions of British, French, and American Concessions as well as Chinese quarters. In 1863, the British concession merged with the American quarters to form the International Settlement for all Western (and later Japanese) residents, while the French Concession remained separate throughout. From its very early days, the Western merchant elites of the Settlement fought for self-rule from the far-flung imperial capital of London and operated with a governance structure akin to a European form of self-governing incorporated urban community. This institutional feature set Shanghai apart from most other treaty ports in China or even from the neighbouring French Concession, often ruled directly by administrators sent by their respective home governments. The Settlement organised a municipal council whose members were elected by an association of tax-paying Western, later Japanese, and eventually Chinese residents in 1928. It operated within the rule of law vested in its own mini-Constitution. The Council levied land, property taxes, and business-license fees, while manning its own prison and police force with a volunteer army in times of need. It provided public goods (or semi-public goods) such as city roads, public utilities, and port facilities (Jackson 2018). The power and the territory of the International Settlement greatly expanded in the wake of the Qing collapse in 1911 with full territorial jurisdiction over all its residents.

Shanghai’s special status had long attracted what were to become some of the world’s premium Western banking institutions, such as HSBC and Chartered Bank. But modern Chinese banks, which only began operating from the end of the 19th century, also found homes there. In particular, the jurisdictional autonomy established by the Settlement sheltered the Bank of China’s Shanghai branch from the Beijing government’s ruinous fiscal demands in 1916, highlighting the value of independence. Even China’s traditional family-owned native banks increasingly chose to locate inside the Settlement. The relocation of the Shanghai Native Bankers’ Association from the Chinese portion of the city to within the Settlement area in 1917, followed by the founding of the association of modern Chinese banks in 1918, marked the rise of Shanghai’s Chinese banking community as the leading force in China’s macroeconomy, monetary, and financial regulation within a free-banking framework.

The second key institution – China Maritime Customs – had similar origins and a trajectory resembling that of the Shanghai International Settlement and treaty ports. The low fixed tariffs for Western powers imposed by the treaties on China were initially collected by Chinese customs officials, but increasingly overseen the by foreign consuls who set up the China Maritime Customs in Shanghai in 1854. Although an imperial Chinese organisation in name, the Customs office became autonomous from the Chinese government, with Britons dominating its senior staff, followed by large numbers of Western and later Japanese employees, and finally with the promotion of Chinese nationals into senior positions beginning in 1929 (Van de Ven 2014). With over 20,000 people in 40 main Customs Houses across China, the Customs office was rapidly becoming China’s first centralised hierarchic bureaucracy just as China was descending into political disintegration. Like the International Settlement, the power of the Maritime Customs Service expanded after 1911 (when the Qing dynasty collapsed) and effectively took over the collection of Customs revenue and the remittance of the net revenue to appropriate authorities. Over time, Maritime customs revenue would become arguably the most secure form of central revenue for a weakened Beijing government and more importantly, the most reliable collateral for the service of the government’s foreign debt.

Both institutions – the Settlement and the Customs office – were intimately connected with Western institutions and Western imperialism in China, which initially served to protect both Western and foreign business interests in the context of extra-territorial privileges. However, in the wake of the 1903 constitutional reforms and the Qing’s collapse in 1911, this mechanism began transferring to China domestically. China’s domestic public debt originated in 1914 with the new Republican government in Beijing setting up an independent committee composed of Chinese and Western Bankers and Maritime Customs officials. This mechanism ensured that tax revenue earmarked for debt repayment be directly remitted to a special revenue account set up in Western banks, and later to Chinese banks headquartered in the International Settlement. The viability of a Chinese domestic public debt spawned a vibrant secondary market from the 1920s.

The founding of the new Nationalist government based in the capital of Nanjing in 1927 initially succeeded in taking over this institutional mechanism based on the establishment of an independent Sinking Fund Commission headed by representatives from the Shanghai banking community and government officials (Li 2016). Overall, the amount of domestic debts issued from 1927 to 1931 was nearly double the amount issued during the entire Beiyang era of 1912-1926. During the Beiyang era, the ratio of domestic to foreign public debt was 1 to 7; it was 6 to 4 in the Nanjing decade of 1927-36 (Yan 2015). Clearly, the nascent Nanjing government created favourable conditions that diffused the fruits of financial revolution in the form of new monetary and financial institutions and instruments unimaginable within the treaty-port framework. An important consequence of banks’ increased holding of securitised governmental bonds was the rapid increase in an individual bank’s capacity to increase its issue of bank notes, as China’s banking regulations allowed modern banks to use securities – composed mostly of governmental bonds – in the range of 40% to serve as reserves for bank notes. This functioned as the critical anchor for China’s financial revolution, as illustrated in Figure 1.

In the end, politics was more complicated than economics as a force behind China’s financial revolution. The new Nationalist government, which aimed at re-establishing more authoritarian rule, moved to rein in the autonomous power of Western treaty ports, Chinese bankers, and China Maritime Customs as soon as the regime’s hold on power was secured in the 1930s. The nationalisation of major Chinese banks in 1935, and the establishment of a fiat currency 1936 – without the simultaneous establishment of an internal system of checks and balances and alongside the waning of Western imperialism and its associated fiscal-financial nexus – set the stage for the rise of hyper-inflation in the 1940s and possibly for the onset of communism.

Conclusion

The emergence of a quasi-political institution was an anomaly in China’s long history of centralized and absolutist political rule that had been inimical to the kind of financial innovation associated with the rise of autonomous cities and merchant elites in Western Europe.2 Although fundamentally Western and colonial, this institutional mechanism nonetheless inspired the imagination of enlightened Chinese entrepreneurs and officials in early 20th-century China. As a sharp departure from the traditional political regime, where credibility was placed at the mercy or benevolence of a strong and stable state, credibility was in this case placed on an institutional mechanism that had grown autonomously from the centre. It was that mechanism that allowed Chinese bankers and bondholders to place some constraints on the power of the state with regards to public finance, and at the same time enabled the Chinese government to tap into the wealth of Chinese elites or ordinary citizens for borrowing without coercion. With the Chinese political regime returning to a centralised and authoritarian tradition from the 1940s onwards, this survey of an early 20th-century Republican experiment offers us a rare glimpse of how an alternative or innovative China might have looked if freed, even temporarily, from the shackles of unity and centralisation.

References

Brandt, L, D Ma and T Rawski (2014), “From Divergence to Convergence: Re-evaluating the History Behind China's Economic Boom”, Journal of Economic Literature 52(1): 45–123.

Jackson, I (2018), Shaping Modern Shanghai, Colonialism in China’s Global City. Cambridge University Press.

Ma, D (2019), “Financial Revolution in Republican China during 1900-1937: a Survey and a New Interpretation”, CEPR Discussion Paper 13502 (forthcoming in Australian Economic History Review).

Ma, D and J Rubin (2019), “The Paradox of Power: Understanding Fiscal Capacity in Qing China, 1644-1911”, Journal of Comparative Economics 47: 277-294.

Ma, D and L Zhao (2019), “A Silver Transformation, Chinese Monetary Integration in Times of Political Disintegration during 1898-1933”, CEPR Discussion Paper 13501.

North, D C and B R Weingast (1989), “Constitutions and Commitment: The Evolution of Institutions Governing Public Choice in Seventeenth-Century England”, Journal of Economic History 49: 803-32.

Rosenthal, J L and B Wong (2011), Before and Beyond Divergence: the Politics of Economic Change in China and Europe, Harvard University Press.

Stasavage, D (2016), "What We Can Learn From the Early History of Sovereign Debt", Explorations in Economic History 59: 1–16.

Van den Ven, H (2014), Breaking with the Past: The Maritime Customs Service and the Global Origins of Modernity in China, Columbia University Press.

Li, D (2016), “Big Data” in History, The Development of Security and Bond Markets in Republican China, Peking University Press (in Chinese).

Yan, H (2015), “Governmental Debts and Financial Development in Modern China”, Journal of Finance and Economics 41(9): 108-120 (in Chinese).

Endnotes

[1] See North and Weingast (1989) for the well-known case of Glorious Revolution in 1688 as case of credible commitment.

[2] See David Stasavage’s recent survey (2016) on Western European cities.