Firms do not operate in isolation. Virtually every firm belongs to a network – a set of firms interconnected through buyer-supplier relationships. These firm-level interconnections matter for a number of economic phenomena such as the propagation of economic shocks and the effectiveness of government policies.

Economic theory suggests that idiosyncratic shocks can propagate through production links causing aggregate fluctuations (Acemoglu et al. 2012). Although it is widely accepted that domestic production networks matter for economic outcomes, empirical research quantifying the importance of their role is still quite limited because of two major challenges. First, until very recently, comprehensive data on (domestic) firm-to-firm linkages were not readily available. Second, designing an empirical strategy to convincingly identify the relevant mechanisms is far from trivial.

Recently, a number of researchers have found ways to address these challenges. The existing studies typically take one of two approaches: either they rely on large localised economic shocks caused by natural disasters (e.g. Barrot and Sauvagnat 2016, Carvalho et al. 2020), or focus on economy-wide shocks and identify network connections through aggregate input-output tables (e.g. Acemoglu et al. 2016).1

In our new research (Demir et al. 2020), we take a different approach. We examine the impact of an unexpected non-localised cost shock, while observing a quasi-universe of firm-to-firm relationships in an open economy that is a member of the G20. We conclude that even the relatively small shock that we consider gets transmitted through domestic production networks and is amplified by firms with short-term financial constraints.

Empirical context

We exploit an unexpected increase in the tax on imports purchased with foreign trade credit, which took place in October 2011 in Turkey. We use detailed administrative data that allow us not only to observe firms’ sales, input usage, and financial accounts, but also their domestic buyer and supplier linkages. The tax increase affected only a portion of firms in the domestic production network, namely, firms that buy foreign inputs using cross-border trade credit, deferred-payment letters of credit or acceptance credit. For these firms, the price of imports increased unexpectedly by 3% overnight.

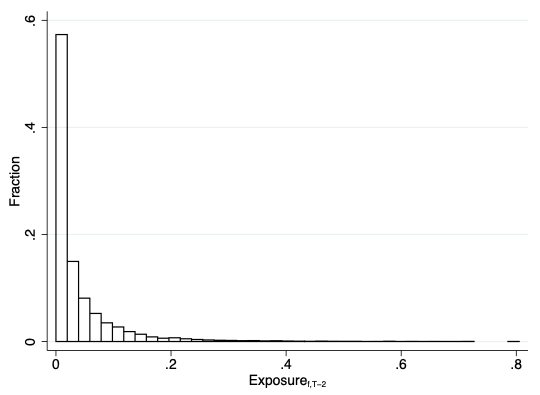

Based on pre-shock data (i.e. 2010), affected imports accounted for on average less than 2% of an importer’s total costs (the sum of domestic and foreign material input purchases and wages). However, this figure reached more than 20% in firms with the highest exposure (see Figure 1).

Figure 1 Distribution of firm-level exposure to the shock

Notes: This figure plots the distribution of the firm-level exposure to the tax shock, the share of imports subject to financing tax in firm-level total costs (sum of material input purchases and wages) for the year 2010.

Results

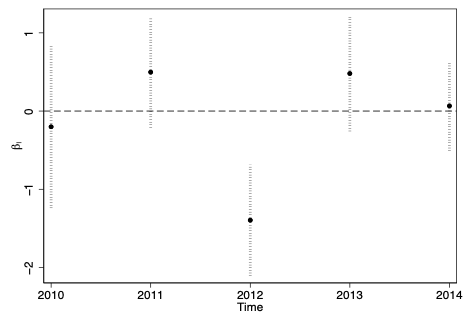

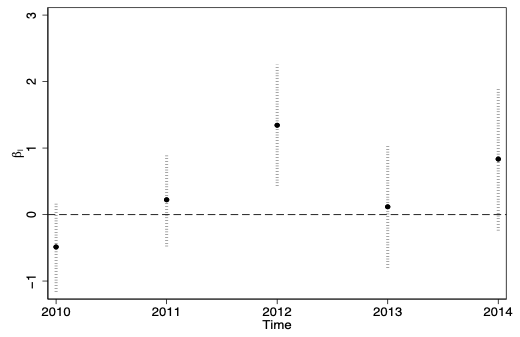

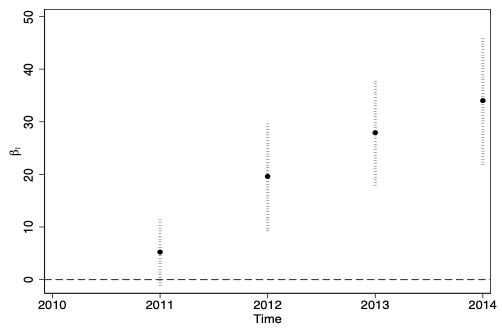

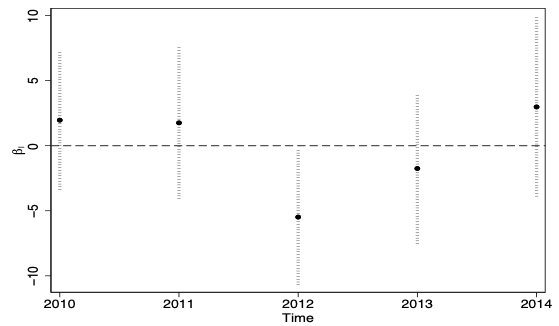

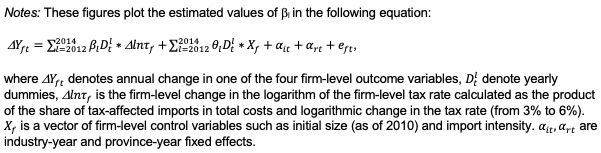

As depicted in Figure 2, our results suggest that this non-localised shock had a non-trivial economic impact on exposed firms compared with other firms operating in the same industry and located in the same region. Importers exposed to the higher tax reduced their reliance on imported inputs, experienced an increase in their material input costs (as a share of total costs), expanded their domestic supplier network, and suffered a decline in sales. The estimated effect on sales implies that pass-through of the tax to prices ranged between 0.7 and 1.5 depending on the assumed value of the price elasticity of demand.2 Importantly for identifying various outcomes, the shock could be viewed by firms as a permanent one in contrast to many natural disasters used in the literature (e.g. the Tohoku earthquake) that might have not led firms to alter their sourcing, production, and sales plans. Indeed, the Turkish authorities kept the tax without changes for the following three years and maintained it for most products afterwards.

Figure 2 Direct effects of the tax shock

a) Change in the share of imported inputs

b) Change in share of material input costs

c) Change in new domestic suppliers relative to 2010

d) Change in log of sales

Our results also indicate that the shock propagated downstream from suppliers to their buyers. Firms exposed to the tax increase through their suppliers experienced an increase in the cost of inputs and a reduction in sales. The estimated indirect effect on sales working through suppliers is comparable in magnitude to the direct effect that the exposed importers face. In contrast, we find no evidence of upstream propagation of the shock from the exposed buyers to their domestic suppliers.

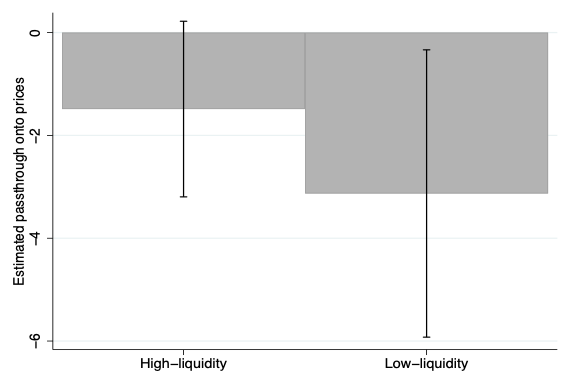

Equally importantly, the shock propagated in the production network especially through suppliers with low financial liquidity. For these financially constrained firms the estimated sales response to the shock was more than four times higher than the one for unconstrained firms. Low financial liquidity firms also played the primary role in propagating the shock to their customers (see Figure 3).

Figure 3 Indirect effects of the shock through suppliers by type

Notes: This figure plots the implied (indirect) pass-through of the tax onto prices by supplier type. Vertical lines represent 90% confidence intervals around the point estimates.

Discussion

Our results suggest that even a relatively small and non-localised cost-push shock propagates downstream in production chains and is amplified by firms that face short-term financial constraints. Our study highlights the importance of firms’ liquidity on their resilience to shocks – the ability to make quick investments in changing payment methods or in searching for other sources of inputs. This implies that an increase in the provision of available bank credit for working capital purposes alleviating liquidity shortages could be a remedy to firms’ trade finance disturbances.

References

Acemoglu, D, V M Carvalho, A Ozdaglar and A Tahbaz-Salehi (2012), “The Network Origins of Aggregate Fluctuations”, Econometrica 80(5): 1977–2016.

Acemoglu, D, U Akcigit and W Kerr (2016), “Networks and the Macroeconomy: An Empirical Exploration”, in M Eichenbaum and J Parker (eds.), NBER Macroeconomics Annual.

Amiti, M, S J Redding and D Weinstein (2019), “The Impact of the 2018 Trade War on U.S. Prices and Welfare”, Journal of Economic Perspectives 33(4): 187-210.

Barrot, J-N and J Sauvagnat (2016), “Input Specificity and the Propagation of Idiosyncratic Shocks in Production Networks”, Quarterly Journal of Economics 131(3): 1543– 1592.

Bernard, A B and A Moxnes (2018), “Networks and Trade”, Annual Review of Economics, Annual Reviews 10(1): 65-85.

Carvalho, V M and A Tahbaz-Salehi (2019), “Production Networks: A Primer”, Annual Review of Economics, Annual Reviews 11(1): 635-663.

Carvalho, V M, M Nirei, Y U Saito and A Tahbaz-Salehi (2020), “Supply Chain Disruptions: Evidence from the Great East Japan Earthquake”, Quarterly Journal of Economics, Forthcoming.

Demir, B, B Javorcik, T K Michalski and E Ors (2020), “Financial Constraints and Propagation of Shocks in Production Networks”, CEPR Working Paper 15316.

Fajgelbaum, P D, P K Goldberg, P J Kennedy and A K Khandelwal (2019), “The Return to Protectionism”, Quarterly Journal of Economics 135(1): 1– 55.

Endnotes

1 See surveys by Bernard and Moxnes (2018) and Carvalho and Tahbaz-Salehi (2019).

2 The upper bound is comparable to the estimates of tariff pass-through onto producer prices reported in the literature (e.g. Amiti et al. 2019, Fajgelbaum et al. 2019).