During the last two decades, many developed and emerging economies have experienced massive boom-bust cycles in house prices. Housing bubbles have occurred in the US, the UK, Spain and Ireland, and one may be happening in China at the moment. They are believed to have important effects not only on the housing sector, but also on the broader economy (e.g. Jordà et al. 2015). Spain is typical. As shown in Figure 1, the spectacular boom-bust cycle in Spanish house prices between 1995 and 2015 (Panel a) went hand-in-hand with an equally spectacular boom-bust cycle in aggregate economic activity (Panel b).

Figure 1 Boom and bust in Spain, 1995-2015

Source: Spanish Statistical Institute, Bank of Spain, and Ministry of Construction.

These dynamics suggest that housing bubbles have spillover effects on economic sectors such as manufacturing or services. The credit market in one important channel for spillover effects. Panel (c) of Figure 1 shows that the Spanish housing bubble was accompanied by a boom in firm credit, driven mostly by credit to housing firms. Panel (d) shows the share of construction and real estate firms in total firm credit increased from 22% in 1995 to 48% in 2007. However, it is not clear whether this massive expansion of housing credit reduced or increased the availability of credit for firms that had nothing to do with housing.

A priori, there are good reasons for both sides of the argument:

- Crowding out. The massive credit demand for housing-related purposes (by construction and real estate firms, but also by households asking for mortgages) may have crowded out credit from other sectors. A recent paper by Chakraborty et al. (2018) shows that during the US housing boom, banks that were more exposed to house price increases lowered their lending to firms.

- Crowding in. Higher house prices can also stimulate credit in other sectors, as they provide collateral to real estate-owning firms (Chaney et al. 2012) or generate attractive assets which banks can securitise and use to increase their credit supply (Jimenez et al. 2014).

Crowding out and crowding in

In a recent paper, we argue that these contrasting views are not mutually exclusive, but instead describe two phases of the same phenomenon (Martín et al. 2018). Using a simple macroeconomic model, we show that housing bubbles initially crowd out credit from other economic sectors, but eventually – if they last long enough – crowd it in. We provide empirical evidence that these crowding-out and crowding-in effects were present during the Spanish bubble.

We model Spain as a small open economy in which firms borrow from banks, and banks borrow from international financial markets. Crucially, we assume that all of these credit relationships are subject to financial constraints: how much any given firm or bank can borrow depends on its net worth.

To explore the effects of housing bubbles, we allowed for rational bubbles on the price of land: in some periods, agents buy land at a price exceeding its fundamental value because they expect to resell it at a higher price. When this occurs, the collateral of housing firms (which are the natural holders of land) appreciates, and they can demand more credit from banks. On impact, however, financially constrained banks cannot ramp up their credit supply – they are constrained by their net worth, which depends on past profits and is not immediately affected by the bubble. So the onset of the bubble is characterised by a relative increase in the domestic demand for credit, which raises the domestic interest rate and crowds out non-housing credit and investment.

Over time, however, crowding out gives way to crowding in because as long as the bubble lasts, housing firms repay their (large) loans. This raises bank profits and net worth, enabling them to borrow more from the international financial market and to expand the domestic supply of credit. The rise in the interest rate at the onset of the bubble is gradually reversed, as is the initial decline in non-housing credit and investment. If the bubble lasts long enough,, this crowding-in effect dominates. Eventually, housing bubbles reduce the domestic interest rate and expand credit to all sectors, including non-housing ones.

But bubbles are fickle, and they can burst once expectations about high future land prices change. The ensuing collapse in land prices wipes out the collateral of housing entrepreneurs, which reduces their credit repayments and thus the net worth of banks. This triggers a sudden stop in bank borrowing from the international financial market, an increase in the domestic interest rate, and a fall in credit to (and investment by) both housing and non-housing sectors.

The effects during the Spanish bubble

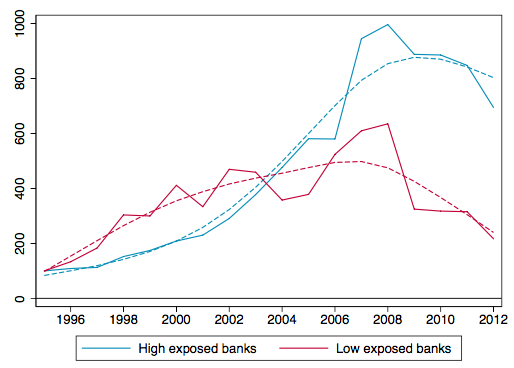

From aggregate data alone, we cannot establish whether these crowding-out and crowding-in effects were present during the Spanish housing bubble. This is because we cannot construct a counterfactual series of non-housing credit in the absence of the bubble. However, we can use micro-level data from the Credit Registry maintained by the Banco de España, which contains information on virtually all loans to Spanish firms. Our empirical strategy relies on the fact that not all banks were equally exposed to the bubble. Some had business models that focused more on housing or were located in regions with greater house price increases. Using a simple extension of our model with heterogeneous banks, we show that the crowding-out and crowding-in effects should be observable at the bank level. Initially, credit to non-housing firms should grow less at highly exposed banks relative to less exposed ones, but this pattern should reverse in later years and credit to non-housing firms should actually grow more at highly exposed banks. Figure 2 shows that this prediction matched the evidence.

Figure 2 Credit allocation during Spain's housing bubble

Source: Martín et al. (2018).

Note: Exposure was measured by the bank’s ratio of mortgage-backed credit to total credit between 1992-1995 (before the start of the bubble). The most exposed banks were above the 90th percentile of this measure, the least exposed banks below the 10th percentile. We also considered alternative exposure measures based on geography.

The pattern shown in Figure 2 is suggestive, but it considers only a limited group of banks and it may be due to systematic differences between the clients of banks with the highest and lowest housing exposure. To control for these factors, we follow Khwaja and Mian (2008) and regress annual credit growth of non-housing firms at the loan level (that is, for any bank-firm pair) on bank exposure to the housing bubble and firm-time fixed effects. Firm-time fixed effects controlled for firm-level shocks to credit demand.

Coefficients were thus identified by differences in the growth of credit to the same firm by more or less exposed banks, and only reflected changes at the bank level. These regressions confirmed the pattern in Figure 2 – for a given firm, annual credit growth from highly exposed banks was significantly lower during the first years of the bubble, but was significantly higher by 2008.

Having established the evolution of these crowding-out and crowding-in effects, we were able to show that they mattered for firm-level outcomes. We did so by noting that, in the presence of frictions that limited firms’ ability to switch banks, the credit growth of a specific firm was likely to depend on its bank relationships.

To test whether this was the case in Spain, we regressed a firm’s annual credit growth on a weighted average of housing bubble exposure of all banks from which the firm borrowed. We found that firms that borrowed more from more exposed banks experienced lower credit growth during the first years of the bubble, higher credit growth in its last years, and lower credit growth during the crisis. These results were confirmed when we considered value-added growth instead of credit growth as a dependent variable, which implies that the differences in credit growth had real effects.

Spillovers from bubbles

Our research suggests that housing bubbles have important spillovers on other sectors through the credit market. The direction of these spillovers changes over time. While a housing bubble first crowds out credit from other sectors, it eventually crowds it in.

Therefore, any concern that housing bubbles absorb credit that is needed in other sectors is likely to be temporary. The eventual crowding-in effect of bubbles is also intrinsically fragile, however. Bubbles burst and – once they make up a substantial share of banks' net worth – their collapse spreads well beyond the housing sector.

Our results are not limited to housing bubbles, but generalise to other sectoral shocks. Indeed, as long as banks or other lenders face collateral constraints, a positive shock to one particular sector first reduces credit availability for other sectors, but eventually stimulates it. Thus, the mechanisms outlined here can shed light on the general role of the financial system as a transmission mechanism in modern economies.

Authors’ note: The views expressed in this column are those of the authors and do not necessarily reflect the views of the ECB or the Bank of Spain.

References

Chakraborty, I, I Goldstein, and A MacKinlay (2018), "Housing price booms and crowding-out effects in bank lending", The Review of Financial Studies 31(7): 2806–2853.

Chaney, T, D Sraer, and D Thesmar (2012), "The Collateral Channel: How Real Estate Shocks Affect Corporate Investment”, American Economic Review 102(6): 2381–2409.

Jimenez, G, A Mian, J-L Peydro, and J Saurina (2014), "The Real Effects of the Bank Lending Channel", mimeo.

Jordà, O, M Schularick, and A M Taylor (2015), "Betting the house", Journal of International Economics 96(S1): S2–S18.

Khwaja, A I and A Mian (2008), "Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market", American Economic Review 98(4): 1413–1442.

Martín, A, E Moral-Benito, and T Schmitz (2018), "The Financial Transmission of Housing Bubbles: Evidence from Spain", CEPR Discussion Paper 12999.