“With nominal short-term interest rates at or close to their effective lower bound in many countries, the broader question of how expectations are formed has taken on heightened importance. Under such circumstances, many central banks have sought additional ways to stimulate their economies, including adopting policies that are directly aimed at influencing expectations of future interest rates and inflation.”

Janet Yellen (2016).

With the onset of the effective lower bound on policy interest rates since the start of the Great Recession, there has been increasing interest among policymakers and academics in policies that operate through expectations channels (e.g. Woodford 2013). Mainstream macroeconomic models, in particular, suggest that policies aimed at raising the inflation expectations of agents should lead to lower perceived real interest rates, thereby stimulating economic activity through increased demand for both durable and non-durable goods. Unconventional policies such as forward guidance and quantitative easing were in part motivated by the desire of central banks to raise inflation expectations. More generally, the fact that most economic decisions are forward-looking implies that changes in the expectations of households and firms about the future should exert immediate effects on their economic behaviour. However, the fact that expectations and decisions are jointly determined implies that testing these channels empirically has been a challenge. In a new paper (Coibion et al. 2018), we exploit a randomised, controlled experiment implemented in a survey of Italian firms to provide new empirical evidence on how changes in inflation expectations causally affect economic decisions using persistent and exogenously generated variation in the expectations of firms.

The information treatment on Italian firms

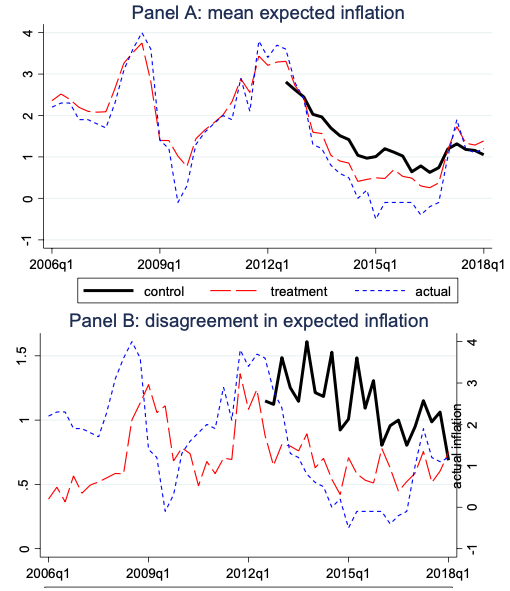

In a quarterly survey of firms that has been running since 1999, the Bank of Italy introduced an information treatment in 2012 to a randomly selected subset of the panel of firms participating in the survey, as described in Bartiloro et al. (2017). The treatment was to provide selected firms with recent and publicly available information about actual inflation in the Italian economy at the time of the survey, immediately prior to asking them about their inflation expectations. These firms continued to receive this treatment for years thereafter. A control group, in contrast, was not provided with any information about recent inflation over the same time period. This information treatment led to large and persistent differences in the inflation expectations of treated firms relative to those in the control group. Figure 1 plots the mean inflation expectations for the two groups. Prior to 2012, all firms were receiving information about recent inflation, and the average inflation expectation of firms in the survey tracked actual inflation very closely. Starting in 2012, however, one can observe a significant difference arising between the inflation expectations of the subset of firms who were no longer provided this publicly available information relative to the expectations of firms who consistently received the treatment. Disagreement across firms also increased sharply among those who were not provided this common source of information.

Figure 1 Inflation expectations (one-year ahead) for treatment and control groups

Notes: Treated firms (red long-dash line) are presented with the most recent value of actual inflation before being asked for their inflation expectations. The most recent value of inflation in Italy (“actual”) is shown with blue, short-dash line. Firms in the control group (solid black line) receive no such information prior to being asked about their inflation expectations. Prior to 2012, all firms received the treatment.

As Figure 1 suggests, the effects of the treatments on expectations are large. Being told that inflation is 1% higher raises the average one-year ahead inflation expectation of treated firms by a little over 0.5% on average. The effect is larger for expectations of inflation over shorter horizons but smaller for expectations over longer horizons.

However, the effects of information treatments are rather short-lived. Six months after receiving the information, treatment effects on expectations have largely dissipated. Finally, we find little variation in terms of how firms respond to the information treatment depending on their demographic characteristics (big firms vs small firms, manufacturing vs services, etc.).

The causal effect of inflation expectations on firm decisions

The exogenous and time-varying differences in expectations across the two groups of firms induced by the information treatments serve as a powerful instrument with which to characterise the causal effect of inflation expectations on firms’ decisions. Exploiting this instrumental variable strategy, we document that higher inflation expectations on the part of firms translate into their economic decisions. When using the full-sample period (2012Q3-2018Q1) we find that firms with higher inflation expectations raise their prices somewhat, increase their credit utilisation, and reduce their employment relative to firms with lower inflation expectations. The economic magnitudes involved for the employment decisions are large. Raising inflation expectations by 1% leads firms to reduce their employment by 0.5% after two to three quarters, with effects building further over time.

Because expectations policies are particularly important when central banks are constrained by the effective lower bound on interest rates, we also consider sub-sample estimates starting in 2014Q1, the date at which Mario Draghi announced that the ECB had reached the effective lower bound. When focusing solely on this latter period, the effects of inflation expectations on prices and credit utilisation are stronger, while the effects on employment disappear, consistent with firms perceiving a stronger demand-side channel of inflation at the effective lower bound. Indeed, firms with exogenously higher inflation expectations during this period perceive that demand for their goods will be stronger than it otherwise would be. This mechanism is in line with the predictions of New Keynesian models at the effective lower bound (e.g. Woodford 2011), and suggests that managing inflation expectations at the lower bound on interest rates can be an effective strategy for policymakers.

Conclusion

Our results speak directly to whether policies that operate primarily through expectations channels can be effective. We show that providing information to firms clearly induces changes in their economic behaviour, which supports the idea that policymakers can affect economic outcomes by shaping agents’ expectations of the future. These expectations channels can be important not just for monetary policy (e.g., forward guidance) but also for fiscal policies, as exemplified in a recent discussion of anticipated VAT changes (D’Acunto et al. 2016). Furthermore, because the ECB was facing the effective lower bound on interest rates during a sub-period of our analysis, our results also demonstrate the expectations channel precisely in the circumstances when that channel is expected to be most relevant for policymakers. In particular, we find that firms interpret higher inflation during the effective lower bound as being associated with much stronger demand side effects than outside the lower bound period and change their behaviour outside and inside the effective lower bound, much as standard models would predict when nominal interest rates do not offset changes in expected inflation (Woodford 2011).

More generally, our results also speak to the broader success of central banks’ communication strategies and the degree to which inflation targeting regimes have ‘anchored’ inflation expectations. Providing firms in Italy with recent information about inflation has large effects on their forecasts and significantly reduces the disagreement in their beliefs, suggesting that they are largely unaware of recent inflation dynamics. This does not speak highly of their prior knowledge of this readily available information (or potentially a sign of success – firms are not concerned with inflation) and suggests that central banks in general, and the ECB in particular in this case, have a lot of room to improve the way they communicate with the public. The transitory effects of information treatments on inflation expectations further indicate that a successful communication strategy must not only be able to reach decisionmakers within firms but do so in a persistent way. How policymakers should address this point remains an open question.

References

Bartiloro, L, M Bottone, and A Rosolia (2017), “What does the heterogeneity of the inflation expectations of Italian firms tell us?”, Banca d’Italia Working Paper no. 414, December.

Coibion, O, Y Gorodnichenko, and T Ropele (2018), “Inflation Expectations and Firm Decisions: New Causal Evidence”, NBER Working Paper 25412.

D’Acunto, F, D Hoang , and M Weber (2016), “The Effect of Unconventional Fiscal Policy on Consumption Expenditure”, NBER Working Paper No. 22563.

Woodford, M (2011), “The Simple Analytics of the Fiscal Multiplier”, American Economic Journal: Macroeconomics 3(1): 1-35.

Woodford, M (2013), “Forward Guidance by Inflation-Targeting Central Banks”, CEPR Discussion Paper no. DP9722.

Yellen, J (2016), “Macroeconomic Research After the Crisis,” speech at “The Elusive 'Great' Recovery: Causes and Implications for Future Business Cycle Dynamics” 60th annual economic conference sponsored by the Federal Reserve Bank of Boston.