In the aftermath of the recent financial crisis, the discussion of the effects of fiscal adjustment on economic growth has intensified. While some scholars have focused on the characteristics of the fiscal consolidation needed to bring public debt down from historically high levels, others have examined the effects of alternative strategies on economic performance. The VoxEU debate aptly covered in “Has Austerity Gone Too Far?” (Corsetti 2012) sums up the conflicting positions. Most scholars have delved into different dimensions of fiscal adjustments, including their timing, composition, and duration. The empirical analysis of the growth effects of these policies, however, has largely concentrated on the short run. This has left unanswered the question of how fiscal consolidations affect growth over the longer term.

In our view, important insights are gained from taking a medium-term perspective of fiscal adjustment and its effects on growth. In particular, the composition of fiscal adjustment, and its interaction with initial and accompanying conditions, has important consequences for economic activity. Monetary policy, exchange rates, and financial conditions are important factors shaping the medium-term effects of fiscal consolidations on economic performance (see Cottarelli 2012 and Buti 2014).

In this context, we would like to draw attention to another dimension – the interplay of credit constraints, the composition of fiscal adjustment, and growth. This is particularly relevant in the current environment, where the legacy of the financial crisis has constrained credit supply and affected the channels through which fiscal policy impacts growth.

Debt-reduction episodes under different financial conditions

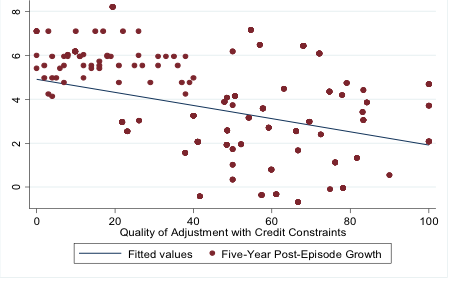

In a recent paper (Baldacci et al. 2013), we show that there is a link between fiscal adjustment and medium-term output growth in the presence of credit constraints. We use a database of 79 debt-reduction episodes achieved by means of fiscal adjustment, covering advanced, emerging, and developing economies between 1980 and 2012. In particular, we focus on the relationship between the quality of adjustment (measured by the relative contribution of cuts in current spending to total deficit reduction) and average economic growth in the medium term. In this context, we define the medium term as the five years after the debt-reduction episode has ended. The relationship between the quality of adjustment and medium-term growth is weakly positive under normal conditions in our sample. However, this relationship becomes negative when credit constraints and bank deleveraging conditions are taken into account (Figures 1 and 2).

Figure 1. Quality of adjustment with credit constraints and growth

Figure 2. Quality of adjustment with bank deleveraging and growth

A shortage of credit and impaired financial channels can damage growth, while spillovers of risks from the financial sector to sovereign debt markets can affect public debt sustainability. While these figures are only illustrative, in the paper we perform a robust empirical analysis in which we interact traditional variables that measure the size and the composition of fiscal adjustments with indicators that measure the relative health of the financial sector. In particular, we focus on two financial variables: the growth of credit to the private sector and bank deleveraging, with the latter measured by the change in the capital-to-assets ratio.

We find that if credit is not available to consumers and investors, private demand has more difficulties in compensating for cutbacks in public demand. As a consequence, strong spending cuts can have a negative effect on medium-term output growth; this impact is larger than in traditional models that do not take credit constraints into account. When countries start the adjustment with high unemployment, the negative effect of spending cuts on growth is even more acute.

The combination of low credit growth, bank deleveraging, and public debt consolidation can change the way economic agents assess the effects of government policies. In particular, the fiscal mix (that the mix of expenditure and revenue policies) that under normal circumstances would have delivered growth-boosting public debt reductions may not be successful in an environment of credit restrictions and uncertainty about the future. The presence of troubled financial conditions probably explains why fiscal adjustments that worked in the 1990s have not produced similar beneficial effects on growth in recent years.

Related work

These results are consistent with those of Eggertsson and Krugman (2010), who illustrate the adverse growth consequences of deleveraging when the effectiveness of monetary and fiscal policy is constrained by the liquidity trap. They also confirm that the deleveraging of both the public and the private sector at the same time has a negative impact on growth (Bornhorst and Ruiz Arranz 2013).

Policy implications

The policy implications of these results are significant – when bank deleveraging is high and credit is not flowing to the private sector, public debt consolidations should be gradual. They should also be based on an appropriate combination of revenue and expenditure measures rather than spending cuts alone (IMF 2013).

In a nutshell, credit conditions matter for the medium-term success of fiscal adjustments, as judged by their impact on growth. The expenditure-based consolidations of the past, which worked well in an era without credit constraints, may disappoint when financial conditions are less favourable. Fiscal adjustments based on a prudent mix of both revenue and expenditure measures may be a better recipe for success at the current juncture.

Disclaimer: The views expressed herein are those of the authors and should not be attributed to the institutions to which the authors are affiliated, the IMF and ISTAT, nor to their Executive Boards, or their management.

References

Baldacci, Emanuele, Sanjeev Gupta, and Carlos Mulas-Granados (2013), “Debt Reduction, Fiscal Adjustments, and Growth in Credit Constrained-Economies”, IMF Working Paper 13/238.

Bornhorst, Fabian and Marta Ruiz Arranz (2013), “Indebtedness and Deleveraging in the Euro Area”, 2013 Article IV Consultation on Euro Area Polices: Selected Issues Paper, IMF Country Report 13/232, Chapter 3.

Buti, Marco (2014), “A consistent trinity for the Eurozone”, VoxEU.org, 8 January.

Corsetti, Giancarlo (2012), “Has austerity gone too far?”, VoxEU.org, 2 April.

Cottarelli, Carlo (2012), “The austerity debate: Festina lente!”, VoxEU.org, 20 April.

Eggertsson, Gauti B and Paul Krugman (2010), “Debt, Deleveraging and the Liquidity Trap: A Fisher-Minsky-Koo Approach”, mimeo.

IMF (2013), “Reassessing the Role and Modalities of Fiscal Policy in Advanced Economies”, IMF Policy Paper.