In several countries, fiscal policies have become unsustainable. It is inevitable that their fiscal policies will need to be adjusted to reduce the indebtedness of their governments. But how should these policymakers get their fiscal house in order?

According to Alesina and de Rugy (2013):

“[E]vidence suggests that the types of fiscal adjustment packages that are most likely to reduce debt are those that are heavily weighted toward spending reductions and not tax increases.”

Many other authors have also concluded that successful fiscal policy adjustment is done by cutting spending, rather than increasing revenue. The list includes Alesina and Perotti (1995), McDermott and Wescott (1996), Alesina and Ardagna (2010), Alesina et al. (1998) von Hagen et al. (2001, 2002), and Afonso and Jalles (2012).

One size does not fit all

In a forthcoming paper (Wiese et al. 2018), we re-examine which type of austerity measures create a successful fiscal adjustment. Unlike previous studies, we apply the Bai and Perron (1998, 2003) structural break filter to identify fiscal adjustments and their success.

To be more precise, we apply the Bai-Perron (BP) approach to the cyclically adjusted budget balance as share of GDP to identify fiscal adjustments. We also apply the BP approach to the growth rate of the government debt-to-GDP ratio to identify whether a fiscal policy adjustment has been successful.

This approach is more objective than others used so far, because it takes the variability of the budget balance within countries into account. Adjustments have generally defined in previous research as a discretionary (cyclically adjusted) and significant decline in the general government’s budget balance. 'Significant' in this context does not refer to statistical significance, but rather whether the change in the cyclically adjusted (primary) budget balance has exceeded a subjective threshold. Previous studies also identified 'success' as the lasting effect the adjustment on reducing the government debt-to-GDP ratio, or the budget deficit-to-GDP ratio. Once more, this is based on a subjective threshold.

So these filters are based on a ‘one-size-fits-all’ principle, even though budgetary processes in some countries may lead to a much more volatile budget balance than in others. A filter that does not take volatility into account is likely to identify fiscal adjustments that are the result of existing budgetary institutions, or other factors driving fiscal policy volatility, rather than deliberate attempts to improve the budget balance.

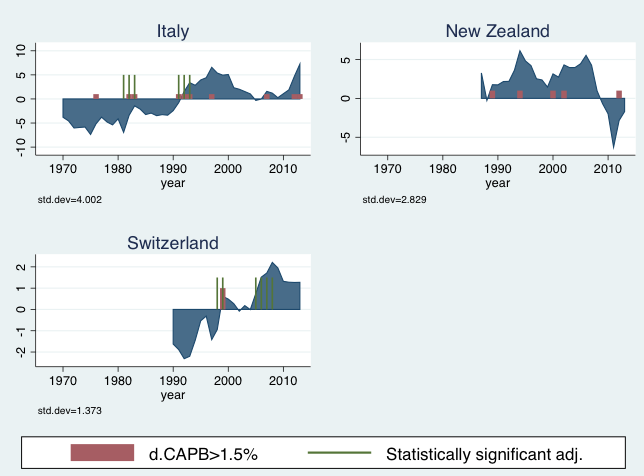

To illustrate, Figure 1 compares budget balances of Italy, New Zealand, and Switzerland. The difference in the scale on the vertical axes makes it clear that the budget balance in Italy and New Zealand is much more volatile than in Switzerland. A filter that is based on a ‘one-size-fits-all’ approach would be likely to identify more fiscal adjustments for Italy and New Zealand than for Switzerland, as shown by the red bars in Figure 1. This is simply because a change of budget balance is the key criterion used to identify a fiscal adjustment. This is a so-called type I error.

Figure 1 Fiscal policy outcomes in three countries, 1970-2015

Notes: The figure shows the cyclically adjusted primary balance (in blue), and years identified as fiscal adjustments using two approaches, namely the requirement that the change in the CAPB is larger than 1.5 percentage points (in red) and the approach outlined in this section (in green).

It is doubtful that the identified adjustments really represent deviations from policy as usual, and so unlikely that these periods will have an effect on the debt-to-GDP ratio. But the red bars are nevertheless likely to be categorised as unsuccessful fiscal adjustments. ‘One-size-fits-all’ analyses that compare successful and unsuccessful adjustments are likely to suffer from a selection problem.

Similarly, ‘one-size-fits-all’ filters are less likely to detect significant changes in fiscal policy in countries where the budgetary process leads to less volatile policy outcomes, such as in Switzerland. In this case the filters suffer from type II errors.

The composition of adjustment and the probability of success

Therefore we instead identify fiscal adjustments (and their success) using the Bai-Perron test in 20 OECD countries. We identify 108 years in which there was a fiscal adjustment, of which 58 are classified as being successful. This deviates substantially from previous research.

Using these findings, we estimate models to identify the determinants of successful fiscal adjustments. Our estimation strategy follows a latent variable framework. We estimate the likelihood of observing a successful adjustment conditional on the presence of a fiscal adjustment. We consider a panel discrete choice model in which the dependent variable is a dummy equal to 1 if there is a successful fiscal adjustment in country i at time t, and 0 when there is an unsuccessful fiscal adjustment. We include the extent to which a fiscal adjustment is spending-based and tax-based, as well as several controls for the state of the economy (like GDP growth) and the need for a fiscal adjustment (like government deficits).

Our results suggest that:

- The lagged budget balance and GDP growth increase the likelihood of a successful fiscal adjustment, but the coefficient of the size of the adjustment is not significant. This contrasts with the findings of some previous papers.

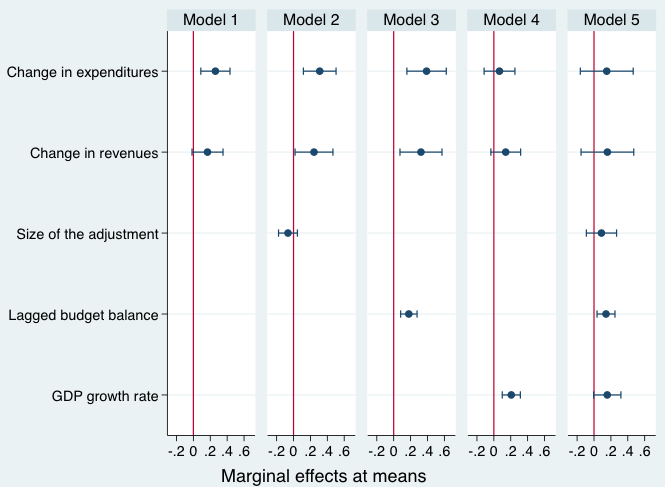

- When we test whether the probability of successful fiscal adjustments differs between expenditure based or revenue-based adjustments, we cannot reject the hypothesis that the effect of the change in expenditures is equal to the effect of the change in revenues (see Figure 2).

Figure 2 Marginal effects of the drivers of the probability of a successful fiscal adjustment in 20 OECD countries

Note: The figure shows the marginal effect of variables believed to cause successful fiscal adjustments, and their 95% confidence intervals. The effect of changes in revenues is never significantly different from the change in expenditures, as the confidence intervals always overlap. The figure shows different model specifications, starting with a simple panel discrete choice model with only the change in expenditures and revenues as explanatory variables. Subsequent models add controls. Model 5 does not plot all variables included in that specification.

We also estimate models in which we use successful fiscal adjustments, as identified using criteria in previous research. When successful fiscal adjustments are identified using some subjective ‘one-size-fits-all’ criterion, we confirm the result that they relied more on spending cuts than tax hikes. Our different identification of successful fiscal adjustments leads us to conclude that successful fiscal adjustments may also be tax-based.

Composition does not affect success

Our results suggest that whether the fiscal adjustment is spending-based or revenue-based does not affect the probability of its success. There may be good reasons to prefer spending-based fiscal adjustments to tax-based ones, but increased likelihood of success is not one of them.

References

Afonso, A and J T Jalles (2012), "Measuring the success of fiscal consolidations", Applied Financial Economics 22(13): 1053-1061.

Alesina, A and S Ardagna (2010), "Large changes in fiscal policy: Taxes versus spending", in J R Brown (ed.), Tax Policy and the Economy, Volume 24, National Bureau of Economic Research.

Alesina, A and V de Rugy (2013), Austerity: The relative effects of tax increases versus spending cuts, Mercatus Research.

Alesina, A and R Perotti (1995), "Fiscal expansions and adjustments in OECD countries", Economic Policy 10: 205–248.

Alesina, A, R Perotti and J Tavares (1998), "The political economy of fiscal adjustments", The Brookings Papers on Economic Activity, Spring: 197–266.

Bai, J and P Perron (1998), "Estimating and testing linear models with multiple structural changes", Econometrica 66: 47–78.

Bai, J and P Perron (2003), "Computation and analysis of multiple structural change models", Journal of Applied Econometrics 18: 1–22.

McDermott, J and R Wescott (1996), "An empirical analysis of fiscal adjustments", IMF Staff Papers 43: 725-753.

von Hagen, J, A Hughes Hallett, and R Strauch (2001), "Budgetary consolidation in EMU", European Commission economic papers 148.

von Hagen, J, A Hughes Hallett, and R Strauch (2002), "Budgetary consolidation in Europe: quality, economic conditions, and persistence", Journal of the Japanese and International Economies 16(4): 512-35.

Wiese, R, R Jong-A-Pin, and J de Haan (2018), "Can successful fiscal adjustments only be achieved by spending cuts?" European Journal of Political Economy, forthcoming.