Predicted demographic developments over the coming decades are well known. Due to low fertility rates and rising life expectancy, OECD nations will see a ‘greying’ of their populations. The fiscal implications have been widely discussed (Kotlikoff 2012). One angle that is under-appreciated is the interaction between increasing spending on health and pensions, the post-crisis growth slowdown, and ongoing fiscal rebalancing efforts.

- According to the empirical literature, high indebtedness may further amplify the economic slump, as it has adverse effects on growth and inflation (Reinhart and Rogoff 2010, Caner et al. 2010, Kumar and Woo 2010, Checherita and Rother 2010).

This raises the question: What degree of consolidation is needed to face increasing social spending and to ensure long-term sustainability?

Implications of health and pension spending for fiscal consolidation

Many countries have already started fiscal consolidations. However, additional consolidation will be required beyond 2012. In a recent paper (Merola and Sutherland 2012), we assess the post-2012 needs. The calculation of long-term fiscal gaps is based on a simple model based on a number of assumptions about growth, interest rates, inflation and underlying fiscal policy. The country-specific model builds on the medium-term baseline projections up to 2025 presented in the OECD’s Economic Outlook (2011a). The fiscal gap (see Blanchard 1993, and Auerbach 1994) indicates the improvement in the primary balance needed to ensure that the debt ratio meets a target in 2050, in terms of either a permanent increase in tax rates or a permanent reduction in the expenditure ratio. The implications of increases in social spending in the absence of reforms can be assessed by allowing health and pension spending to change over the horizon, according to the projections provided by the OECD and the European Commission (European Commission 2009a, European Commission 2009b, OECD 2011b), as reported in Table 1.

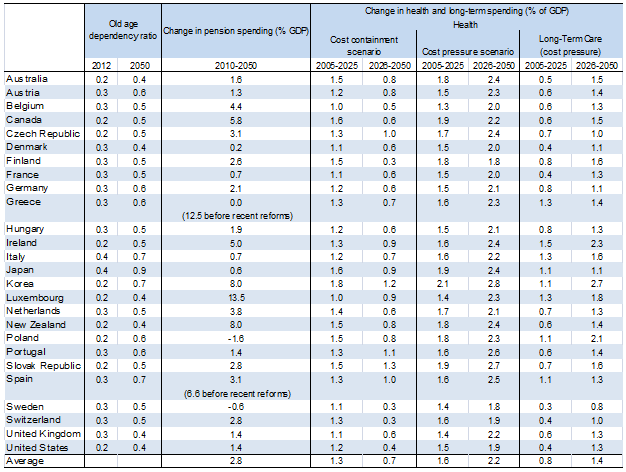

Table 1. Ageing, health and pension spending assumptions

Source: United Nations 2008 revision, OECD (2011b), CBO (2010), European Commission (2009b) and OECD estimates of 2010 pension reforms for Greece and Spain.

Note: For Australia, Canada, Japan, Korea, New Zealand and the US, the horizon is 2000-50.

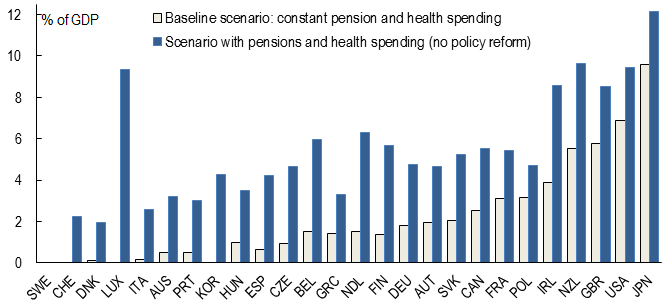

Figure 1 shows the fiscal gaps needed to ensure that the public debt-to-GDP ratio reaches the 50% target in 2050. Under the baseline scenario, which assumes that health and pension spending are constant as a share of GDP, the fiscal gaps present minimum consolidation needs. Allowing health and pension spending to increase, as projected by the European Commission and the OECD, alters the fiscal gaps for many countries radically relative to the baseline scenarios. This result confirms that these spending items play a relevant role in the long-run sustainability assessment.

Even under the baseline scenario, considerable differences across countries emerge. Countries differ mainly because of large differences in underlying deficits at the starting point and to some extent the level of initial debt. Some countries (e.g. Switzerland, Korea, Luxembourg and Sweden) do not face any tightening requirements to meet the target. On the contrary, countries where underlying fiscal deficits were still very high in 2012 face much larger fiscal gaps (e.g. New Zealand, the UK the US and Japan).

Figure 1. Effect of health and pension spending on fiscal gaps: Change in the primary balance needed to bring public debt to 50% of GDP in 2050

Note: The change is for primary balance projected for 2012. Health spending includes long-term care.

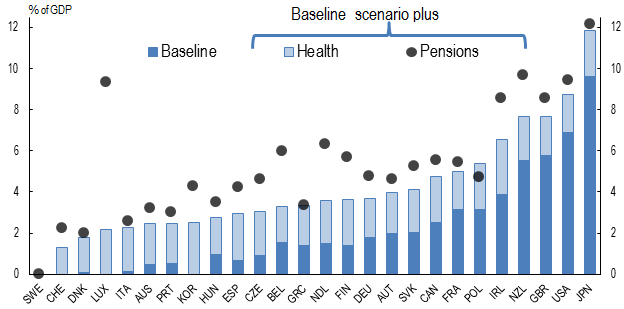

The additional budget pressures relative to the baseline scenario posed by health and pension spending are decomposed in Figure 2. When the health-spending increase is unconstrained and governments do not implement policies to control expenditure growth, fiscal consolidation becomes more difficult in all countries except Sweden. In a few countries, the projected increases in long-term care are substantial and add significantly to the fiscal gap, particularly for Italy, Luxembourg, Finland and Ireland, where such spending adds around an additional percentage point of GDP to the fiscal gap.

Predicted increases in pension spending put additional pressures on public finance, except in Poland and Sweden. In some countries, the increase in pension spending over the next 40 years does not represent a major challenge, either because the population is ‘greying’ at a slow pace (e.g. Denmark) or because pension spending is expected to increase moderately (e.g. in Germany, France, the UK, the US and Japan). On the contrary, the rise in consolidation requirements is far more pronounced in those countries where the predicted increase in pension spending as a share of GDP is large (e.g. Hungary, Switzerland, Finland, the Netherlands, Belgium, Korea and Luxembourg). The fiscal gaps of the countries facing the largest pension spending pressures (e.g. Belgium, the Netherlands and Luxembourg) are large and underline the need for prompt reforms. In Greece and Spain, reforms of their pension system in 2010 addressed the pressure emanating from this source. In Finland, while ageing increasingly weighs on the public finances, considerable financial assets have been built up for supporting future pension spending.

In the Czech Republic, Slovakia, and Canada, the predicted increase in pension spending is quite large. However, pressures on public finances from increasing pension spending are partially muted because the population is comparatively young compared with the other OECD countries.

Figure 2. Contribution to fiscal gaps of health and pension spending

Note: The change is for primary balance projected for 2012. Spending on long-term care is included in total health spending.

Policy reforms

Against the background of rising health and pension spending, structural policies boosting productivity as well as policy reforms to entitlement programmes become particularly important to mitigate budget pressures.

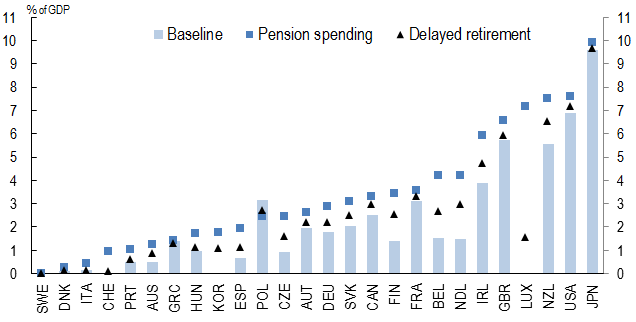

Reforms aimed at delaying pension receipt (e.g. raising the statutory retirement age together with increased penalties for early retirement; indexing the statutory retirement age to increases in life expectancy) cannot only slow the growth of outlays, but can also boost the labour-force participation of elderly workers. Long-run simulations prove that the impact of delaying retirement by five years can be considerable (Figure 3). In those countries in which fiscal gaps are large due to pension spending (e.g. Belgium, Luxembourg and the Netherlands), the reduction in the fiscal gap can be several percentage points.

Figure 3. The effects of delaying the retirement by five years on fiscal gaps: Change in the primary balance needed to bring public debt to 50% of GDP in 2050

Note: The change is for primary balance projected for 2012.

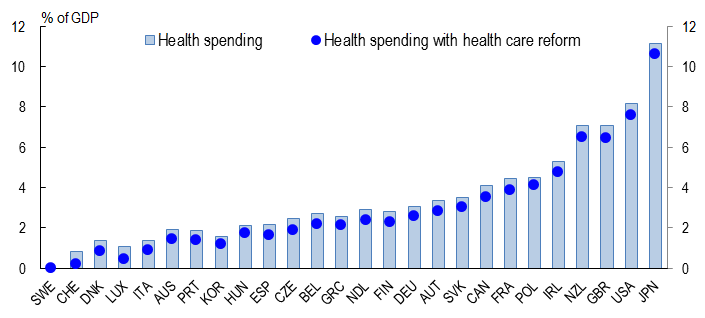

Reforms to health and long-term care spending could also ease some of the pressure on budgets. Figure 4 shows the effect of assumptions that countries are able to moderate the projected increases in health and long-term care spending. The possible scope for savings on health and long-term care may be larger for some countries. Recent research (see Joumard et al. 2010) suggests that reforms of healthcare systems could lead to efficiency gains of almost 2% of 2017 GDP on average in the OECD countries. However, there is no particular institutional arrangement that performs systematically better than others, and cost containment strategies are therefore specific to a country’s starting point, including its choice of healthcare model. The research suggests that, generally, the most effective reforms include those that strengthen and broaden the role of market mechanisms, change reimbursement schemes (e.g. from fee-for-service to capitation or a mix of both), improve public management and control, and impose budget caps.

Figure 4. The effects of healthcare reform on fiscal gaps: Change in the primary balance needed to bring public debt to 50% of GDP in 2050

Note: The change is for primary balance projected for 2012. Spending on long-term care is included in total health spending.

Conclusions

The fiscal gap calculations show that considerable cross-country differences for the scale of fiscal consolidation exist, due to differences in underlying deficits and the level of debt at the starting point. The various scenarios suggest that in several OECD countries, the fiscal challenges are exacerbated in the long-term by spending pressures related to health and pensions. Therefore, to assess whether the public finances are sustainable, projected health and pension costs cannot be neglected. Given the scale of ageing and health and pension costs, reforms to entitlement programmes need to be an important part of any longer-term sustainability strategy.

References

Auerbach, Alan J (1994), “The US Fiscal Problem: Where We Are, How We Got Here, and Where We’re Going,” in S. Fischer and J. Rotemberg (eds.), NBER Macroeconomics Annual, NBER,141-75.

Blanchard, O (1993), “Suggestions for a New Set of Fiscal Indicators” in H A A Verbon and F A A M van Winden (eds.) The Political Economy of Government Debt, 307-325.

Caner, M, T Grennes and F Koehler-Gelb (2010), “Finding the Tipping Point -- When Sovereign Debt Turns Bad”, World Bank Policy Research Working Paper, WPS 5391.

Checherita, C and P Rother (2010), “The Impact of High and Growing Government Debt on Economic Growth. An Empirical Investigation for the euro Area”, ECB Working Paper Series, No. 1237.

European Commission (2009a), Sustainability Report 2009, European Commission, Brussels.

European Commission (2009b), 2009 Ageing Report: Economic and Budgetary Projections for the EU-27 Member States (2008-2060), European Commission, Brussels.

Joumard, I, Hoeller, P André, C and C. Nicq (2010), Health Care Systems: Efficiency and Policy Settings, OECD Publishing.

Kotlikoff, Laurence J (2012), “The hysterical economy”, VoxEU.org, 16 December.

Kumar, M S and J Woo (2010), “Public Debt and Growth”, IMF Working Paper, WP/10/174.

Merola, R and D Sutherland (2012), “Fiscal Consolidation: Part 3. Long-Run Projections and Fiscal Gap Calculations”, OECD Economics Department Working Papers, No. 934.

OECD (2011a), OECD Economic Outlook, 1(89), May, OECD Publishing.

OECD (2011b), Pensions at a Glance, OECD Publishing.

Reinhart, C M and K S Rogoff (2010), “Growth in a Time of Debt”, The American Economic Review, 100(2), 573-578.