Are industrialised countries facing inflation, deflation, or disinflation? The global crisis has led economists to raise all of these possibilities on this site (Eijffinger 2009, Aron and Muellbauer 2008, and Ophèle 2009). Commentators have even questioned whether the golden years of central banking are over (Gerlach et al.2009).

While the recent global recovery has eased most fears of deflation (UK CPI is now 2.9%) this crisis does raise the need to better understand inflationary pressures outside of the good times. An example of efforts to explain inflation in an unusual setting is the “fiscal theory of the price level”.

The defining conditions for this theory are that monetary policy sets no limits on inflation, and that the government pursues policies for taxes and spending which will not ensure solvency by themselves. Fortunately, this is rather unusual.

The theory states that under these conditions, people can only form rational expectations of what inflation or prices will be by evaluating the inflation rate which, via devaluation of the government’s nominal liabilities, will ensure government solvency (see for example Leeper 1991, Woodford 2001 and Cochrane 2001).

Typically we would expect – and even demand – that a government or central bank pursues a monetary policy whose aim is to control inflation, and that the treasury pursues a fiscal policy designed to ensure solvency by changing tax or spending as necessary. But clearly governments have, on occasion, not lived up to these desirable requirements, often because of political pressures or economic ignorance or both. One such occasion is the UK during the 1970s.

A prime candidate: UK during the 1970s

In 1972 the UK government floated the pound while pursuing highly expansionary fiscal policies whose aim was to reduce rising unemployment. To control inflation the government introduced statutory wage and price controls. Monetary policy was given no targets for either the money supply or inflation, interest rates were held at low rates with the aim of accommodating growth and falling unemployment.

From this brief description of policies it would seem that the fiscal policy was not limited by concerns with solvency – this was to be attended to by the market – and that monetary policy was not setting any limits to inflation. Since wage and price controls inevitably broke down in the face of the inflationary effects of such policies, this period appears to be a prime candidate for the theory.

Furthermore, there was no basis for the belief that alternative policies would bring this period to an end. While Margaret Thatcher won the Conservative leadership in 1975 and also the election in 1979, there was no basis to assume that the monetarist policies she advocated would ever occur. So it appears that in the period 1972-79 there was a policy regime prevailing which was expected to continue.

Market discipline drives up inflation – in equilibrium

With a policy regime of this type, the financial markets – forced to price the resulting supplies of government bonds – will take a view about future inflation and set interest rates and bond prices accordingly. It will set bond prices so that the government's solvency is assured in equilibrium. Thus, it will be ensuring that buyers of the bonds are paying a fair price.

Future inflation is therefore expected. If the bonds were priced at excessive value then consumers would have wealth to spend, in that their bonds would be worth more than their future tax liabilities. This would generate excess demand which would drive up inflation. But this mechanism would only come into play out of equilibrium, we would not observe it because markets anticipate it and so drive interest rates and expected inflation up in advance.

New evidence on the fiscal theory of the price level: The 1970s in the UK

In recent research we test whether the fiscal theory of the price level applied to this period (Fan and Minford 2010).

To explain inflation we think of the value of government bonds in the market place as that which will be equal in present value to future government surpluses of tax over spending – the classic definition of solvency. For convenience we define the present value of tax and spending in terms of their ‘permanent’ share of GDP – i.e. the constant shares whose present value is the same as that of the actual path.

By construction, such permanent variables move randomly each period, so we can think of the “current state of fiscal policy” as being defined by their current values. The present value of these policies can then be thought of as the difference between the permanent current values of tax and spending shares discounted by the long-term real interest rate minus the long-term growth rate of the economy. The current real market value of outstanding government bonds must therefore be equated to this by the necessary movement in the long-term nominal interest rate.

This equation pins down the current jump in inflation expectations needed move to push interest rates where they need to go to ensure government solvency. To determine current inflation we assume that it jumps at once to this new long-run rate. We assume this on the grounds that the off-equilibrium excess demand effects are extremely powerful if inflation is below its long-run equilibrium. This assumption implies that inflation, like long-run inflation, follows a random walk.

Doing the random walk

By accumulating all past random movements in inflation, tax and public spending, we obtain that the accumulated level of inflation must also be directly related to the accumulated levels of permanent tax and public spending – that is, they should be cointegrated.

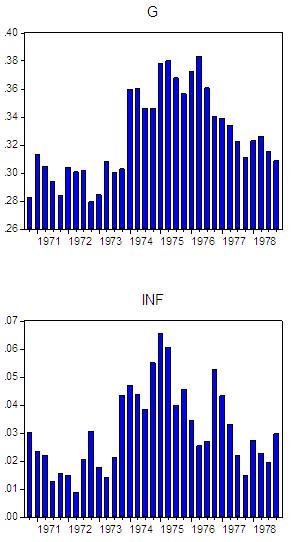

We find that there is in fact no movement in the level of permanent tax – the tax share shows no trend movement over the period. But there is a strong trend pattern in public spending (G in the following chart), first upwards, peaking in the mid-70s and then falling back. This of course quite closely matches the trend behaviour in inflation (INF in the next chart) and the two are cointegrated.

As dictated by the random movement of the permanent public spending share, and other random shocks in the model, the dynamic behaviour of inflation should be a random walk. We estimate the actual dynamic behaviour of inflation by a time-series process and solve the model for inflation behaviour under our identified shock to permanent public spending and all other aggregate shocks.

The model solution together with the actual data over the sample period gives us the sample values of this aggregate shock. We then repeatedly draw random values of this – and the public spending shock – to generate samples of how inflation would have behaved according to the model over the sample period had the shocks arrived randomly instead of as they actually did.

We compare these modelled inflation shocks with the ones in the data. Do they lie within the 95% confidence bounds implied by the model? We found that they did – and for a wide variety of possible time-series processes. Indeed none of these processes were significantly different from a random walk. So, as implied by the model, inflation was indeed a random walk during this period.

References

Aron, Janine and John N Muellbauer (2008), “US price deflation on the way”, VoxEU.org, 10 October.

Eijffinger, Sylvester (2009), “Deflation or stagflation in the Eurozone”, VoxEU.org, 15 January.

Fan, Jingwen and Patrick Minford (2010), “Can the Fiscal Theory of the price level explain UK inflation in the 1970s?”, CEPR Discussion Paper 7630.

Gerlach, Stefan, Alberto Giovannini, Cédric Tille (2009), “Are the golden years of central banking over?”, VoxEU.org, 17 July.

Ophèle, Robert (2009), “Deflation or disinflation”, VoxEU.org, 11 February.