Nowcasting and short-term forecasting economic conditions during the Covid-19 crisis are of key interest for economic and policy decision-making (e.g. Helsinki Graduate School of Economics Situation Room 2020). Yet, unfortunately, obtaining reliable nowcasts and forecasts during crisis periods is very difficult, and all the peculiar features of the Covid-19 crisis make it even more difficult.

In a recent paper (Foroni et al. 2020), we consider various approaches previously suggested in the literature, and try to adapt them whenever possible to the specificity of the Covid-19 period and assess their performance during the worst recent crisis – the financial crisis of 2007-2009 – and the following recovery period. Specifically, we evaluate (i) combining forecasts across various specifications for the same model and/or across different models (e.g. Timmermann 2006); (ii) extending the model specification by adding moving-average (MA) terms (e.g. Foroni et al. 2019); (iii) enhancing the estimation method by taking a similarity approach (e.g. Dendramis et al. 2020); and (iv) adjusting the forecasts to put them back on track by a specific form of intercept correction (e.g. Clements and Hendry 1999). Of course, all these methods are second-best with respect to a sophisticated non-linear, time-varying model capable of capturing the specificities of all the past recessions and of the Covid-19 crisis, but the specification of such a model would be very complex, as well as its estimation with the rather short time series available for economic variables (e.g. Ferrara et al. 2015 in the context of forecasting during the financial crisis). Hence, our second-best approach seems promising, though its usefulness and reliability has to be carefully assessed.

In terms of nowcasting models, we consider standard and unrestricted mixed-data sampling (MIDAS) specifications (Ghysels et al. 2004, Clements and Galvão 2008, Foroni et al. 2015) for quarterly GDP growth, with commonly used monthly indicators (industrial production, employment, surveys, spreads, etc.), combined with direct forecasting when the forecast horizon is larger than one quarter (e.g. Marcellino et al. 2006).

Specifically, for the Covid-19 pandemic, the timing of the exercise is as follows. We nowcast the first quarter of 2020, and then forecast until the fourth quarter of 2022, given the monthly information available at the end of April 2020, before the first official release of US GDP for 2020Q1. At that point in time, we observe 2019Q4 for GDP, and the first three months of 2020 for all the monthly indicators we use. Hence, we nowcast the current quarter with monthly predictors available for all three months. This is important in the case of the Covid-19 pandemic since the shutdown of the economy only started in March. Yet, even when information up to March 2020 is included within the best mixed frequency models for nowcasting GDP growth in the first quarter of 2020, the resulting error is large (the nowcasts are too optimistic), in line with Carriero et al. (2020) and Plagborg-Møller et al. (2020), which suggests that the forecasted fast recovery could also not take place (as it also happened after the financial crisis).

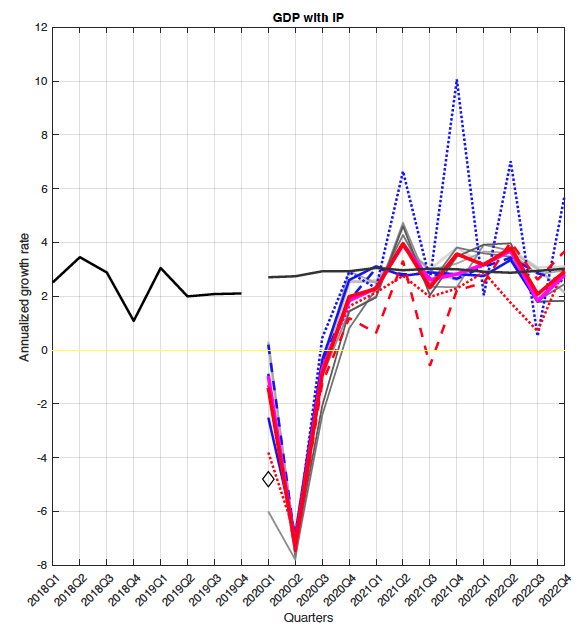

Figure 1 plots the nowcasts and forecasts for the US GDP using a set of mixed-frequency models and industrial production (IP) as a predictor. The average and median predictions across models are also added, as standard examples of the combination of individual forecasts. The top panel shows the annualised growth, while the implied level forecasts are in the bottom panel. Most of the models predict a 1.5% fall of the GDP annualised growth in 2020Q1. As the actual (first released) value of GDP growth by the US Bureau of Economic Analysis (BEA) for 2020Q1 was -4.8%, the majority of the models produced overly optimistic nowcasts.

Figure 1 Actual forecasts of COVID-19 recession and recovery

All this justifies the need for nowcasting and forecast improvement. Among all the methods considered to increase the reliability of nowcasts and forecasts for US growth for the Covid-19 period, adjusting them by an amount similar to the nowcast and forecast errors made during the financial crisis and following recovery seems to produce the best results, notwithstanding the different source of the financial crisis and the fact that the services sector was less affected than in the Covid-19 case. In particular, the adjusted nowcasts for 2020Q1 produced by several mixed frequency models get closer to the actual value, and the adjusted forecasts based on alternative indicators become much more similar, all unfortunately indicating a much slower recovery and very persistent negative effects on trend growth.

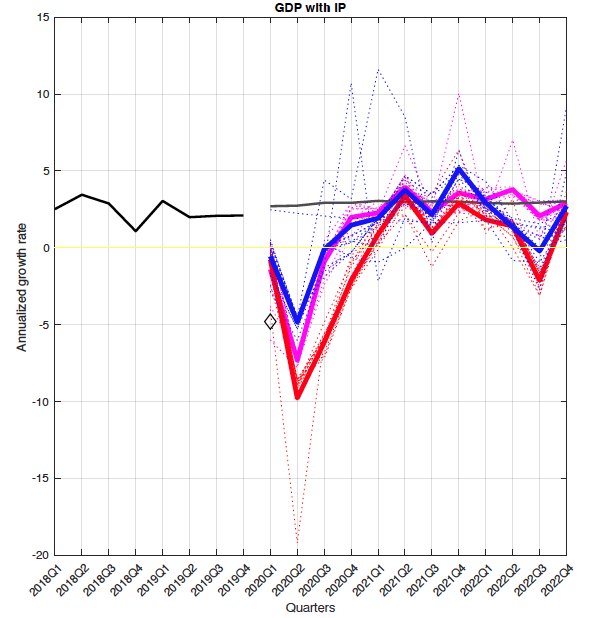

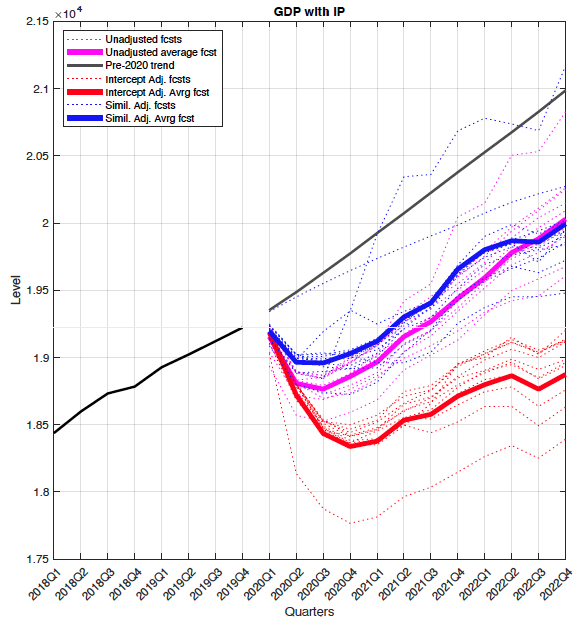

Figures 2 compares the GDP growth and level forecasts for the US from Figure 1 with predictions adjusted by intercept correction or similarity-based estimation. We focus on average forecasts (in bold), with results for other models in dashed lines. More specifically, the intercept corrected nowcasts and forecasts are obtained for each model and indicator by adding to the unadjusted values in Figure 1 the nowcast and forecast errors made by the same model for each horizon over the period 2008Q3–2011Q3. For similarity-based estimation, each model is estimated only over the period 2002Q1–2013Q4 and the resulting estimated parameters are used to construct the nowcasts and forecasts for the period 2020Q1-2022Q4.

The figures highlight that similarity estimation has overall limited effects on the nowcasts and forecasts, while the differences are substantial with intercept correction. In particular, the adjustment does not affect the 2020Q1 nowcast, but the average corrected growth forecasts are lower than the uncorrected ones for each horizon. As a consequence, there are even larger differences between corrected and uncorrected forecasts for GDP level, with the former suggesting that the pre-Covid-19 level could not be reached even by the end of 2022.

Figure 2 Adjusted forecasts of COVID recession and recovery

A rationale to build our forecast adjustments for the Covid-19 crisis on the Great Recession lies in similarities between the two downturns. Although the Great Recession and the Covid-19 crisis are the result of different shocks, they also share similarities. It is true that the financial conditions during the Covid-19 crisis did not deteriorate as much as during the Great Recession, possibly due to the timely reaction of the monetary authority, as suggested in Boivin et al. (2020). Further, both producer and consumer sentiments fell, but they did not achieve the bottom of 2008, while the oil price was already decreasing before the pandemic shock. However, several similarities with the financial crisis can be observed. First, both financial and pandemic collapses were unprecedented, of course with a major difference that the trigger is not the same. Nevertheless, both shocks are of a large size rarely observed in modern history, potentially implying non-proportional and long-lasting effects as noted previously. Second, we are back to the zero lower bound regime for monetary policy and further stimulus is likely to be less effective, implying a slower recovery. Lastly, uncertainty is playing a major role in both recessions. Hence, we believe that the performance of nowcasting models during the Great Recession could be informative for the Covid-19 crisis, which is indeed what we find empirically, at least for 2020Q1.

References

Boivin, J, M Giannoni and D Stevanovic (2020), “Dynamic effects of credit shocks in a data-rich environment”, Journal of Business & Economic Statistics 38(2):272–284.

Carriero, A, T Clark and M Marcellino (2020), “Nowcasting tail risks to economic activity with many indicators”, Technical report, Cleveland FED WP 20-13.

Clements, M and A B Galvão (2008), “Macroeconomic forecasting with mixed-frequency data: Forecasting output growth in the united states”, Journal of Business and Economic Statistics 26.

Clements, M P and D F Hendry (1999), Forecasting Non-Stationary Economic Time Series, The MIT Press.

Dendramis, Y, G Kapetanios and M Marcellino (2020), “A similarity-based approach for macroeconomic forecasting”, Journal of the Royal Statistical Society - Series A, forthcoming.

Ferrara, L, M Marcellino and M Mogliani (2015), “Macroeconomic forecasting during the great recession: The return of non-linearity?”, International Journal of Forecasting 31:664–679.

Foroni, C, M Marcellino and C Schumacher (2015), “U-MIDAS: MIDAS regressions with unrestricted lag polynomials”, Journal of the Royal Statistical Society - Series A 178(1):57–82.

Foroni, C, M Marcellino and D Stevanovic (2019), “Mixed-frequency models with ma components”, Journal of Applied Econometrics 34(5):688–706.

Foroni, C, M Marcellino and D Stevanovic (2020), “Forecasting the Covid-19 recession and recovery: lessons from the financial crisis”, ECB Working Paper 2468.

Ghysels, E, P Santa-Clara and R Valkanov (2004), “The MIDAS touch: Mixed data sampling regression”, Technical report, Department of Economics, University of North Carolina, Chapel-Hill, North Carolina.

Helsinki Graduate School of Economics Situation Room (2020), “Real-time economic analysis of the COVID-19 crisis: Lessons from Finland”, VoxEU.org, 21 May.

Marcellino, M, J H Stock and M W Watson (2006), “A comparison of direct and iterated multistep ar methods for forecasting macroeconomic time series”, Journal of Econometrics 135:499–526.

Plagborg-Møller, M, L Reichlin, G Ricco and T Hasenzagl (2020), “When is growth at risk?”, Brookings Papers on Economic Activity, forthcoming.

Timmermann, A (2006), “Forecast Combinations”, In G Elliott, C Granger and A Timmermann (eds.), Handbook of Economic Forecasting, volume 1, chapter 4, pages 135–196, Elsevier.