With an estimated average daily trading volume of $4 trillion, the foreign exchange (Forex) market is by far the world’s largest market (Bank for International Settlements 2010). Due to this size, market participants commonly regard foreign exchange as highly liquid at all times – liquid in the sense that you can buy or sell very large sums quickly and without turning the price against yourself by much.

In a recent study we challenge this view by documenting significant declines in Forex liquidity during the 2007-2009 financial crisis. Moreover, Forex liquidity risk impairs investors' international diversification and affects the returns of popular Forex trading strategies such as carry trades (Mancini et al. 2012).

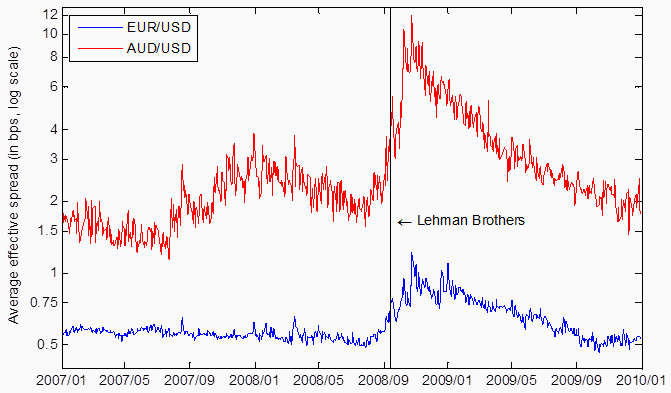

Using a novel and comprehensive dataset of intraday data from Electronic Broking Services (EBS), the leading platform for spot Forex interdealer trading, we estimate various liquidity measures capturing different dimensions of market liquidity. An asset is considered liquid if it can be sold quickly, at low cost, without causing a significant price change. We investigate price impact, trading costs, and price dispersion of exchange rates finding significant temporal and cross-sectional variation in Forex liquidities. Contrary to common perceptions, all exchange rates experienced a significant decline in liquidity during the financial crisis, especially after the bankruptcy of Lehman Brothers. For the least liquid exchange rates, the liquidity evaporation was ten times more severe than for the most liquid ones (see the comparison of effective bid-ask spreads between AUD/USD and EUR/USD in Figure 1).

Figure 1. Average daily effective spread

Forex illiquidity is not isolated to certain exchange rates. Market liquidities of individual currencies move together and are positively, but to different degrees, related to market-wide Forex liquidity. This commonality in liquidity implies that Forex liquidity is largely driven by shocks affecting the Forex market as whole rather than by idiosyncratic shocks to the liquidity of individual exchange rates. Forex market liquidity is in turn tied to market-wide liquidity of other asset classes such as equities and bonds, highlighting that liquidity shocks are a cross market phenomenon.

What do these results mean for a foreign exchange investor in practice? To quantify illiquidity costs, we develop an example of a speculator who engages in the AUD/JPY carry trade, i.e., she borrows in low yielding Japanese yen and invests in high yielding Australian dollars. She is forced to unwind her position when markets are illiquid, for instance, because she is not able to roll over short-term positions. In a realistic scenario of sudden exchange rate movements in conjunction with high bid-ask spreads, we show that the speculator loses 13% of her capital – 25% more than in the benchmark case without Forex liquidity cost. Thus, losses due to Forex illiquidity can be substantial.

Forex illiquidity does not only affect speculators, but every investor or company that owns assets denominated in foreign currencies. Even worse, commonality in Forex liquidity implies that the phenomenon of diminishing liquidity and the corresponding Forex illiquidity cost affect all exchange rates and thus Forex liquidity risks cannot be diversified away easily. The commonality in market-wide liquidity of foreign exchange, equity, and bond markets suggests that liquidity risk impairs the efficacy of international and cross asset class diversification: Even a broadly diversified portfolio across asset classes is likely to suffer liquidity issues in crisis periods when market-wide liquidities of different asset classes deteriorate contemporaneously.

Liquidity risk in the foreign exchange market also helps explaining the profitability of carry trades – a long-standing conundrum in the field of finance. According to Uncovered Interest rate Parity (UIP), the expected carry trade return is zero, because exchange rates move to compensate for the interest rate differential. Historically, however, carry trades have yielded an annual return of more than 5% (Burnside et al. 2011). Previous studies have identified the volatility of global equity markets (Lustig et al. 2011) or the volatility of Forex markets (Menkhoff et al. 2012) as risk factors driving carry trade returns. We find that carry trade returns can, at least partially, be explained by Forex liquidity risk.

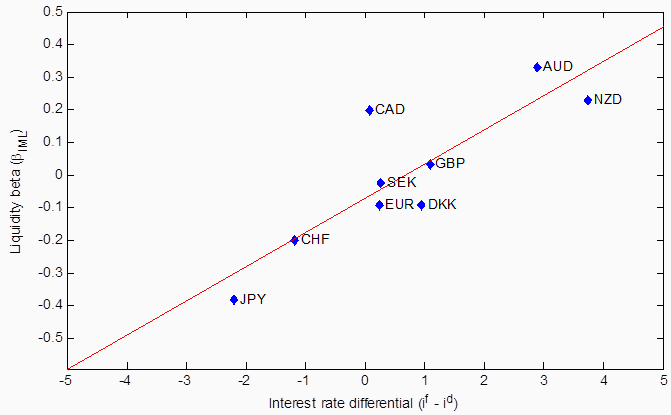

We call the link between currency return and liquidity risk ‘liquidity betas’. As shown in Figure 2, low interest rate currencies exhibit negative liquidity betas, thus funding currencies offer insurance against liquidity risk. On the other hand, liquidity betas for high interest rate currencies are positive, hence investment currencies provide exposure to liquidity risk. The opposite signs of liquidity betas of high and low interest rate currencies have important implications for carry trade returns. When Forex liquidity improves, high interest rate currencies appreciate further, because of positive liquidity betas, while low interest rate currencies depreciate further, because of negative liquidity betas, increasing the deviation from UIP. During the unwinding of carry trades (i.e., when investors sell high interest rate currencies and buy low interest rate currencies), market-wide Forex liquidity drops and liquidity betas lead to further selling pressure on investment currencies, which exacerbates currency crashes. This finding is consistent with a flight to liquidity and suggests that investors may demand a risk premium for bearing Forex liquidity risk.

Figure 2. Liquidity betas and interest rate differentials from the perspective of a US investor

Liquidity spirals may trigger our findings of declining Forex liquidity, commonality in Forex liquidity, and liquidity risk premiums in Forex returns (see Brunnermeier and Pedersen 2009). The theory of liquidity spirals implies that traders are forced to liquidate positions when funding liquidity diminishes. This selling pressure reduces market-wide liquidity and triggers large price drops. We provide evidence that when traders' funding liquidity decreases, market-wide Forex liquidity drops, which then affects exchange rates via their liquidity betas. Figure 3 illustrates the time series evolution of our index of illiquidity in the Forex market, the TED spread as well as the VIX volatility index, highlighting the connection between investors' uncertainty and fear (proxied by the VIX), funding strains (proxied by the TED spread), and Forex market liquidity.

Figure 3. Uncertainty in the market, funding strains, and Forex market illiquidity

Several policy implications can be drawn from our study. From a central bank perspective commonality in Forex liquidity implies that providing liquidity for a specific exchange rate may have positive spillover effects to other currencies. Take the example of investment currencies during an unwinding of carry trades. A central bank’s liquidity injection in its own currency could alleviate liquidity strains in other investment currencies and moderate the sudden appreciation (depreciation) of funding (investment) currencies. Moreover, our empirical evidence on liquidity spirals suggests that monetary policies aimed at relieving funding market constraints could also improve Forex market liquidity in all exchange rates. But abundant liquidity may have adverse consequences. Overwhelming liquidity in one currency tends to spread to other currencies in general and investment currencies in particular. In risk-taking environments with attractive carry trade opportunities, ample liquidity could bolster speculative trading.

References

Bank for International Settlements (2010), “Foreign exchange and derivatives market activity in April 2010”, Triennial Central Bank Survey.

Brunnermeier, Markus, and Lasse Pedersen (2009), "Market liquidity and funding liquidity", Review of Financial Studies, 22(6):2201-2238.

Burnside, Craig, Martin Eichenbaum, Isaac Kleshchelski, and Sergio Rebelo (2011), "Do peso problems explain the returns to the carry trade?", Review of Financial Studies, 24(3):853-891.

Lustig, Hanno, Nikolai Roussanov, and Adrien Verdelhan (2011), "Common risk factors in currency markets", Review of Financial Studies, 24(11):3731-3777.

Mancini, Loriano, Angelo Ranaldo, and Jan Wrampelmeyer (2012), "Liquidity in the foreign exchange market: measurement, commonality, and risk premiums", Journal of Finance, forthcoming.

Menkhoff, Lukas, Lucio Sarno, Maik Schmeling, and Andreas Schrimpf (2012), "Carry trades and global foreign exchange volatility", Journal of Finance, 67(2):681-718.