There is no doubt that the macroeconomic debate and actual macroeconomic policy in Germany differ considerably from other countries. At first sight this is difficult to explain, as in academia the same textbooks and models are used as in other countries. But behind the formal theoretical apparatus stands a specific paradigm of macroeconomics which was developed by Walter Eucken and which is diametrically opposed to Keynesian economics. From the experience of the Great Depression, Keynes drew the conclusion that active demand management is necessary. Eucken, however, developed from the specific German experience of the 1930s a theory according to which ‘full employment policy’ leads to a centrally planned economy. While Keynes saw the Depression as a result of the inherent instability of the market economy, Eucken attributed it to an insufficient flexibility of wages and an inadequate monetary order. In his view, with flexible prices and wages and an adequate monetary order the instability of the market system can be avoided. Eucken’s dismissal of macroeconomic policy helps to explain the German focus on balanced budgets, price stability, and structural reforms and the neglect of aggregate demand at the German as well as at the European level. The obvious fact that the German economy did quite well with this approach can be explained by its very pronounced openness. Thus in spite of its size, Germany can be regarded as a relatively small economy which can rely on the rest of the world to sustain its aggregate demand. As this is not the case with the Eurozone, the application of the German paradigm leads to negative outcomes.

The German macroeconomic policy paradigm

The German macroeconomic policy paradigm rest on three pillars:

- An almost religious fixation1 on balanced fiscal budgets, which reflects a very sceptical assessment of the effectiveness of demand management and the ability of governments to identify profitable investment projects. In 2009 this philosophy was legally enshrined in the so-called 'debt brake', which has become a part of the federal constitution. The ‘fiscal compact’ which was enacted in 2012 obliges the other member states to implement similar regulations in their national constitutions. The neglect of the demand-side effects of fiscal policy shapes the German approach to the EZ crisis and the insistence on austerity at any price.2

- A very strong preference for price stability as the overarching target of monetary policy with an asymmetric tolerance for deviations. While inflation rates above the ECB’s target of “below, but close to 2%” are regarded as dangerous, to many economists the actual EZ inflation rate of 1% is not a matter of concern (Issing 2016).

- A deep conviction that flexible prices are the most important contribution to the solution of unemployment problems. This is reflected in the German ‘wage moderation’ of the years 2000 to 2007, which was designed as a strategy to reduce unemployment in Germany (Bofinger 2016). This also explains the plea of German economists for structural reforms as the main solution to the problems in the Eurozone.

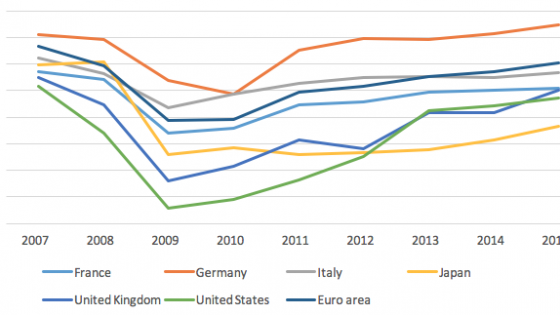

This specific German paradigm has effectively shaped German macroeconomic policy, which stands in strong contrast to the policies of other major economies. This applies above all to fiscal policy since the crisis. While the US, the UK, and Japan allowed very high deficits for a prolonged period of time, in Germany the deficit was rather limited and already in 2011 it was almost back to balance (Figure 1).

Figure 1 Fiscal balances (% of GDP)

Source: OECD Economic Outlook, Annex Tables

A German influence can also be identified in the monetary policy of the ECB. Its reaction to the Great Recession was much weaker than the reaction of other major central banks. In 2011 the ECB even raised its policy rate although the Eurozone was in the middle of the crisis. And while the other major central banks had started comprehensive quantitative easing programmes rather early, the ECB waited until 2015.

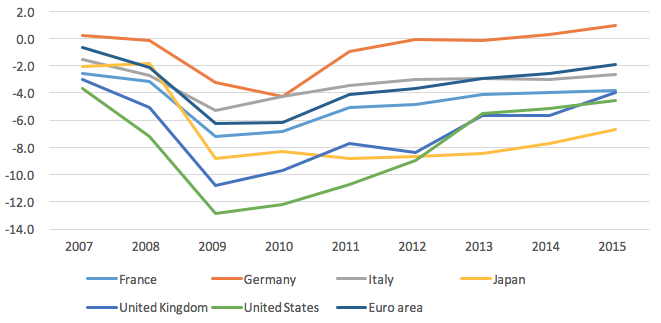

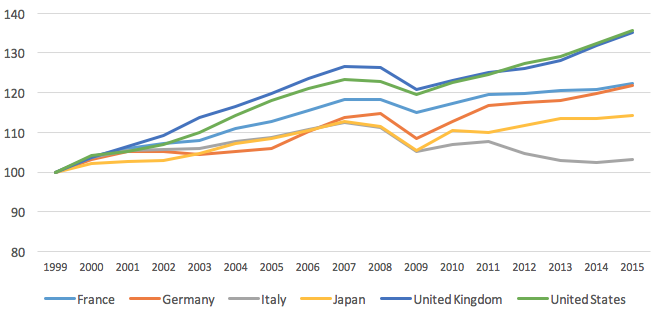

The German approach to unemployment is reflected in the development of unit labour costs. With the exception of Japan, since the start of the monetary union all the other major advanced countries have had much stronger increases in unit labour costs than Germany (Figure 2).

Figure 2 Unit labour costs

(1999=100)

Source: European Economy, Statistical Appendix.

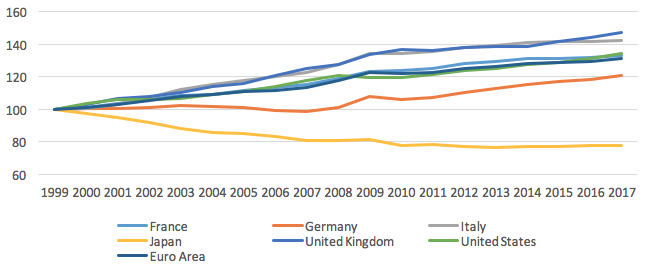

Whatever one may think of the German macroeconomic paradigm, there is no doubt that it has been relatively beneficial for German economic performance, at least in the longer run (Figure 3). While German growth was weaker than in the US and the UK, it was in line with France and better than in Italy and Japan. Especially impressive is the reduction of unemployment in Germany since 2005.

Figure 3 Real gross domestic product

(1999=100)

Source: IMF, World Economic Outlook Database.

The living heritage of Walter Eucken

At first sight, the specific macroeconomic policy paradigm is difficult to explain. German university students read the same macroeconomic textbooks as students in other countries and at the advanced level the standard DSGE models are taught and applied. But behind the formal theoretical apparatus one can identify a specific paradigm to economic policy, called ‘Ordnungspolitik’, which in this form does not exist in other countries. While there are no university courses on this topic, Ordnungspolitik plays an important role in German academic debate on policy issues and actual economic policy.

For an understanding of this paradigm, it is useful to have a closer look at the works of Walter Eucken (1891-1950). Eucken taught at Freiburg University from 1927 until his death and he is regarded as the spiritus rector (guiding spirit) of the so-called ‘Freiburger Schule’. The recent celebrations of his 125th birthday underline his impact for present-day policymakers. In her speech at this occasion, Angela Merkel (2016) emphasised that the principles of the ‘Freiburger Schule’ had lost nothing in relevance and importance.

Walter Eucken’s philosophy of economics can be presented in a positive and a negative message (Oliver 1960). The positive message is presented in his ‘constitutive’ and ‘regulatory principles’. Without going into detail these principles do not look very original, they are almost trivia.[3] As Oliver (1960) argues, they are very similar to the programme which was developed by the Chicago School, above all by Henry Simons (1948). In fact, most economists outside Germany would more or less agree with these principles as a precondition for an optimum allocation of resources.

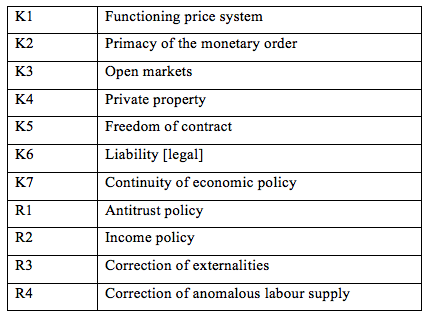

Table 1 Eucken’s constituent (K) and regulatory (R) principles

Source: Van Suntum et al. (2011)

For the macroeconomic policy paradigm, the more interesting elements of Eucken’s philosophy concern his negative messages. They include not only an outright dismissal of central planning, which was prevalent at the time when Eucken was active, but also a very strong critique of what he calls the ‘policy of full employment’. He uses this term for a Keynesian style expansionary fiscal policy but without mentioning Keynes. In his works, Eucken only discusses the German experience in the 1930s, which was dominated by the takeover of the Nazi government in 1933. Eucken draws a direct line from the ‘policy of full employment’ to price controls, rationing, and central planning:

“Thus the policy of full employment, like the corporative structure of the labour market, resulted in a marked tendency towards central control of the economy. The one, like the other, was conducive to an unstable economic system with a tendency to move in the direction of central control. So there were two strong historical forces impelling German economic policy along the path to central control: firstly, the formation of comprehensive economic and social pressure groups, and secondly, the policy of full employment.” (Eucken 1952a, p. 60)

Thus, it was not the Nazis that brought Germany under dictatorship, but trade unions (the “corporative structure of the labour market”) and Keynesian demand policies. The complete neglect of the extreme political situation in Germany in the years from 1933 to 1945 also becomes obvious in Eucken’s analysis of the consequences of Hitler’s economic policy:

“It is one [a disturbance, P.B.] in which, though all factors are engaged, human activities are not properly co-ordinated and investments are not in line with one another, with the result that bottlenecks form.” (Eucken 1952a, p. 80)

A more awkward description of the German war economy is difficult to imagine. From this very flawed analysis of the German experience in the years 1933 to 1945, Eucken develops a general theory of ‘full employment policy’.

“Thus, our review of the German experience leads us to a grave and serious conclusion: Economic policy is faced with a dilemma: on the one hand, mass unemployment necessitates a full employment policy; on the other the policy of full employment makes for an instability on other markets, which is extremely dangerous, and in addition forces economic policy in the direction of central planning. This dilemma is perhaps the most crucial economic and social problem of our time.” (Eucken 1952a, p. 66).

In the path from ‘full employment policy’ to centralisation, Eucken sees an important role for inflation:

“Not only did the inflations destroy the price system and hence all free types of economic order, not only did they engender or decisively foster the tendency to central planning, but they were also a precondition for the existence of central planning.” (Eucken 1952a, p. 73)

Eucken’s solution to the dilemma is related to his analysis of the main causes of the deflation in the years 1929-33.4 In his view, price and wages were not sufficiently flexible:

“In the crisis year, 1931, Berlin builders, for instance, had to reckon with relatively firm prices of materials, such as iron and cement, which were fixed by syndicates, and also with relatively fixed wages, where housing prices were dropping rapidly.” (Eucken 1952a, p. 78)

In addition, the monetary system had a destabilising effect on the economy:

“When price fell, money contracted further, and so on indefinitely, the fall in prices causing contraction of money and a further fall in prices.” (Eucken 1952a, p. 67)

This leads Eucken to the conclusion:

“It can be firmly established that unstable market forms and monetary systems are bound to lead to cumulative depression and mass unemployment. This being so, economic policy should concentrate on developing systems conducive to market equilibrium, and in this respect the configuration of the monetary system is particularly important.” (Eucken 1952a, p. 67)

And if this can be properly organised, a permanently stable equilibrium can be reached:

“The policy of full employment will then no longer be necessary and the great dilemma will have been overcome.” (Eucken 1952a, p. 67)

These are strong conclusions. They stand in some contrast to Eucken’s view on the theory of the business cycle that he develops in his book Grundlagen der Nationalökonomie (Principles of Economics) (Eucken 1949). In this book, he adopts a completely agnostic standpoint. He maintains that theories trying to make general statements on seemingly regularly occurring changes in economic development are bound to fail.

All in all, Eucken’s economic philosophy can be regarded as the complete antithesis to Keynes. As Riese (1972) argued, both Eucken and Keynes were children of the Great Depression. But while Keynes developed a theory which explains why market economies are not perfectly self-stabilizing even if prices are fully flexible, Eucken saw the instability as caused by insufficient price flexibility and a destabilising monetary system. Thus, Riese is correct when he argues that the messages of Keynes and Eucken are incompatible (Riese 1972, p. 45).5

In retrospect, it is quite astonishing that Eucken thought he could develop general economic principles from the very specific historical experience of Germany in the years 1933 to 1945.6 It may be due to the difficult times when he was writing his books that he does not make any explicit reference to the dictatorship of the Nazis and the very specific economic and political conditions of a country that is in a ‘total war’. It is also difficult to explain why Eucken does not discuss the writings of John Maynard Keynes that were published in the 1930s or, for example, those of Hayek (1929). In fact, he does not make any specific reference to the leading economists of his time or to the vast theoretical literature on economic cycles that was available at the time he worked. Eucken also makes no attempt to support his reasoning with any statistical material. The severe limitations of his analyses and his complete unawareness of this may be regarded as a symptom of the isolation of German intellectuals under the comprehensive totalitarianism of the Nazis and the growing devastations of World War II.7 In fact, Eucken died as early as March 1950 so he had almost no chance to discuss his views with a broader international academic community.

If one compares Eucken’s narrow macroeconomic analyses with the comprehensive theories of Keynes, Hayek or Schumpeter, his long-standing popularity and reputation in Germany is hard to understand. Above all there is no doubt his crude dismissal of ‘full employment policies’ has been refuted by the evidence. Jewkes (1952a), who wrote an introduction to the English translation of Eucken’s works, mentioned the rather successful full employment policies of the US and the UK, which did not lead to a centrally planned economy. And since then repeated applications of ‘full employment policies’ have contributed to macroeconomic stabilisation in the global economy without leading to central planning. On the contrary, the centrally planned economies have lost ground in many countries.

In the 1950s Eucken’s popularity in Germany can be explained by a lack of internationalisation of the German academic community. But today it is difficult to understand why German politicians and academics still regard him as an outstanding economist and why his philosophy still shapes the German paradigm of macroeconomics. One explanation could be that he is simply used as a symbol of a neoliberal approach and that most of his followers have never read his works on macroeconomic issues.

But there is no doubt that Eucken’s heritage is very much alive in the German macroeconomic paradigm as it has been already described:

- Eucken’s aversion to ‘full employment policy’ by means of fiscal policy is reflected in the German approach to fiscal policy at the national and the European level;

- Eucken’s negative attitude towards trade unions and corporatism is reflected in proposals for ‘structural reforms’ which reduce the bargaining power of trade unions;

- Eucken’s theory that inflation destroys “all free types of economic order” shapes the German attitude towards monetary policy.

Why has German macroeconomic policy been successful?

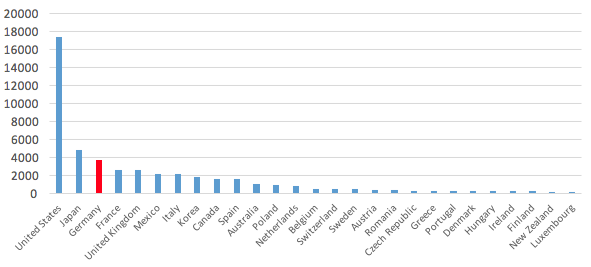

The strong support for the anti-Keynesian paradigm in Germany can be explained by the quite successful economic performance of the German economy since World War II and again since the mid-2000s. Given the limitations of the theoretical framework of the German Ordnungspolitik, this raises an obvious conundrum. It can be solved if one takes into account the relatively large size of the German economy and its pronounced openness. In terms of GDP German is the third largest economy in the group of advanced economies (Figure 4).

Figure 4 GDP based on purchasing power parity valuations of countries

Source: IMF, World Economic Outlook Database.

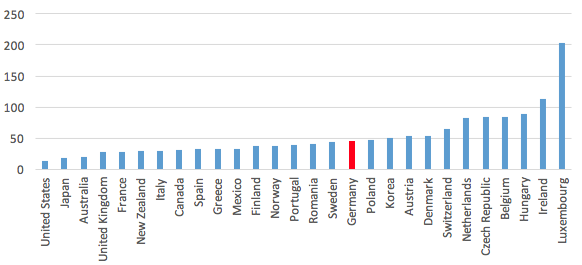

But in terms of openness (exports as a percent of GDP), Germany ranks among relatively small economies (Figure 5). Due to this openness, the German economy is able to follow a passive macroeconomic policy approach as it strongly benefits from macroeconomic policies pursued in other major countries. In other words, the German economy is supported by the ‘full employment policies’ of other countries. This is reflected in the very large fiscal deficits in all other major economies in the period after 2007, which successfully helped to avoid a reappearance of the Great Depression. In other words, the German economy is supported by the demand management policies of other countries that are heavily criticised by mainstream German economists.

Figure 5 Openness: Exports (% of GDP)

Source: World Economic Outlook Database.

Editors’ note: This column first appeared as a chapter in the EPC ebook, “German macro: how it's different and why that matters”, edited by George Bratsiotis and David Cobham.

References

Bofinger, P (2015), ‘German wage moderation and the EZ Crisis’, VoxEU, 30 November

Eucken, W (1949), Die Grundlagen der Nationalökonomie, 9th edition, 1989, Springer, Berlin, Heidelberg, New York

Eucken, W (1952a), This Unsuccessful Age or The Pains of Economic Progress, Oxford University Press, New York

Eucken, W (1952b), Grundsätze der Wirtschaftspolitik, 6th edition, J.C.B. Mohr, Tübingen

Hayek, F A (1929), Geldtheorie und Konjunkturtheorie, Vienna and Leipzig

IMF (2013), Greece, IMF Country Report No. 13/20

Issing, O (2016), Interview, "Nichts ist in Stein gemeißelt", Börsen-Zeitung 13, p. 7.

Jewkes, J (1952a), Introduction to Walter Eucken, This Unsuccessful Age, Oxford University Press, New York

Merkel, A (2016), Rede von Bundeskanzlerin Merkel beim Festakt zum 125. Geburtstag von Walter Eucken,13 January.

Oliver, H (1960), ‘German Neoliberalism’, Quarterly Journal of Economics, 74 (1), 117-149

Riese, H (1972), ‘Ordnungsidee und Ordnungspolitik – Kritik einer wirtschaftspolitischen Konzeption‘, Kyklos 25 (1), 24–48

Sinn, H-W (2015), ‘The Greek Tragedy’, CESifo Forum Special Issue, Munich 2015

Simons, H C (1948), Economic Policy for a Free Society, Chicago: University of Chicago Press, 1948

Vanberg, V J,(2011), ‘The Freiburg School: Walter Eucken and Ordoliberalism’, Freiburg Discussion Papers on Constitutional Economics

van Suntum, U, T Böhm, J Oelgemöller and C Ilgmann (2011), ‘Walter Eucken’s Principles of Economic Policy Today’, CAWM Discussion Paper No. 49, August 2011.

Endnotes

[1] This is reflected in the label of the ‘black zero’, which describes the slight budget surplus of the German Federal Government since 2014. It is celebrated in the media and the public as an epochal achievement.

[2] An example of the complete neglect of the demand side effects of austerity is provided by the analysis of the ‘Greek Tragedy’ by Hans-Werner Sinn (2015, p. 10). This leads him to the question: “At first sight, it may seem puzzling that Greece’s economy, despite the huge financial help it has received, has not improved and actually appears sicker than ever.” But instead of referring to the effects of an ‘unprecedented’ budget consolidation (IMF 2013, p. 39), he presents an odd ‘Dutch disease’ story.

[3] See for instance Vanberg (2011, p.6): “The ordo-liberalism of the Freiburg School starts from the very premise that the market order is a constitutional order, that it is defined by its institutional framework and, as such, subject to (explicit or implicit) constitutional choice. It assumes that the working properties of market processes depend on the nature of the legal-institutional frameworks within which they take place, and that the issue of which rules are and which are not desirable elements of such frameworks ought to be judged as a constitutional issue, i.e. in terms of the relative desirability of relevant constitutional alternatives.”

[4] In his book Grundsätze der Wirtschaftspolitik (Eucken 1952b) he even goes so far as to explain the outbreak of the Great Depression as the result of demand management in the US, the UK, and Germany (p. 309).

[5] In the 1960s the German Finance Minister Karl Schiller tried to reach “a synthesis of the Freiburg imperative with the Keynesian message” (“Synthese zwischen Freiburger Imperativ und keynesianischer Botschaft”). But Eucken would not have agreed to this.

[6] This is even more astonishing as Eucken (1949, p. 183) explicitly argues that economic developments should be regarded as elements of the concrete historical situation.

[7] This intellectual isolation is confirmed by Vanberg (2011, p.6): “…the Freiburg ordo-liberalism appears to be an essentially original German ‘invention’ for which no significant direct influences from other sources can be discerned”.