The international market for cross-border bank lending is characterised by the widespread origination of claims in currencies which are ‘foreign’ from the lenders' perspective. As of end-2016, 82% of global cross-border claims in US dollars were originated outside the US, while 35% of euro claims came from outside the euro zone.

To fund this FX lending, banks use a variety of funding sources – including FX deposits, internal capital markets, wholesale funding and FX swaps – to access liquidity in currencies different than that of the country in which they are based. Recent evidence suggests that banks' choices of, and access to, FX funding sources can have important implications for the stability of bank lending (Bruno and Shin 2015, Ivashina et al. 2015).

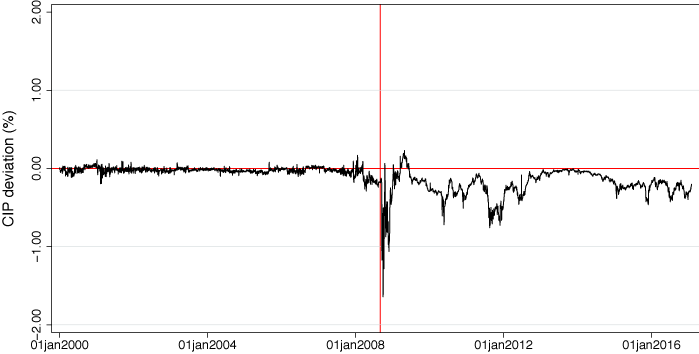

FX funding using FX swaps (usually called ‘synthetic’ funding) allows banks with limited access to foreign currency funding markets to tap FX liquidity by swapping local currency funding without incurring foreign exchange risk. This process was smooth for a long time, but since the crisis the market has seen large pricing dislocations (see Figure 1). These dislocations have been the focus of a series of recent studies (Avdjiev et al. 2016, Du et al. 2018, Sushko et al. 2016, Cenedese et al. 2019), which have nevertheless focused on their causes rather than their consequences.

Figure 1 Sterling-based CIP deviations (average across currency pairs)

Notes: Authors' elaboration based on data from Bloomberg. The figure shows the average cross-currency basis between sterling (GBP) and four major currencies: US dollar (USD), Japanese yen (JPY), Swiss franc (CHF) and euro (EUR). The red vertical line marks September 1st 2008. A negative CIP deviation denotes a situation in which foreign currency funding is more expensive in FX swaps markets compared to cash markets.

Synthetic funding shocks and bank lending

In a recent paper (Eguren-Martin et al. 2018), we explore whether the described shocks to the cost of FX swap-based funding affect cross-border bank lending supply. We conjecture that banks' reliance on synthetic FX funding can affect the supply of cross-border FX lending in the face of these shocks. In order to test this hypothesis, we use regulatory data on global banks based in the UK that provide cross-border lending in currencies different than sterling. The use of data on UK banks provides an ideal vantage point to answer this question, as the UK is the single largest global originator of cross-border bank credit, a large share of which is denominated in currencies other than sterling (see Figure 2).

Figure 2 Cross-border bank claims by country of origination

Notes: This figure depicts aggregate cross-border claims in US dollar trillions from 2004 to 2016 on a quarterly basis. The figure is based on data from the BIS Locational Banking Statistics. Each line represents the aggregate claims originated by banks located in the UK, the US, Japan, Germany, France and Hong Kong (HK). German data are interpolated when missing. These countries represent the major sources of cross- border banking claims.

Our results suggest that liquidity shocks in global FX synthetic funding markets significantly affect the supply of cross-border FX lending by banks located in the UK. When synthetic FX funding becomes more expensive, banks cut back cross-border lending in that currency, and it is banks that rely the most on this type of funding that react more sharply.

These effects are not only statistically significant but also meaningful economically. Consider the second quarter of 2012, when the sterling–US dollar basis widened by 7 basis points. In this quarter, the group of banks in our sample with positive reliance on synthetic funding cut back cross-border US dollar lending (to all destinations) by $184 billion. But by employing our benchmark results, we can calculate that if these banks had had zero reliance on synthetic funding, they would have cut back lending by $160 billion instead; that is, the fall in lending would have been 13% smaller.

The benefits of foreign relatives

How can foreign relatives help? From the perspective of UK banks, foreign relatives would include related banks located abroad, be it the parent of a foreign affiliate operating in the UK or affiliates of UK-owned banks located abroad. The idea is that banks with access to alternative sources of FX financing (at similar prices) would turn to the help of these relatives instead of cutting back on lending in the event of a spike in the cost of FX swaps. Indeed, we find that large access to alternative sources of FX funding shields banks’ cross-border FX lending supply from synthetic FX funding shocks, but only if such access occurs via internal capital markets. To illustrate, foreign branches in the UK do not cut their foreign currency lending if their parents are domiciled in the currency area in question (i.e. the US or the euro area). We corroborate these findings by documenting how banks effectively draw FX funds from their internal (foreign) network in these events; that is, there are advantages of having foreign relatives in these instances.

Macroeconomic dimension and substitution

In order to estimate the aggregate effect of shocks to the cost of synthetic funding, we explore potential substitution effects from borrowers into unaffected lenders. By aggregating data at the destination country-currency level, we find that banks from the relevant currency areas tend to step in and increase lending in the event of a retreat of UK banks when synthetic funding shocks hit, particularly in the case of the most affected markets. However, this does not typically lead to a full offset of the cut back of UK-originated lending. For example, our results imply that the increase in US dollar lending from the US offsets around two-thirds of the fall in UK lending for Singapore, but only around one third for South Africa (given its larger reliance on the UK for US dollar funding).

Taken together, we hope that the results discussed in this column (and in more detail in the underlying working paper) can inform discussions on the financial stability implications of possible institutional frictions and fragmentation in international funding markets (e.g. Dobler et al. 2016, ECB 2016, FSB 2019).

References

Avdjiev, S, W Du, C Koch, H S Shin, “The dollar, bank leverage and the deviation from covered interest parity”, BIS Working Papers 592.

Bruno, V, H S Shin (2015), “Cross-border banking and global liquidity”, Review of Economic Studies 82(2): 535-564.

Cenedese, G, P Della Corte, T Wang (2019), “Currency mispricing and dealer balance sheets”, Bank of England Staff Working Paper No. 779.

Dobler, M, S Gray, D Murphy, B Radzewicz-Bak (2016), “The lender of last resort function after the global financial crisis”, IMF Working Paper WP/16/10.

ECB (2016), Financial integration in Europe, ECB Technical Report.

Eguren-Martin, F, M Ossandon Busch and D Reinhardt (2018), “Global banks and synthetic funding: the benefits of foreign relatives”, Bank of England Working Paper No. 762 (updated September 2019).

FSB (2019), “Financial stability board report on market fragmentation”, Financial Stability Board, Basel.

Ivashina, V, D S Scharfstein, J C Stein (2015), “Dollar funding and the lending behaviour of global banks”, Quarterly Journal of Economics 130(3): 1241-1281.

Sushko, V, C Borio, R N McCauley, P McGuire (2016), “The failure of covered interest parity: FX hedging demand and costly balance sheets”, BIS Working Papers 590.