The recent COVID-19 pandemic has influenced our society in various ways. In particular, changes in business environments induced by border closures, lockdown policies, social distancing, and preference changes have generated a spike in uncertainty, significant disruptions in business, and a reallocation across firms (e.g. Baker et al. 2020, Barrero et al. 2020, Ding et al. 2020). During periods of such turmoil, firms with more resilient business models tend to survive and expand more than others, which leads to an important question of what characteristics of firms are vital in managing crises.

Our recent paper (Hyun et al. 2020) attempts to answer this question with particular emphasis on two firm characteristics — global connectedness and market power — which play central roles in the economics and finance literature, and have attracted a great deal of attention in the last decade.

Global integration: Necessarily bad during the pandemic?

The global economy has so far evolved toward integration through global value chains, trade, and migration, and there is now a consensus in the media and policy circles that global integration has exacerbated the negative impact of the pandemic crisis, both through the direct spread of the disease and through the disruption in foreign supply and demand.1 From a theoretical point of view, however, more globally connected firms via supply chains and exports could enjoy a more diversified portfolio of suppliers and markets, which would potentially allow them to buffer negative domestic shocks by making more flexible decisions in production and market management. Another firm characteristic, market power (which we measure through markup), could also make firms more resilient to negative shocks by providing bigger margins of adjustment and flexibility, as a large degree of markup implies that the firms’ products are not easily substituted for others, allowing the firms to adjust prices without a significant decline in demand.

Descriptive evidence: Firms with higher global connectedness and market power performed better in stock markets

Using a weekly global stock market dataset of covering 8,000 listed firms in 71 countries for the first five months of 2020, we investigate how pre-pandemic firm characteristics, including global connectedness and market power, affect firms’ stock market performances in response to the COVID-19 pandemic shock. We primarily focus on a firm’s market value, which equates to the present value of the expected future stream of profits (or dividends).2 Thus, changes in stock market value reflect investors’ information about firms’ current and future performances.

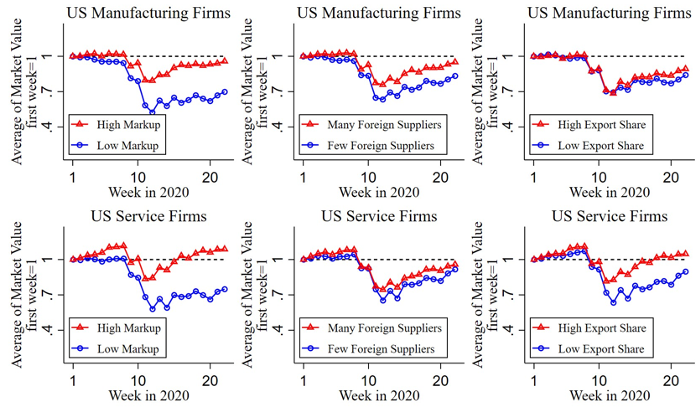

Figure 1 shows the evolution of the average market value of the US firms as a function of their degree of global connectedness (measured by foreign supplier share and export share) and market power (measured by markups).3 Specifically, we group firms separately across those in the top and bottom quantiles of markup, foreign supplier share, and export share distributions. Firms with higher markups and who are more globally integrated through supply chains and exports, differentially performed better compared to those with lower markups and who are less globally integrated. This descriptive exercise suggests that global production and export networks as well as markups potentially allow firms to be more resilient during crisis periods.

Figure 1 Changes in market values of different groups of firms

Notes. The figures plot the average market values of each group of firms over time, which are rebased to one for the first week. The manufacturing and service firms are classified by the Standard Industry Classification (SIC) codes 2000 – 3999 and 7000 – 8999, respectively. In each column, the red square and blue circle lines are the average market values of top and bottom quantile firms of each measurement of markups, foreign supply, and export networks, respectively.

Source. Hyun et al. (2020)

Regression analysis: Global connectedness and market power make firms more resilient to the domestic pandemic shock

We confirm our result using a formal regression analysis. Specifically, we regress a firm’s weekly market value growth on various explanatory variables, including the domestic pandemic shock measured by weekly growth rate in domestic total confirmed cases and its interaction with various pre-pandemic firm characteristics, including measures of global connectedness through global supply chains and exports, markups as a measure of market power, employment, and various financial conditions. We also control for measures of foreign pandemic shocks, any time-varying and time-invariant industry and/or country differences that might influence stock market reactions to the pandemic, as well as time-invariant unobserved firm characteristics.

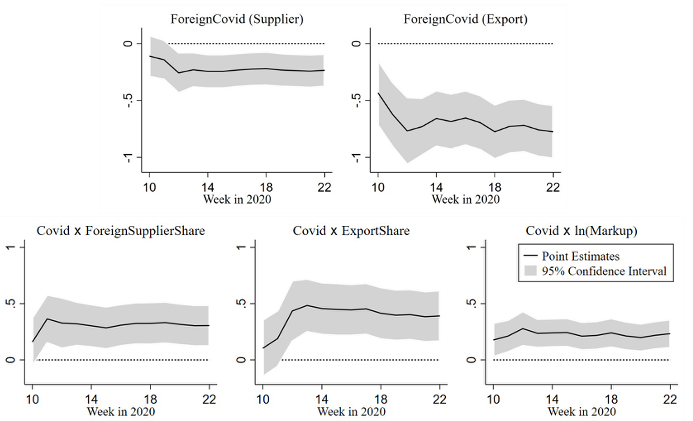

Figure 2 visualises our main findings. We plot the estimated coefficients and their 95% confidence intervals of our main coefficients of interest by moving the terminal period from the tenth week (5 March) of 2020 to the 22nd week (28 May).4 First, consistent with widely accepted views, global supply chain and exports negatively affect firms’ market value by transmitting foreign pandemic shocks (the first row in Figure 2). However, we find a significant heterogeneous response to the domestic pandemic shock: firms with larger foreign supplier share, export share, and markup experience smaller decrease of weekly market value growth in reacting to the domestic pandemic shock. This result is consistent with the view that global connectedness and market power make firms more resilient to domestic shocks by diversifying the markets and suppliers and by providing more flexibility and margins of adjustment in response to negative shocks.5

Figure 2 Impacts of domestic and foreign COVID-19 shocks on firms’ market value

Notes. The figures plot the estimated coefficients and their 95% confidence interval with clustered standard errors at the firm level. The dependent variable is weekly growth rate of market value (in percent) of each firm. In the figure, ForeignCovid (Supplier) and ForeignCovid (Export) measure the foreign pandemic shocks exposed through foreign suppliers and exports, respectively. Covid is the domestic pandemic shock, ForeignSupplierShare and ExportShare measure the share of foreign suppliers among total number of suppliers and the share of revenue generated from foreign countries among total revenue, respectively, Markup is constructed from the firm’s cost minimisation.

Source. Hyun et al. (2020)

Concluding remarks

Using stock market data, we analyse which characteristics of firms allow them to be more resilient during the pandemic, highlighting the role of global networks and markups. This gives guidance to policymakers, investors, businesses, and workers to make optimal decisions facing large short-run and long-run changes and uncertainties during periods of crises.

A firm’s market value is the present value of the expected future stream of profits. Thus, our findings illuminate stock market investors’ information about the post-pandemic world.6 As a result of the pandemic, the cross-sectional distribution would be tilted toward high markup and more globally connected firms.

References

Baker, S R, N Bloom, S J Davis and S J Terry (2020), “COVID-Induced Economic Uncertainty”, NBER Working Paper 26983.

Barrero, J M, N Bloom and S J Davis (2020), “COVID-19 Is Also a Reallocation Shock”, NBER Working Paper 27137.

Bonadio, B, Z Huo, A A Levchenko and N Pandalai-Nayar (2020), “The role of global supply chains in the COVID-19 pandemic and beyond”, VoxEU.org, 25 May.

Ding, W, R Levine, C Lin and W Xie (2020), “Corporate Immunity to the COVID-19 Pandemic”, NBER Working Paper 27055.

Gormsen, N J and R S J Koijen (2020), “Coronavirus: Impact on Stock Prices and Growth Expectations”, VoxEU.org, 23 March.

Hyun, J, D Kim and S-R Shin (2020), “The Role of Global Connectedness and Market Power in Crises: Firm-level Evidence from the COVID-19 Pandemic”, Covid Economics: Vetted and Real-Time Papers 49.

Pagano, M, C Wagner and J Zechner (2020), “COVID-19, asset prices, and the Great Reallocation”, VoxEU.org, 11 June.

Ramelli, S and A F Wagner (2020), “What the stock market tells us about the consequences of COVID-19”, VoxEU.org, 12 March.

Endnotes

1 For example, the United Nations Department of Economic and Social Affairs reported in April 2020 that “The adverse effects of prolonged restrictions on economic activities in developed economies will soon spill over to developing countries via trade and investment channels. In addition, global manufacturing production could contract significantly, amid the possibility of extended disruptions to global supply chains.” (World Economic Situation And Prospects: April 2020 Briefing, No. 136).

2 We combine weekly global stock market data from Compustat Security Daily database with various firm-level information from Compustat Fundamental and Factset Revere database.

3 In Figure 1, we only consider firms in the US manufacturing and service sectors and plot them separately across sectors to isolate country-specific and sector-traits. In the formal regression analyses and Figure 2, we consider a more disaggregated sector definition and consider firms in all countries.

4 We perform regressions under various specifications. In the figure, we use the regression specification with firm, industry-by-time, and country-by-time fixed effects.

5 Our result is in line with Bonadio et al. (2020) and Ramelli and Wagner (2020), which emphasise the dual roles played by global connectedness — Bonadio et al. (2020) show that supply chain re-nationalisation will not make countries more resilient to pandemic shocks through the lens of a quantitative model. Ramelli and Wagner (2020) show that US firms that were more exposed to China initially performed worse during the pandemic, while they relatively did better when the crisis spread to Europe and the US.

6 Gormsen and Koijen (2020) use the stock market indexes and dividend future market data to forecast economic growth in reacting to the COVID-19 pandemic.