Some East Asian countries experienced a serious currency crisis in 1997. The crisis was blamed on both the de facto US dollar peg system and double mismatches of domestic financial institutions’ balance sheets in terms of currency and maturity. Following the Asian currency crisis, recognition of the importance of regional monetary cooperation has steadily grown. Specifically, the monetary authorities of most East Asian countries have come to perceive the importance of monitoring intra-regional exchange rates. The Association of Southeast Asian Nations (ASEAN) +3 (Japan, China, and Korea) has promoted regional monetary cooperation within the framework of the Financial Deputy Ministers’ Meeting (Bayoumi et al. 2000).1 In the early 2000s, two important regional arrangements – the Chiang Mai Initiative and the Economic Review and Policy Dialogue – were established among the ASEAN+3. Both are regarded as symbols of regional monetary cooperation in East Asia.

The objective of currency swap arrangements such as the Chiang Mai Initiative is to manage currency crises. The Economic Review and Policy Dialogue is a system in which the monetary authorities monitor the performance of each country’s macroeconomic variables and the soundness of each country’s financial sector in order to prevent currency crises from occurring. Monitoring intra-regional exchange-rate fluctuations and misalignments is also necessary.

Measuring intra-regional exchange-rate misalignments

To meet this objective, Williamson (1999), Kuroda and Kawai (2003), and Ogawa (2004) have suggested introducing a common basket system into East Asia. Among the various approaches used to calculate a common currency basket, Ogawa and Shimizu (2005) have proposed a new measurement called the Asian Monetary Unit (AMU). The same method applied to calculate the European Currency Unit is used to calculate the AMU. Deviation indicators of the AMU’s component currencies are calculated based on the AMU in order to monitor deviations of East Asian currencies from their benchmark levels.

There are two types of AMU deviation indicators – the nominal AMU deviation indicator, which is in terms of the nominal exchange rate, and the real AMU deviation indicator, which is in terms of the real exchange rate. Our recent paper (Ogawa and Wang 2013a) took into account the higher productivity growth rate in the tradable goods sectors of the East Asian countries to calculate a purchasing power parity (PPP)-based AMU deviation indicator, adjusted for the Balassa–Samuelson effect. The measurements are expected to improve regional monetary cooperation through improved monitoring of intra-regional exchange-rate misalignments.

The impact of the Global Financial Crisis

We used the PPP-based AMU deviation indicator adjusted by the Balassa–Samuelson effect to investigate how the East Asian currencies were affected by the Global Financial Crisis of 2007–2008. The crisis was triggered by the BNP Paribas shock during the summer of 2007. As many US and European financial institutions had significant holdings of subprime mortgage-backed securities, they were badly affected by excessive defaults on subprime mortgages. Even though most East Asian financial institutions were not directly affected by subprime mortgage defaults, the related economic slump in the US and Europe had indirect adverse effects on the East Asian economy.

After the collapse of the housing bubble in the summer of 2007, many US and European financial institutions faced a serious liquidity crisis because of their own counterparty risks in interbank markets. This greatly reduced the risk tolerance of US and European financial institutions and institutional investors. As a result, they withdrew their short-term capital from all over the world, including from emerging economies. This led the currencies of these countries – including East Asian currencies – to depreciate against the US dollar.

East Asian currencies suffered misalignments and increased exchange-rate volatility. The Chinese monetary authority re-pegged the Chinese yuan to the US dollar in order to stabilise its exchange rate. Thus, the exchange rates of East Asian currencies were indirectly affected by the Global Financial Crisis even though East Asian countries’ financial sectors were sound. Our empirical analysis shows that East Asian currencies did not converge in most sample periods.

Those East Asian currencies that converged in the early sample periods have also been diverging since late 2005. One of the main reasons for these changes has been capital movements among East Asian countries.

Capital flows within East Asia

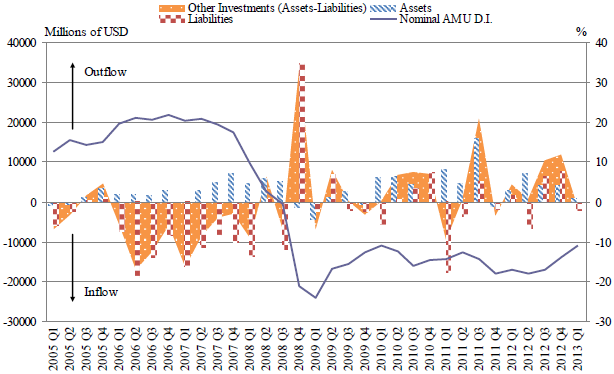

Specifically, the growing exchange-rate fluctuations are partially attributable to intra-regional capital flows, such as the yen carry trade occurring in some East Asian countries – especially between Japan and Korea – since around 2005. In order to identify the impact of the yen carry trade on exchange-rate misalignment, we focus on the capital flows of the two countries on the category of other investments.2 As shown in Figures 1 and 2, the category of other investments is given as the difference between assets and liabilities. Therefore, a positive value in the category of other investments indicates capital outflows, while a negative value indicates capital inflows.

Figure 1 Capital flow (other investments) and nominal AMU deviation indicator, Japan (2005.Q1–2012.Q3)

Note: The left scale gives the volume of transaction in other investments; the right scale gives the rate of change of the nominal AMU deviation indicator.

Source: International Financial Statistics (IMF) and RIETI online database.

Figure 2 Capital flow (other investments) and nominal AMU deviation indicator, Korea (2005.Q1–2013.Q1)

Note: The left scale gives the volume of transaction in other investments; the right scale gives the rate of change of the nominal AMU deviation indicator.

Source: International Financial Statistics (IMF) and RIETI online database.

In the case of Japan, the category of other investments tended to be positive before the third quarter of 2008, and then turned negative. This shows that Japan experienced capital outflows before the Global Financial Crisis, and capital inflows afterwards. Due to these capital flows, the Japanese yen first depreciated and then appreciated. In the case of Korea, the category of other investments was negative until the third quarter of 2008, and turned positive at the end of 2008. This implies that Korea faced capital inflows before the Global Financial Crisis, and capital outflows afterwards. These capital flows pushed the Korean won toward overvaluation from 2006, but also made it fall into undervaluation after the bankruptcy of Lehman Brothers. By comparing the other investments of Japan with those of Korea, we find that they were moving in opposite directions, especially from the beginning of 2006 to the third quarter of 2008.

These capital flows significantly affected the exchange rates of East Asian currencies. In particular, the Japanese yen was undervalued, and the Korean won, the Thai baht, and the Indonesian rupiah were overvalued from July 2005 to July 2007.3 A dramatic withdrawal of short-term capital from the East Asian countries by US and European financial institutions and institutional investors accelerated the depreciation of East Asian currencies against the US dollar. At the same time, since the defaults on subprime mortgages had only a limited effect on Japanese financial institutions, the Japanese yen was considered a less risky currency, and consequently was bought in foreign exchange markets across the world. The Japanese yen substantially appreciated against the US dollar and the euro since the summer of 2007. Both the depreciation of emerging-market currencies and the appreciation of the Japanese yen induced exchange-rate misalignments among the East Asian currencies. The asymmetric response of East Asian currencies to the changes in capital flows around the Global Financial Crisis is still an urgent problem to be resolved.

Concluding remarks

The exchange-rate policies adopted by East Asian countries subjected their currencies to the Global Financial Crisis indirectly, and widened the exchange-rate misalignments. It is necessary for the monetary authorities of East Asian countries to monitor intra-regional exchange rates in order to resolve and prevent exchange-rate misalignments among their currencies. Some policymakers and scholars have suggested that the monetary authorities of each country employ a common currency basket to monitor intra-regional exchange-rate fluctuations. If we can develop an intra-regional exchange-rate monitoring system and ensure policy coordination, each country as well as the whole of East Asia will stand to gain.

Editor's Note: The main research on which this column is based (Ogawa and Wang 2013b) first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Bayoumi, T, B Eichengreen, and P Mauro (2000), “On Regional Monetary Arrangements for ASEAN”, Journal of the Japanese and International Economies, 14(2): 121–148.

Hattori, M and H Shin (2007), “The Broad Yen Carry Trade”, IMES Discussion Paper 2007-E-19.

Kuroda, H and M Kawai (2003), “Strengthening Regional Financial Cooperation in East Asia”, PRI Discussion Paper 03A-10.

Ogawa, E (2002), “The US Dollar in the International Monetary System after the Asian Crisis”, JBICI Discussion Paper 1.

Ogawa, E (2004), “Regional Monetary Cooperation in East Asia against Asymmetric Responses to the US Dollar Depreciation”, Journal of the Korean Economy, 5(2): 43–72.

Ogawa, E and J Shimizu (2005), “A Deviation Measurement for Coordinated Exchange Rate Policies in East Asia”, RIETI Discussion Paper 05-E-017.

Ogawa, E and Z Wang (2013a), “East Asian Monetary Cooperation System: Based on the AMU Deviation Indicator and Growth Rate of Productivity”, Journal of World Economy, 36(8): 3–25.

Ogawa, E and Z Wang (2013b), “How Did the Global Financial Crisis Misalign East Asian Currencies?”, RIETI Discussion Paper 13-E-096.

Ogawa, E and Z Wang (2014), “AMU Deviation Indicators Based on Purchasing Power Parity and Adjusted by Balassa–Samuelson Effect”, Global Journal of Economics, forthcoming.

Ogawa, E and T Yoshimi (2009), “Analysis on β and σ Convergences of East Asian Currencies”, RIETI Discussion Paper 09-E-018.

Williamson, J (1999), “The case for a common basket peg for East Asian currencies”, in S Collignon, J Pisani-Ferry, and Y C Park, eds., Exchange Rate Policies in Emerging Asian Countries, London: Routledge: 327–343.

1 ASEAN consists of 10 countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

2 As mentioned in Hattori and Shin (2007), interbank positions are able to outline the aggregate yen liabilities. Therefore, we focus on the category of other investments in the financial account to identify the channel of the yen carry trade within East Asia.

3 For more detail, see Ogawa and Wang (2013b).