The debate on policy responses to the crisis has been unfolding in real time. John Taylor and John Williams (2009) questioned the use of liquidity support in reducing financial distress. It has been argued on this site that a coordinated recapitalisation programme was essential to stabilise the global financial system (see Baldwin and Eichengreen 2008). Olivier Blanchard and his colleagues at the IMF emphasised that efforts to clean up the financial sector need to be complemented by measures to mitigate the impact of the crisis on the fiscal stimulus.

Who is right? With a modicum of hindsight now available, we present a preliminary assessment of what forms of crisis intervention were most effective in achieving the short-term goal of addressing the fragility of banking systems and calming financial markets.

In our recent research (Aït-Sahalia et al 2010) we examine the immediate response of markets to announcements of macroeconomic and financial sector policy initiatives – or the lack of such initiatives – by major advanced economies during the crisis.

The latest evidence

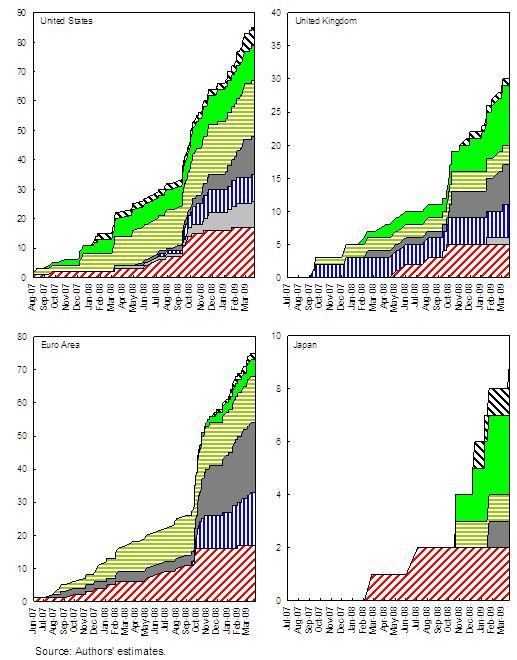

Our main indicator of financial distress is a widely monitored measure of credit and liquidity risk premia in the global interbank markets―the change in the spread between London Inter-Bank Offered Rates (Libor) and Overnight Index Swaps (OIS) for the US dollar. To construct measures of policy initiatives, we have created a detailed database of major macroeconomic and financial sector policy announcements made between June 2007 and March 2009 in four systemically important advanced economies―the US, the Eurozone, Japan, and the UK. The database contains 196 announcements aggregated in 12 policy categories (see Figure 1).

Figure 1. Cumulative number of front-page policy annoucements, June 1, 2007 - March 31, 2009

We account for differences in the macroeconomic and financial environment before and after the collapse of Lehman Brothers by splitting the crisis period into two subperiods:

- the subprime crisis from 1 June 2007 to 14 September 2008, which was characterised by a series of predominantly central bank policy measures with a relatively narrow focus on arresting the downward spiral of counterparty confidence; and

- the global crisis from 15 September 2008 to 31 March 2009, which witnessed frequent and diverse policy interventions motivated by a sense of heightened urgency about the need to restore financial stability and avoid a global economic depression.

Integrated policy response, not ad-hoc measures

Our analysis shows that neither macroeconomic nor financial policies had an advantage in reducing financial distress. What matters is whether policy is perceived as ad-hoc or part of a wider strategy. Ad-hoc policy scares markets while integrated policy stabilises them. This finding is clear with a number of policies:

- Decisions to keep interest rates stable or raise them had adverse implications during the subprime crisis, while announcements of interest rate cuts were associated with reductions in interbank risk premia during the global phase of the crisis.

- Announcements of liquidity support in domestic and foreign currency were associated with reductions in interbank risk premia during both stages of the crisis. This is consistent with findings by McAndrews, Sarkar and Wang (2008) and Baba and Packer (2009).

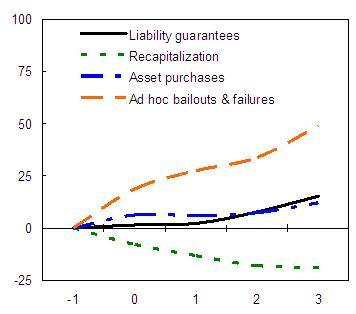

- In the financial sector, policy actions that were perceived as ad-hoc or targeted at individual institutions had by far the most negative effect on market fears as the possibility of systemic collapse did not appear to be dealt with (see Figure 2). This is despite some of these policies having a long run perspective, for example, to prevent moral hazard.

- Systematic, financial-restructuring measures were more likely to be associated with a reduction in interbank risk premia. Recapitalisation announcements were accompanied by particularly favourable developments in interbank risk premia during the global crisis, suggesting that markets saw merit in rebuilding buffers against losses (see Figure 2). Liability-guarantee announcements were associated with reductions in interbank risk premia during the subprime crisis but had the opposite effects during the global crisis – possibly because markets saw them as insufficient to address concerns about regulatory arbitrage in the future. Announcements of asset purchases do not appear to have been associated with reductions in interbank risk premia throughout the crisis, lending support to the notion that asset purchases are ideally applied once the extent of impairment becomes clear.

Figure 2. Impact of policy announcements on the Libor-OIS spread, September 14, 2008 - March 31, 2009 (in basis points)

Source: Authors' estimates

Note: The variable plotted on the veritcal axis is the average cumulative abnormal differences in basis points within the event window of one day before the event and three days after the event. The horizontal axis shows days within the event window, with "0" corresponding to the day of the annoucement.

These results are robust to controlling for a host of factors including the surprise content of monetary and fiscal policy announcements, and expectations about the Libor-OIS spread.

International coordination

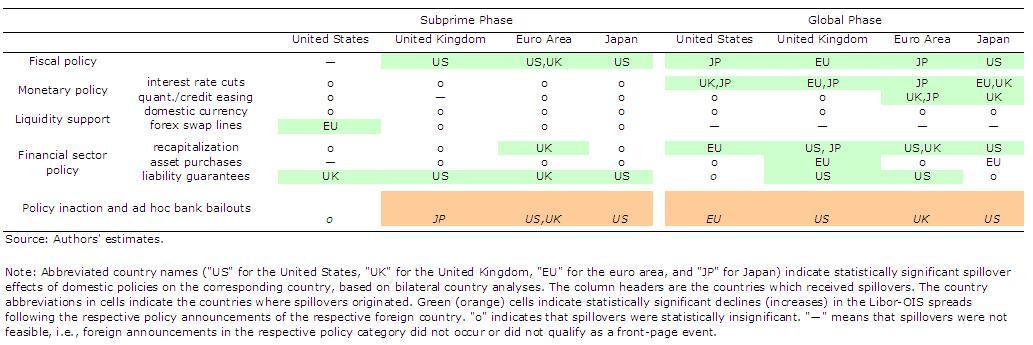

Policy announcements had significant international repercussions during the crisis, largely owing to close financial integration among major advanced economies. Many macroeconomic and financial sector policy announcements were associated with changes in risk premia not only in domestic but also foreign interbank markets and such spillovers intensified as the crisis deepened (see Table 1).

Table 1. Statistical significance of foreign policy announcements on the Libor-OIS spreads

Announcements of interest rate cuts, fiscal easing, recapitalisation and liability guarantees were associated with particularly large international spillovers (Table 1). The adverse impact of policy inaction and ad-hoc bank bailouts also was not limited to domestic markets but spread throughout the global financial system. These findings underscore the importance of international policy coordination in response to problems in the global financial system.

Conclusion

Our assessment of the markets’ immediate reaction to policy announcements suggests that markets tended to favour an integrated, systematic and coordinated policy response to the global financial crisis. Announcements of monetary easing, recapitalisation and liability guarantees were associated with the most significant reductions in interbank risk premia. By contrast, ad-hoc measures such as bailouts of individual financial institutions not accompanied by announcements of systematic financial sector restructuring, tended to exacerbate market fears. Moreover, announcements of both policy initiatives and policy inaction had significant international repercussions, which intensified as the crisis developed.

Although our study focuses on the immediate policy impact and cannot substitute for a comprehensive ex post policy evaluation, it may suggest the long-term effectiveness of policies. A positive immediate market reaction may be self-fulfilling and lay the foundations for a sustained policy success.

Governments and central banks pondering a new regulatory regime for the financial sector and a guideline for policy responses should consider our evidence that coordinated interventions appear to have been far more effective that ad-hoc policies.

References

Aït-Sahalia, Yacine, Jochen Andritzky, Andy Jobst, Sylwia Nowak, and Natalia Tamirisa (2010), “Market Response to Policy Initiatives during the Global Financial Crisis,” NBER Working Paper No. 15809.

Baba, Naohiko and Frank Packer (2009), “From Turmoil to Crisis: Dislocations in the FX Swap Market Before and After the Failure of Lehman Brothers,” Bank for International Settlements Working Paper No. 285.

Baldwin, Richard and Barry Eichengreen eds. (2008), Rescuing Our Jobs and Savings: What G7/8 Leaders Can Do to Solve the Global Credit Crisis. London: VoxEU.org.

McAndrews, James, Asani Sarkar, and Zhenyu Wang (2008), “The Effect of the Term Auction Facility on the London Inter-Bank Offered Rate.” Federal Reserve Bank of New York Staff Report No. 335.

Taylor, John B. and John C. Williams (2009), “A Black Swan in the Money Market.” American Economic Journal: Macroeconomics, 1(1): 58–83.