How are firms affected by the rising calls worldwide to combat climate change? How are they affected by increasingly stringent policies aimed at curbing carbon emissions? How are they affected by technological advances and growing market shares of renewable energy?

Many sceptical commentators believe that the rise of the responsible investment movement is mostly a public-relations exercise, with little material impact on firms’ cost of capital (e.g. Aswani et al. 2021). If this is true, we would expect to see little difference in the valuation of companies exposed to carbon-transition risk relative to other similar companies that are less exposed to this risk.

By carbon-transition risk, we mean the risks associated with the requirement to significantly, and maybe suddenly, curb carbon emissions within a relatively short period of time (one or two decades, if the company is required to align itself with the net-zero commitments of the countries in which it operates). The size of this risk for a company is proportional to the size of its carbon (and other greenhouse gas) emissions, and to the rate of growth of these emissions.

We undertake a broad exploration of this question, asking whether companies similar in all observable respects except for their carbon emissions have different stock returns, and if so, what the source of this difference is – exposure to policy risk, technological risk, competition from renewable energy risk, investor pressure, or reputation risk (Bolton and Kacperczyk 2020).

We take a (forward-looking) financial market perspective to evaluate the economic importance investors attach to carbon-transition risk globally, by looking at the stock returns of more than 14,000 publicly listed companies in 77 countries with different degrees of exposure to this risk over the sample period 2005 to 2018.

From an individual firm’s perspective, transition risk captures the uncertain rate of adjustment towards carbon neutrality. From an investors’ perspective, the risk also embodies the evolving beliefs about the transition to a greener economy. Transition risk is the result of a wide range of shocks, including changes in climate policy, reputational impacts, shifts in market preferences and norms, and technological innovation.

Indeed, investors in companies that supply fossil fuel energy, and investors in companies that rely on this energy for their operations, are increasingly exposed to risk with respect to policies seeking to curb carbon emissions and to technological risk from alternative, more and more affordable renewable energy.

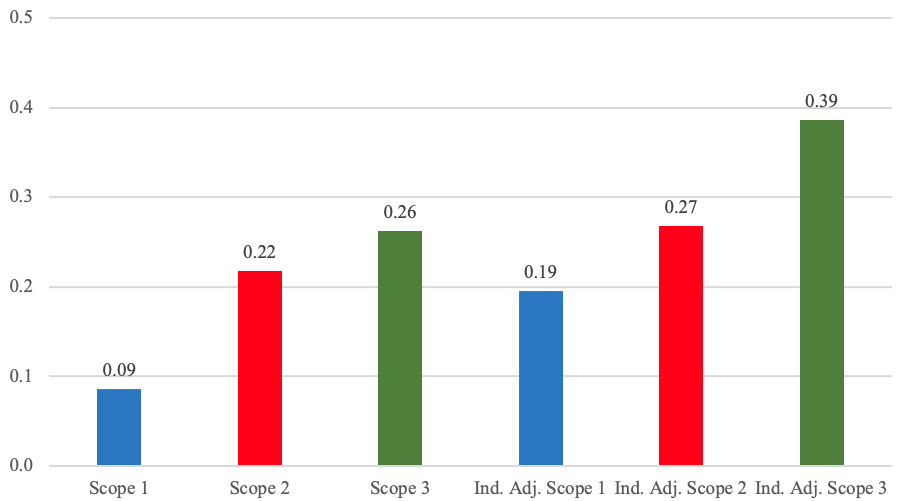

Using firm-level carbon emission and financial data, we quantify the carbon premium – that is, the return that compensates investors for taking on this carbon-transition risk, other things being equal. If carbon-transition risk is ignored by investors, one would expect to see no significant correlation between stock returns and the level of the company’s CO2 emissions (once one controls for other relevant firm characteristics). Yet, we find that carbon emissions positively and significantly affect stock returns in most geographic areas of the world, as Figures 1 and 2, with some of our main findings, illustrate. The first three columns indicate the size of the carbon premium (the higher cost of capital, or expected returns, of firms with higher carbon emissions as compensation to shareholders for their greater exposure to carbon transition risk) for respectively direct (Scope 1 and 2) and indirect upstream (Scope 3) emissions that are one standard deviation above the average level of emissions of firms, other things equal across all industries. The second three columns indicate the size of the carbon premium within a given industry (when we add industry fixed effects).

Figure 1 Carbon premia to CO2 emission levels

The dependent variable in Figure 1 is the average monthly stock returns of firms, a good predictor of future expected monthly returns. The main explanatory variables of interest are the logs of the total size of Scope 1, Scope 2 (both measures of direct emissions), and Scope 3 (upstream indirect) carbon emissions, all measured in units of tons of CO2 emitted in a year. We add key firm characteristics and fixed effects as controls to make sure that we are comparing apples to apples. Each column bar represents the difference in stock returns between firms with emissions measures that are respectively one standard deviation above the average and firms with average emissions. The first three bars do not adjust for differences in emissions across industries, and the last three bars do adjust for such differences. We find that a firm that experiences an increase in its log emission levels, offers a return premium to investors. This premium is both highly statistically significant and economically sizeable, with the economic magnitudes ranging between 2 to 4 percentage points per year.

Interestingly, what matters is both the total level of CO2 emissions produced by companies as well as their year-by-year growth in emissions, as is shown in Figure 2.

Figure 2 Carbon premia to year-by-year growth in CO2 emissions

The main explanatory variable of interest in Figure 2 is S1CHG, S2CHG, and S3CHG, respectively the yearly percentage growth in Scope 1, 2, and 3 emissions.

The emissions-level measure in Figure 1 can be understood as a long-term risk projection, given that emissions are highly persistent, while the growth measure in Figure 2 is a short-term projection of the risk.

Note that we do not find any relation between stock returns and emission intensity (the ratio of total emissions to sales). As we explain in our paper, this is not surprising, given that the true measure of transition risk is the level and growth rate of emissions, not emission intensity. As Ben Ratner, senior director at the Environmental Defense Fund, eloquently stated: “Meeting the goals of the Paris Agreement requires an energy transformation that slashes absolute emissions, not piecemeal intensity targets backed by spotty methane data and reporting” (McCormick et al. 2020).

We further explore which factors carbon premia are associated with across countries, industries, and firms, and discover several interesting patterns. The first surprising result is that the level of economic development does not explain cross-country variations in the carbon premium. However, several other country characteristics matter.

Both ‘voice’ (how democratic political institutions are) and ‘rule of law’ significantly affect the carbon premium associated with changes in emissions. More democratic countries with stronger rule of law tend to have lower carbon premia, other things being equal. One possible interpretation of this result is that in these countries, pressure from green public opinion has already resulted in significant tightening of carbon-emissions regulations, so that the transition risk going forward is lower. In support of this interpretation, we also find that the carbon premium is lower in countries with a higher share of renewable energy, and higher in countries with larger oil, gas, and coal extracting sectors.

We further find that firms located in countries with tighter domestic (but not international) climate policies exhibit a higher long-term return premium. Surprisingly, firms in countries that have been exposed to greater damages from climate disasters (floods, wild-fires, droughts, etc.) do not show a markedly different carbon premium associated with the level of direct emissions.

Given that climate change has become a salient issue for investors only recently, we also explore how the carbon premium around the world has changed in recent years. We do this by comparing the estimated premia for the two years leading up to the Paris Agreement and following the agreement. Several striking results emerge from this analysis.

First, when we pool all countries together, we find that there was no significant premium before the Paris Agreement, but a highly significant and large premium in the years following the agreement. This general result is consistent with the view that investors have only recently become aware of the urgency of climate change.

When we break down the change in the carbon premium around the Paris Agreement by continent, we find that the premium is insignificant in North America before and after Paris, has declined in Europe, but, astonishingly, has sharply risen in Asia. In effect, Asia is entirely responsible for the rise in the global carbon premium around the Paris Agreement.

Overall, our analysis paints a nuanced picture of the pricing of carbon-transition risk around the world. The pricing is uneven across countries but widespread in North America, Asia, and Europe. The pricing is also rising, with a significant increase post–Paris Agreement in 2015.

Our study is relevant for the debates around carbon taxation. Carbon taxes have been touted as the policy solution for mitigating climate change. Yet, in practice, (global) carbon taxation has met significant political opposition. In light of this reality, our study suggests an alternative complementary approach via financial markets. The increasing cost of equity for companies with higher emissions can be viewed as another form of carbon pricing by investors seeking compensation for carbon-transition risk.

References

Aswani, J, A Raghunandan and S Rajgopal (2021), “Are carbon emissions associated with stock returns?”, SSRN.

Bolton, P, and M T Kacperczyk (2020), “Global pricing of carbon-transition risk”, SSRN.

McCormick, M, J Jacobs and G Meyer (2020), “Why no one is impressed with Exxon’s emissions pledge”, Financial Times, 16 December.