Covid-19 has significant implications for trade and investment due to disruption of global value chains. Recent research (Baldwin and Freeman 2020, Baldwin and Toimura 2020, Friedt and Zhang 2020) identifies three channels of disruption: a demand shock caused by lockdowns and stalled economic activity, a supply shock emanating from temporary or permanent disruptions in supply networks, and a global value chain contagion simultaneously affecting multiple locations, marked by a high level of interconnectedness of the global economy that amplifies the impact, especially on global hubs.

Other research has studied the effects of health crises and natural disasters in the last two decades on both economic and non-economic outcomes. However, limited work has been done exploring the global value chain response to these events (as observed in actual trade and investment data). Although recent work provides both historical evidence (Ceylan et al. 2020) and empirical analysis (Fernandes and Tang 2020), it does not focus on global value chains (Friedt and Zhang (2020) is an exception). This is a major gap in research given that trade in intermediate goods and services accounts for over 60% of total international trade (Strange 2020).

In a recent paper (Shingal and Agarwal 2020), we aim to bridge this research gap by studying global value chain responses to two major health epidemics (as observed in actual trade data) and explore the following hypotheses emanating from recent work (Baldwin and Tomiura 2020, Ivanov 2020, Mirodout 2020):

- The disease outbreaks were associated with a rise in domestic production at the expense of total imports (‘reshoring’).

- There was a tendency to reduce the share of imports from disease epicentres during the epidemics (‘geographical diversification of value-chains’).

- The disease outbreaks were associated with a rise in the number of suppliers for each global value chain-based product that was imported (‘global value chain widening’).

- There was a tendency to import more from suppliers in the geographical neighbourhood at the expense of the disease epicentres (‘near-shoring’).

- Global value chain-disruptions coincided with the time period of the virus outbreaks but dissipated over time (‘Global value chain resilience’).

We use difference-in-difference analysis to examine these hypotheses, as well as changes in patterns of global value chain based intermediate and final goods imports from the worst-affected countries in Asia during SARS (China, Hong Kong, Singapore, Vietnam), and from the worst-affected countries during MERS (Saudi Arabia, South Korea, the UAE), over 2001-2005 and 2011-2018, respectively.1 We focus on SARS and MERS for reasons that are common to the current pandemic: both outbreaks originated at an epicentre but spread around quickly, both the diseases were characterised by flu-like symptoms, and manufacturing value-chains were likely disrupted during both episodes.

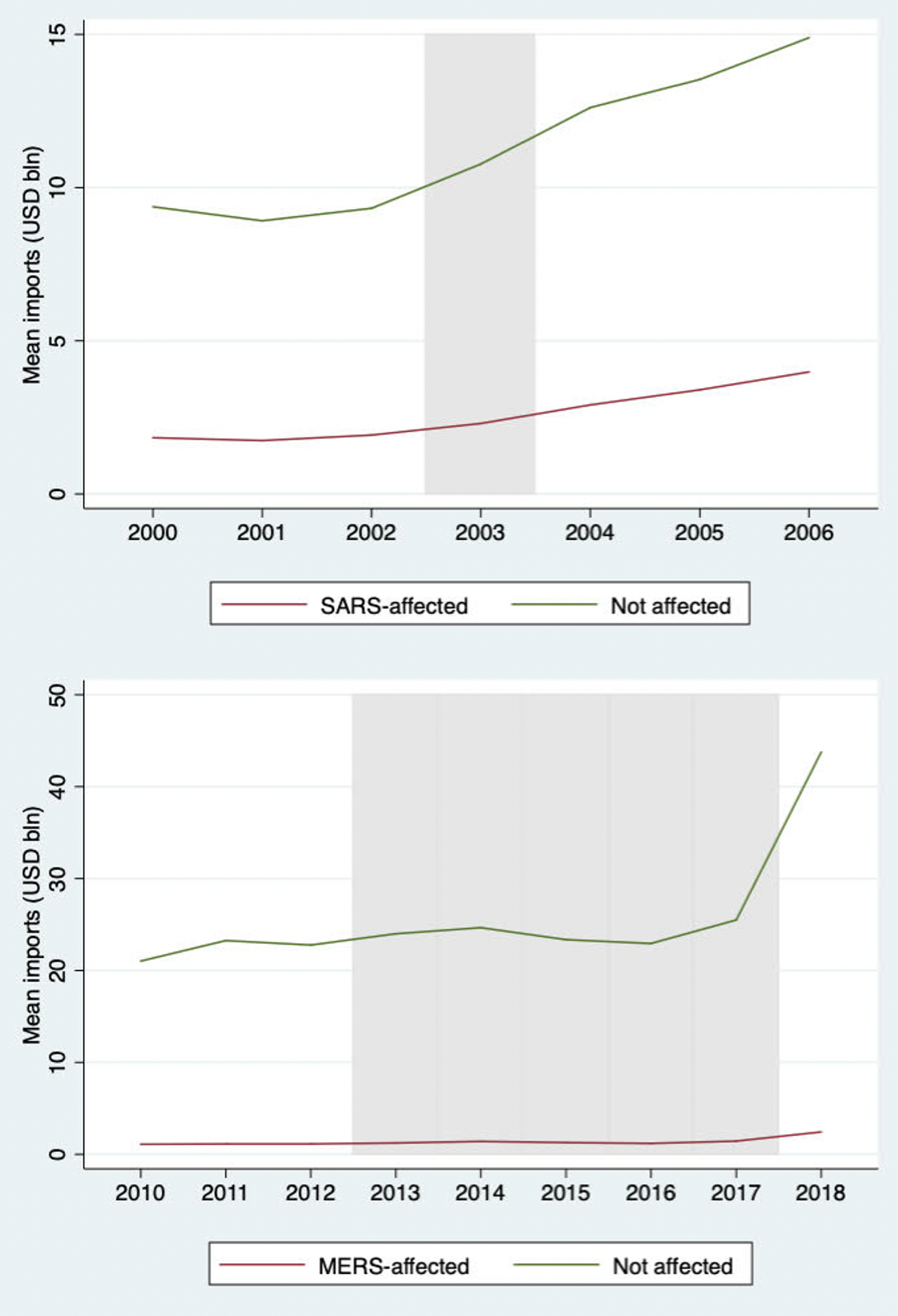

Our identification strategy exploits differences in the time period of severe incidence of each disease and in the samples covering trading partners that were more adversely affected than others. We aggregate bilateral disaggregated trade data from BACI (Gaulier and Zignago 2010) over the 2000-2018 period, for over 200 countries. These data show that the mean cumulative imports from countries worst affected by these disease episodes were significantly lower than those from unaffected countries, both before and after each virus outbreak (see Figure 1).

Figure 1 Mean cumulative imports of GVC-based products from worst-affected SARS (top panel) and MERS (bottom panel) countries and unaffected countries overtime

Source: BACI dataset; own calculations

Note: The coloured slabs denote the time periods corresponding to the incidence of SARS and MERS, in the worst-affected countries, respectively. The worst-affected SARS countries include China (epicentre), Canada, Hong Kong, Singapore and Vietnam; countries worst-affected by MERS include Saudi Arabia (epicentre), UAE and South Korea.

Stylised facts

Mean imports of global value chain based intermediate and final products2 did not decline during the SARS outbreak, suggesting an absence of reshoring in the wake of that epidemic. In contrast, these imports seem to have witnessed a clear decline during the MERS outbreak across sectors, especially in the automotive and electronics, pharmaceuticals, and textiles sectors. The import decline seems to have been accompanied by a rise in domestic output in the auto and electronics sector for both intermediate and final products. This is suggestive of reshoring in these sectors during the MERS outbreak.

There is suggestive evidence for ‘near-shoring’ in the stylised facts: SARS may have been associated with an increase in US imports from Mexico, Australian imports from Vietnam, and EU15 and Swiss imports from Poland – all at the expense of Chinese exports. Stylised facts also provide suggestive evidence for global value chain widening: six major importers seem to have diversified the source distribution of their imports at the ‘HS6-product-level’ during each disease outbreak.

Results

Baseline difference-in-difference estimates suggest a decline in cumulative imports from the worst-affected countries during SARS. However, a similar effect is not observed in the case MERS. There is no evidence for a rise in domestic production at the expense of total imports (‘reshoring’), though import shares of global value chain based products from China and UAE may have declined during SARS and MERS, respectively. This provides evidence for the geographical diversification of value-chains. SARS may have also been associated with a decline in the number of importers and the number of products imported from the worst-affected countries, while MERS seems to be associated with a decline in the import concentration ‘Hirschmann-Herfindahl’ indices at the disaggregated HS6-product level. Value-chains also seem to have been non-resilient to the SARS outbreak, as adverse effects seem to have been accentuated over time, especially in the case of China.

On the whole, the analysis suggests that there may have been a disruption to global value chains, especially following the SARS outbreak. This was seen both by way of reducing reliance on the disease epicentre at both margins of trade and by diversifying the portfolio of trading partners. These effects also seem to have persisted over time. SARS effects were driven by lower-middle-income and non-OECD importers. Countries more heavily reliant on the worst-affected suppliers more integrated in global value chains received more investment, were more competitive, were less capital-intensive, and were less technology-intensive in the production of intermediate goods.

Conclusion

While it may be reasonable to expect similar disruptions to global value chain trade from Covid-19, it is important to be mindful of China’s participation in global GDP and trade in 2003 compared to now (during SARS, China accounted for 4% of global output; today, that number has quadrupled). As a result, any slowdown in China today will impact the world much more severely than in 2003. Moreover, the overall impact of Covid-19 is likely to be worse than SARS because of three additional reasons: the current scale of the pandemic is much larger than that of SARS, the state-mandated social-distancing norms during Covid-19 have resulted in both an immediate supply and a subsequent demand shock, and services trade will be more severely impacted this time as three of the four modes of services delivery require physical proximity between buyers and sellers (Shingal 2020).

Recent anecdotal evidence already points to reshoring as well as ‘nearshoring’ of manufacturing global value chains during the Covid-19 pandemic, especially aimed at reducing over-reliance on China. These plans are a part of a larger ‘China+1’ strategy, with the aim of diversifying away from China towards other low-cost Asian countries. Mexico is also emerging as a close favourite, especially for American and Japanese firms, while there is talk of nearshoring by companies in the euro area to Hungary, the Czech Republic, and Poland. Japan has also expressed concerns over reliance on China for imported inputs and has incentivised shifting production closer to home for high-tech manufacturing.

In summary, while value-chains may have exhibited selective resilience to previous health shocks despite disruptions, there may be more permanent changes this time around, including a conscious diversification away from China.

References

Baldwin, R and R Freeman (2020), “Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion”, VoxEU.org, 01 April.

Baldwin, R and E Tomiura (2020), “Thinking ahead about the trade impact of COVID-19”, in R Baldwin and B Weder di Mauro (eds) Economics in the Time of COVID-19, London: CEPR Press.

Friedt, F L and K Zhang (2020), “The triple effect of Covid-19 on Chinese exports: First evidence of the export supply, import demand and GVC contagion effects”, Covid Economics 53.

Gaulier, G and S Zignago (2010), “BACI: International Trade Database at the Product-Level. The 1994-2007 Version”, CEPII Working Paper 2010-23.

Ivanov, D (2020), “Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case”, Transportation Research Part E, 136.

Miroudot, S (2020), “Resilience versus robustness in global value chains: Some policy implications”, in R Baldwin and S Evenett (eds) COVID-19 and Trade Policy: Why Turning Inward Won’t Work, London: CEPR Press.

Shingal, A (2020), “Services trade and Covid-19”, VoxEU.org, 25 April.

Shingal, A and P Agarwal (2020), “How did trade in GVC-based products respond to previous health shocks? Lessons for COVID-19”, EUI RSCAS Working Paper 2020/68, Global Governance Programme 415.

Sturgeon, T and O Memedovic (2010), “Mapping Global Value Chains: Intermediate Goods Trade and Structural Change in the World Economy”, UNIDO Development Policy and Strategic Research Branch Working Papers.

Endnotes

1 SARS originated in China and affected these countries in the first half of 2003, while MERS originated in Saudi Arabia in 2013 and spread to the Middle East (with UAE being the worst-affected in 2014) and to South Korea in 2015.

2 The HS 6-digit products used in disaggregated analysis are classified as intermediate and final products in GVCs in six sectors - apparel, automobiles, electronics, footwear, pharmaceuticals and textiles - based on Sturgeon and Memedovic (2010) and the World Bank WITS classification.