Social scientists have for a long time been cognisant that globalisation may have deep impacts on tax systems. In particular, economists have conjectured that increased openness pushes governments to reduce taxes on mobile factors of production and recover the revenue shortfalls by increasing taxes on immobile factors (Bates et al. 1985, Rodrik 1997). In this view, globalisation erodes the taxes effectively paid by capital owners, shifting the tax burden towards workers. The fall of statutory tax rates on corporate income worldwide (IMF 2019), and evidence that globalisation reduces income tax rates on mobile high-income earners at the expense of median-income workers (Egger et al. 2019) support this hypothesis. Prior work has focused on the recent experience of high-income countries, but how has cross-border integration affected the relative taxation of labour and capital historically and globally? And which countries have been most affected by the erosion of effective capital taxation, and why? Answering these questions is critical to shed light on the macroeconomic effects and long-run social sustainability of globalisation.

A new dataset to measure the effective taxation of capital and labour globally since the 1960s

Assessing the extent to which globalisation has affected tax systems requires a global and long-run dataset on the taxation of capital and labour. In Bachas et al. (2022), we assemble data on effective tax rates (ETRs) on labour and capital covering 150 countries and half a century. Constructed following a common methodology, these series offer a worldwide, historical, and comparative perspective on the evolution of tax structures.1

ETRs capture all taxes paid: on corporate income, individual income, payroll, property, inheritance, and consumption. They then assign each type of tax revenue to capital, labour or a mix of the two and divide these by their respective capital and labour flows in national accounts (Mendoza et al. 1994).2 ETRs thus make it possible to estimate total tax wedges – for instance, the gap between what it costs to employ a worker and what the worker receives – and how these wedges vary internationally and over time. Since capital income is always more concentrated than labour income, the relative taxation of the two factors of production is closely linked to the overall progressivity of the tax system.

Diverging global trends in capital versus labour taxation

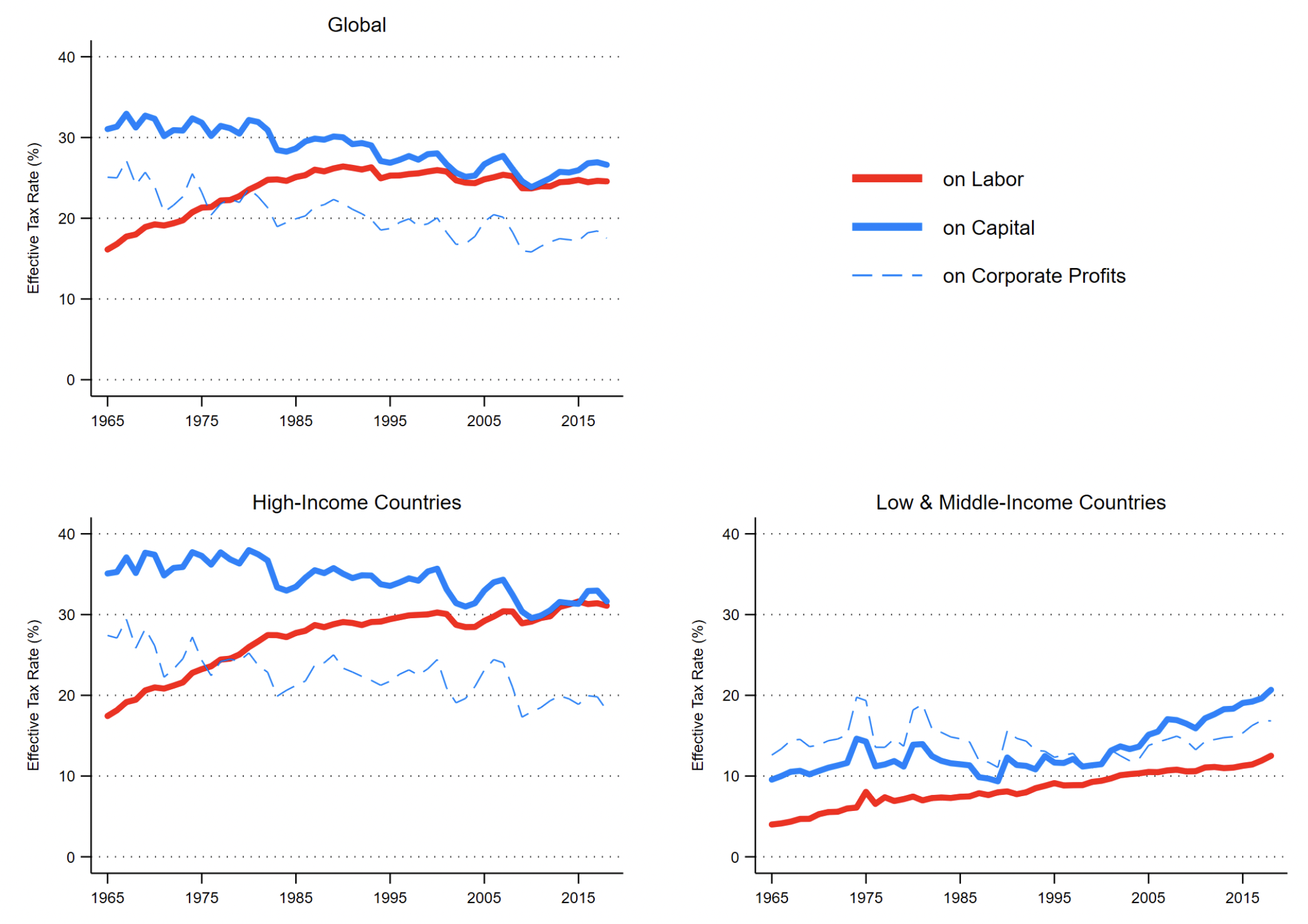

We use these new data to describe the evolution of factor income taxation (Figure 1). Taking a global perspective, we find that average effective labour and capital tax rates have converged globally since the 1960s, due to a 10 percentage point increase in labour taxation and a 5 percentage point decrease in capital taxation. The decline in capital taxation is driven by a collapse in the taxation of corporate profits, from close to 30% in the 1960s to less than 20% in the late 2010s. The rise in labour taxation owes primarily to the expansion of payroll taxes.

Yet, a striking finding is the asymmetric evolution of capital taxation across countries of different development levels. In high-income countries, ETRs on capital collapsed from close to 40% in the post-WWII decades to about 30% in 2018. By contrast, in developing countries ETRs on capital have been on a rising trend since the 1990s, albeit starting from a low level. Their effective capital tax rate increased from 10% to 20% in the past three decades, with the rise happening primarily in large economies. Between 1995 and 2018, the ETR on capital rose from 10% to 30% in China, 7% to 11% in India, 18% to 28% in Brazil, and 5% to 10% in Mexico. This is one factor explaining the rise in the overall tax-to-GDP ratio of developing countries, along with the increase of indirect taxes and a slow but steady rise in labour taxation.

Figure 1 The effective taxation of capital and labour

Note: this figure plots the time series of average effective tax rates on labour (blue) and capital (red), as well as the effective tax rate on corporate profits (red dashed line). The top-left panel corresponds to the global average, weighting country-year observations by their share in that year’s total NDP, in constant 2019 USD (N=156). The bottom-left panel shows the results for high-income OECD countries (N=37), and the bottom-right panel for low- and middle-income countries (N=119).

Globalisation had asymmetric effects on capital taxation in OECD versus developing countries

A major evolution of the past decades is the rapid growth in the trade of goods and services, in high- and low-income countries alike. Since firms’ ability to shift production processes across borders may limit governments’ capacity to tax mobile factors of production, globalisation may help explain the long-run decline in the taxation of capital in rich countries. However, since the 1990s – the onset of the hyper-globalisation period – developing countries experienced a rise, not a fall, in effective capital taxation.

Focusing on developing countries, the positive association between trade and capital taxation runs deeper. Developing countries which joined the first wave of globalisation saw trade and the ETR on capital rise in tandem prior to the 1990, and stagnate thereafter, while countries which participated in the second wave of globalisation (after the early-1990s proliferation of trade agreements) saw an increase in their trade and capital taxation in the past two decades.

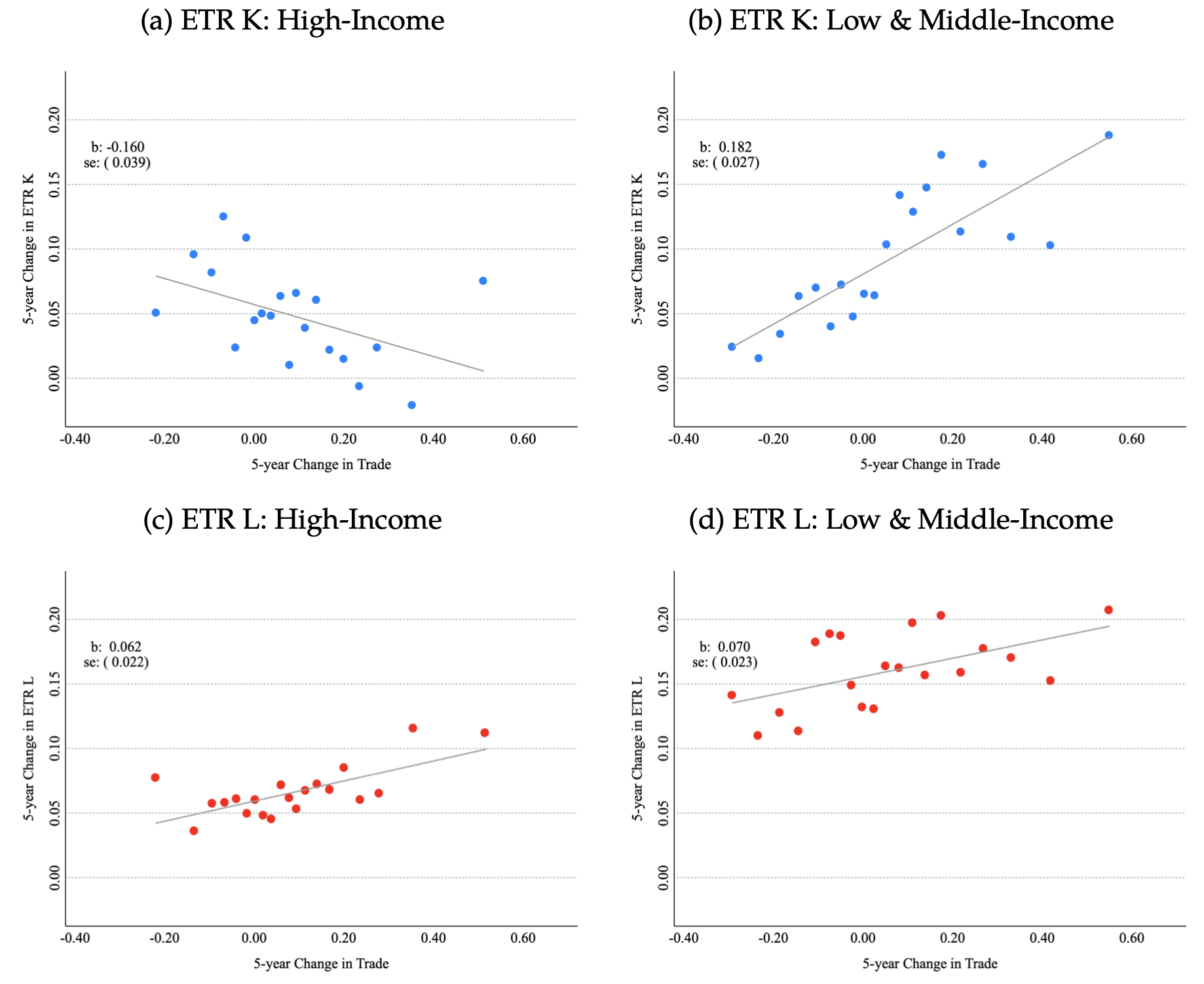

The dichotomy in the correlation of trade and capital taxation between high versus low- and middle-income countries can be seen in Figure 2. Changes in trade – measured as exports and imports as a share of GDP – correlate negatively (positively) with changes in capital taxation in rich (poor) countries. This is not the case for the correlation of changes in trade with changes in labour taxation, which is positive and similar across countries.

In our paper, we develop two further empirical strategies to show that the results are likely to be causal: an event study around the time of key trade liberalisation reforms in large developing countries (detailed in Goldberg and Pavcnik 2016), and an instrumental variable strategy for trade (adapted from Egger et al. 2019). The results consistently show that trade integration leads to rising effective capital taxation in developing country but not in richer ones, and a more modest rise in effective labour taxation, everywhere.

Figure 2 Changes in effective taxation of capital and labour versus changes in trade

Note: Association between changes in trade and changes in effective tax rates of capital (panels a and b) and labour (panels c and d), respectively for high income OECD countries and for low and middle income countries. Trade is measured as the sum of import and exports as a share of Net Domestic Product. Binned scatter plots of the outcome against trade, after residualising all variables against year fixed effects.

Trade integration exerts a positive effect on tax capacity of developing countries

What mechanisms might explain these results? Trade liberalisation could produce two opposing effects on capital taxation. First, as previously discussed, globalisation exacerbates tax competition and creates new opportunities for tax avoidance, putting downward pressure on capital tax rates (a race-to-the-bottom effect). Indeed, we find that trade liberalisation is associated with a decline in statutory corporate tax rates across all countries, but more so in high-income countries.

Second, trade integration can exert a positive effect on developing countries’ ability to raise tax revenue by increasing the concentration of economic activity in formal corporate structures at the expense of smaller informal businesses. This facilitates the imposition of taxes, particularly of corporate taxes (a pro-tax-capacity effect).

Consistent with the tax-capacity hypothesis, we show that trade integration leads to a rise in the fraction of domestic product that originates from the corporate sector (at the expense of the non-corporate business sector) and to an increase in salaried employment (at the expense of self-employment). Thus, a growing fraction of output is produced in sectors that are more visible and easier to tax. Further, the positive impact of trade on capital taxation is stronger in populous countries and in countries with restrictions on capital flows, consistent with the notion that large countries and countries managing their capital accounts are less exposed to the race-to-the-bottom effect.

Conclusion

On net, the trade-induced increase in tax capacity dominates the statutory tax rate reduction in developing countries, and vice-versa in rich countries. Thus, the results paint a nuanced picture of how trade integration has impacted the taxation of capital versus labour, and enhanced both labour and capital taxation in developing countries, albeit starting from much lower levels than in rich countries.

In future research, the database could be used to study the effects of globalisation on tax inequality between groups of individuals, by combining macroeconomic tax rates on labour and capital with estimates of the progressivity of labour and capital taxes. Moreover, changes in tax progressivity could be compared to the effects of globalisation on the distribution of pre-tax income. This would make it possible to quantify the extent to which changes in taxation caused by globalisation have curbed or exacerbated the un-equalising effects of international economic integration.

References

Bachas, P, M Fisher-Post, A Jensen and G Zucman (2022), “Globalization and Factor Income Taxation”, NBER Working Paper Series 29819.

Bates, R and D D Lien (1985), “A Note on Taxation, Development and Representative Government”, Politics and Society 14(1): 53-70.

Egger, P H, S Nigai and N M Strecker (2019), “The Taxing Deed of Globalization,” American Economic Review 109(2): 353-90.

Goldberg, P and N Pavcnik (2016), “The Effects of Trade Policy”, NBER Working Paper Series 21957.

International Monetary Fund (2019), “Corporate Taxation in the Global Economy”, IMF Policy Paper No. 19/007.

Mendoza, E G, A Razin, and L L Tesar (1994), “Effective tax rates in macroeconomics: Cross-country estimates of tax rates on factor incomes and consumption”, Journal of Monetary Economics 34(3): 297-323.

Rodrik, D (1997), “Trade, Social Insurance, and the Limits to Globalization”, NBER Working Paper Series (5905).

Endnotes

1 The data are available here.

2 Indirect taxes are not included in the main definition of effective labour and capital taxes. To include indirect taxes, one would assign them to capital and labour proportionally to their respective shares in national accounts, thus not changing the gap between the ETR on capital versus the ETR on labour (but changing their overall levels).