Globalisation changes the conduct of businesses. On the one hand, they have access to new international markets; on the other, they find themselves facing new competitors in their own domestic markets. There is, however, a fundamental asymmetry. While all businesses endure the adverse effects of increased domestic competition, only the most efficient manage to compensate for these with the benefits of greater penetration in foreign markets. A consequence of this asymmetry is globalisation’s tendency to have disruptive effects on the internal equilibrium of entire sectors, in which the more efficient businesses can afford the costs of internationalisation and thus prosper, while the less efficient ones remain confined to their increasingly contested domestic market and suffer. In some cases, globalisation changes not only the conduct of businesses but also their rules of engagement, thus redefining the very nature of the industries in which they operate, with unpredictable outcomes in terms of their financial stability and competitive balance. One very interesting case in point is that of the European football industry.

Globalisation, regulation, and European football

In 2009 the Union of European Football Associations (UEFA) began developing a set of Financial Fair Play (FFP) regulations, with the aim of imposing greater financial discipline and responsibility on the strategies of European clubs in defence of the long-term sustainability of the football industry. At that time, very few clubs were managing to make a profit. Indeed, half were operating at a loss, and the combined losses of the major European leagues kept on rising: from €0.6 billion in 2007 to over €1.5 billion in 2010. Financial fair play was approved precisely in that year and came into force the following year.

At the core of the Financial Fair Play are the ‘break-even requirements’, which demand that clubs offset certain “relevant” expense items with “relevant” income items. Roughly speaking, the relevant items are those having to do directly with the running of the first team. For example, the players’ and coaches’ salaries and the costs for players’ registrations and their amortisation are recognised as relevant on the expenditures side. On the revenues side, to the relevant category belong the receipts from match tickets, income from media coverage (especially from TV rights), advertising and sponsorships, and profits made from the buying and selling of players’ contracts. Differently, expenses for long-term strategic investments, such as for building a new stadium or developing the youth teams, are not relevant for the break-even requirements. The final goal is to help clubs avoid finding themselves in a situation of being unable to meet the financial commitments necessary to ensure their participation in the competitions in which they are enlisted without running into excessive debt and without resorting to discretionary (and therefore unpredictable) “gifts” from their owners. The break-even requirements have to be met over a three-year period, with the exception of acceptable “deviations”. Sanctions for breaching this balancing requirement are imposed by UEFA on clubs in the form of various forfeitures should they participate in its international competitions.

What does globalisation have to do with all this? To answer this question, one must inquire as to the origin of the growing interest of the regulators (i.e. the national football federations gathered under the UEFA umbrella) and, in parallel, the regulated (i.e. the clubs gathered under the umbrella of the European Club Association, or ECA) in ensuring each club’s financial stability. This interest arises from the fact that the main product that UEFA and the ECA sell to the world is the Champions League (the competition among Europe’s best teams). This is a media entertainment product that participating clubs produce jointly. Each club is only an ingredient – a more or less important one as the case may be. The joint product, therefore, is attractive only if all the ingredients are of good and stable quality over time. In this respect, a club that fails to make ends meet in a sustainable manner runs the risk of not ensuring adequate participation in the competition, and thus of impairing the joint product’s quality and saleability.

Globalisation has opened up an enormous international market for the Champions League, especially in large emerging countries such as China. At the same time, it has pitted UEFA and the ECA against new competitors such as the American professional sports leagues, above all those of baseball (Major League Baseball, MLB), American football (National Football League, NFL), basketball (National Basketball Association, NBA) and ice hockey (National Hockey League, NHL).

Financial Fair Play and economic performances: The ‘real effects’

In a recent paper (Caglio et al. 2019) we shed light on the impact of Financial Fair Play on the European football industry in terms of economic and financial performance, with a special emphasis on what accounting refers to as the ‘real effects’ of measurement rules. For the football industry, the introduction of the regulations amounts to a change in “which economic transactions are measured, which are not measured, how they are measured and aggregated” (Kanodia and Sapra 2016). In particular, the break-even requirements represent a new accounting measure that must be implemented according to well-defined measurement rules, making it verifiable and contractible. They may have ‘real effects’ in so far as they have the potential to shape football managers’ decisions by redefining their preferences and incentives towards financial sustainability in a situation of moral hazard due to a soft budget constraint (Kornai et al. 2003).

Our analysis exploits an original dataset assembled using publicly available information from Amadeus (Bureau van Dijk) covering 150 clubs playing in the top five European Leagues (those of England, France, Germany, Italy, and Spain) from 2005 to 2015. In principle, since 2011 all clubs have had to comply with the Financial Fair Play regulations. However, the penalties for lack of compliance are only relevant to clubs with ambitions of participating in UEFA’s international competitions. We thus divide our 150 clubs into two groups. The first includes clubs that we refer to as being ‘targeted’ by the FFPR: those with international ambitions as proxied by their regular participation in international competitions. The second group includes all other clubs. We then compare the behaviour of the two groups of clubs after 2011 to identify any ‘real effects’ of the FFP regulations on targeted clubs through a difference-in-differences (DiD) methodology.

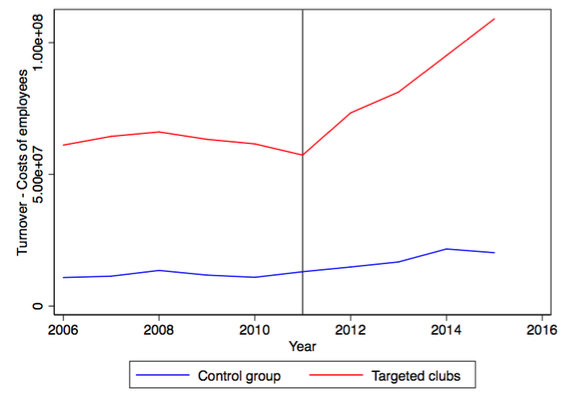

We find that, after the introduction of regulations, the gap between turnover and cost of employees has increased for all clubs (by an average of around €5 million per year from 2011 to 2015), but much more markedly for clubs with stronger international ambitions (by an average of around €20 million per year). In particular, the gap between turnover and cost of employees for targeted clubs has increased on average by 40%, amply exceeding the initial level of €60 million after the introduction of the new regulations. Figure 1 depicts the evolution of the difference between turnover and cost of employees over the period of observation.

Figure 1 Turnover minus cost of employees: Targeted clubs versus control group

In Figure 1, targeted clubs follow the higher trajectory, which exhibits a clear break in trend when the Financial Fair Play regulations are implemented. The break is hardly detectable for the lower trajectory corresponding to the non-targeted clubs, indicating a differential increase in the margin between turnover and costs of employees for targeted clubs post-FFP that is consistent with the increasing relevance of the break-even requirements for these clubs. Our econometric results not only confirm the statistical significance of these patterns, but also reveals that around three quarters of the increase for targeted clubs would not have materialized without the FFP regulations. The observed growth in the difference between turnover and cost of employees is the result of growth in both terms, with turnover increasing more than costs.

A limitation of publicly available information is that the difference between turnover and cost of employees is only an approximate measure of the balance between the “relevant income” and “relevant expenses” monitored by under the FFP regulations. UEFA thus agreed to replicate our methodology on their proprietary database, which more accurately reflects the calculation of break-even requirements. The results are confirmed: from 2011 to 2017, the gap between relevant income and relevant expenses increased on average for all clubs, but more markedly for clubs with stronger international ambitions.

Financial Fair Play, financial sustainability, and competitive balance

While we find that, since the introduction of the Financial Fair Play regulations, there has been an improvement in the income statements of European football clubs consistent with the break-even requirements having ‘real effects’, two issues remain unsettled and call for future research. First, we find that the improvement in clubs’ income statements has yet to translate into better overall financial sustainability evaluated also in terms of the balance sheets (e.g. in terms of debt over cash flow). As financial sustainability of the football industry is the final goal of UEFA, it will be important to monitor how it evolves in the next few years.

Another important issue worth further investigation is how the FFP regulations affect the polarising impact of globalisation in the industry. The fear of some analysts (e.g. Simmons 2012, Peeters and Szymanski 2014, Szymanski 2014; also Grabar and Sonin 2018 for a dissonant view) is that, through an ‘ossification effect’, the Financial Fair Play may entrench the process of polarisation between a tiny minority of large, successful clubs and the vast majority of struggling small and medium-sized clubs. This is a fear common to many other globalising sectors.

References

Caglio, A, S Lafitte, D Masciandaro and G I Ottaviano (2019), “Does Financial Fair Play Matter? The Real Effect of UEFA Regulation for European Football Clubs”, Baffi Carefin Working Paper Series No. 119, Bocconi University.

Grabar, V and K Sonin (2018), “Financial Restrictions Improve Competitive Balance in Sports”, VoxEU.org, 20 October.

Kanodia, C and H Sapra (2016), “A Real Effect Perspective to Accounting Measurement and Disclosure: Implications and Insights for Future Research”, Journal of Accounting Research 54(2): 623-676.

Kornai, J, E Maskin and G Roland (2003), “Understanding the soft budget constraint”, Journal of Economic Literature 41: 1095–1136

Peeters, T and S Szymanski (2014), “Financial Fair Play in European Football”, Economic Policy 29(78): 343-390.

Simmons, R (2012), “Financial Foul Play? An Analysis of UEFA’s Attempts to Restore Financial Discipline in European Football”, VoxEU.org, 3 September.

Szymanski, S (2014), “Financial Fair Play in Football”, VoxEU.org, 6 July.