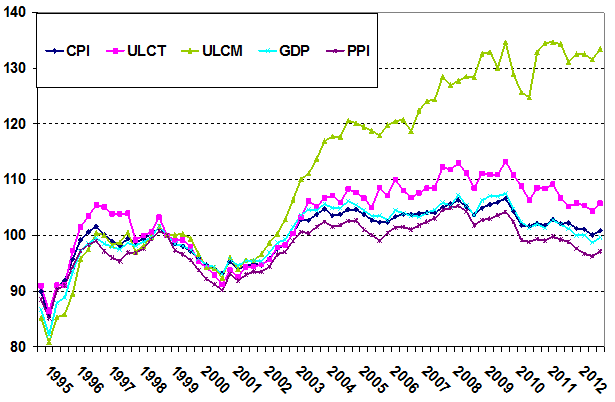

Assessing Italy’s price competitiveness is becoming a puzzling challenge. Among others, Paul Krugman (2012) has questioned the reliability of the Italian cost-based indicators pinpointing their links with the “[country’s] mysterious productivity collapse”. Bayoumi et al. (2011) also claimed that “[w]hile Italy’s competitiveness does appear to have eroded [since 1995], the size of this effect is, frankly, anyone’s guess”. Indeed, since the inception of the European Monetary Union and until the end of 2012, Italy had lost as much as 33.5 percentage points in competitiveness on the basis of its real effective exchange rate, built upon unit labour costs in manufacturing, while a moderate gain of nearly three percentage points is revealed by the indicator based on producer prices and minor changes in the other frequently used measures (Figure 1). The contrasting evidence across indicators proves more pronounced for Italy than for other main economies in the Eurozone (Fig. 2); if due to diverging domestic labour costs and prices, it may signal a worrying buildup of cost pressures on Italian firms, which would be forced to progressively squeeze their profit margins in order to keep up with their competitors in a strive to stay on the market. If that were the case, absent a swift change in labour-cost trends, the process would risk to be unsustainable in the medium term (see, for instance, Levy 2012 on this site).

Figure 1. Alternative price-competitiveness indicators for Italy

Note: Average quarterly data; 1999Q1=100.

Figure 2. The dispersion of price-competitiveness indicators within the Eurozone

Note: Standard deviations across indicators in Figure 1.

Source: Bank of Italy and ECB. (1) PPI stands for producer price index in manufacturing, CPI for consumer price index, ULCT (ULCM) for unit labour costs in total economy (manufacturing) and GDP for GDP deflator.

In this column we review the main drivers of different competitiveness indicators in order to assess whether the alarming reading of their discrepancy in Italy is warranted, and to shed light on their varying power to predict the ability of domestic exporters to thrive in a changing environment.

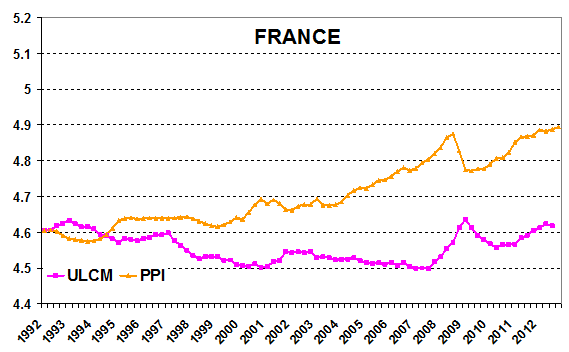

First, a visual inspection of the trends of manufacturing producer prices and unit labour costs within countries suggests that in Italy the two series move together over time, whereas a significant divergence is detected in Germany and France (Figure 3). In order to validate these indications, we pursued a formal cointegration analysis in the period 1992Q1-2012Q4 (Giordano and Zollino 2013). Our empirical findings confirm the lack of significant misalignment between unit labour costs and producer prices in the Italian manufacturing sector in the long run, thus dismissing the haunt of non-viable restraints on profit margins due to excessive labour costs. A glance at institutional sector accounts confirms that in the years 2003-07, in which the real effective exchange rate, based on unit labour costs in manufacturing, sky-rocketed, the profit rate of non-financial corporations in Italy marked only a moderate decrease, of around two percentage points in the overall period. At the same time we find that a long-run co-movement between unit labour costs and producer prices in the industrial sector is rejected for both Germany and France. This would suggest that the discrepancy between real effective exchange rates based on unit labour costs in manufacturing and producer prices observed in Italy is more correctly due to price-cost developments in its main trading partners.

Figure 3. Trends in manufacturing producer prices and unit labour costs

Note: Average quarterly data; logarithms of indices 1992Q1=100. Source: Eurostat.

Although a full explanation of the long-run behaviour of deflators across countries goes beyond the scope of this article, we believe that a key factor is the internationalisation of domestic production processes. Less pronounced offshoring in Italian manufacturing, and therefore less sizeable changes in the shares of wages and intermediate inputs on gross output, can explain the broad stability found in the long-run relation between its prices and labour costs. This is confirmed by the observation that the use of material intermediate goods has been relatively stable in Italy between 1995 and 2005 (based on EU-Klems data), while it has significantly increased in countries such as Germany (see also Sinn 2005 and, on this site, Marin 2010).

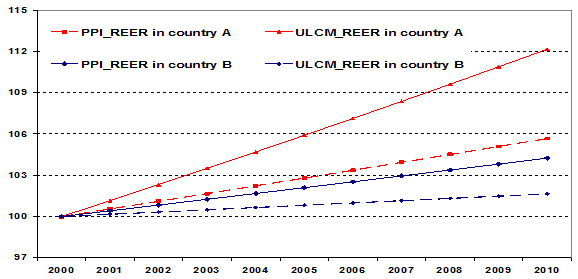

Secondly, we run a simulation in order to better illustrate why Italy’s real effective exchange rates diverge so significantly although the underlying domestic deflators co-move in the long run. In particular we build artificial competitiveness indicators for a limited number of trading partners, namely country A, B and the Rest of the World, under the following assumptions: i) country B is a major partner of country A, whereas the relevance of country A for country B is much smaller, e.g. as is the case of Italy (country A) and Germany (country B); ii) trends in producer prices and unit labour costs in manufacturing are similar in country A, whilst they are higher in both country B and in the Rest of the World.

In this simplified setup it clearly turns out that the basic arithmetic of real effective exchange rates plays a pivotal role. Focusing on a comparison between country A and B, we find that i) the discrepancy in the producer prices-based real effective exchange rates of the two countries is limited, but ii) the ones based on unit labour cost in manufacturing would signal a larger loss of competitiveness in the former than in the second country (Figure 4). Indeed firms in country A suffer from lower labour-cost than producer-price growth in both their partners, while country B exporters on the one side face only one partner (Rest of the World) in this condition, on the other they directly gain from their domestic labour-cost growth being lower than their producer-price growth.

Figure 4. Producer-price- and labour-cost-based indicators in an artificial world

Note: Average yearly data; 2000=100.

Italy’s price competitiveness : Mystery or mirage?

Is the 'mystery' of Italy’s price competitiveness real or is it a mirage emanating from flawed indicators? Traditionally relative labour costs are a good proxy of a country’s competitiveness in the medium term, beyond the short-term adjustments in profit margins. However, in a context of intense globalisation and of restructuring of global value chains, the share of domestically employed labour on total production costs is decreasing, to different extents across countries. Wage shares in the manufacturing sector have actually fallen in most European countries, but to a changing degree generally depending on initial conditions. For instance, between 1998 and 2007 wage shares of gross output plummeted in Germany (from 27.4% to 20.7%), whereas they only marginally diminished in Italy (from 20.6% to 18.2%).

Given the fading representativeness of labour costs in the manufacturing sectors of advanced economies, relying solely on labour-cost-based indicators may provide a biased assessment of price competitiveness. Price-based indicators seem to convey more reliable signals, and in our analysis this proves a convincing argument for Italy.

To conclude, we do not intend to downplay the competitiveness strains incurred by Italian exporters, as indirectly revealed by the progressive erosion of their world market shares (European Commission 2013), somewhat more pronounced than in the case of their main partners. We do however point out that the drag on Italy’ price competitiveness of increasing labour costs is much less relevant, in current times, than the sluggish restructuring of its firms’ production processes, including their pattern of participation in increasingly pervasive global value chains.

References

Bayoumi, Tamim, Richard Harmsen and Jarkko Turunen (2011), “Euro Area Export Performance and Competitiveness”, IMF Working Paper, n. 140.

European Commission (2013) “In-depth review for Italy”, Staff Working Document, n. 118.

Giordano, Claire and Francesco Zollino (2013) “The Divergent Behaviour of Different Competitiveness Indicators for Italy: An Assessment”, Bank of Italy, mimeo.

Krugman, Paul (2012), “More about Italy”, The New York Times, 28 November.

Levy, Mickey (2012), “Diverging competitiveness among EU nations: Constraining wages is the key”, VoxEU.org, 19 January.

Marin, Dalia (2010), “Germany’s super competitiveness: A helping hand from Eastern Europe”, VoxEU.org, 20 June.

Sinn, Hans-Werner (2005), “Bazaar economy”, IFO policy issues.