An arbitrage opportunity is being created for insurers and, if not overseen, it may entail systemic risks.

Banking disintermediation – the search of institutions to find other sources of financing than banks – is on the rise as banks come under pressure. New regulations and capital constraints in the banking industry entail the need for more liquid instruments, such as government bonds, and retrench profitable trading activities and business lines deemed to be too risky, and hence too expensive. Since the capital treatment for insurers is, so far, less onerous than for banks, insurance groups are filling the void left by banks. Insurance companies have sizeable quantities of cash from policyholders and do not face the same funding issues currently affecting many of the banks. This new group of lenders is looking for alternative venues for their liquid cash.

The traditional insurance business is not systemic...

Per se, and as John Gapper correctly points out in the Financial Times, insurance is a less threatening activity than banking for the financial system as a whole. Insurers can get the risk of having to make payouts wrong, but it is very unlikely that they will suffer something like a bank run. In the aftermath of the financial crisis, there were no significant and negative collateral effects in the insurance sector. It ran and functioned normally and the rates rose significantly only in sporadic cases as a consequence of payouts due to costly but random events, such as earthquakes and hurricanes, and not as a consequence of the financial crisis.

…but other lines of business can be

This can change, however, if they get involved in noninsurance underwritings that may make them systemically relevant. The case of AIG, prior to September 2008, engaged in credit default swaps is a good example. Currently, the vacuum left by banks could display similar characteristics, as reflected in several investment vehicles:

- First, and according to a recent study from Allen & Overy, real estate finance is one of the markets where we are seeing tangible signs of insurance credit becoming available.

- Second, there is also an increasing scope for insurance firms to compete in corporate lending.

Insurers lend their excess liquidity to the banking sector in the form of liquidity swaps and other transactions. A similar scenario is collateral transformation, in which an institution trading through a central counterparty swaps – in the repo market – securities that are non-eligible as collateral for cash or short-term debt owned by, for instance, insurers.

- Third, insurance firms are stepping into the infrastructure debt market, • and their lending is expected to increase substantially, according to a recent study by Standard & Poor’s.

- Last, in a survey conducted by ING on managers involved in insurance company assets, 66% of respondents said that insurers will increase their equity allocations over the next five years, against only 8% anticipating a cut.

This increase is motivated by the search for yield, despite the high capital reserves imposed by Solvency II. The bottom line of these examples of non-insurance underwritings is that investment insurance groups are acting, and will increasingly act, as shadow banks, since they replace traditional banks as lenders.

There are many unknowns regarding shadow banking. It is difficult to track price movements, particularly in a market that is relatively illiquid. This poses the threat of a build-up of systemic risks because of the opaque nature of the sector. And some of the aforementioned lending activities, looking back, have shown themselves to be too risky and expensive for the taxpayer. Take real estate lending - the legacy of the last property bubble continues to weigh heavily on the banking sector as provisions against bad loans ate into profits and, in many cases, have required bailouts.

The International Association of Insurance Supervisors is about to announce its plans to deal with systemically important insurers and the Financial Stability Board will announce a list of such insurers – in the same spirit as it did with globally systemic banks – by the middle of this year. The criteria for joining the list will focus on the importance of their non-insurance underwritings, their centrality to the financial system, and their size. The metric to produce such a list is, however, still unclear. We hope that our recent research (Dungey et al. 2012) sheds some light on the subject.

‘SIFIRanking’ or ‘Googling systemically important financial institutions’

Measuring to what extend large insurance groups are becoming systemic is challenging due to the lack of central counterparty platforms for these investment vehicles. However, we propose that a simple network-based methodology for ranking systemically important financial institutions will help (2012). We view the risks of firms – including both the financial sector and the real economy – as a network with nodes representing the volatility shocks. The metric for the connections of the nodes is the correlation between these shocks. Techniques similar to those of PageRank’s centrality of Google allow us to rank firms in terms of risk connectedness, which is coupled with firm characteristics (size among others), which leads to our ‘SIFIRanking’. In our paper, we also present a systemic risk index for the financial sector.

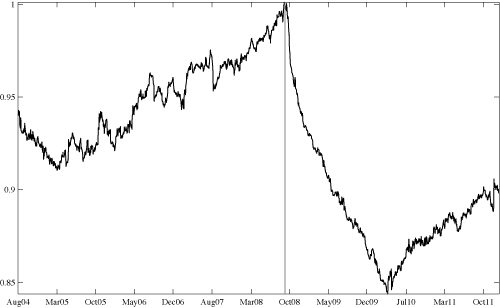

Figure 1 Systemic Risk Index - financial sector

Constructing a systemic index for the financial sector

Our system consists of all the firms in the Standard & Poor’s 500 index and the sample is from January 2003 to December 2011. Figure 1 shows the index for the financial sector. It builds up from early 2005 to reach its peak on the day deemed most risky in the sample, 11 September 2008. It follows a week of growing stress in the financial system, which included the federal takeover of Fannie Mae and Freddie Mac. Tensions remained very high in the period until 23 September 2008, following the bailout of AIG (16 September), peaked in September 2008, and greatly reduced after the introduction of Troubled Asset Relief Program and the rescue of AIG. The increase in the index from April 2010 aligns with increasing concerns over emerging problems in European sovereign debt markets. While the first signs of Greece’s problems emerged in late 2009, it was in the first quarter of 2010 that international financial markets were affected. The nadir of the Goldman Sachs index occurs around 15 April, after the EU bailout package was announced but before the call for IMF assistance on 23 April.

Classifying banks and insurers according to their systemic risk

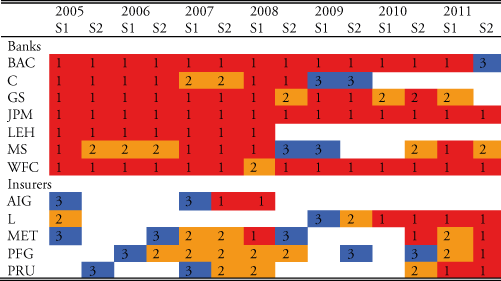

Next, we show the results for our SIFIRanking. In order to display our results, we opt for the bucketing approach of the Basel Committee on Banking Supervision (2011) that proposes a methodology to classify global systemically important bank.s They consider ‘buckets’ that represent increasing levels of additional loss absorbency requirements. The additional loss absorbency for the top empty bucket is 3.5% of risk–weighted assets, and it reduces by 0.5% for subsequent buckets. This bucketing approach is a convenient way to summarise the results.

Table 1 shows SIFIRanking in three buckets. Each year of the sample is divided into two periods of 6 months (S1 and S2). Each period, we check if at least 80% of the days each firm ranks in the top 10 (bucket one), between the top 10 and 20 (bucket two), and between the top 20 and 30 (bucket three). The number 1 in the table means that the corresponding firm on the given period is classified in bucket one. Likewise, for numbers 2 and 3.

Table 1 SIFIRanking using the Basel Committee bucketing approach

Bank of America (BAC in the table), JP Morgan (JPM) and Wells Fargo (WFC) are the three major banks that suffered the least from the crisis and that, in fact, have become bigger and reinforced. They rank consistently in bucket 1 throughout the sample. Citigroup (C) and Lehman Brothers (LEH) were also consistently in bucket 1. Goldman Sachs (GS) and Morgan Stanley complete the set of systemically important banks.

More interestingly, insurance firms also appear in the top of the ranking – AIG also appears in bucket 1 from July 2007 to its bailout in September 2008. AIG had poorly supervised non-insurance subsidiaries, and it did not appear on the radar screen of supervisors until it was too late. It manifests itself, however, in the top of our ranking in due time. At the end of the sample, other insurance firms emerge as systemic. Loews (L), Metlife (MET), Principal Financial Group (PFG), and Prudential (PRU) appear increasingly in the top over the last years. Metlife and Prudential are among the largest insurance groups worldwide. Principal Financial Group is a financial conglomerate that gathers retirement savings, investment and insurance products and services, i.e. insurance and investment vehicles. Loews Corporation owns 90% of CNA, a commercial and casualty insurance company that is among the largest in the US, and about 63% of the total revenues of Loews in 2011, the most important business line of the Corporation.

Conclusions

Probably the most fundamental regulatory concern today is the supervision of systemically important financial institutions. While much of the debate in the aftermath of the financial crisis focused on banks, insurers are also financial institutions that because of their size, market importance, related noninsurance businesses, and their sheer connectedness, may well be systemic. The Financial Stability Board is right in caring about insurers - our results show that they are becoming systemic.

References

Allen & Overy (2012), The future of credit, available at www.allenovery.com.

Dungey, M, Luciani, M and Veredas, D (2012), “Ranking Systemically Important Financial Institutions”, ECARES WP 2012/37.

Gapper, J (2012), “Insurers must learn lessons from AIG”, Financial Times, 12 December.

Masters, B (2013), “Insurers escape bank–style levies”, Financial Times, 22 March.

Standard & Poor’s (2013), “Out of the shadows: The rise of alternative financing in infrastructure”. RatingsDirect, 31 January, available at www.standardandpoors.com/ratingsdirect.

ING Investment Management (2013), “Investment view”, 27 March.