In recent decades, governments around the world have been increasingly interested in boosting innovation and the ‘knowledge economy’, as opposed to the manufacturing sectors that were the traditional focus of industrial policies. One manifestation of this trend has been through public efforts to boost financing for early-stage ventures. While this trend has been emerging for many years, it was manifested most dramatically in the months after the onset of the COVID crisis, as many tens of billions of dollars were allocated to support entrepreneurial firms and venture funds across major industrialised nations.1

The interest of policymakers in entrepreneurial finance is understandable. Financial intermediaries in the private capital markets, especially venture capital firms, have been shown to be a critical driver of innovation and economic dynamism in the US, and more recently, China (Akcigit et al. 2019, Puri and Zarutskie 2008). The historical absence of a robust venture sector has become a major concern of policymakers in the EU and elsewhere (Bottazzi et al. 2007).

But young high-growth businesses face substantial information problems, and their financing requires significant expertise (documented, for instance, by Kaplan and Stromberg 2003). The skilful allocation of capital to such companies may consequentially be difficult for public officials. First, substantial uncertainty and informational asymmetries surround the selection of new ventures, leading private investors to frequently make decisions based on soft information. Decision-making based on such imperfect information may be difficult for officials in bureaucracies to duplicate. Moreover, unlike virtually all government employees, private financiers’ compensation is strongly tied to the success of their investments. This approach improves investors’ incentives to devote substantial effort and make tough decisions (e.g. shutting down an investment despite the pressures associated with career concerns and other agency problems).

In our recent paper (Bai et al. 2021), we assemble the first comprehensive and detailed data on the universe of government funding programmes of entrepreneurial ventures around the world. We explore whether government entrepreneurial funding programmes can address capital allocation through ties with private capital markets. Consistent with the suggestions of Acemoglu and Robinson (2013), we might anticipate that highly effective governments would anticipate the capital allocation difficulties outlined above and collaborate with private capital markets to address them.

This hypothesis can be contrasted with two alternative views. The first is that government programmes’ allocation of capital is unrelated to private financing. In fact, government investments may even ‘crowd out’ private capital. Alternatively, public funding may follow private funding. But these dynamics may also arise for reasons other than maximising efficacy and improving capital allocations to early-stage ventures. We highlight two alternative explanations for such a pattern. First, ‘trend-chasing’ may explain the positive correlation between private capital markets and public government programmes, as both sets of actors pursue investments perceived with promising attractive private returns.2 Second, the literature has suggested that government financing programmes subject to rent extraction may have a pro-cyclical bias. The abundant revenues during booms may be especially tempting for parties seeking to benefit themselves. Such forces could generate a positive correlation between private capital markets and government funding programmes, but for reasons other than improving capital allocation.

Motivated by the hypotheses articulated above, we seek to understand (1) if public entrepreneurial finance programmes rely on private capital; and (2) if so, is it because of an attempt to improve capital allocation to early-stage ventures or instead due to trend-chasing or rent-extraction motives? Answering these questions is challenging due to data limitations.

We addressed this gap by using a hand-collected novel data set on nationwide entrepreneurial finance policies around the world, active between 1995 and 2019 (755 programmes in 66 countries). We looked at national level programmes with a focus on financing domestic entrepreneurial firms or intermediaries that fund them.

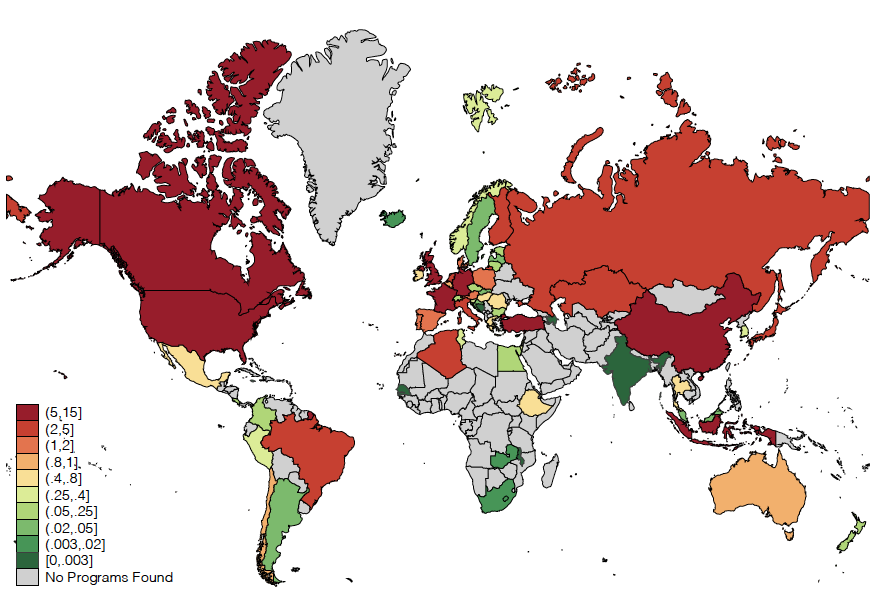

The dataset (summarised in Figure 1) illustrated, among other patterns, the scale of these efforts. Between 2010 and 2019, national governments’ entrepreneurial finance programmes around the world had on average a cumulative annual budget of $156 billion, as opposed to an average of $153 billion of global disbursements of traditional venture funds.

Figure 1 Average of annual budget (in billions of US dollars) of entrepreneurial finance policies active between 1995 and 2019 inclusive by nation

Our analysis found that more private venture activity was associated with subsequent government entrepreneurial finance – the two sources of capital were positively correlated. Using panel data, we saw not just a positive correlation but also that public policies followed private capital investments. Moreover, increases in venture capital activity in a given industry-country pair were followed by subsequent government funding programmes that targeted those industries as well.

To better understand the mechanisms behind the positive correlation between governments’ funding programmes and local private capital, we then examined the structure of these programmes. Consistent with the hypothesis that the complementarity mitigated investment frictions, we found three ways in which government programmes frequently structured their programmes to rely on private capital markets: (1) the involvement of private sector actors in investment screening, (2) the funding of intermediaries rather than companies directly, and (3) capital matching requirements by private investors. Moreover, we found that government programmes were even more likely to rely on private capital markets when targeting earlier stage companies, where information asymmetries may be greater.

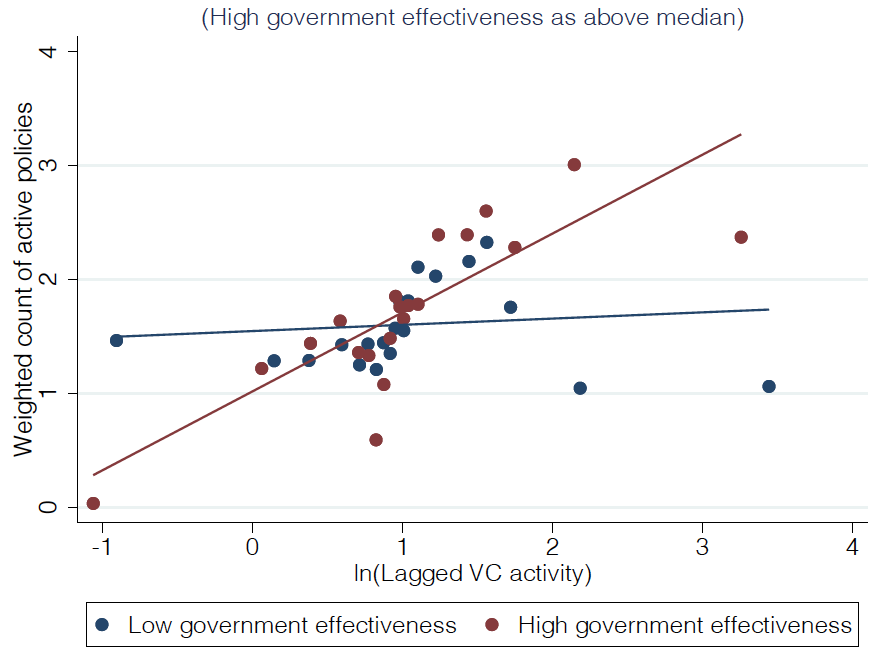

Consistent with the interpretation that government reliance on the private sector alleviated the information and incentive problems that the public sector may encounter, we found that the positive correlation between private and public activities was more pronounced when governments were more effective (see Figure 2). More effective governments were more likely to structure their funding programmes with greater private sector involvement. These findings were consistent with the hypothesis that highly effective governments foresaw and addressed the information and incentive problems that public programmes encountered. By collaborating with private financiers of entrepreneurial firms, public bodies may have been able to head off problems proactively.

Figure 2 Active policies versus lagged VC activity

Note: This figure is a binned scatter plot of the weighted count of active policies versus the natural logarithm of lagged VC activity split by government effectiveness, that is, above and below the median level of the government effectiveness measure. The binscatter controls for population and GDP per capita, and includes country and year fixed effects. Observations are at the country-year level from 1995 to 2019.

We also found consistent evidence when we looked at the impact of neighbouring programmes. Nations whose neighbours initiated public entrepreneurial finance programmes were more likely to do so themselves. More interestingly, the evidence was consistent with knowledge spillovers regarding effective programme design – countries with neighbouring programmes were likely to display a strong correlation between public and private funding.

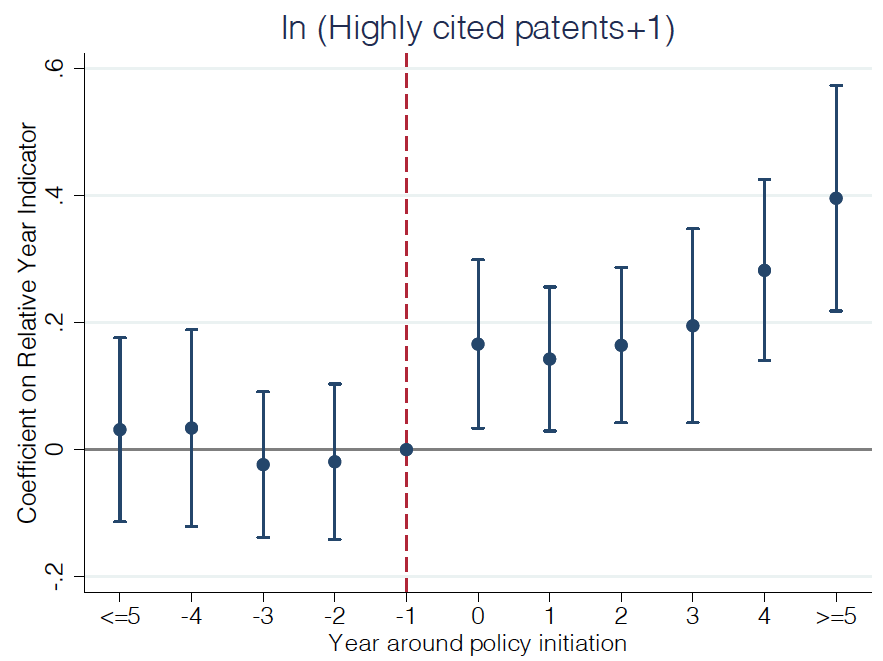

Finally, we explored the innovation generated following the initiation of government funding programmes. We explored different metrics based on US patent filings, which we believed were well suited for this assessment. Across all innovation measures, we found similar patterns – a meaningful and statistically significant improvement following the initiation of government funding programmes (see Figure 3). Important for interpreting these results, we found no statistically significant pre-existing trends in the years leading to the government funding programmes. Moreover, the improvements in innovations were particularly concentrated among the set of programmes that targeted early-stage ventures or required collaboration with the private capital markets.

Figure 3 New venture policy introduction and patent outcomes

Note: The figure shows the coefficients on the relative year indicators from a regression which includes country and year fixed effects as well as country-year specific controls, specifically the logarithm of population, per capita GDP, and lagged venture capital activity. The patent outcome variable is the log-transformed number of awards in the top 10% of that application year-technology class cohort. Results are reported relative to the year of the first introduction of an entrepreneurial finance program observed in the sample period of 1990-2019 by country i. The vertical line is positioned at the year prior to program initiation. Standard errors are clustered at the country level. 95% confidence intervals are shown.

The results are inconsistent with the alternative interpretations offered above. There was little a priori reason why the trend-chasing or the rent-seeking stories would lead to the heavy reliance on private sector actors in the way public programmes are structured. Instead, the complementarity between public and private entrepreneurial finance seemed to be mostly consistent with the hypothesis that such complementarity enabled mitigating frictions that arose in the deployment of capital to early-stage firms. This was also consistent with our finding that innovation increased following government funding programmes that either targeted early-stage ventures or required collaboration with private capital investors.

Authors' note: Harvard Business School’s Division of Research provided financial support for our work. Josh Lerner has advised institutional investors in private equity funds, private equity groups, and governments designing policies relevant to private equity. All errors and omissions are our own.

References

Acemoglu, D, and J A Robinson (2012), Why Nations Fail: The Origins of Power, Prosperity, and Poverty, New York, Crown Business.

Akcigit, U, E Dinlersoz, J Greenwood, V Penciakova (2019), “Synergising ventures: The impact of venture capital-backed firms on the aggregate economy”, VoxEU.org, 24 September.

Bai, J, S Bernstein, A Dev, and J Lerner (2021), “Public entrepreneurial finance around the globe”, SSRN working paper no. 3834040.

Bottazzi, L, M Da Rin, and T Hellmann (2007), “The European venture capital industry”, VoxEU.org, 16 August.

Kaplan, S N, and P Stromberg (2003), “Financial contracting theory meets the real world: An empirical analysis of venture capital contracts”, Review of Economic Studies 70: 281-315.

Puri, M, and R Zarutskie (2008), “Lifecycle dynamics of venture-capital-financed firms”, VoxEU.org, 19 September.

Endnotes

[1] See, for example, CNBC, Betakit, and Business Insider.

[2] For instance, public programs are sometimes assessed based on “success stories” (accounts of companies that succeed commercially, regardless of the marginal contribution of public funds) or rely on proceeds from successfully exited investments for additional investment capital. Both these considerations may pressure public managers to in the companies or sectors with the greatest financial prospects.