The Arab world is undergoing a major political transition. The final outcomes of the changes are far from certain in nations where they have occurred. The geographical spread of the changes is also far from clear at this point. Nevertheless, there have been and will continue to be economic consequences from the moves towards democracy (see Besley and Kudamatsu 2007).

In recent research (Freund and Jaud 2013), we have looked at historical experiences to get an idea of likely outcomes. Specifically, to get a sense of what to expect, we identified and examined 90 attempts at transition from autocracy to democracy that took place over the last half century. Our results offer a cautiously optimistic tale for the Arab countries: most transitions are successful politically and/or economically.

In particular, we find that about 45% succeeded, 40% failed, and 15% achieved democracy gradually. Success is defined as achieving a high level of democracy within three years and maintaining it; failure is when democracy is achieved temporarily or only at very low levels; and gradual is sustained and significant democratic change that takes 4-15 years to complete.

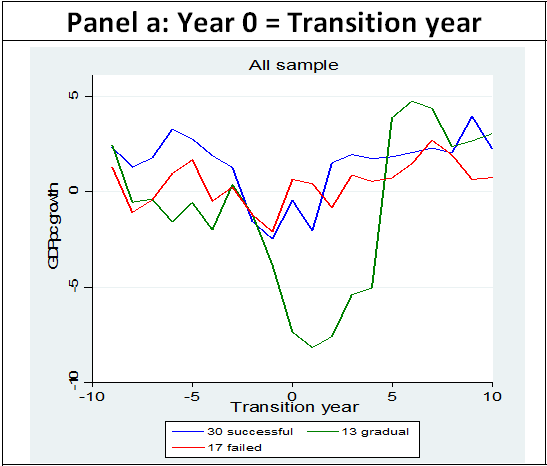

Importantly, we find that the majority of countries that underwent a transition experienced long-run gains in income growth following short-run declines (see Figure 1). Typically, countries face temporary challenges around the time of change with growth declining by 7-11 percentage points in the year of transition, though in the case of gradual transition declines were much larger around 21 percentage poiints and lasted longer1.

Figure 1. Average growth performance during democratic transitions

Note: After restricting thesample to countries with available data for at least ten years before and after the transition, the sample includes 30 successful, 13 gradual and 17 failed transitions. Panel a show the evolution of log per capita real income growth in a 20-year interval around the transition dates. In panel B the data are re-scaled, taking as year zero the year with lowest growth rate within a four-year interval before and after the date of transition.

But it is the effect of the type of transition on long-term growth that is most distinct. Countries with rapid transitions, irrespective of whether they are successful or failed, experience swift recoveries and a long-run growth dividend of about one percentage point relative to pre-transition growth levels. In contrast, countries undergoing gradual transition tend to stagnate for years, with high long-run costs to growth.

The similarity between successful and failed transitions in economic outcomes is striking. This suggests that the growth dividend found in earlier time-series studies of democratic transition may be due to regime change and not democracy. In particular, Rodrik and Wacziarg (2005), Persson and Tabellini (2006) and Papaioannou and Siourounis (2008) examine transition to democracy and also find a roughly one percentage point growth dividend – however, they focus on successful transitions. One explanation for the similarity between failed and successful transitions is that poorly performing dictators are more likely to be ousted and replaced with more competent ones, whether autocratic or democratic, so it is the regime change that brings growth and not the political slant. Our results are consistent with a large cross-country literature that does not find a significant effect of democracy on growth (Barro 1996).

The poor economic performance associated with gradual transition seems counterintuitive. Why does the speed of transition matter more for economic prospects than the outcome of transition? The answer is that most gradual transitions are gradual by default not by design, with political transition happening in fits and starts, resulting in elevated political and policy uncertainty for many years. This gives investors, employers, and consumers the incentive to wait and see what will happen before risking capital.

A typical example is Romania, one of only two eastern European countries that transitioned gradually. At issue was the 1990 election of the National Salvation Front, comprised of high-ranking officials from the ousted communist party. Numerous protests followed, some of which turned violent. The resulting uncertainty about Romania’s direction as well ongoing social unrest coincided with extremely poor economic performance. From 1991-1999, Romania’s GDP shrank nearly 2% on average each year, as compared with near zero growth for Hungary and almost 4% growth for Poland, two former communist countries with rapid and complete democratic transitions.

Of 14 gradual transitions only one, Ghana, was accompanied by strong economic performance. In Ghana, a predictable but slow political transition coincided with ongoing economic reform. Political freedoms were granted little by little, beginning with a free press, allowing human rights organisations, and elections in 1992, and leading to the president stepping down after serving two terms in 2000 as the constitution mandated, and the opposition party winning elections. Importantly, during this period, President Rawlings continued with the economic reform that had brought Ghana the highest growth in west Africa in the late 1980s, and growth remained over 5% throughout the transition period. Ghana, gradual by design and not default, is the exception that proves the rule.

Conclusions

There may be a lesson here for the post-revolution countries in the Middle East and in north Africa. A reasonable level of predictability is a prerequisite to growth. This means carefully plotting the direction of the transition, announcing the route in advance, and sticking close to it.

References

Barro, Robert J., “Democracy and Growth”, Journal of Economic Growth, 1 (1996), 1--27.

Besley, Tim and Masa Kudamatsu (2007), “What can we learn from successful autocracies?”, VoxEU.org, 5 July

Freund, Caroline, and Mélise Jaud (2013) “Regime Change, Democracy and Growth”, CEPR Discussion Paper 9282 (2013)

Papaioannou, Elias, and Gregorios Siourounis, “Democratisation and Growth”, Economic Journal, Royal Economic Society, 36, 365-387.

Persson, Torsten, and Guido Tabellini, “Democracy and Development: The Devil is in the Details”, The American Economic Review, 96, 319-24.

Rodrik, Dani and Romain Wacziarg, “Do Democratic Transitions Produce Bad Economic Outcomes?," The American Economic Review Papers and Proceedings, 95 (2005), 50-56.

1 The percentage drop is computed as the difference in income growth between year 0 and year (-3) when the data is rescaled taking trough year as year 0.