The near-term outlook is muted by rising Covid-infections and persisting supply bottlenecks …

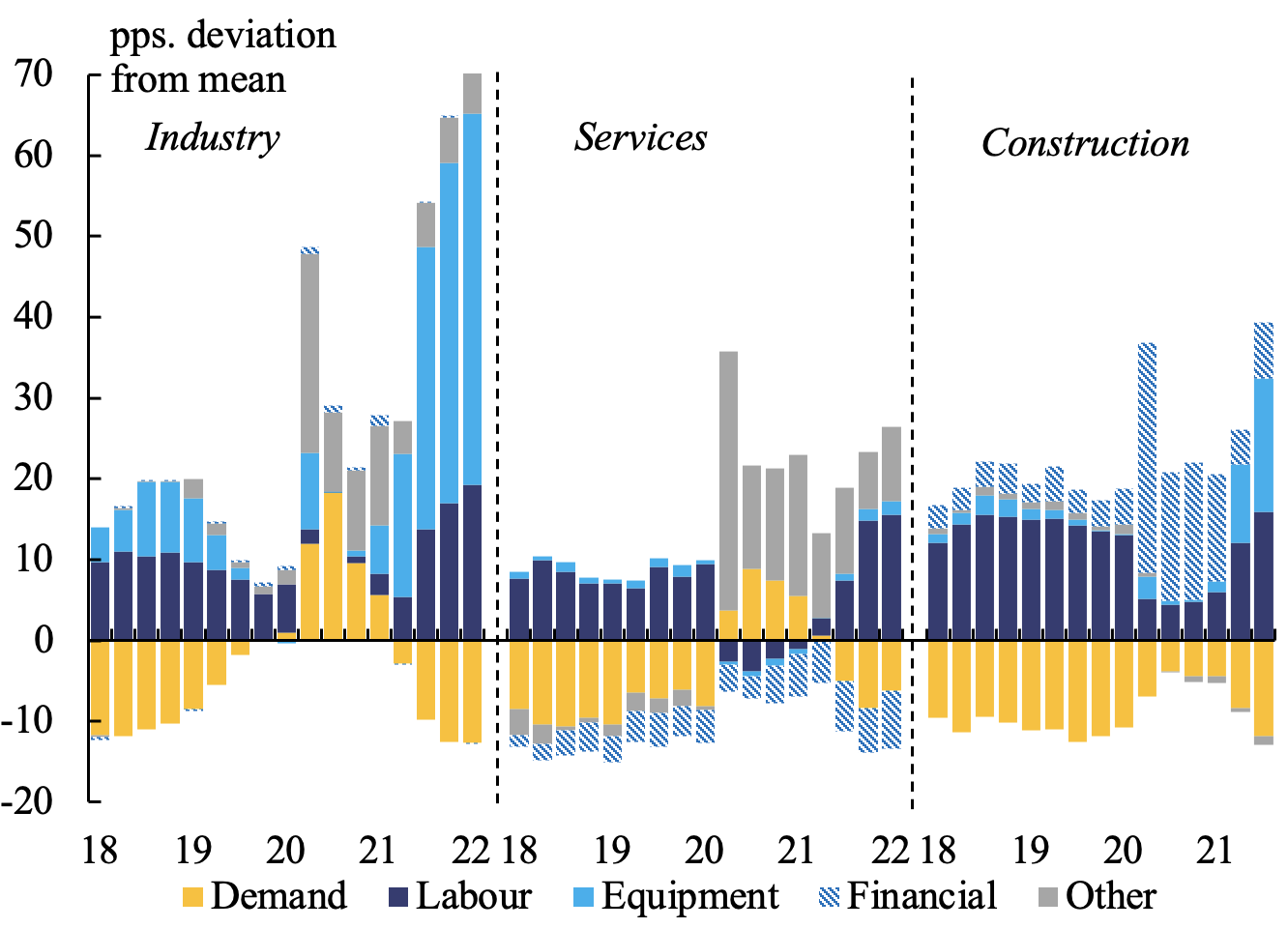

The EU economy entered the New Year on a weaker note than previously anticipated, as headwinds to growth intensified. The surge in COVID-19 infections from late October and the subsequent emergence of the highly infectious Omicron variant resulted in the reintroduction of restrictions. While these containment measures tended to be milder and more selective compared to previous waves, many member states still saw their economies affected by a combination of renewed stress on healthcare systems and a surge of staff shortages due to sickness, isolation, quarantine, and care duties. Meanwhile, the European Commission’s business and consumer surveys (Figure 1) show that supply constraints and labour shortages have been growing in importance in managers’ assessments of factors limiting their production since the autumn (Kataryniuk et al. 2021, Axioglou and Wozniak 2022).

Table 1 Key figures from the Winter 2022 Forecast

Figure 1 Factors limiting production in the EU

…but expansion is set to regain pace after the winter soft patch…

As many member states are already easing restrictions at the time of writing, this forecast assumes that the economic impact of the current wave of infections will be short-lived, and that most bottlenecks gradually ease. A strong labour market, high accumulated savings, still favourable financing conditions, and a powerful stimulus from the Recovery and Resilience Facility should allow the economic expansion to regain pace in the second quarter and remain robust over the forecast horizon.

Following a strong recovery by 5.3% in 2021, we now forecast the EU economy to grow by 4.0% in 2022 and by 2.8% in 2023. Output is projected to surpass pre-pandemic levels in all member states by the end of 2022, while for the EU as a whole this point was already reached in summer last year. In the course of 2023, real GDP in the EU should converge to the steady growth path that the economy was set to follow before the pandemic hit (Figure 2).

Figure 2 EU Real GDP growth path

…with the labour market standing out as the bright spot

The exceptional performance of the labour market would not have been possible without the unprecedented policy response put in place by the member states, but also at the EU level. Thanks to job retention schemes, unemployment rates edged up only mildly during the crisis and by the end of 2021, they fell to all-time lows. Similarly, headline employment and activity rates surpassed their pre-pandemic levels in the third quarter of 2021. These outcomes contrast with the EU experience in the aftermath of the Global Financial Crisis. Tightening labour markets amid increasing demand-supply mismatches have, however, led to labour shortages in many member states, increasing the risk of second-round effects on inflation.

Inflation has accelerated, following a strong increase in energy prices

Following a rapid increase throughout 2021, consumer price inflation is estimated to have reached a record high of 5.1% year-on-year in the euro area in January. A key driver of this development was the surge in energy prices. Against this backdrop, the Commission’s Winter Economic Forecast analyses the speed and intensity with which changes in commodity prices feed through to consumer prices. Transmission is highly differentiated across member states, due to a number of factors. First, the structure of retail energy prices varies due to differences in the share of taxes and network costs in the final price. Second, regulatory frameworks and government interventions differ. Finally, retail gas and electricity contracts can also differ within countries, with some households opting for longer-term contracts that lock in prices for several years.

Figure 3 Spot and future wholesale prices of brent, gas and electricity

Source: ICE

Note: Thick dotted lines refer to updated assumptions; thin dotted lines to those of the Autumn 2021 Forecast.

Our estimates show that, on average, almost 40% of the change in Brent oil prices is passed on to consumer liquid fuel prices within 12 months – most of which (80%) occurs within one month. In the case of natural gas, the transmission is found to be both smaller and slower. Only about 13% of an increase in natural gas prices is passed on to consumers in the subsequent 12 months, with just 20% of this effect occurring within the first month. Nevertheless, even if the transmission is weaker, the magnitude of changes in the wholesale gas prices over the previous year is still expected to continue generating significant increases for consumers for some time. Furthermore, we find strong cross-country heterogeneity, which likely reflects the differences in national market structures described above.

Finally, the transmission mechanism turns out to be more complex for electricity prices. In the past, EU markets were less integrated than they are now and the national energy production mix played a major role in price setting. Wholesale electricity prices have recently been more correlated with gas prices. We find that only about 4% of a change in wholesale gas prices is passed on to consumer electricity prices within 12 months. This is a markedly lower share than for the other two commodities. About 25% of this transmission happens within the first month. For a majority of member states, however, no significant relationship between gas and electricity prices could be established.

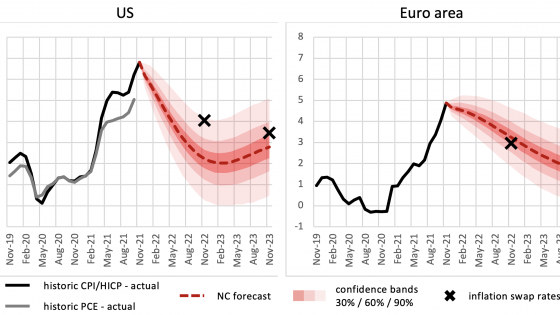

Inflationary pressures are expected to remain high for longer...

Compared to the Commission’s Autumn Forecast, inflation projections have been revised up, as future contracts now suggest that energy prices are set to remain high for longer, and price pressures are already broadening to several categories of goods and services.

As highlighted by our analysis, even in the absence of further increases in the price of energy commodities, past increases will keep feeding through to retail prices over time. Moreover, as energy is an input to the production of virtually all goods and services in the HICP basket, high production costs may be passed on to consumers, depending on the elasticity of demand. These indirect effects are therefore likely to linger for some time.

… but are expected to ease towards the end of the year

As these pressures fade and the impact of the rapid price increases throughout 2021 and early 2022 fall out of the calculations, inflation is projected to decline markedly towards the end of 2022 and to settle below 2% next year. Overall, inflation in the euro area is forecast to increase from 2.6% in 2021 (2.9% in the EU) to 3.5% (3.9% EU) in 2022, before declining to 1.7% (1.9% EU) in 2023.

The balance of risks to the growth outlook is broadly even

Overall, the growth outlook in the Commission’s Winter Forecast is assessed as broadly balanced. First, the current wave of infections could last longer than we assume and bring with it fresh disruptions to critical supply chains. Second, household consumption could grow even more strongly, while investments fostered by the RRF could prove to be a larger boost to the economy. On the inflation side, upside risks prevail. Cost pressures may be passed on from producer to consumer prices to a larger extent, increasing also the likelihood of strong second-round effects. Risks to the growth and inflation outlook are aggravated by geopolitical tensions in Eastern Europe.

References

Axioglou, Ch. and P Wozniak (2022), “The impact of shortages on manufacturing in the EU: Evidence from the Business and Consumer Surveys”, VoxEU.org, 18 January

ECB (2021), “ECB staff macroeconomic projections for the euro area”, December.

Kataryniuk, I, A del Rio and C Santchez Carretero (2021), “Euro area manufacturing bottlenecks”, Quarterly Report on the Spanish Economy, Banco de España.

OECD (2021), “The Recent Rise in Energy Prices - Drivers and Implications”, OECD Economic Outlook 2021(2): 23–25.

Tagliapietra, S and G Zachmann (2021), “Is Europe’s gas and electricity price surge a one-off?”, Bruegel Blog, 13 September.