With government budgets under pressure in mature economies, burgeoning healthcare expenditures are under scrutiny. In this light, healthcare innovation can either help by developing new cheaper treatments or make healthcare policy decisions more difficult by introducing new, better but more expensive technologies. As documented by Huckman and Cutler (2003), while a 'substitution effect' does exist, a simultaneous 'treatment expansion effect' might actually dominate, which leads us to conclude that technology adoption leads to demand shifting and subsequent expenditure increases, bringing some quality improvements along the way.

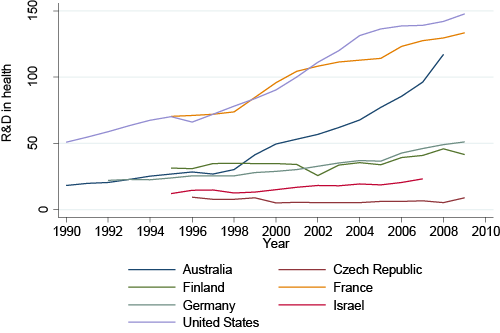

Figure 1 shows the evolution of research and development in health for seven OECD countries during the time period 1990-2010. Clearly, there is no common cross-country pattern.

Figure 1. Research and development in health (per capita, $US purchasing power parity)

Source: OECD Health Data 2012.

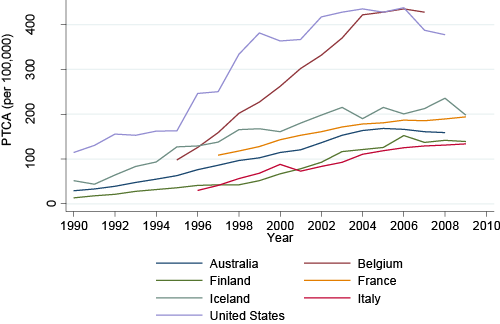

Figures 2 and 3 display the patterns of such technologies over the last two decades as an illustration of the remarkable differences in technology diffusion across countries, which appears to increase after the mid-1990s.

Figure 2. PTCA (per 100,000 population) for a selection of countries

Source: OECD Health Data 2012.

Figure 3. MRI (per million population) for a selection of countries

The role of health insurance in technology

One explanation is that unlike other technologies, healthcare technology is intermediated by insurance mechanisms, both private and public.

Weisbrod (1991) was among the first to suggest that growing healthcare insurance provides an incentive for the development of cost-increasing technologies in the healthcare sector. The latter has been qualified by evidence that the consumer willingness to pay is of course liable to be higher under insurance than in its absence (Zweifel 2003, Zweifel and Manning 2000).

However, the development of universal and publicly integrated systems has a tendency to promote monopsony purchasing. Such monopsony power allows greater control over treatment restrictions and cost containment, although with some potential detrimental effects on social welfare (Pauly 1988). Hence, the question is contentious. Bech et al. (2010) provide evidence that systems with monopsony payers tend to have lower rates of technology adoption for heart disease, than systems which do not exhibit this characteristic. While some systems may have a tendency to monopsony, most healthcare systems are characterised by mixed purchasing of some kind.

Either supplementary private insurance within a dominant social-insurance setting or mixed insurance schemes tend to be the most prevalent form of healthcare system. Where the insurance market is more fragmented, the possibility that insurance firms compete on quality implies that the direct control of treatment costs, including those associated with the adoption of new technologies, may become more difficult.

New research

In Costa Font et al. (2012) we attempted to empirically investigate the dynamic processes through which different forms of funding interact with research and development and with the diffusion of new products. Following Weisbrod (1991), insurance coverage provides an incentive to invest in research and development, and the new healthcare technologies developed from this research and development investment providing in turn a further demand for insurance. We exploit aggregate demand at the country level and dynamic relationships between these variables to assess one dimension of this process: namely, the impact of insurance on research and development and healthcare technology. We therefore build on the earlier literature by providing some aggregate empirical estimates on these relationships to test whether there is support for this part of the Weisbrod hypothesis. More specifically, we use longitudinal data on 34 OECD countries with information on technology, insurance and research and development information.

As technology is multivariate we consider specific examples.

- First, a diagnostic input – MRI scanners – which reflects Weisbrod’s notion of a costly technology introduced through insurance coverage incentivising an ever-widening concept of healthcare coverage.

- Second, a surgical procedure – Percutaneous Transluminal Angioplasty (PTCA) – associated with demand shifting made possible by insurance coverage.

We examine the volume of their use in different healthcare systems according to the variation in the form and coverage of healthcare insurance.

Results show that consistent with Weisbrod (1991), there is a dynamic relationship between private healthcare expenditure, including private insurance, and healthcare technology development. We find supportive evidence at the aggregate level of a positive and dynamic relationship between private healthcare expenditure (including private insurance) and healthcare technology development. The mechanism for this relationship is consistent with the Weisbrod view that increasing coverage of healthcare insurance does lead to an incentive to provide new technology. However, there is no support for the idea that insurance coverage leads to greater technology uptake; at least as illustrated by MRI scanners and PTCA procedures. Moreover, the results do not support a cost-containing effect of governmental expenditures on healthcare research and development, as no statistical significant relationship was found to exist between these variables.

Implications

Expanding health-insurance coverage can incentivise expenditure on innovation but there is no evidence that it will heighten technology adoption. Instead, technology diffusion is limited by other institutional barriers (see Philipson and Sun 2008, Costa-i-Font et al. 2011).

References

Bech, M, T Christiansen, K Dunham, J Lauridsen, C H Lyttkens, K McDonald, and A McGuire (2009), “The influence of economic incentives and regulatory factors on the adoption of treatment technologies: a case study of technologies used to treat heart attacks”, Health Economics 18, 1114-1132.

Costa Font, Joan and McGuire, Alistair and Serra-Sastre, Victoria (2012), “The ‘Weisbrod Quadrilemma’ revisited: insurance incentives on new health technologies”, Geneva Papers on Risk and Insurance, 37(4), 678-69.

Costa Font J, N Varol, A McGuire (2011), “Does price regulation affect the adoption of new pharmaceuticals?” VoxEU.org, 8 July.

Cutler, D M and Huckman, R S (2003), “Technological development and medical productivity: the diffusion of angioplasty in New York state”, Journal of Health Economics, 22, 187-217.

Pauly, M (1988), “Market power, monopsony and health insurance markets”, Journal of Health Economics, 7, 111-118.

Philipson, T and Eric Sun (2008), “Regulating the safety and efficacy of prescription drugs”, VoxEU.org, 3 January.

Zweifel, P (2003), "Medical innovation: A challenge to society", The Geneva Papers on Risks and Insurance: Issues and Practice, 28(2), 194-2002

Zweifel P, Manning, W G (2000), "Moral Hazard and consumer incentives in health care", in Culyer and Newhouse (eds.) Handbook of Health Economics, Boston, Chapter 8.