Editor's note: This column first appeared as a chapter in the Vox eBook, Economics and policy in the Age of Trump, available to download here.

The Affordable Care Act (ACA), enacted in 2010, was intended to address long- standing problems with the American system of health care and health insurance. Chief among these were spiralling costs and a substantial number of individuals – roughly 50 million in 2010 – without any insurance coverage. In addition, the exclusion of employer-paid health insurance premiums from income and payroll taxes raised the spectre of inefficiency along multiple dimensions, potentially reducing job mobility and entrepreneurship while bloating the benefits offered by employers, as well as raising equity concerns about an annual tax expenditure of over $250 billion that disproportionately benefits higher-income households.

In this column, we review the main provisions of the ACA related to insurance coverage and healthcare costs, including what is known so far about their impact. We also discuss the recent Republican attempt to ‘repeal and replace’ the law, which would have reduced and restructured both the ACA’s subsidies for the purchase of private health insurance and the Medicaid programme while eliminating many of the ACA’s taxes, largely benefiting the highest-income taxpayers. Although this proposal failed, it is unlikely to be the Republicans’ last attempt to dismantle the ACA; it thus provides useful insight into the views of the ACA’s opponents. We conclude by discussing ongoing challenges that face the US healthcare system.

ACA coverage provisions

The ACA took a three-pronged approach to expanding coverage: mandating increased access to employer-sponsored coverage for young adults, expanding Medicaid to all non-elderly adults with very low income, and reforming the non-group health insurance market for those without access to employer-sponsored or other coverage.

- The ACA young adult coverage provisions, which took effect shortly after the law was enacted in 2010, require employers who offered dependent coverage to make that coverage available to workers’ children up to the age of 26.

- The ACA Medicaid provisions were intended to expand the programme from one primarily benefiting children and parents in low-income families to one that would reach very low-income childless adults as well, beginning in 2014. Constitutional challenges from multiple states, however, led to a June 2012 Supreme Court decision rendering this expansion effectively optional. As of April 2017, 31 states have expanded Medicaid, while 19 have not.

- The ACA nongroup market reforms, which took effect in 2014, are intended to pro- mote competition by establishing regulated competition in a market that had long been hobbled by adverse selection. Insurers can no longer deny coverage or charge consumers higher prices on the basis of health status; premiums charged to older beneficiaries may not be more than three times what younger beneficiaries pay; and policies must cover a specified set of ‘essential benefits’. Low- and middle-income beneficiaries without access to employer coverage are eligible for advanceable, refundable tax credits for purchasing coverage in newly established ‘marketplaces’. The tax credits are pegged to both family income and the cost of coverage in a local market. Finally, consumers without coverage face a tax penalty (the ‘individual mandate’) that provides an additional incentive for healthy consumers to sign up for coverage.

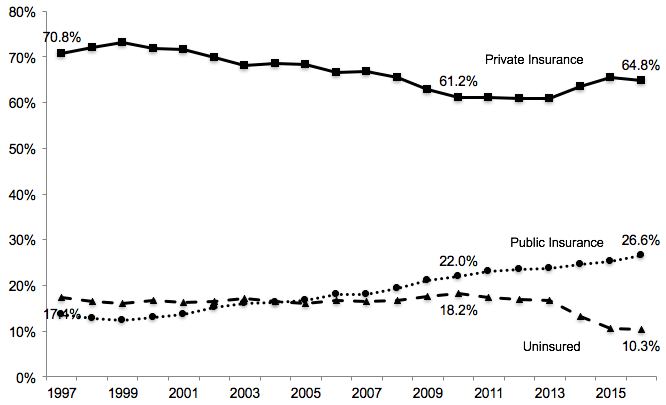

These coverage provisions have sharply reduced the fraction of the US population without coverage (Cantor et al. 2012, Somers et al. 2013, Antwi et al. 2013, Kaestner et al. 2015, Obama 2016, Frean et al. 2017, Zhao et al. 2017). Overall, the share of the non-elderly US population without insurance fell from 18.2% in 2010 to 10.3% in 2016 (Martinez et al. 2017); see Figure 1.

These gains in coverage have reduced disparities in coverage and financial barriers to care (Sommers et al. 2013, Buchmueller et al. 2016, Courtemanche et al. 2017); increased utilisation of services (Busch et al. 2014, Meara et al. 2014, Wherry and Miller 2016, Miller and Wherry 2017); improved household financial security (Hu et al. 2016); and reduced hospital uncompensated care (Nikpay et al. 2015, Dranove et al. 2016, Blavin 2016). Moreover, despite some concern that the ACA would reduce labour supply or undermine the provision of employer-sponsored coverage, there is no evidence to date that this has been the case (Abraham et al. 2016; Gooptu et al. 2016; Kaestner et al. 2015; Leung and Mas 2016; Levy et al. 2016).

Figure 1 Trends in insurance coverage for non-elderly Americans, 1997-2016

Notes: Data are from the National Health Interview Survey as reported by Martinez and Cohen (2011) and Martinez et al. (2017). Figures represent the percentage of individuals with each type of coverage at the time of the survey. Public insurance includes Medicaid, CHIP, state- sponsored or other government-sponsored health plan, Medicare, and military plans. Private insurance includes plans obtained through an employer, purchased directly or purchased through local or community programmes. Because respondents can report multiple sources of coverage, the figures for a given year add up to more than 100%. The data for 2016 pertain to the period January to September. In all other years, the estimates are based on surveys conducted throughout the year.

ACA cost control provisions

The ACA was intended to control costs in two senses: first, by reducing (or at least not increasing) the deficit as projected by the nonpartisan Congressional Budget Office (CBO), which was critical to the ACA’s political viability; and second, by introducing a variety of policies aimed at changing economic incentives in the healthcare system with the goal of ‘bending the curve’ of health spending. The ACA succeeded in the first sense, more than paying for the increased spending associated with the ACA’s new programmes through cuts to existing programmes (primarily Medicare payments to providers and insurers) and increases in taxes (primarily on very wealthy individuals) over the initial ten-year window scored by the Congressional Budget Office (CBO 2010).

At this early stage, it is less clear whether the ACA is succeeding in bending the curve of health spending. The ACA introduced a number of programmes to move the Medicare programme away from fee-for-service payments and toward reimbursement systems that better align provider incentives to provide high-value care, such as the shared savings/ accountable care organisation programme and bundled payments for certain services. It is also true that the implementation of the ACA coincided with a period of historically low growth in US health care spending (Council of Economic Advisers 2016); the jury is still out on whether the ACA programmes are, in fact, reducing spending (Doran et al. 2016, McWilliams et al. 2014, 2015, 2016, Nyweide et al. 2015).

One ACA provision that is of particular interest to economists is an excise tax on high- cost employer-sponsored health insurance plans. This ‘Cadillac tax’ was designed not only to raise revenue, but also to give employers an incentive to consider more efficient benefit designs, and can be seen as a somewhat more politically feasible alternative to limiting the exclusion of employer-paid premiums. Nonetheless, the Cadillac tax remains in political limbo, having been postponed until at least 2020.

Repeal and replace, part I: The American Health Care Act of 2017

In March 2017, Donald Trump and Congressional Republicans moved quickly to make good on their promise to ‘repeal and replace’ the ACA. House Republicans drafted the American Health Care Act of 2017 (AHCA), which proposed major changes to the design of the ACA’s tax credits and to Medicaid.

Like the ACA, the AHCA included advanceable, refundable tax credits for the purchase of private health insurance. But whereas the ACA’s tax credits are based on income and the cost of coverage, so that most consumers are effectively insulated against large premium increases, the AHCA’s tax credits varied only with age, with older consumers getting slightly larger credits.

At the same time, the AHCA would have relaxed the ACA’s restriction on charging older consumers higher premiums, so the net impact would have been to raise premiums for older consumers, lower-income consumers, and those living in high-cost areas.

The AHCA would have made even larger changes to the Medicaid programme, changing it from an entitlement for which the financing is split between the Federal government and the states to essentially a ‘block grant’ model.

The CBO projected that the AHCA would cause the number of Americans without health insurance to increase by 18 million in the first year the policy was in place. By 2026, after the elimination of the ACA Medicaid expansion and of subsidies for insurance purchased through the ACA marketplaces, that number would increase to 32 million (CBO 2017).

Editor's note: This column first appeared as a chapter in the Vox eBook, Economics and policy in the Age of Trump, available to download here.

The AHCA can be seen as an attempt to find a middle ground between hard-line conservatives who wanted to repeal the ACA outright and more moderate Republicans who were uncomfortable returning to the pre-ACA status quo. At the time of this writing, the Republican leadership is working to find this middle ground. In March, they chose not to put the bill to a vote when it became clear that it would not pass. In May the bill was modified to make certain parts less objectionable to conservatives, and other parts less objectionable to moderates. Whether this compromise will attract sufficient support in the Senate remains to be seen.

What’s next?

The Trump administration and Republican leaders in Congress must now decide what chapter they will write in the ongoing book of health reform. They may interpret this assignment narrowly or broadly.

A narrow interpretation would lead them to focus on the question ‘what should we do about the ACA?’ On this question, there are three paths they might take.

The first is to continue trying to craft major reforms to repeal and replace the ACA. The experience with the AHCA suggests that this will be a very challenging task politically.

A second path would be to eschew major legislation in favour of quietly starving the ACA, for example by refusing to actively encourage insurers and individuals to participate in the marketplaces and discouraging additional states from expanding Medicaid. Since Republicans took control of Congress in 2011 they have claimed to be pursuing the first path, introducing numerous bills to repeal or replace the ACA. However, since there was no chance of this legislation being enacted with President Obama in the White House, these bills were political statements rather than serious legislation. As a result, their actual strategy was more along the lines of the second path.

A third path would be to acknowledge that the ACA, from an economic perspective, already represents a moderate, market-based approach to providing coverage to tens of millions of Americans, and to assume a role of stewardship for making these programmes work. This would involve fully funding cost-sharing subsidies for low-income households in the marketplaces (currently under legal attack by House Republicans); enforcing the individual mandate; extending and funding a federal reinsurance programme in order to encourage private insurers to remain in the marketplaces; and working with the 19 states that have not expanded Medicaid to find approaches they can embrace, building on the success of Republican-led states like Michigan and Ohio that have expanded Medicaid coverage through waivers.

There is, however, a broader view that this Administration might take on health reform. This broader view would require them to move beyond the current focus on the ACA to consider the problems the ACA was intended to solve.

The Administration might, for example, try to do more to address the long-run cost problems facing the Medicare and Medicaid programmes. Ideally this would be achieved not simply by pushing costs onto beneficiaries or state governments, but would also include a search for solutions that yield higher value for the government’s dollar. These solutions might involve the private provision of publicly-subsidised coverage - as in the ACA’s health insurance marketplaces, Medicaid managed care, or the Medicare Advantage programme - or they might involve the design of better provider payment models for publicly provided coverage, as in the ACA’s Medicare Shared Savings Program.

The broader view might also include an effort to impose some order on the complex tax treatment of private health insurance. The current patchwork system involves a regressive exclusion for employer-provided coverage, progressive refundable credits for marketplace coverage, and a politically unstable excise tax on high-cost employer plans to be implemented at some future date.

References

Abraham J., A.B. Royalty, and C. Drake (2016), “Employer-Sponsored Insurance Offers: Largely Stable In 2014 Following ACA Implementation”, Health Affairs, 2016 Oct 26:10-377.

Antwi Y.A., A.S. Moriya, and K. Simon (2013), “Effects of federal policy to insure young adults: evidence from the 2010 Affordable Care Act’s dependent-coverage mandate”, American Economic Journal: Economic Policy,1;5(4):1-28.

Blavin F. (2016), "Association Between the 2014 Medicaid Expansion and US Hospital Finances", JAMA 316(14):1475-83.

Buchmueller T.C., Z.M. Levinson, H.G. Levy, and B.L. Wolfe (2016), “Effect of the Affordable Care Act on racial and ethnic disparities in health insurance coverage”, American Journal of Public Health 106(8):1416-21.

Busch S.H., E. Golberstein, and E. Meara (2014), “ACA dependent coverage provision reduced high out-of-pocket health care spending for young adults”, Health Affairs, 33(8):1361-6.

Cantor J.C., A.C. Monheit, D. DeLia, and K. Lloyd (2012), “Early impact of the Affordable Care Act on health insurance coverage of young adults”, Health Services Research, 47(5):1773-90.

Congressional Budget Office (2010), Letter to the Honorable Nancy Pelosi, March 20, 2010.

Congressional Budget Office (2017), Cost Estimate of the American Health Care Act, March 13, 2017.

Council of Economic Advisers (2016), The Economic Record of the Obama Administration: Reforming the Health Care System.

Courtemanche, C., J. Marton, B. Ukert, A. Yelowitz, and D. Zapata (2017), “Early Effects of the Affordable Care Act on Health Care Access, Risky Health Behaviors and Self-Assessed Health”, National Bureau of Economic Research Working Paper No. 23269 (March)

Doran T., K.A. Maurer, and A.M. Ryan (2016), “Impact of Provider Incentives on Quality and Value of Health Care”, Annual Review of Public Health, 15(0).

Dranove D., C. Garthwaite, and C. Ody (2016), “Uncompensated care decreased at hospitals in Medicaid expansion states but not at hospitals in nonexpansion states”, Health Affairs 35(8):1471-9.

Frean, M., J. Gruber, and B.D. Sommers (2017), “Premium subsidies, the mandate, and Medicaid expansion: Coverage effects of the Affordable Care Act”, Journal of Health Economics 53:72-86.

Gooptu A., A.S. Moriya, K.I. Simon, and B.D. Sommers (2016), “Medicaid expansion did not result in significant employment changes or job reductions in 2014”, Health Affairs 35(1):111-8.

Hu L., R. Kaestner, B. Mazumder, S. Miller, and A. Wong (2016), “The effect of the Patient Protection and Affordable Care Act Medicaid expansions on financial well- being”, National Bureau of Economic Research; 2016 Apr 15.

Kaestner R., B. Garrett, A. Gangopadhyaya, and C. Fleming (2015), “Effects of ACA Medicaid expansions on health insurance coverage and labor supply”, National Bureau of Economic Research; 2015 Dec 31.

Kaestner R., and D. Lubotsky (2016), “Health Insurance and Income Inequality”, The Journal of Economic Perspectives 30(2):53-77.

Leung P., and A. Mas (2016), “Employment Effects of the ACA Medicaid Expansions”, National Bureau of Economic Research; 2016 Aug 18.

Levy H., T.C. Buchmueller, and S. Nikpay (2016), “Health Reform and Retirement”, The Journals of Gerontology Series B: Psychological Sciences and Social Sciences.

Martinez, M. and R. Cohen (2011), “Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, January–June 2011”, National Center for Health Statistics.

Martinez, M., E. Zammitti and R. Cohen (2017), Health Insurance Coverage: (Early Release of) Estimates from the National Health Interview Survey, January–September 2016, National Center for Health Statistics.

McWilliams J.M., M.E. Chernew, B.E. Landon, andA.L. Schwartz (2015), “Performance differences in year 1 of pioneer accountable care organizations”, New England Journal of Medicine, 372(20):1927–36

McWilliams J.M., L.A. Hatfield, M.E. Chernew, B.E. Landon, and A.L. Schwartz (2016), “Early performance of accountable care organizations in Medicare”, New England Journal of Medicine, 374:2357–66

McWilliams J.M., B.E. Landon, M.E. Chernew, and A.M. Zaslavsky (2014), “Changes in patients’ experiences in Medicare accountable care organizations”, New England Journal of Medicine, 371:1715–24

Meara E., E. Golberstein, R. Zaha, S.F. Greenfield, W.R. Beardslee, and S.H. Busch (2014), “Use of hospital-based services among young adults with behavioral health diagnoses before and after health insurance expansions”, JAMA Psychiatry 71(4):404-11.

Miller S., and L.R. Wherry (2017), “Health and Access to Care during the First 2 Years of the ACA Medicaid Expansions”, New England Journal of Medicine, 376(10):947-56.

Nikpay S., T. Buchmueller, and H. Levy (2015), “Early Medicaid expansion in Connecticut stemmed the growth in hospital uncompensated care”, Health Affairs 34(7):1170-9.

Nyweide D.J., W. Lee, T.T. Cuerdon, H.H. Pham, M. Cox, et al. (2015) “Association of Pioneer accountable care organizations versus traditional Medicare fee for service with spending, utilization, and patient experience”, JAMA 313(21):2152–61

Obama B. (2016), “United States health care reform: progress to date and next steps”, JAMA 316(5):525-32.

Sommers B.D, T. Buchmueller, S.L. Decker, C. Carey, and R. Kronick (2013), “The Affordable Care Act has led to significant gains in health insurance and access to care for young adults”, Health Affairs, 32(1):165-74.

Wherry L.R., and S. Miller (2016), “Early Coverage, Access, Utilization, and Health Effects Associated With the Affordable Care Act Medicaid Expansions: A Quasi- experimental Study”, Annals of Internal Medicine, 164(12):795-803.

Zhao G., C.A. Okoro, S.S. Dhingra, F. Xu, and M. Zack (2017), “Trends of lack of health insurance among US adults aged 18–64 years: findings from the Behavioral Risk Factor Surveillance System, 1993–2014”, Public Health, 146:108-17.